Dominic Tayler, Managing Director – UK at Oakglen Wealth, offers insights on the 2023 Autumn Statement delivered yesterday by the Chancellor, Jeremy Hunt.

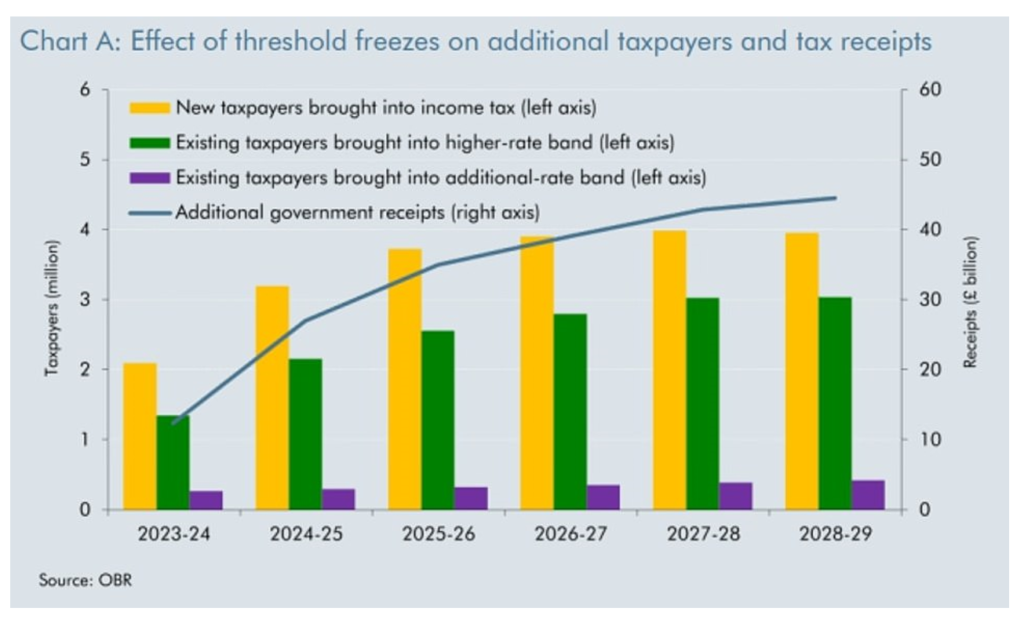

The focal point of the Autumn Statement was the larger than expected cut in National Insurance, with the main rate going down from 12% to 10% in January. Whilst this is a positive development, it’s essential to highlight that the freezing of income tax bands since April 2021 has not only adversely affected more individuals but has also functioned as a significant revenue source for the government. The Office for Budget Responsibility (OBR) anticipates a considerable increase in tax receipts – see below.

Source: The Office for Budget Responsibility (OBR)

One final point to add on this is that the analysis of the OBR’s data suggests that the percentage of the nation’s income being paid in tax is set to rise to its highest level in 70 years.

Savers found little to celebrate, as the savings tax rate bands retained their status quo. However, the Chancellor announced that changes will be made to simplify ISAs and widen the scope of investment that can be included in them from 6 April 2024. These adjustments will allow savers to pay into multiple ISAs of the same type in one year, as well as allowing partial transfers between providers.

Further changes include the ability to invest in fractional shares, open-ended property funds, and long-term asset funds. So-called LTAFs are a new type of fund that invest in illiquid assets such as infrastructure and private equity. Despite these changes, there was a sense of disappointment, particularly as a more extensive overhaul of ISAs had been expected. The ISA allowance remains at £20,000, a level maintained since 2017/2018. This is a space to monitor in anticipation of the Spring 2024 Budget, especially with a general election on the horizon.

Notably absent were changes to inheritance tax bands, leading us to speculate that the Chancellor might be reserving significant measure for the upcoming Spring 2024 Budget.

From an investment perspective, we received encouraging updates regarding sunset clauses for both the Enterprise Investment Scheme (EIS) and Venture Capital Trust (VCT) schemes, as it was announced that these will be extended to 6 April 2025 to 6 April 2035. Additionally, adjustments were made to the rules for Real Estate Investment Trusts, aiming to enhance the overall competitiveness of the regime. Despite the Chancellor not mentioning this during his speech, we also had changes to stamp duty reserve tax (SDRT) relief, with the threshold on shares that qualify for this relief increasing from £170M to £450M.

Businesses received a boost with the announcement that they can heavily capitalise spending for the foreseeable future. This initiative, permitting companies to deduct capital spending from taxable profits, was initially due to expire in 2026. The £11bn measure is poised to effectively reduce companies’ tax by 25p for every £1 spent on plant and machinery.

The Chancellor used his Commons speech to claim that the halving of inflation and a reduction in borrowing has put the UK economy “back on track”. As such, he had room to cut taxes as the government seeks to boost economic growth in the lead up to the general election. Regarding business taxes, the Chancellor declared that he has “delivered the biggest business tax cut in modern British history”.

The Chancellor’s ability to implement these tax cuts can largely be attributed to the positive impact of inflation on tax revenues, which has, thus far, outweighed the challenges posed by higher interest rates on debt payments. The OBR now forecasts inflation at 3.6%, whilst seeing GDP growth of 0.6%.

In summary, we anticipate that the tax cuts will be well received, although there is a palpable sense of disappointment that they did not go far enough. It remains to be seen whether the Chancellor’s Autumn Statement had been influenced by the Kwasi Kwarteng Mini-Budget last year, suggesting a reluctance to push tax cuts too far, or if he is strategically reserving further fiscal measures for the Spring 2024 Budget.

Click here to connect with Dominic on LinkedIn | Contact Dominic >