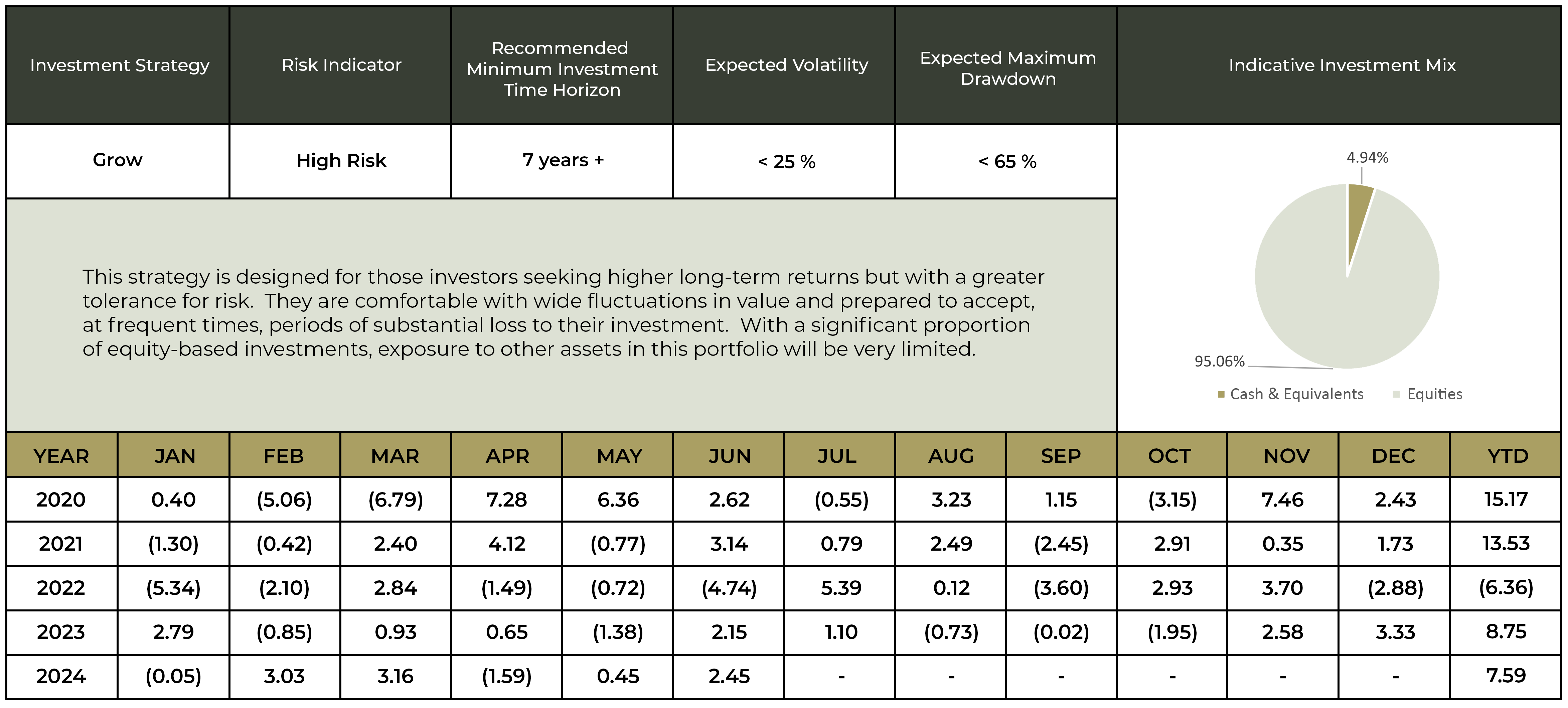

Grow

HIGH RISK

This strategy is designed for those investors seeking higher long-term returns but with a greater tolerance for risk. They are comfortable with wide fluctuations in value and prepared to accept, at frequent times, periods of substantial loss to their investment. With a significant proportion of equity-based investments, exposure to other assets in this portfolio will be very limited.

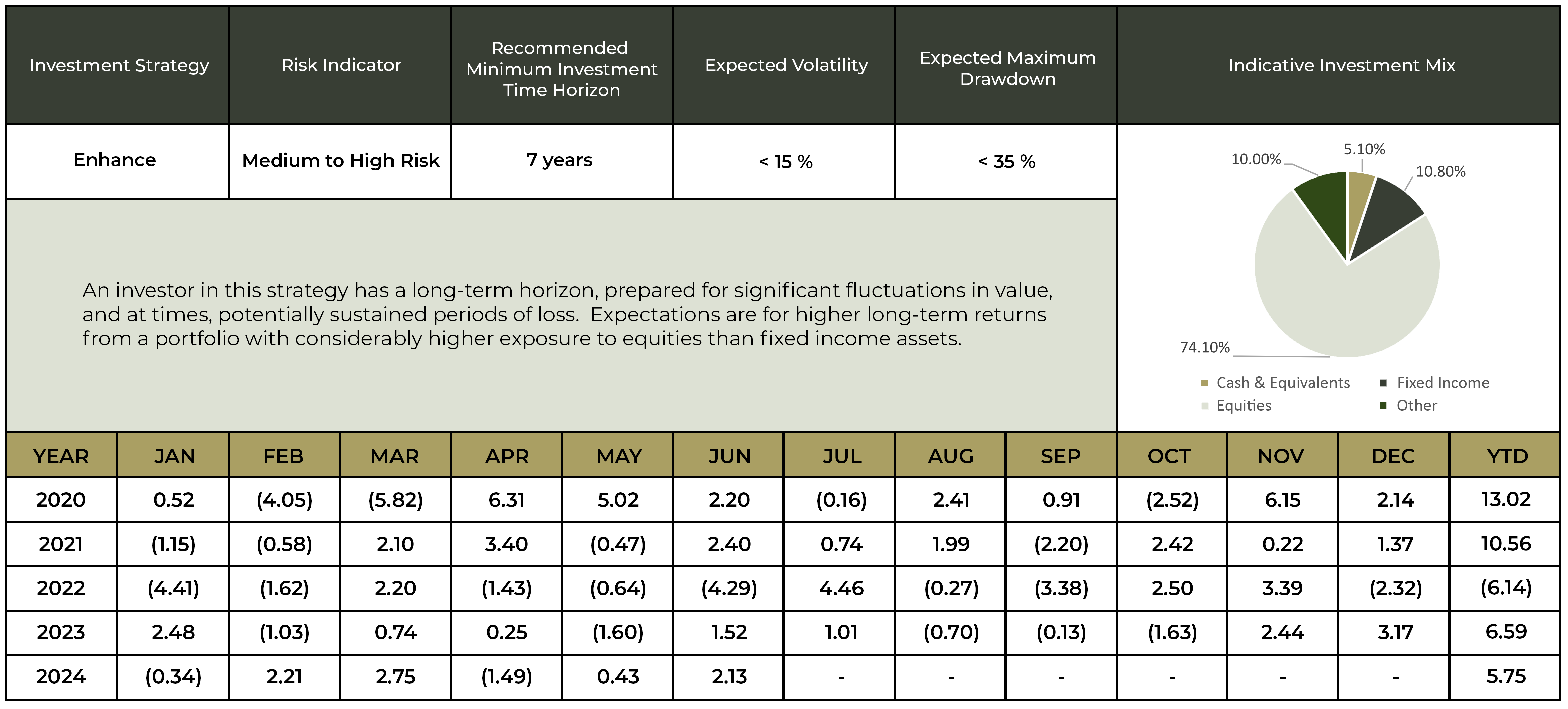

Enhance

MEDIUM-HIGH RISK

An investor in this strategy has a long-term horizon, prepared for significant fluctuations in value, and at times, potentially sustained periods of loss. Expectations are for higher long-term returns from a portfolio with considerably higher exposure to equities than fixed income assets.

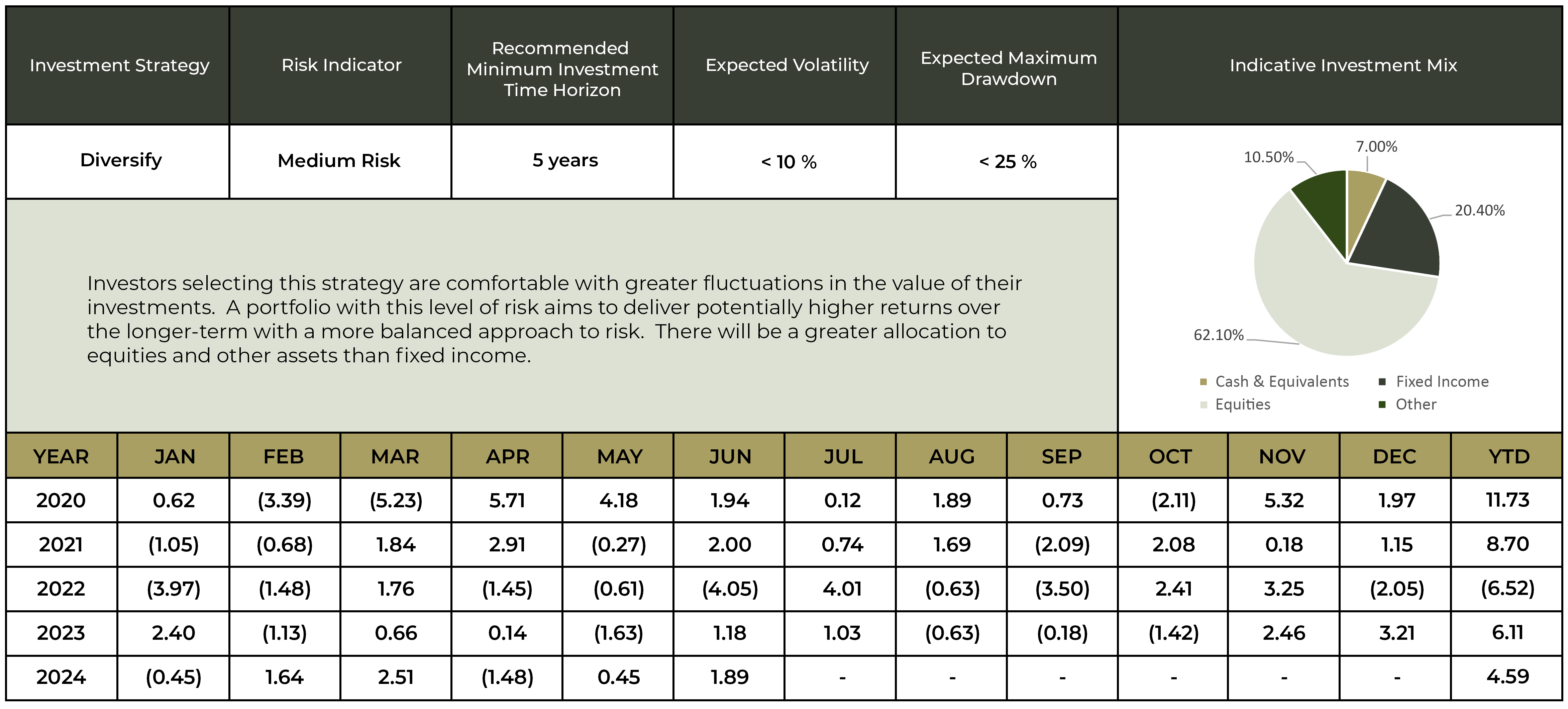

Diversify

MEDIUM RISK

Investors selecting this strategy are comfortable with greater fluctuations in the value of their investments. A portfolio with this level of risk aims to deliver potentially higher returns over the longer-term with a more balanced approach to risk. There will be a greater allocation to equities and other assets than fixed income.

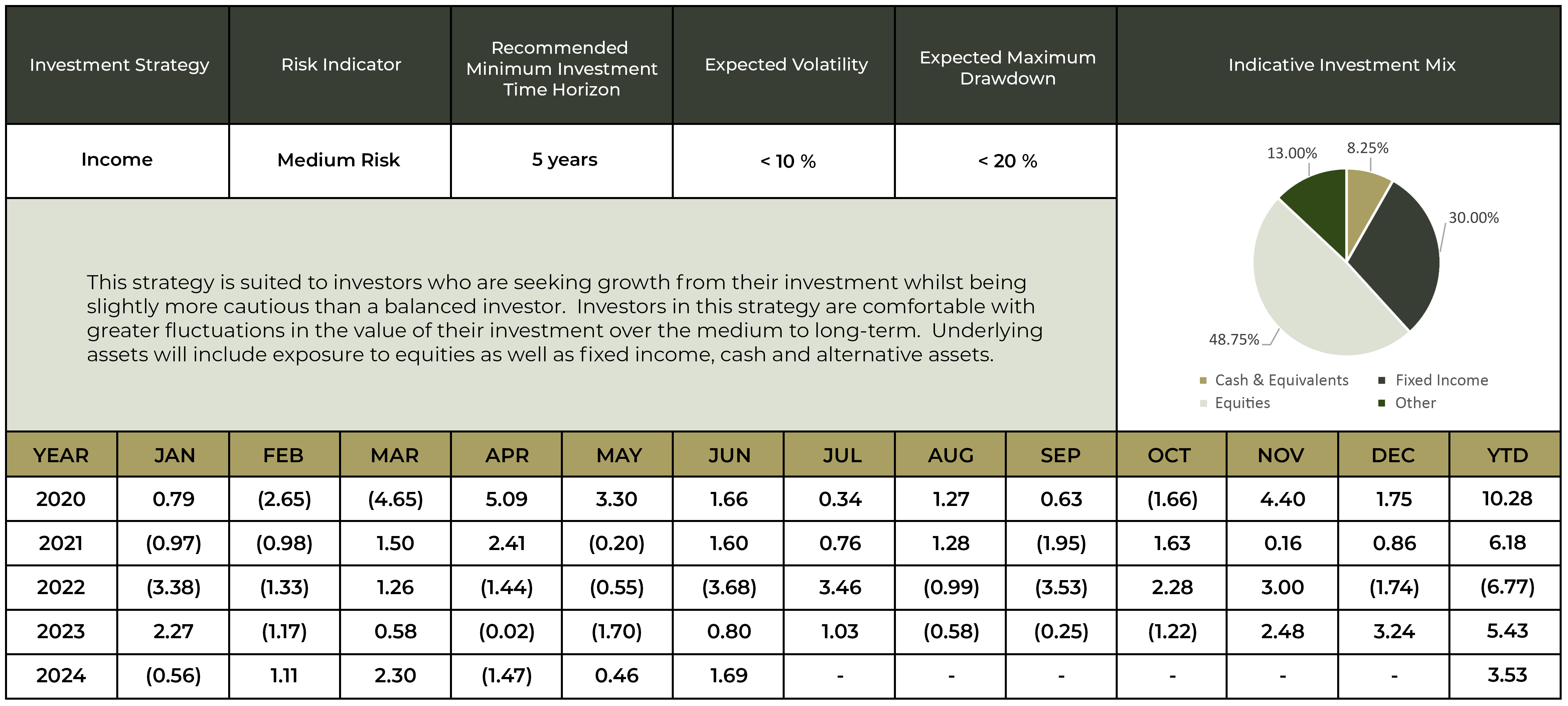

Income

MEDIUM RISK

This strategy is suited to investors who are seeking growth from their investment whilst being slightly more cautious than a balanced investor. Investors in this strategy are comfortable with greater fluctuations in the value of their investment over the medium to long-term. Underlying assets will include exposure to equities as well as fixed income, cash and alternative assets.

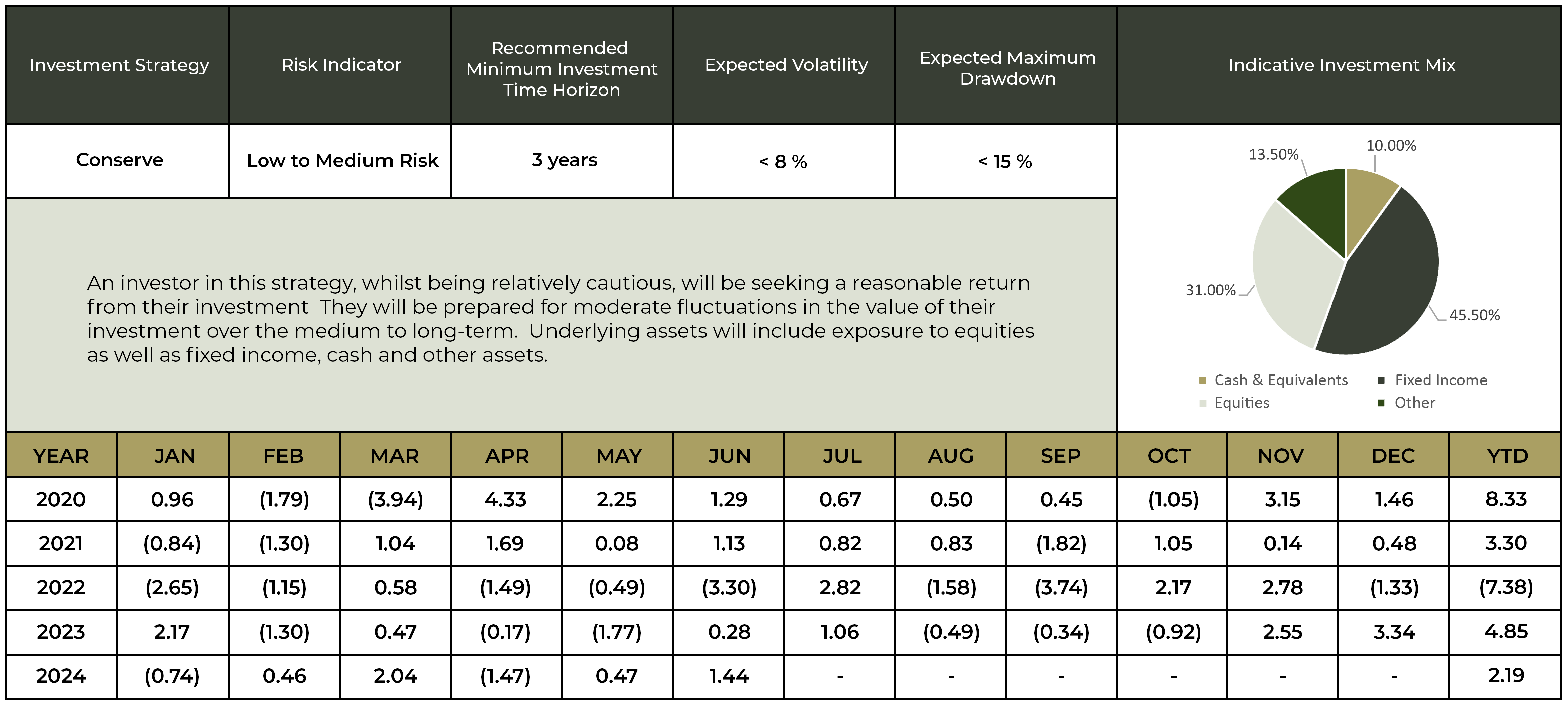

Conserve

LOW-MEDIUM RISK

An investor in this strategy, whilst being relatively cautious, will be seeking a reasonable return from their investment. They will be prepared for moderate fluctuations in the value of their investment over the medium to long-term. Underlying assets will include exposure to equities as well as fixed income, cash and other assets.

Oakglen Wealth Factsheets are currently for June 2024 (as at Quarter 2 2024).

Performance figures are expressed as a percentage figure | Performance does not represent actual returns as it is based upon total return of the model portfolio | Performance is calculated using a time-weighted rate of return using daily valuations | Model Inception date is 01.01.2020 | All of the investments used in the models were available during the time period presented | The model portfolio holds both accumulation and distribution share classes therefore where distribution share classes are held, cash is not re-invested into models | All transactions are executed using closing prices on the day they are communicated | Portfolios are subject to rebalancing at least half-yearly | Performance is stated net of an Oakglen 1% per annum management fee and underlying investment fees | Expected volatility is the maximum standard deviation that can be expected of the portfolio over a market cycle.

Performance Information is provided by Morningstar [2024]. All rights reserved.

Figures refer to past performance. Past performance is not a reliable indicator of future performance. The value of your investment, and any income from it, can fall as well as rise. Your capital is at risk and you may get back less than you have invested.