For our February 2023 Investment Summary, we take a closer look at the latest news and market trends we are seeing take place this month.

The ebullient conditions of financial markets in January collided with higher-than-expected inflation and activity figures in February, bringing a quick halt to the promising equity market rally that began the year.

Headline CPI in the US fell to 6.4% but core PCE, which is the Federal Reserve’s preferred measure, rose to 5.4 %, after steadily declining since peaking in June last year. The US labour market continues to be strong with the unemployment rate falling to 3.4%. Indeed, January saw a huge monthly gain of 517,000 new jobholders. The weekly filings for unemployment insurance claims continue to sit at record low levels despite steady news about worker layoffs in the tech sector.

Good economic news was not limited to the US as the PMI services indices bounced back above 50 in the Eurozone and the UK signalling ongoing expansions in the service sectors of these economies. China has also had a sharp rebound in activity as their economy is exiting the lockdowns and restrictions of their zero-Covid policy. Financial markets which had been pricing (and hoping) for a soft landing abruptly switched to expecting more rate hikes and a longer period of high interest rates perhaps even a significant recession (the proverbial hard landing).

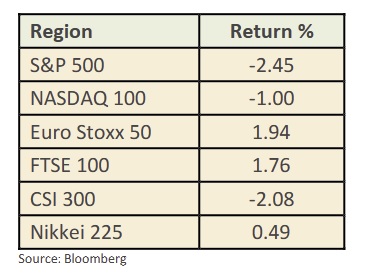

The result of all these gyrations was very mixed equity market performance for February (sharp declines from early month highs) and negative returns in fixed income for the month.

We expect periods of negative market performance to occur frequently over the next year as global central banks continue to struggle with reducing inflation. Markets will oscillate between the soft landing and hard landing scenarios depending on the most recent economic data. This time last year, the US Federal Reserve (Fed) was expecting core PCE inflation to end 2022 at 4.1%, whilst forecasting that the Fed funds rate would end the year at 1.9%. By the end of the year, inflation was at 5.3% and we had a Fed funds rate of 4.25%! Terrible forecasts, and this is with (or maybe because of?) a huge staff of PhD economists and very sophisticated econometric models of the US and World economies.

There is a notion that fighting inflation is simple. A central bank need only raise interest rates to slow activity which will then lower inflation, almost like adjusting the volume knob on an audio device or taking one’s foot off the accelerator in a car and applying the brake.

In January, capital markets had concluded that the central banks had hiked enough, inflation was falling from its highs, economic growth was slowing but not dramatically, a comfortable “soft landing” with equity prices rising and bond yields falling.

Unfortunately, it is not that simple, and it is certainly not painless. Economies are extraordinarily complex systems and the reasons that inflation rises, and falls, are not fully understood. Economists still argue over whether money supply growth is a factor or not.

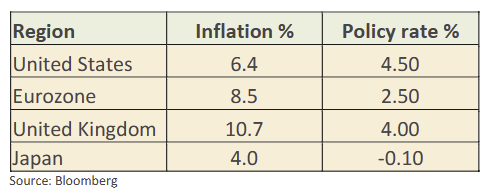

The gap between the current levels of inflation in the developed world and official interest rates suggest to us that more rate hikes will be required to bring inflation down to the popular 2% target most central banks are pursuing. We do not recall a period when inflation was brought down with policy rates below the inflation rate.

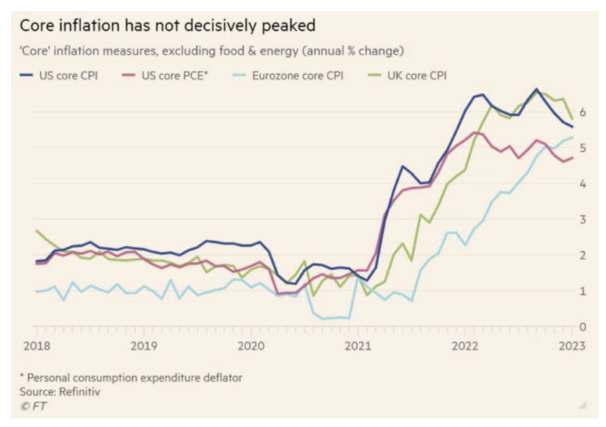

While inflation has come off its peak levels of last summer, much of the decline is due to energy prices falling back from their Russia-Ukraine war peaks. In addition, we have experienced falling goods prices as businesses misjudged how sharply goods demand would fall once economies became free of Covid concerns and people could travel and enjoy services again. Businesses cut prices to offload excess goods inventories. The chart below shows the stubbornness of core inflation, it is staying far too high.

We are just beginning to see corporate profit margins being affected by higher financing costs and by higher input prices and higher wage bills. Some companies can partially offset this by raising their output prices, but not all have this option. This has produced mixed earnings results and many downgrades of future earnings forecasts. This is not good for equity prices. The danger is that this kind of scenario becomes the norm and people, and businesses expect higher prices and alter their behaviour, workers seeking larger pay increases and businesses raising prices. This is why the central banks sound so determined to bring inflation down.

As they continue to raise rates economic activity will slow and the unemployment rate will start to rise. Households and businesses will respond, reducing their spending, and activity will slow further. Politicians do not like this scenario as their voters complain and they in turn will put pressure on the central banks to lower interest rates (or at least stop raising them). Depending on where inflation is, this may or may not be a good thing.

The difficulty is we do not know (nor do the central banks) how long rates will have to stay high in an attempt to reduce inflation back to targeted levels of 2-3%. Given this, we expect the investment environment will continue to be frustrating and central banks will attempt to cause economic growth to slow more.

We continue to favour markets with cheaper valuations (e.g. FTSE 100) and firms and industries (energy and mining) with pricing power that can help mitigate rising costs. We also find shorter duration fixed income attractive as the yields are high enough to contribute to your returns.

There is an old forecasting joke that goes something like this “forecasting is difficult, especially about the future.” But it does seem clear to us we have moved from the quantitative easing, zero-interest rate world, where money and credit was almost free, and certainly abundant, to a world of interest rates well above zero (likely to go higher), central banks no longer buying bonds, and businesses and consumers scrambling to react to the highest inflation they have seen in decades. A disciplined, value focused portfolio approach, with modest expectations will be the best course of action.

Read more from our Chief Investment Officer Jeff Brummette in our Investment Summary for January 2023. Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below.