Our Central Bank Update for Q1 | February 2024 is an incisive summary of recent movements from some of the key central banks globally. Let’s take a closer look at what has been happening so far this year…

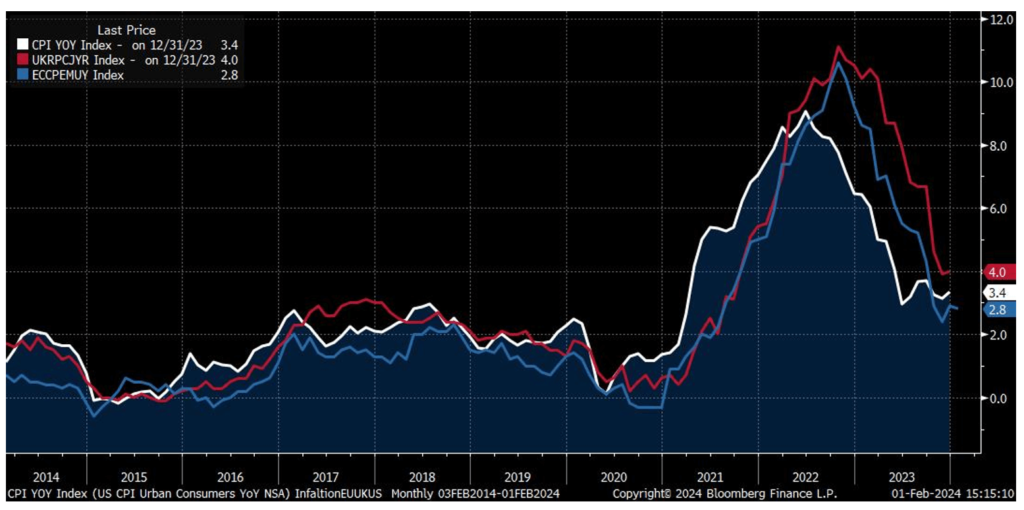

Since last Autumn, financial markets have been aggressively pricing significant interest cuts by three of the major central banks – namely, the European Central Bank (ECB), the Bank of England (BoE), and the Federal Reserve Bank (Fed). This adjustment was in response to a notable decline in inflation and a very dovish tone at the Fed’s mid-December 2023 meeting.

Source: Bloomberg Finance L.P.

Over the past week, all three of these central banks conducted monetary policy meetings, providing us with more insight into their thinking regarding potential interest rate cuts.

Each conveyed a similar message – inflation has declined significantly over the past six months and is approaching their 2% target. Their current monetary policy stance is restrictive and as inflation falls there is a risk their policy becomes too restrictive, hence the possibility of interest rate cuts to offset that unintended additional tightening. None of the central banks are prepared to convincingly assert that inflation has been successfully curbed; they expressed a collective desire for additional economic data before reaching any conclusive decision.

The ECB specifically highlighted wage data, noting that despite minimal growth in the Eurozone throughout 2023, the unemployment rate has reached all-time lows since the launch of the Euro. Recent labour actions illustrate that workers feel they still have bargaining power to press for higher wages. President Lagarde of the ECB expressed a desire to see some moderation in wage gains, emphasising the significance of the upcoming wage data in spring as a crucial factor in their decision-making on interest rates. This suggests that rate cuts by the ECB may commence at their policy meeting in May, providing of course that wage gains meet their expectations.

Chairman Powell of the Federal Reserve was much more explicit stating that rate cuts were unlikely at the upcoming March FOMC meeting. Acknowledging that their preferred measure of inflation had been running at their target rate of 2% for the past six months, Powell admitted that the FOMC remained unconvinced that this was going to continue. Indeed, he emphasised the need for additional inflation data before considering any rate cuts. Their next meeting in March, will feature a new set of forecasts which should provide some insights as to whether May or June will see the first rate cut. Historically, there is an average of 8 months between the last Fed rate hike and the first Fed rate cut, with the last rate hike in July 2023, which makes March 2024 exactly 8 months later.

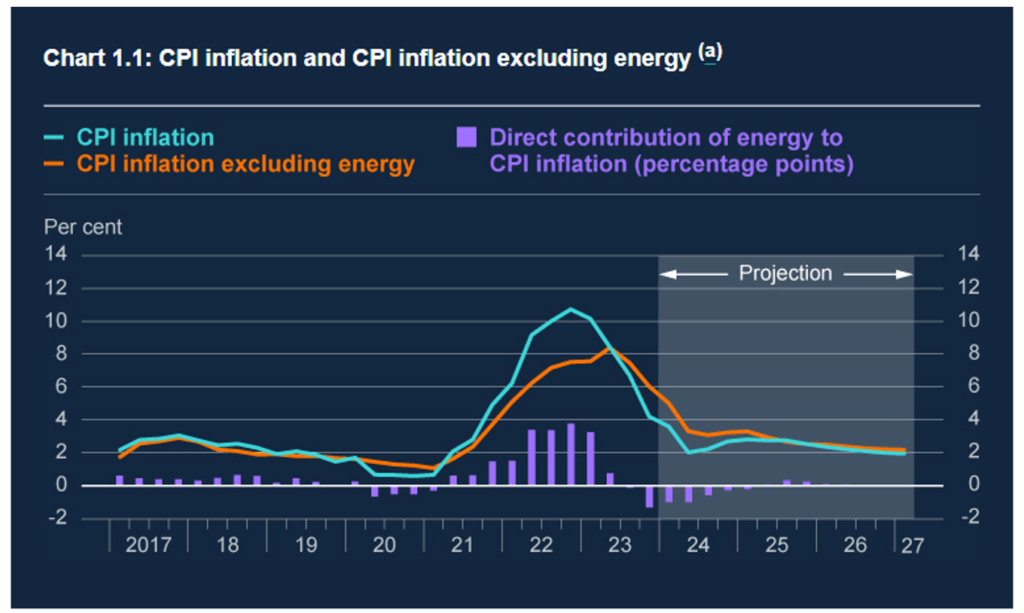

On February 1st, the Bank of England presented updated forecasts, with Governor Bailey asserting that in light of these new (lower) inflation projections, maintaining interest rates at the current level of 5.25% could result in a policy stance deemed excessively tight.

Sources: Bloomberg Finance L.P., ONS and Bank calculations

So, cuts are coming. Mirroring the somewhat cautious stance of the Fed, the BoE would like to see additional data before they begin to lower rates. Wage inflation has fallen, but is still too high, and service inflation remains over 6% posing challenges in achieving the BoE’s inflation target of 2%. Once again, May or June seems the earliest time that the BoE would first lower rates.

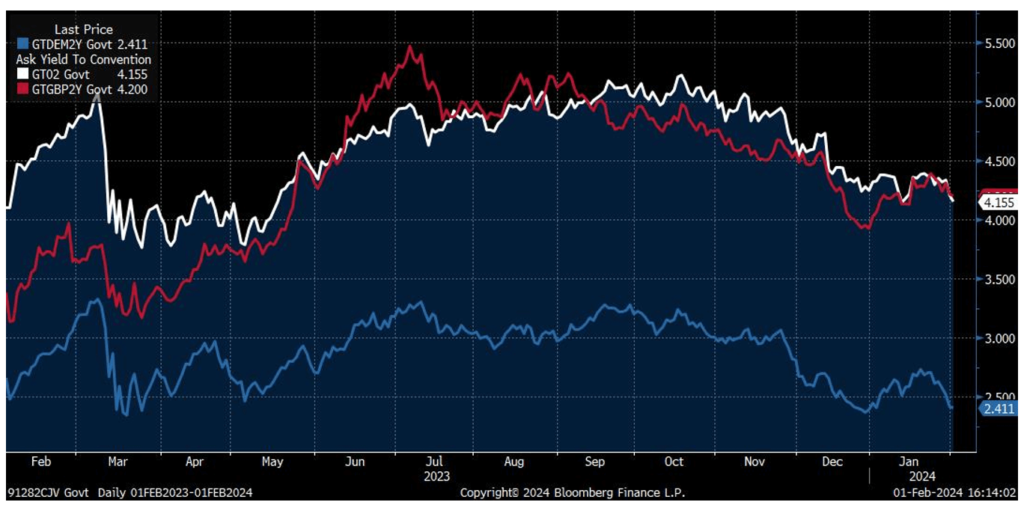

The potential impact of these interest rate cuts is, by and large, already reflected in market dynamics with fixed income and equities experiencing significant price increases since November 2023. In essence, the markets have pre-emptively factored in the likelihood of rate cuts. Notably, as inflation started to cool, yields on 2-year UK and US government bonds have decreased by approximately 100 basis points, while German two-year government bonds have seen a decline of nearly 90 basis points. The expectation of interest rate cuts has significantly influenced these adjustments.

Bond yields fell significantly in Q4 2023

While equities had a strong rally

Source: Bloomberg Finance L.P.

Unless the central banks do much more than the markets are already pricing (or much less), we do not anticipate market direction being driven by them, a departure from the trend observed over the past two years. In the broader context, whether base rates stand at 4% or 5% this is unlikely to exert a substantial influence on economic activity and corporate earnings. Central bank policy was so important in 2022 and 2023 due to the magnitude of their rates moves – increasing interest rates from zero to 5% is a big deal. However, a shift from 5% down to 4% is not expected to carry the same level of significance and influence.

Concluding, I would like to draw attention to the escalating US government debt. Since the start of the 2024 fiscal year on 1 October 2023, the US government deficit has surged by approximately $509 billion compared to the first three months of fiscal 2023. For the full year, the deficit was 7.5 % of GDP, occurring in a year where economic growth exceeded 3%. Already in this fiscal year, both Medicare and Social Security expenditures have risen by over 12%. Compounding these financial pressures are substantial outlays associated with the Chips Act (supporting the semiconductor sector) and the ironically named Inflation Reduction Act. Given the substantial fiscal stimulus in an economy already operating at full employment, the sustainability of the Fed’s current success in curbing inflation becomes uncertain. This problem is not unique to the United States. Running large fiscal deficits was easy during the zero-interest rate world post the 2008 Global Financial Crisis and large deficits were seen as normal. Governments globally are finding it difficult to reduce spending – the pressure to reduce government expenditure is likely to have repercussions on longer-term interest rates.

Explore other interesting insights from the Oakglen investment team on our News & Insights page, such as our recent 2024 Investment Outlook or the piece on the Houthi attacks in the Red Sea. Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client? Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.