As the 2024 US election approaches, market dynamics are expected to shift in response to the upcoming changes – either America getting its first woman president or a second term of Donald Trump. Our Chief Investment Officer, Jeff Brummette, provides some key insights into the latest election developments and what this could mean for financial markets.

With under 50 days to go until the US election, it remains an incredibly tight race.

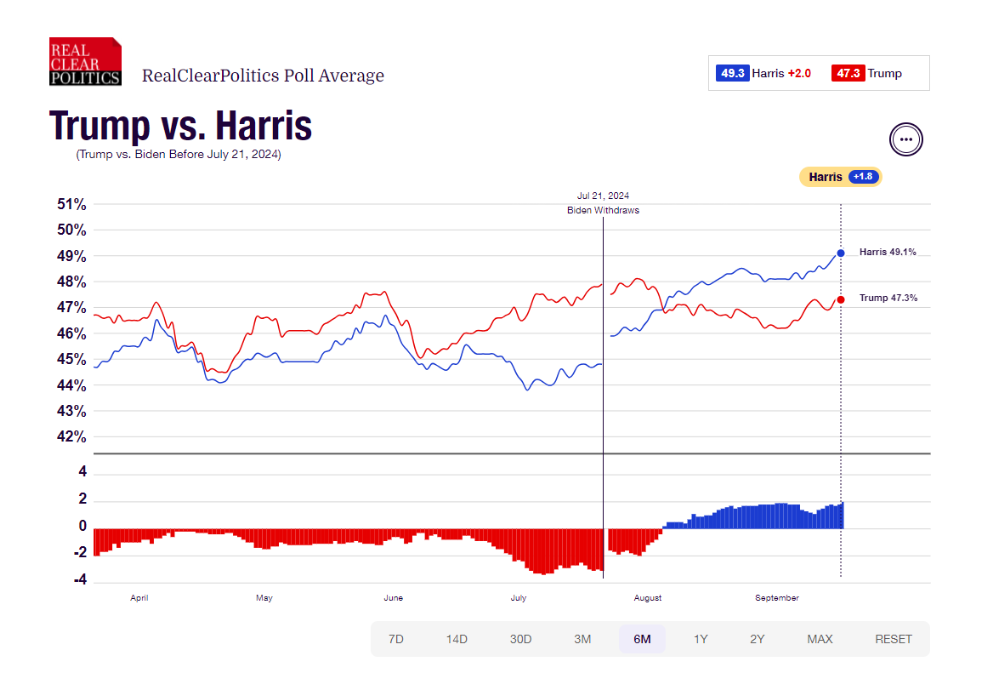

RealClearPolitics Poll Average: Trump vs. Harris

Source: RealClearPolitics – Poll Average

Just before President Joe Biden exited the race, a Trump victory seemed almost inevitable. However, Vice President Kamala Harris, who replaced Biden as the Democratic nominee in late July, has now edged ahead of Trump in some national polls, largely due to her strong performance in their recent televised debate.

It’s important to note that national polls can be misleading, as they often show the dominance of heavily Democratic leaning states like California and New York, which skew the popular vote in Harris’s favour. That said, winning the popular vote doesn’t guarantee winning the Presidency. Whether a candidate wins California by 20 votes or 2 million votes, they still receive the same 54 Electoral College votes.

To secure the presidency, a candidate must win 270 of the 538 available Electoral College votes. Each state is allocated Electoral College votes equal to their number of senators plus their number of congressional seats. California, for example, has 52 congressional seats and two senators, giving it 54 Electoral College votes. The District of Columbia (generally referred to as Washington DC) has 3 Electoral College votes despite having no senators or congressional representatives.

Seven key swing states will determine the outcome of election, as the remaining 43 states and Washington DC are strongly aligned with either one party (candidate) or the other. These swing states – Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin – have shifted between parties in recent elections and it is not clear who they will select this year. Both candidates and their parties are investing significant time and resources in these states in a fierce battle to win over undecided voters.

The races for control of both the Senate and the House of Representatives are nearly as close as the presidential race. Democrats currently hold a thin 51-49 majority in the Senate, but with 34 seats up for election this year, the balance of power is at stake. Of those seats, 23 are currently held by Democrats. Following the resignation of Joe Manchin, a Democrat from West Virgina, that seat is expected be won by a Republican, bringing the balance to 50-50. If the Democrats lose just 1 of their remaining 22 seats, the Republicans will take control of the Senate. Republicans are expected to win all 11 of their seats that are up for re-election, and there are 3 Democrat seats that are at serious risk of flipping to the Republicans. A single flip could tip the balance in favour of the Republicans.

In the event the Senate is a 50-50 tie, the Vice President casts the deciding vote, giving control of the Senate to the party of the sitting President. This tie-breaking power can be crucial in determining which party has the majority in the Senate.

In the House of Representatives, all 435 seats are up for re-election. Currently, the Republicans hold a narrow majority, but polling suggests that the Democrats may take control. This is significant as any legislation must be passed by both the House and the Senate before being signed by the President to become law. If the Democrats win the House of Representatives, they will limit a President Trump agenda, while a Republican Senate would similarly limit President Harris’s ability to advance her legislative agenda.

Both candidates are promising a mix of tax cuts and new spending initiatives, with Trump adding new tax cuts almost daily. However, many of these proposals are seen as unrealistic and unlikely to become law, and it’s unclear whether they are swaying voters. Most voters have already formed strong opinions about Trump over the past eight years, as he continues to deliver a familiar message of impending disaster if he is not elected. In contrast, Vice President Harris’s optimistic but somewhat vague message about improving life in America may prove to be more appealing. It has energised Democratic supporters and may be attracting a larger share of independent voters.

If Republicans were to sweep both the Senate and the House, along with a Trump victory, the initial market reaction would likely be a rally in equity markets, driven by expectations of significant tax cuts. However, bond yields would likely a rise in anticipation of increased government borrowing and inflation risks. As Trump’s agenda materialised, the Federal Reserve would likely slow their pace of interest rate cuts, viewing his policies as potentially inflationary and taking steps to prevent the economy from overheating.

A Harris victory, accompanied by a Democratic sweep of Congress, would likely result in a more muted market reaction, given she is not proposing the same degree of fiscal stimulus, and supports raising the corporate tax rate. The Federal Reserve would not be disturbed by this and would likely continue to ease policy as inflation stays contained.

If either Trump or Harris wins without their party having full control of Congress, the market outlook becomes harder to predict, with potential policy gridlock complicating expectations.

At present, we lean towards a Harris win, though not a full Democratic sweep. That said, we acknowledge that a lot can change in the coming days and weeks ahead.

We will continue to provide updates as the situation evolves.

Hear more from the Oakglen experts

Our investment team continue to provide topical and informative content for you to gain insights from. Leading the way is our Chief Investment Officer, Jeff Brummette, who has put together some timely analysis on the key central banks along with a concise investment summary for September 2024.

Read more:

- Central Bank Update: September 2024 – Fed (50), ECB (25) & BOE (Nil)

- Oakglen Wealth: September 2024 Investment Summary

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.