February’s 2024 Investment Summary revisits January’s market performance and highlights key trends and opportunities for the month ahead. The more cautious of investors can often expect to be filled with optimism at the start of the year due to the ‘January effect’, which usually determines sentiment for the entire year based on how well (or poorly) financial markets perform. But are they feeling the love so far?

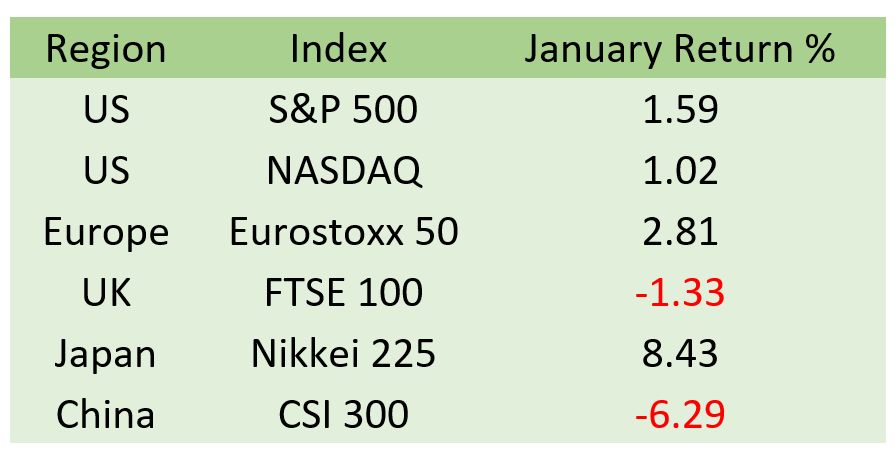

After the excitement of the fourth quarter of 2023, January started off rather cautiously. That said, as we moved through the month we witnessed reasonable returns, with the exception of the UK and China. Notably, Japan stood out as an outlier, experiencing a very strong month.

Source: Bloomberg Finance L.P.

In fixed income, we saw very modest movement in rates after the considerable rally of last quarter. The US GDP print of 3.3% surprised to the upside, resulting in a slight uptick in yields. We believe that markets are being far too optimistic regarding rate cuts, and we look for yields to drift in the short-term. Please refer to our recent piece on this – click here.

Two-Year UK Gilts

Source: Bloomberg Finance L.P.

Two-Year US Treasury Bonds Yields

Source: Bloomberg Finance L.P.

The Bank of England (BoE), European Central Bank (ECB), and the Federal Reserve Bank (Fed) have all pushed back on the prospects of very near-term rate cuts. However, all three at their latest meetings, acknowledged that rate cuts were likely if inflation continues to behave.

In our view, the current environment is positive for risk assets. Central banks will become less of a headwind for markets, having extended the pause of their tightening policy and potentially considering a shift towards easing. Economic growth has withstood the significant interest rate hikes of the past two years, with unemployment rates in the UK, US, and Eurozone at multi-decade lows. While the Eurozone and the UK have experienced only marginal growth (in contrast to the robust 3% growth in the US in 2023), there are promising signs of improvement. Strong labour markets have contributed to the stability of household incomes. If inflation stays subdued and central banks opt for even a slight reduction in rates, the outlook suggests a potential enhancement in growth.

Given all this we are increasing our exposure to both stocks and bonds and reducing cash. In fixed income we are increasing our holdings of intermediate (2yr – 10yr maturity) bonds. Additionally, in equities, we have added to our technology holdings.

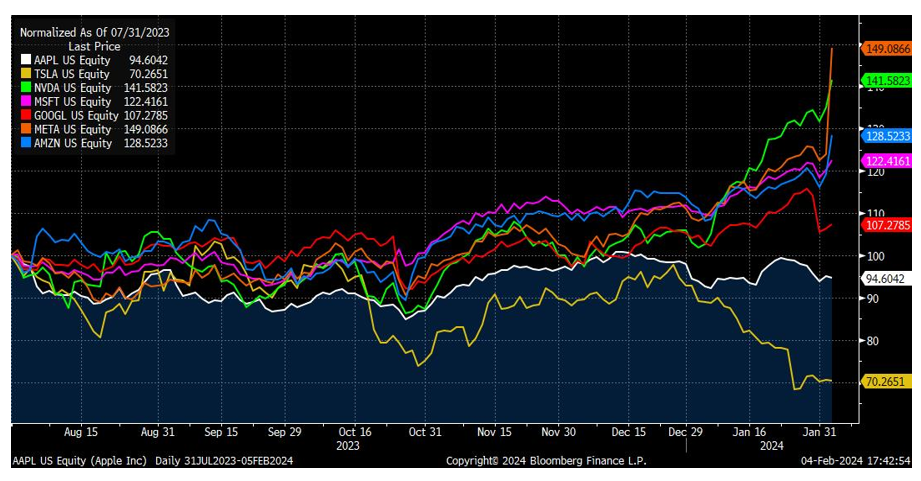

Last year, simply buying the “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) proved to be highly successful. This year we have seen wide dispersion in the performance of these seven stocks. Scrutiny of company specific features such as earnings and revenue growth are driving performance, rather than simply chasing momentum. This shift reflects a more nuanced approach that prioritises individual company features over broad market trends.

Source: Bloomberg Finance L.P.

So far, the favourable conditions for risk assets have not extended to the Chinese equity market. Following a challenging 2023, Chinese equities are continuing their downward trend. The Chinese government is intensifying its efforts to stimulate activity and halt the share price decline, with rumours of government sponsored purchases of equities abound. However, we remain sceptical about the success of these measures.

Source: Bloomberg Finance L.P.

Recent US economic data is affirming the Federal Reserve’s decision to abstain on near term interest rate cuts. January witnessed a very strong gain in jobs and higher wages. This needs to be watched closely. If subsequent US data indicates an acceleration in economic activity, the possibility of interest rate cuts may diminish. Meanwhile, there has been modest improvement in the European and UK economic indicators, maintaining the current favourable environment characterised by decreasing inflation and positive growth, supporting the performance of risk assets.

However, there are looming risks on the horizon. The situation in the Middle East is escalating, with US air and missile strikes targeting the Houthis and various Iranian backed militias in Iraq and Syria, heightening the potential for a broader conflict. Additionally, the upcoming US presidential campaign, with President Biden and former President Trump expected to be confirmed as candidates, introduces uncertainties. Trump’s protectionist rhetoric is already raising concern among US allies and trading partners.

In navigating these uncertainties, a robust and vigilant risk management approach will be crucial.

Discover other interesting investment insights from our Chief Investment Officer Jeff Brummette on our News & Insights page, such as the recent Central Bank Update: Where are the rate cuts? or his take on the Houthis, the Red Sea, and inflation. Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client? Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.