With the world now facing two wars, economists are understandably worried for how markets and the global economy will react in response as we move further into the final quarter. Having already covered persistent inflationary pressure and continued fiscal policies, amongst a number of other considerable factors, we focus on how oil prices, oil supplies and bond markets are being affected by the current Israel-Hamas conflict.

The military conflict in the Gaza Strip and Israel has once again drawn the world’s focus and raised concerns about oil prices and oil supplies. There is no shortage of military pundits and “experts” being rolled out in the media discussing various scenarios that bring Iran and the US into the conflict, raising the spectre of a significant reduction in oil supply and a sharp spike in oil price. Rather than attempting to “out expert the experts” and offer a scenario analysis for how events will develop in Gaza and the Middle East, we wish to emphasise a critical point: this new oil supply risk emerges at a time when global oil demand is at a historic high.

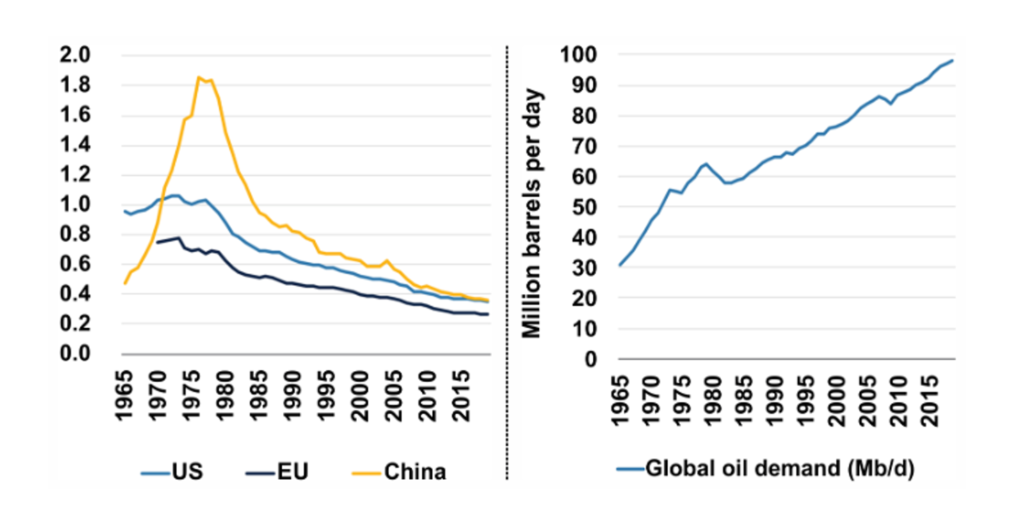

Despite significant advancements in energy efficiency within developed nations and a shift towards renewable energy sources, the demand for oil continues to rise. Emerging markets now account for 54% of the world’s oil consumption. US shale production has reached its zenith, and without significant new investment, it is unlikely to increase further. OPEC is determined to keep prices high, and the Saudis have been willing to cut production to support this goal. Furthermore, the US has significantly depleted its strategic petroleum reserve, making it unable to offset production cuts by Saudi Arabia and other OPEC members.

In the absence of a sudden cessation of hostilities in the Middle East or a severe global economic downturn, it is hard to see a material decline in oil prices.

Oil intensity in barrels per $1,000 of GDP (2015 $, left) and global petroleum consumption (right), 1965-2019

Source: Columbia University CGEP

Since this summer, there has been a consistent and increasingly rapid rise in yields on longer dated bonds throughout the developed world, with the US witnessing one of the most significant jumps. Presently, US 10-year treasuries now yield 5%, a level not seen since just before the Great Financial Crisis (GFC) in 2007-08.

Benchmark 10-year bond yield (%)

Source: LSEG via the Financial Times

We are not suggesting that another financial crisis is imminent. Instead, we are observing that, for the first time since that crisis, bond markets have been liberated from extensive central bank manipulation. No more negative interest rates, and no more massive purchasing of bonds by central banks. In fact, some are even selling. As a consequence, the markets are left to themselves to determine the appropriate level of yields. However, it appears that the markets might be somewhat out of practice in this regard, and the liquidity of the bond markets has changed as well.

One of the by-products of increased regulation within the financial sector (post the Global Financial Crisis or GFC) is a reduction in banks’ ability to take risk. This, in turn, limits their ability to accommodate large flows in fixed income. As a result, we are witnessing more pronounced moves in yields and prices. To exacerbate matters, concerns are mounting regarding the size of fiscal deficits and the increasing interest rate burdens on governments. In the case of the US, the situation is further complicated by a dysfunctional legislative branch of government.

Where should US ten-year treasury yields be?

Considering a 3.5% inflation rate and the Federal Reserve’s indication of maintaining cash rates at 5.25% for an extended period, a 5% yield on a ten-year note doesn’t appear unreasonable. You could also argue that 4.5% or even 5.5% might be appropriate as well depending on your outlook.

The era of low levels of volatility that characterised the decade of near-zero interest rates and central bank bond purchases has come to an end. Adapting to this new environment will present challenges for many. Be prepared.

What are your thoughts? Get in touch with us and share your opinions. You can also suggest a topic you would like to hear more about in the future from our investment team.

Read more from our Chief Investment Officer Jeff Brummette in the October 2023 Investment Summary piece from earlier this month. Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below.