Dark and freezing cold nights? Check. Busy shops and festive lights? Check. Another thoughtful piece from Oakglen? Check. We’ve got you covered in our Investment Summary for December 2023. The holiday season is almost upon us and perhaps we’re finally seeing a cooling of the economy, which has run hot this year.

Equities and bonds had one of their best months in years as both asset classes had powerful rallies. Continued significant declines in the rate of inflation have created hopes that the proverbial “soft landing” is upon us. Perhaps we just had it?

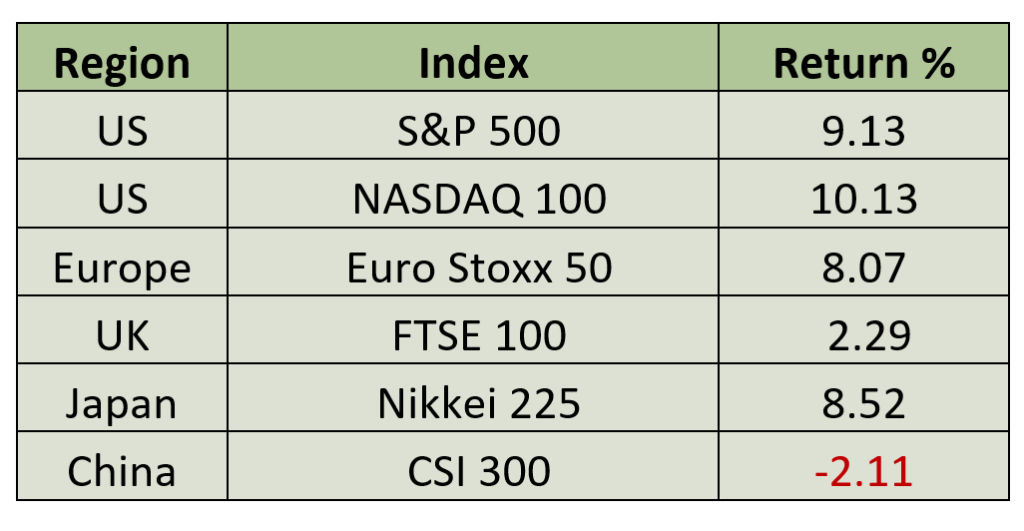

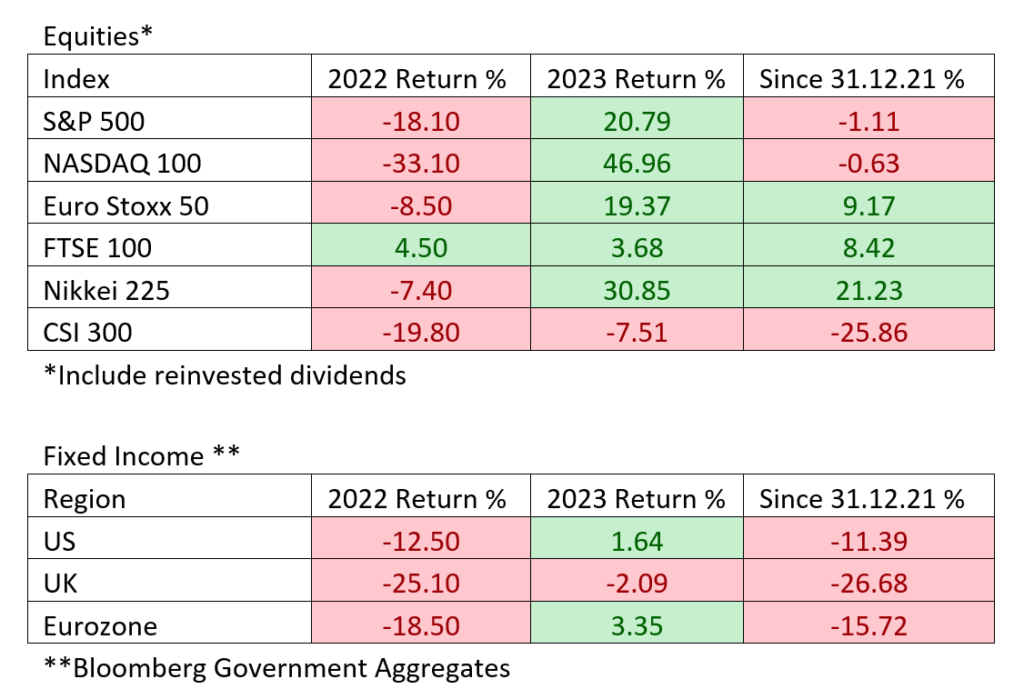

As the table below illustrates, nearly all equity markets produced significant positive performance for the month. Fixed income wasn’t left out, as the Bloomberg US Aggregate Index rose 4.52% for the month. US government ten-year yields fell nearly 50 basis points over the month erasing half of the rise in yields we had witnessed over the third quarter.

Please note: Returns include reinvested dividends

Source: Bloomberg

As illustrated below, inflation is now approaching the target rate of 2%, leading financial markets to conclude that central banks have not only finished raising rates but that they will likely be cutting rates by late spring or early summer of 2024.

Source: Refinitiv – Financial Times

In response, the central banks have been pushing back on this notion with Chairman Powell of the US Federal Reserve, President Lagarde of the European Central Bank, and Governor Bailey of the Bank of England, all asserting that it is premature to declare victory and initiate rate cuts.

Their apprehension stems from their failure to properly addressing inflation in 2021, when they told us it was transitory. They are determined to ensure that inflation is unequivocally on track toward their 2% targets before contemplating any loosening of monetary policy.

Is the market’s assessment accurate regarding the absence of further interest rate hikes and probable policy easing next year?

We believe they are partially correct. Economic data suggests some early signs of moderation in US consumption and a small reduction in the tightness of the US labour market, reducing the likelihood of the Federal Reserve needing to raise rates again. It’s important to note that the Federal Reserve is still shrinking their balance sheet by $90 billion per month, representing a continued tightening of monetary conditions, even without directly increasing interest rates.

European and UK economic data have been even softer than that of the US, suggesting that their current monetary policy settings are restrictive enough, warranting little need for further rate hikes. However, we disagree with the markets expectation of rate cuts in the first half of next year. We anticipate the central banks will prefer to observe a few more months of declining inflation rates and additional signs of weakening of growth, particularly some easing of the labour markets, before considering to loosen policy.

Despite the recent significant market rallies, which have effectively eased financial conditions, we do not believe central banks are concerned about current interest rates being excessively tight. Recent statements from central bankers suggests they are at present very comfortable with existing policy, and they remain vigilant, whilst closely monitoring data and being prepared to act in either direction as necessary. The risk of policy error is high.

As we discussed at our recent 2024 outlook investment conference, we feel the major economies are navigating between a soft landing and what we term as no landing, with a recession not appearing inevitable. The past two years of inflation fighting by central banks have made it difficult for investors but we suspect the worst may be over.

Source: Bloomberg. Data up to 30.11.2023

We expect rates will remain elevated (above pre-COVID-19 levels) but may not need to go higher to defeat inflation. Ongoing adjustments to the current level of interest rates are underway, and many borrowers have yet to fully experience the repercussions. We anticipate there will be more negative surprises as outstanding debt is rolled over at the higher levels. During our recent conference, we mentioned opportunities we saw in Healthcare, Defence, and Energy. Additionally, we believe there is some attractive opportunities in the front end of the yield curves, particularly in 3 to 5 years maturities in fixed income.

We continue to maintain an underweight position in stocks and markets with notably high valuations, choosing instead to favour companies and markets with less demanding valuations. While we anticipate market apprehension regarding the timing of potential rate cuts and do not forecast a recession, we believe investors should remain prepared. Acknowledging the fallibility of central bankers – as evidence by their declaration that inflation would be transitory – we adhere to a cautious and conservative approach in our strategic positioning.

As we move into 2024, we uphold our cautious and conservative portfolio positioning, avoiding the runaway expansion of price-to-earnings ratios in the technology sector. Owning stocks with excessively high valuations leaves little margin for error in the event of sudden shifts in these valuations. Additionally, we maintain moderate fixed income duration, as we do not anticipate rate cuts coming as quickly as the market is currently pricing.

Furthermore, we foresee expected concerns about fiscal deficits potentially putting upward pressure on yields. We believe our fixed income positioning has sufficient duration to provide support in the event of a recession. Although November saw a decline in volatility for risk assets, we acknowledge the lingering possibility of volatility spikes. Nevertheless, we maintain confidence in our strategic positioning, which will enable us to navigate these challenges.

Explore more engaging insights from our experienced team of professionals; Chief Investment Officer Jeff Brummette covered November market trends in the recent Investment Summary for November 2023, whilst our Managing Director Dominic Tayler summarised the economic impact of the UK Autumn Budget 2023.

Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below or get in touch with one of the team.