As we enter a new year, let’s look back at global stock market movements and some of the actions taken by central banks in December 2023. The festive month witnessed varied trends and occasional volatility in markets, reflecting further resilience and adaptation. Central banks played a crucial role in navigating uncertainties, implementing measures to mitigate risks and attempting to further support growth. This retrospective analysis of market forces and monetary policies defines the closing chapter of 2023 and sets the stage for our January 2024 Investment Summary.

Equities and bonds continued their strong rally through to the end of the year. A dovish pivot by the Federal Reserve Bank (Fed) at their last Federal Open Market Committee (FOMC) meeting of the year fuelled a further decline in market interest rates, propelling stocks to achieving new highs for the year.

During the FOMC meeting Q&A, Chairman Powell presented an even more dovish outlook than what the already optimistic markets had anticipated. The FOMC adjusted their forecast for the Fed Funds rate at the conclusion of 2024, reducing it by 50 basis points. Additionally, they signalled the likelihood of two 25 basis point cuts in the Fed Funds rate in the upcoming year. Furthermore, they maintained their forecast for the unemployment rate to stay low, while slightly reducing their inflation forecasts for 2024 and 2025.

Could this be indicative of a soft landing?

Notably, none of the FOMC members forecast any rate hikes.

Source: Bloomberg (all returns are in local currency and exclude dividends)

Equity investors in particular experienced a highly favourable year in 2023, even as central banks continued to hike interest rates during the first half of the year. Indeed, the rallies witnessed in 2023 have almost completely offset the losses incurred in 2022. Consequently, over the past two years of aggressive central bank inflation fighting, investors have essentially achieved flat returns.

Given the potential conclusion of the inflation fighting phase, should investors expect strong equity performance in 2024?

The challenges faced by asset markets over the past two years has stemmed from the rapid and rather substantial tightening of central bank monetary policies. While a modest reduction in rates is noteworthy, it may not yield the same magnitude of impact on financial markets.

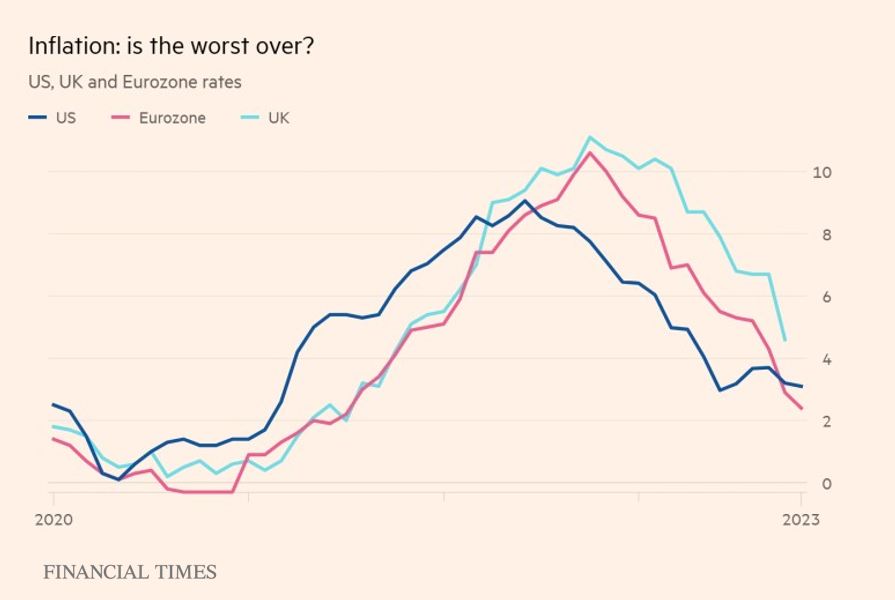

Source: LSEG, ONS, Eurostat via FT (Financial Times)

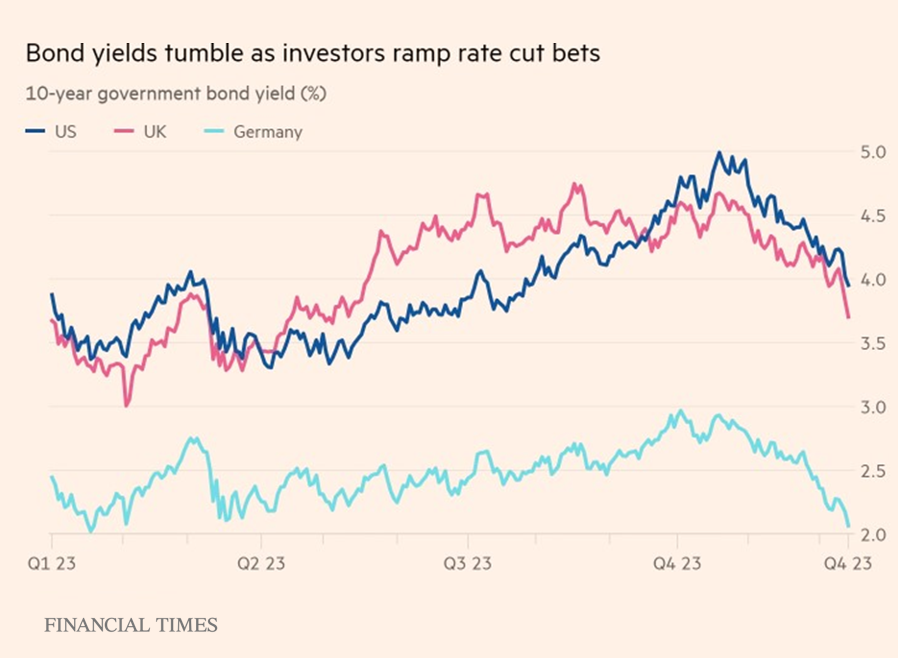

The market’s mood has shifted dramatically as inflation has improved. Financial markets continue to price a significant easing of monetary policy by the European Central Bank (ECB), the Bank of England (BoE), and the US Federal Reserve, with expectations of this easing starting in the spring of 2024. This anticipation has led to a downward trend in bond yields.

Source: Bloomberg via FT (Financial Times)

We believe that a substantial portion of the positive effects on asset markets resulting from central bank policy easing may already be reflected in current prices. Investing in stocks with the expectation of benefitting from further declines in interest rates might be a mistake, given that interest rates have already fallen considerably from their peak levels in the summer of 2023.

Our approach is to focus on stocks that can manage through persistently tight labour markets, and which can withstand the cumulative impact of interest rate hikes witnessed over the past two years. We are not comfortable having an overweight position in the richly valued technology stocks. There is considerable risk of disappointment concerning anticipated interest rate cuts; for instance, in the US, markets are currently pricing in almost 150 basis points in cuts, three times the Fed’s own projection.

In the fixed-income space, we continue to prefer government bonds and high-quality investment grade credit.

Our view is that central bank rate adjustments will likely be more modest compared to the past two years, exerting a diminished influence on markets. Stock performance will be driven more by earnings and valuation rather than by central bank behaviour. Our current positioning is consistent with this thinking.

Stay tuned for our 2024 outlook note which will be published later this month.

Wishing you all the best for the New Year!

___________________________________________________

Revisit some of our interesting insights from 2023, put together by our team of investment experts;

- December 2023 Investment Summary

- Central Bank Update: December 2023

- Central Bank Update II: December 2023

Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below or get in touch with one of the team.