For our March 2023 Investment Summary, we take a closer look at the latest news and market trends we are seeing take place this month.

This was one of the more exhausting months that we have seen in financial markets in quite some time. There were moments where it reminded me of worst parts of the Global Financial Crisis of 2008/9.

Over the course of a weekend, the US experienced two bank failures, namely Silicon Valley Bank (SVB) and Signature Bank, while there were serious concerns surrounding others. The yield on the two-year US Treasury note climbed above 5% early in the month, but then collapsed below 4% in just a few days. In addition, Credit Suisse, the well-respected global investment bank and wealth manager, was acquired by its long-term competitor UBS in a hastily arranged government backed takeover (see UBS company announcement here).

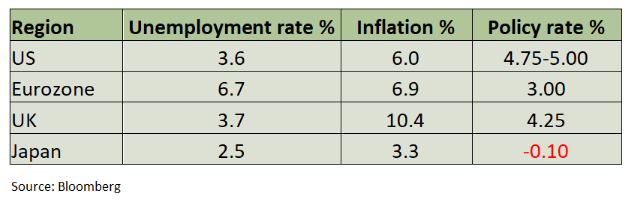

Despite the banking turmoil, the US Federal Reserve (Fed), Bank of England (BoE), and European Central Bank (ECB) all raised interest rates. Meanwhile, former President Trump was indicted by a grand jury in New York City. I am sure I have left something out!

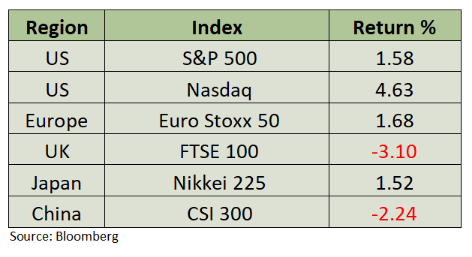

Global equities were very much a mixed picture. The S&P 500, NASDAQ, Euro Stoxx 50, and the Nikkei 225 all posted gains, while the FTSE 100 and CSI 300 lagged their global peers. In contrast, fixed income generated positive returns as markets continued to price in central bank rates cuts within the next year or so.

Let’s look through the noise of March and focus on the broader themes influencing the markets. To start, we are beginning to witness the effects of the significant rates hikes implemented over the past year, but they’re not playing out as central banks expected or hoped. Central banks anticipated weaker labour markets, slower demand growth, and significant decreases in inflation, but that hasn’t happened – yet. Instead, we’re seeing money move from banks to short-term government securities. Given advances in internet banking and the rapid spread of news on social media, deposit flows can happen very rapidly to the detriment of unprepared banks (SVB most notably).

In the US for example, one can now earn over 4.5% in 3-month US Treasury bills, while most banks are offering meagre rates of 1% or so on deposits. As a result, many depositors are moving their money out of banks to chase better returns. According to Refinitiv Lipper data, US money market funds had received over $270bn of inflows in March alone. This is exposing banks to the classic risk of borrowing short and lending long. Banks typically lend out short-term demand deposits while investing in long-term loans and securities. However, interest rates have been low for an extended period, resulting in losses on virtually all fixed income securities banks have purchased over the past decade. Normally, banks manage this risk, but some banks, like SVB, have not properly hedged their interest rate exposure. This mismanagement has caused some US politicians to criticise the Fed and regulators for not catching the problem earlier. There is some truth to this as the stress tests that banks undergo did not account for rising interest rates. They only looked at a repeat of the Great Financial Crisis, i.e., falling interest rates, an economic slowdown, and deflation. What is that saying, “generals always fight the last war”? Fortunately, the large banks in the US that hold the majority of household and business deposits are well-capitalised and are not indicating systemic risk from deposit flight.

The ongoing fight against inflation (a second theme) is currently influencing markets, but progress is not as quick as central banks would like. Despite coming off its highs from last summer, inflation remains above the 2% target set by most central banks. Tight labour markets and low unemployment levels suggest that more interest rate hikes and slower growth will be necessary. Until inflation moves closer to the target, it is unlikely that central banks will lower interest rates as the market currently expects. The Fed did acknowledge that the banking issues in the US, and the resultant tightening of lending conditions, acted like a rate hike. This may result in a Fed pause, but we are not yet able to suggest a Fed cut is on the horizon. In contract, the ECB and the BoE have not experienced the same kind of banking issues and we expect they are not yet near pausing their policy tightening strategy. This may result in some continued weakness for the dollar versus the euro and pound sterling.

The impact of higher rates is still being felt. There has been a lot of noise about the commercial real estate market and no doubt there are vulnerabilities there. But unlike bank deposit flight this will be more of a slow-motion revelation of losses and deflation of valuations. As mortgages are refinanced at higher rates problems will be revealed. The change in work habits has companies re-evaluating their office space needs and demand for office space is falling. Private credit and equity markets will no doubt have challenges as well. Refinancing debt when interest rates are 400 basis points higher than a year ago is not going to be easy or pleasant. The impact of higher rates is complex and multifaceted, and its effects will continue to be felt for some time to come.

The new Governor at the Bank of Japan, Kazuo Ueda, takes charge on April 8th. Japan remains the only central bank with negative rates and a policy of purchasing government bonds to hold yields at exceptionally low levels. The yen is weak, inflation is above target, and the scale of bond purchases is staggering. A change is coming. We need to watch this closely as Japan has been a major exporter of capital to the rest of the world. Were they to export less or heaven forbid repatriate capital, the world would feel it.

We still expect economic growth to slow, interest rates to stay high or rise a bit further (to ensure the desired growth slowdown). Corporate earnings and earnings growth will be softened, and this will take the steam out of the recent equity rally.

As we draft this letter OPEC has just announced a 1 million barrel a day production cut which emphasises to us the vulnerabilities in the energy space, and it is why we remain confident holding the energy sector.

Our current positioning has been adjusted by extending our fixed income duration and making slight tweaks to our equity exposure to adopt a more defensive stance. We continue to feel being conservative and cautious with our positioning is the best approach.

Read more from our Chief Investment Officer Jeff Brummette in our Investment Summary for February 2023. Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below.