Our Central Bank Update for Q4 | December 2023 is an incisive summary of recent movements from some of the key central banks globally. Let’s take a closer look at what has been happening…

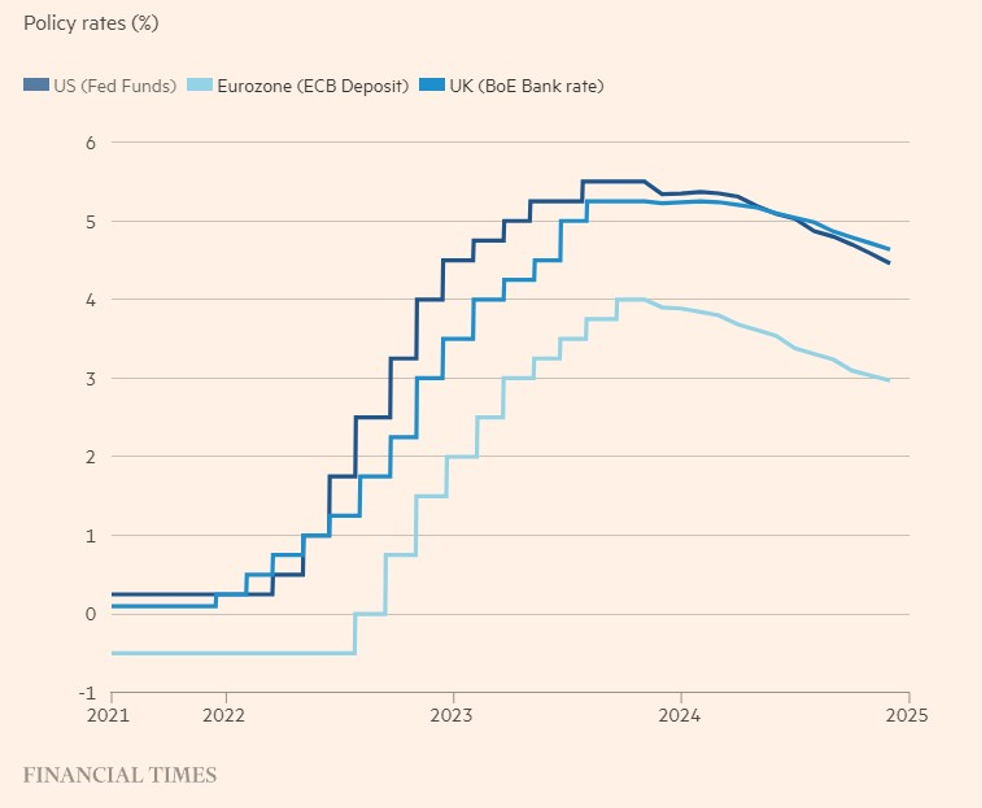

The notable decrease in inflation rates in the Eurozone, the United Kingdom, and the United States has encouraged financial markets to price an easing of monetary policy by the European Central Bank (ECB), the Bank of England (BoE), and the US Federal Reserve (Fed) beginning in the spring of 2024.

Source: Refinitiv via Financial Times

The expectation of interest cuts has also prompted significant rallies in both equity and bond markets over the past six weeks. Indeed, November was one of the best months for balanced portfolios in decades. The question arises:

Are the markets correct in predicting that the central banks will begin to lower interest rates next spring, thereby sustaining the momentum in financial markets?

Central banks embarked on the fastest and steepest rate hike cycle we have seen in response to the rapid rise in inflation the world experienced as the pandemic ended. In 2021, they collectively misread the inflation situation, viewing the rise increase as transitory. Upon realising their error, they hastened to rectify it by implementing a rigorous tightening of policy in 2022, which continued into this year.

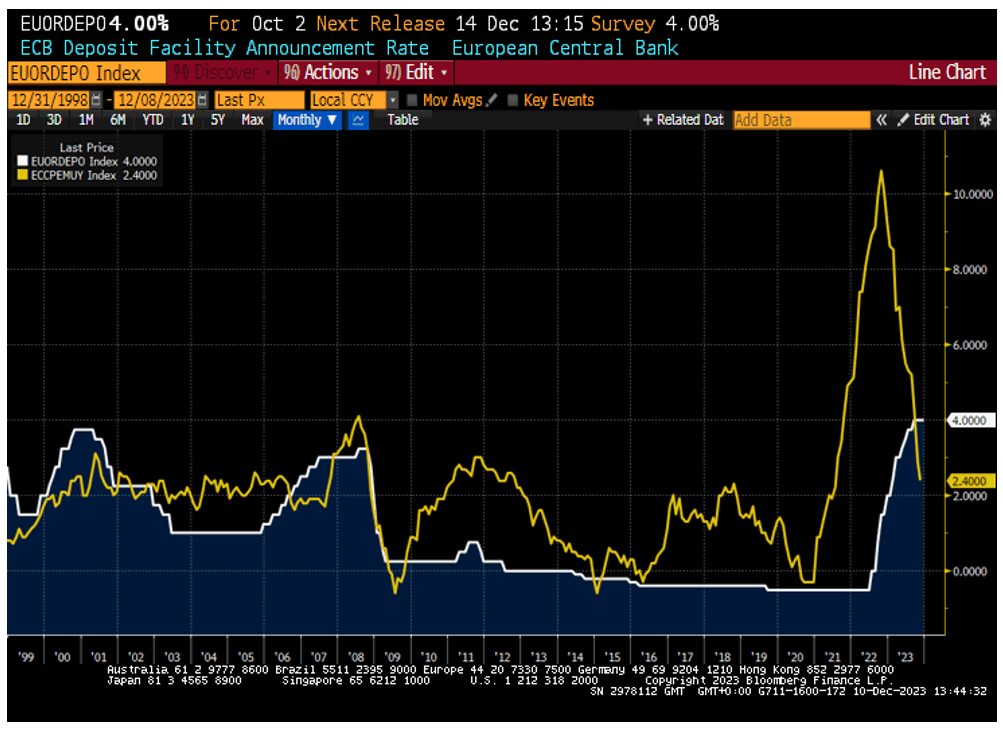

Expected path for policy rates based on overnight index swaps

Source: LSEG via Financial Times

These central banks have now concluded that their policy measures are adequately restrictive. The belief is that if maintained for long enough (how long is that?) inflation will return to their 2% targets.

Have the central banks pulled off the proverbial “soft landing”? Is economic growth now subdued enough that inflationary pressures have dissipated, rendering restrictive interest rate policies unnecessary?

Let’s examine each of the major three central banks individually.

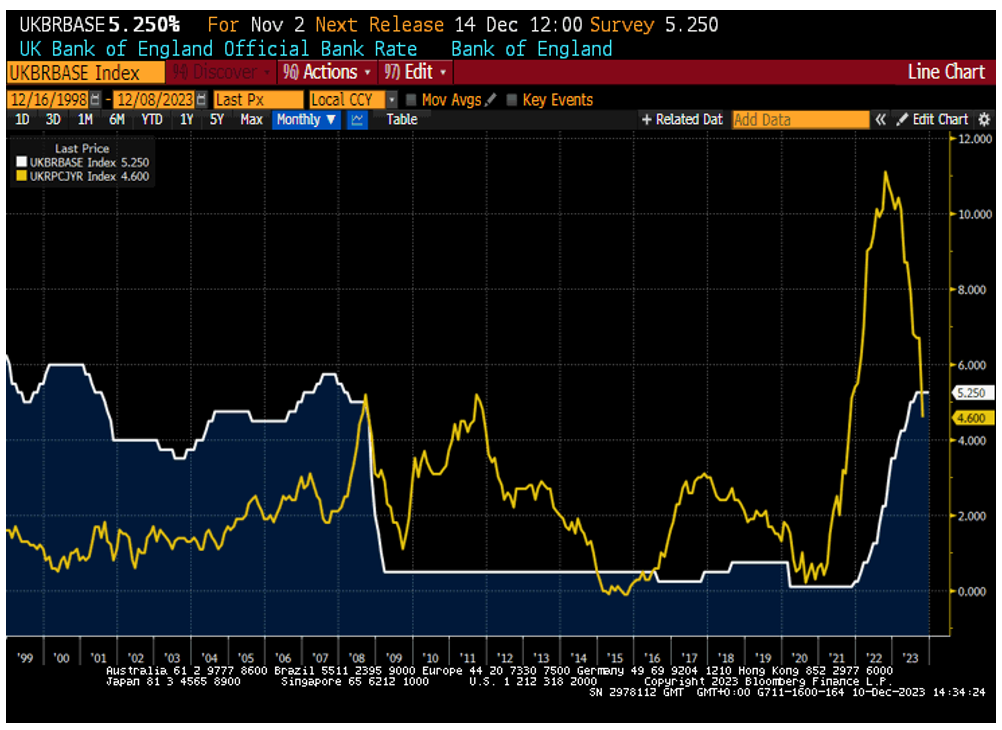

European Central Bank

With Eurozone inflation down to 2.4%, and growth barely positive, the ECB appears to be the most likely to lower rates first. Despite a tight labour market, we think the ECB would like to see several more months of consistently low or decreasing inflation before contemplating policy easing. In their 25 years of existence, the ECB has never encountered an inflationary challenge quite like the current one. There is a potential concern that if they were to implement easing measures first, it could lead to a weakening of the Euro’s exchange rate, thereby generating new upward inflationary pressures. The role of a central banker is undeniably challenging.

Source: Bloomberg

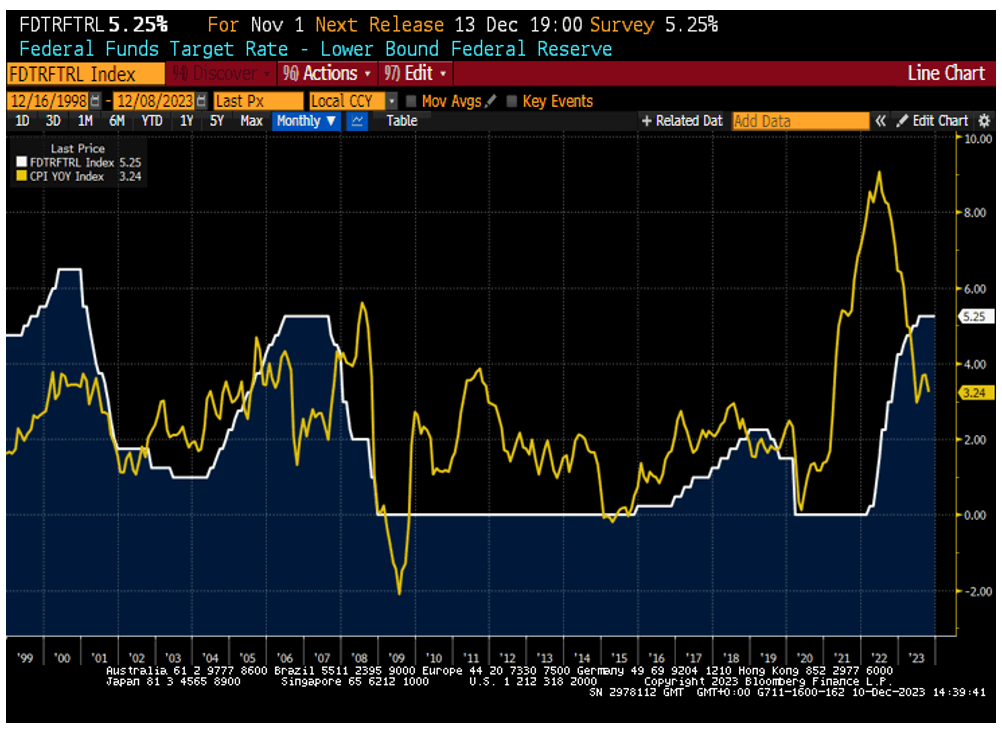

Bank of England

The BoE faces a stickier inflation problem, as the Consumer Price Index remains elevated with November print at 4.6%, well above the 2% target. Despite modest economic growth, the labour market is exceptionally tight, and there are valid concerns regarding data accuracy; actual unemployment may in fact be even lower than the current statistics show. We believe the BoE would require substantial additional decreases in the rate of inflation before contemplating rate cuts. Historically, post-Global Financial Crisis period aside, the BoE has favoured maintaining the base rate well above the rate of inflation. Only recently have they marginally achieved this objective.

Source: Bloomberg

US Federal Reserve

Inflation in the US has fallen to 3.2%, with robust economic growth and a labour market that, although possibly showing slight softening, remains notably tight. Similar to the BoE, the Fed has typically maintained the Fed Funds rate above inflation. In this context, we would expect the Fed would prefer some additional easing in the labour market and for inflation to at least fall below 3% before contemplating any rate cuts.

Source: Bloomberg

Other considerations come into play as well. If labour markets were to deteriorate quicky, central banks would respond by cutting rates. Similarly, in the presence of significant distress in the financial system, quick rate adjustments would be made. In the absence of such events, we anticipate central banks to remain patient without any immediate need to lower rates. The recent rallies in both bond and equity markets have eased financial conditions (notably, mortgage rates have declined by 1% in both the US and UK). Central banks could argue that market conditions have already eased, allowing them to feel more at ease with keeping policy rates at their current levels. All three central banks are scheduled to meet this week, and their updates on policy thinking are eagerly waited. However, it is premature, in our opinion, to celebrate the prospect of a soft landing.

What are your thoughts? Get in touch with us and share your opinions. You can also suggest a topic you would like to hear more about in the future from our investment team.

Compare and contrast this insightful update from our Chief Investment Officer Jeff Brummette against the last Central Bank Update: September 2023. You can also catch up on the latest market trends and news in the December 2023 Investment Summary piece.

Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below.