Welcome to our 2023 Review and 2024 Investment Outlook. In 2023, the finance industry underwent dynamic changes, compelling Oakglen Wealth to assess some of the key trends and examine how things are evolving. Our review takes a closer look at some of the trends which occurred last year and offers a forward-looking outlook for 2024.

To start off this piece, we thought it would be helpful to provide a quick recap of some of the key events that defined 2023:

January

Microsoft invests $10bn into OpenAI (Creator of ChatGPT).

February

Chinese “spy balloon” drifts over the Americas.

March

Banking crisis ending with the collapse of SVB and UBS’s acquisition of Credit Suisse.

April

Finland joins NATO.

May

WHO declares the end of the Covid-19 global emergency.

June

Wagner Group rebellion.

July

Hottest global average temperature ever recorded at 17.01°C.

August

BRICS to add Argentina, Ethiopia, Egypt, Iran, UAE and Saudi Arabia in 2024.

September

Novo Nordisk becomes Europe’s most valuable company.

October

Attacks on Israel and the commencement of the Israel-Hamas war.

November

Chinese President Xi Jinping meets US President Joe Biden.

December

Houthi attacks result in global shipping firms suspending Red Sea activity.

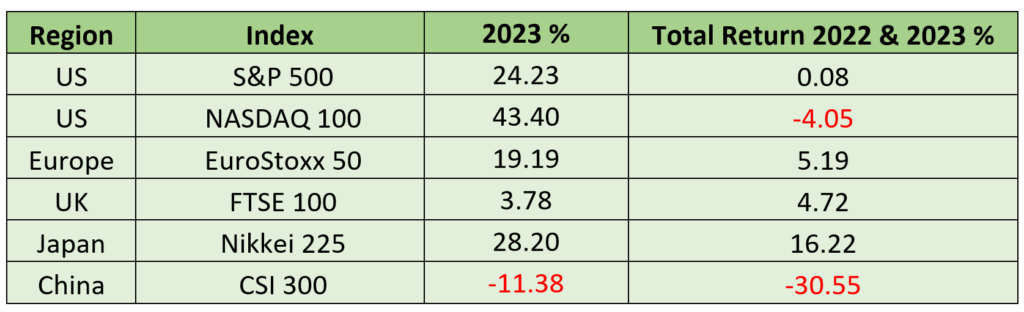

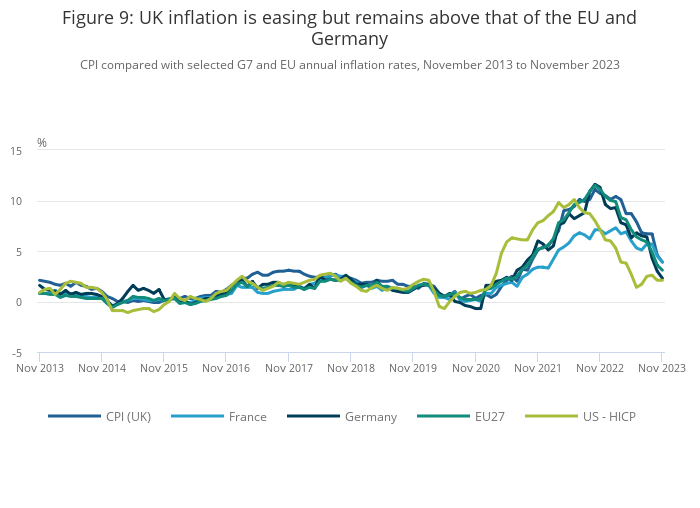

Quite the list. What we haven’t mentioned is the behaviour of financial markets, which, since 2022, have been primarily shaped by the central banks’ struggle against inflation. In response to this, we witnessed some of the fastest policy tightening by central banks since the 1970s, significantly influencing markets. Although there has been notable growth in both equity and fixed income markets last year, some indices remain below the levels at the end of 2021.

Equities*

*Local currency excludes dividends

*Local currency excludes dividends

Fixed Income**

**Bloomberg government aggregates

**Bloomberg government aggregates

Source: Bloomberg

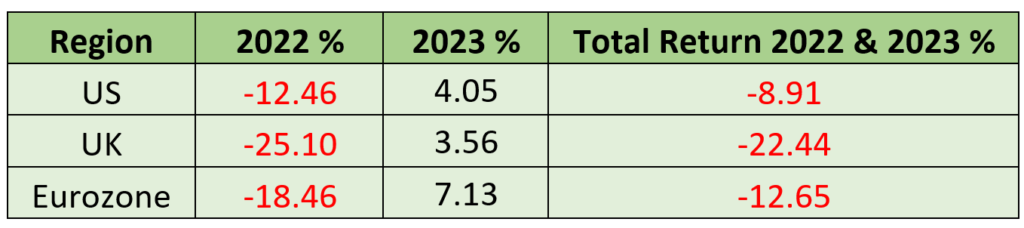

Equity market performance in 2023 was boosted by the so-called “Magnificent 7” stocks in the US. To varying degrees these stocks also played into the market’s love for Artificial Intelligence (AI) stocks last year. It’s interesting to note that the S&P 500 performance for 2023 would have been nearly half of the actual return if measured on an equal weight basis.

Source: marketsentiment.co

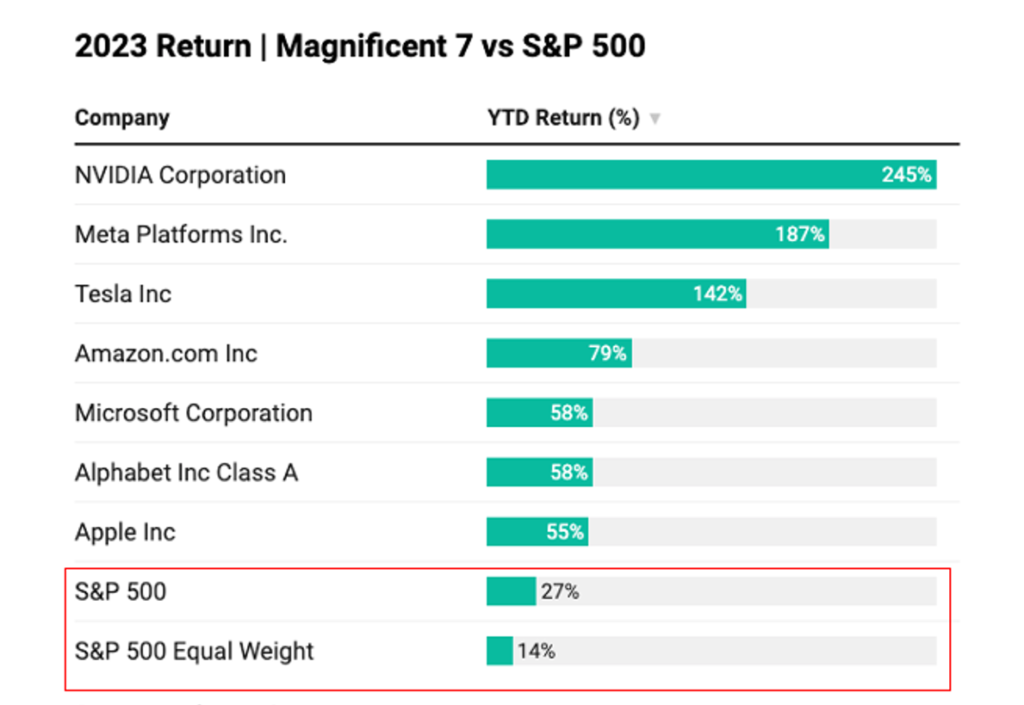

An added tailwind for equities last year was the fall in inflation, which pulled back dramatically from last year’s highs to levels approaching the 2% target that the major central banks would like to meet.

Source: Consumer price inflation from the Office for National Statistics, Harmonised Index of Consumer Prices (HICP) from Eurostat, and US HICP from the US Bureau of Labour Statistics

The recent improvement in inflation sparked enthusiasm in financial markets regarding potential interest rate cuts in 2024. Over the last six weeks of 2023, both fixed income and equity markets experienced a strong rally as they factored in the possibility of rate reductions. This raises the question:

Could this be a preview of what lies ahead in 2024?

During their latest Federal Open Market Committee (FOMC) meeting, the US Federal Reserve (Fed) adjusted their forecast for interest rates and inflation, seeing both lower by the end of 2024 compared to their previous forecast in September. This shift is being hailed as a dovish pivot by the Fed, as they seem to be all in on forecasting a soft landing. According to their updated projections, inflation, as measured by core PCE (the Fed’s preferred indicator), is expected to decline to 2.4%. Unemployment is forecast to drift up ever so slightly to 4.1% from the current 3.7%, which is still indicative of a tight labour market. The Fed Funds rate is now projected to fall to 4.6%, and growth is forecast to be a positive 1.4% for 2024 – perfect soft landing!

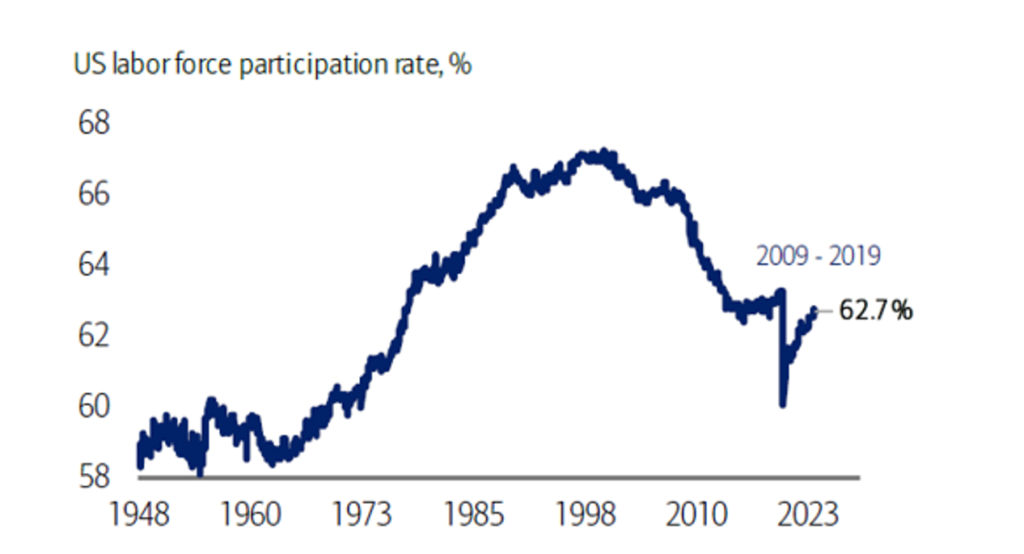

While this outcome would be fantastic for asset markets, with positive growth, low inflation, and falling interest rates, it raises concerns about the Fed’s ability to accurately navigate the economic landscape. It is hard for a central banker to be that skilled or that lucky. We are concerned that the labour market in the US still looks remarkably tight, yet the Fed is signalling potential interest rate cuts on the horizon, leaving room for scepticism about their forecast accuracy and the element of luck in their policymaking.

Source: BofA Research Investment Committee, Bloomberg

Workers continue to secure higher pay, and a considerable number of individuals who exited the labour force during the pandemic have not yet returned. Despite the healthy wage agreements negotiated by workers last year, these will not take full effect until later in 2024, leading us to expect more upward pressure on prices as companies attempt to pass on these higher wage costs to consumers.

Source: BofA Research Investment Committee, Haver

The recent improvement in inflation is largely attributed to declines in energy prices and the continuing fall in goods prices. We all know energy prices can be quite volatile and even with the recent surge in US shale production, the supply demand balance in energy is still very tight. Recent disruptions in the Red Sea illustrate the vulnerability of transport links for energy supplies.

Neither the Bank of England (BoE) nor the European Central Bank (ECB) have adopted the dovish sounding message delivered by the Fed. In the BoE’s case, they still have inflation just below 4% (measured by CPI) so it is difficult for them to declare victory on the inflation fighting front. The ECB has seen a larger drop in inflation recently and the Eurozone is barely growing so the pressure on the ECB to ease is mounting. It would not surprise us to see the ECB cut rates before the Fed and the BoE.

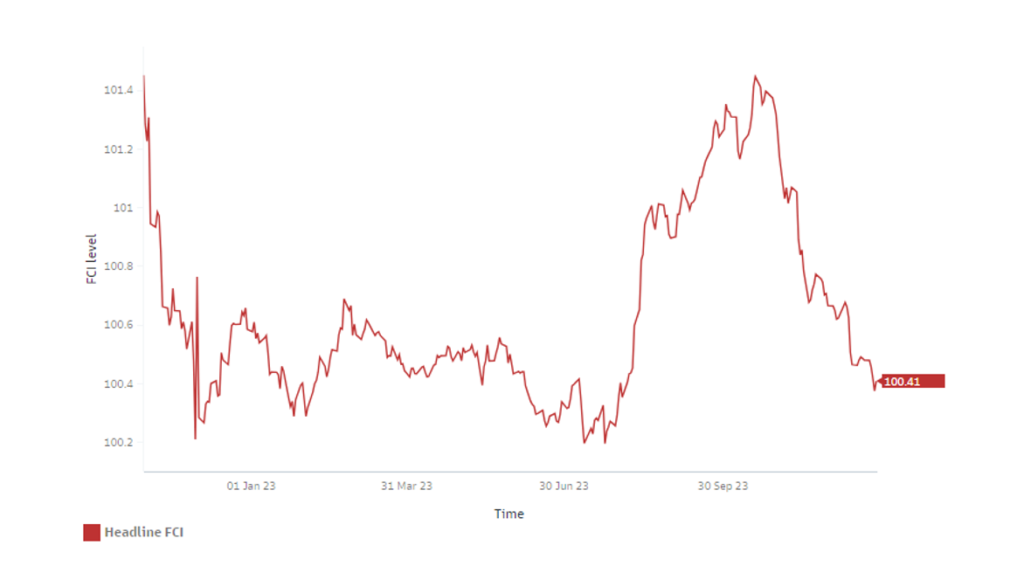

We believe that central banks will not be the headwind for markets they have been for the past two years. Indeed, the easing of financial conditions over the course of Q4 (as illustrated below) was most certainly another tailwind for fixed income and equity markets.

Source: Goldman Sachs Investment Research

Nevertheless, it is important to be cautious. We have consistently highlighted that markets are overplaying the likelihood of aggressive rate cuts from central banks. Although they are no longer hiking rates, we do not anticipate them reducing rates to the extent that financial markets currently project, unless there is a significant further decrease in inflation or a notable downturn in labour markets. It’s essential to recognise that monetary policy works with long lags, so some of the effects of the rate hikes from the past two years may not have fully manifested yet.

In our recent outlook presentation a few weeks ago, we explored the possibility of a “no-landing” scenario in which the central banks declare victory over inflation and reduce their degree of monetary tightness despite inflation still being above target. It appears that we are moving in this direction. Initially, this shift would likely have a positive impact on markets, akin to the trend observed over the last six weeks. However, a potential drawback emerges when inflation ceases to decline and resumes its ascent. Bond markets may respond adversely, triggering a ripple effect into certain segments of the equity markets.

We believe the best way to navigate through this environment is to continue to be relatively conservative. Our portfolio managers are steering clear of some of the high price / earnings technology stocks, instead allocating to firms with robust balance sheets and strong cash generation. Despite the ongoing influence of AI in driving spending in the tech space, we believe there are alternative avenues for participation beyond merely owning the likes of Nvidia although we acknowledge their earnings growth over the last 12 months has been impressive.

Given the potential for central banks’ prematurely declaring victory over inflation, we believe you should have some inflation hedges in your portfolio. We favour exposure to energy and mining stocks, particularly companies that that produce copper and gold. The ongoing shift towards green energy will continue to demand ever larger amounts of copper.

To provide insight into the challenges ahead for copper production, I recommend reading the excellent “Material World” by Ed Conway. Conway illustrates these challenges using the Chuquicamata mine, one of the world’s largest located in the Atacama Desert of Chile. Operating around the clock, 24 hours a day, 365 days a year, this mine yields approximately 650,000 metric tons of copper each year. Conway highlights that if we are going to effectively transition to batteries from fossil fuels, then we need to find a way to excavate another three Chuqui’s of copper every year – a colossal task.

Turning to gold, central banks, led by The People’s Bank of China, have bought record amounts of gold for the second year running. Do they know something we don’t about the future path of inflation?

Sources: Metals Focus, Refinitiv GFMS, World Gold Council

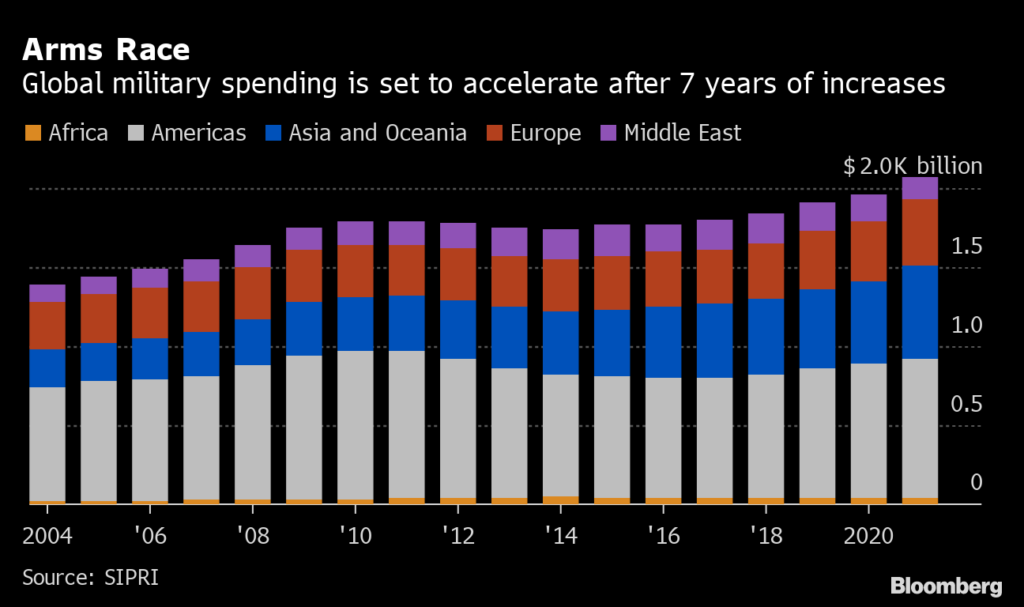

The defence industry has faced criticism over the years, largely due to ethical concerns around profiting from conflict. We acknowledge the emotional aspect tied to investing in this sector. For clients comfortable with investing in defence stocks, we believe there are opportunities. Recent events, such as the war in Ukraine and the fighting in Gaza, have highlighted the insufficient munition and weapons stockpiles in NATO and the West. Spending on defence is on a rising secular path, independent of economic conditions.

Source: SIPRI via Bloomberg

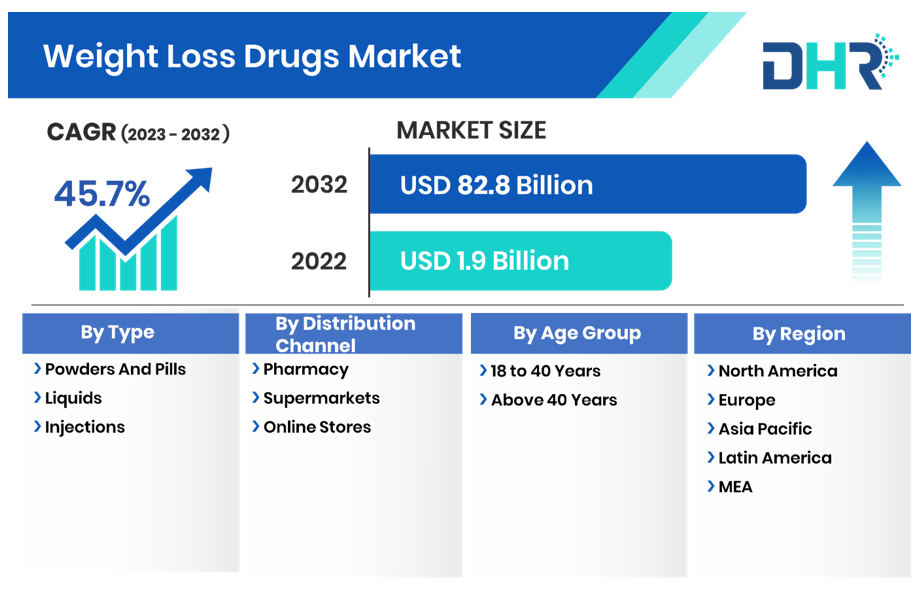

We also see opportunities in healthcare where we have witnessed some significant new developments in weight loss drugs. The success of the launch of Wegovy helped the Danish manufacturer, Novo Nordisk, earn the title of ‘Europe’s most valuable firm’, as their stock climbed over 50% last year. It’s US peer, Eli Lilly fared even better returning over 60%. Recent industry analysis has suggested the weight loss market could see a compound annual growth rate of some 45.7% up to 2032.

Source: DHR Global

2024 should be more about earnings than central bank actions. Companies equipped to handle rising costs and who possess pricing power are likely to perform well. Do not be deceived by the recent deceleration in inflation rates. The overall level remains considerably higher than pre-pandemic levels; lower inflation only means the pace of price increases is slowing, not that the price level is falling. One needs to own businesses that can manage in this new, much higher cost environment.

Political dynamics are poised to shape the landscape as elections will be held in the US, India, Indonesia, Mexico, the Eurozone and the UK to name a few. In fact, over one third of the world will be voting in elections but the US election will by far be the most consequential. The US Presidential campaign officially kicks off with the Iowa Caucus and the New Hampshire primary later this month. The current choice of President Biden versus former President Trump is generally unappealing to most Americans. The Supreme Court of the State of Colorado has ruled that Trump cannot appear on the ballot in that state citing Section 3 of the 14th Amendment to the US Constitution. This amendment forbids anyone who previously served in office, took an oath to uphold the Constitution, and then participated in an insurrection or rebellion from holding such office again. Trump has appealed this verdict and the case will be heard by the US Supreme Court on 8th February.

The Supreme Court will also be ruling on whether the doctrine of Presidential immunity prevents former President Trump from being prosecuted for his actions or inaction on January 6 2021. The US Supreme court is being seen as having an unusually large role in this year’s election adding to the concern that US elections are no longer free and fair.

At present former President Trump is leading in the polls, and most importantly leading in five of the seven “swing” states: Arizona, Georgia, Michigan, Nevada, Pennsylvania, Wisconsin, and North Carolina. These states will decide the election.

It’s essential to highlight that Trump’s America First rhetoric, particularly when it comes to the imposition of tariffs, is viewed as perilous and inflationary. The act of imposing tariffs on imports allows domestic producers to raise prices, which, in the long run, is not conducive and will ultimately hurt US consumers. This type of policy stance reinforces the inclination to hold fewer US equities and more non-US equities. Outside of the US, equity valuations are significantly lower, and with exception of the UK, political considerations are not expected to be a major issue in 2024.

China has been a huge disappointment for investors, as the exit from the Covid-19 lockdown did not produce the bounce in growth that everyone anticipated. Instead, the housing and property markets continued to weaken, leading to the collapse of several highly leveraged homebuilding firms. The downturn has significantly impacted consumer spending and sentiment discouraging investment. Unsurprisingly, valuations on Chinese stocks are hovering near to rock bottom versus their 10-year averages.

Source: Bloomberg

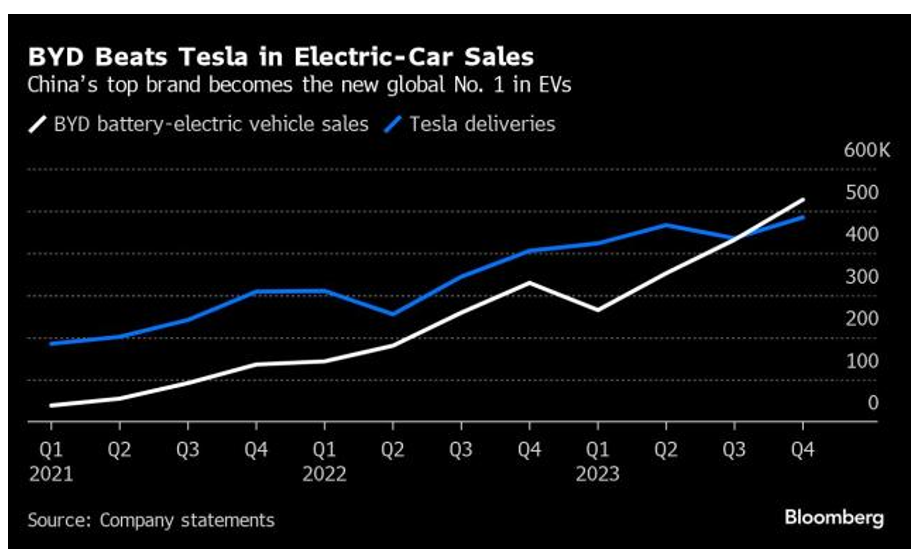

Despite these economic challenges, China remains a global leader in alternative energy, particularly in solar and battery technology. Additionally, it has become a dominant force in the production of electric vehicles. Indeed, Chinese based BYD recently overtook Tesla to become the number one manufacturer of electric vehicles, helped by its much broader range of cheaper models in China.

Source: Company Statements, Bloomberg

The US restrictions on technology exports to China have compelled Chinese firms to improve their capabilities in microchips. This is likely to be a continuing theme as we move through this decade. Despite geopolitical concerns, particularly around Taiwan and China’s perceived support of Russia, we remain optimistic about finding ample investment opportunities in China.

In fixed income, we prefer the front part of the yield curve, specifically the 3-7 year maturity space. When the central banks ease, this is where you are likely to see the best performance, much like we have just witnessed, as markets have already begun to price significant policy easing. Conversely, we are less inclined towards longer maturity bonds as the fiscal situations are poor in most developed countries, with little prospect of substantial deficit reduction or a decrease in bond supply. Furthermore, if we are correct that inflation will begin to rise again later next year, then the longer end of the bond market will be particularly vulnerable.

Source: IMF Projections for 2023 via IMF (October 2023)

Geopolitical tensions will continue to be a powerful and unpredictable influence on markets. The war in Ukraine is approaching it’s two-year anniversary with no end in sight. Only a growing fatigue in the West of continuing to support Ukraine.

In Gaza, there is no obvious end to the conflict either with increasing risk of spillover into other countries in the region such as Lebanon and Yemen for example with the Houthi rebels continuing to attack shipping in the Red Sea. Additional shocks from these conflicts will be negative for markets.

In summary, we are not forecasting a global recession this year. We anticipate growth will be slower than 2023, with the lagged effects of higher interest rates influencing the market throughout the year. The central banks will no longer be the markets enemy, and they may even be modestly helpful if they lower interest rates in the event that the rate of inflation has fallen closer to their target. This improved outlook may be challenged by political events in the US as former President Trump looks likely to become the Republican nominee. His policy prescriptions are certain to be alarming. The two ongoing wars in Ukraine and Gaza will also not contribute positively to world markets and one should be on guard for shocks coming from them.

Expectations for high single-digit returns should be considered realistic, and investors preparing for such outcomes should not be disappointed.

Discover other interesting insights from our Chief Investment Officer Jeff Brummette on our News & Insights page, such as the recent Investment Summary for January 2024. Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client? Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.