President Trump has once again turned to tariffs as a key weapon in his “America First” economic strategy, imposing a fresh wave of import duties aimed at protecting U.S. industries and reducing trade deficits. Framing the move as essential to making America great again, the President argues that these tariffs will boost domestic manufacturing, create jobs, and counter what he views as unfair trade practices by foreign competitors. Our Chief Investment Officer, Jeff Brummette, dives into the recent actions taken by Trump and what could be the potential consequences for such an aggressive trade agenda.

_______

Over this past weekend, President Donald Trump announced his long-threatened tariffs on Canada, Mexico and China, three of the U.S.’s largest trading partners. Tariff levels are 25% on Canada and Mexico, and 10% for China. At the time of writing this note, Trump had pulled back from the brink of a trade war with Canada and Mexico, by agreeing to postpone the tariffs by one month.

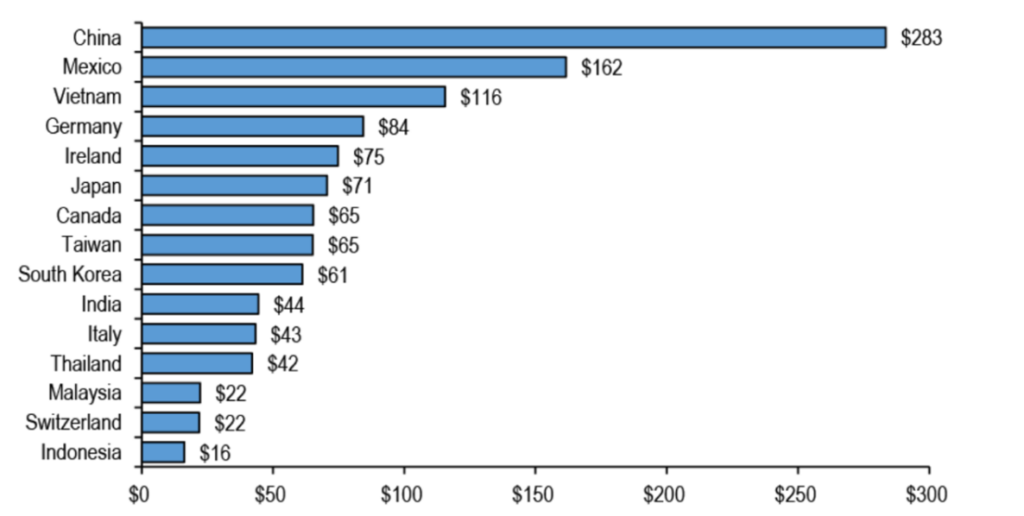

Tariff Targets: Countries with trade surpluses with the United States of America

Source: J.P. Morgan Equity Macros Research, USITC.

The scale of the potential economic threat must not be underestimated. The U.S. imported over $1.4 trillion in goods from these three nations and exported over $800 billion to them over the past year. Canadian and Mexico exports are key components to the manufacturing of automobiles in the US. Canadian heavy crude oil is used by US refiners to produce gasoline. Tariffs would negatively impact the auto manufacturing industry and higher oil prices are not desirable. There is fear this will be inflationary and that counter measures will damage U.S. growth.

The financial markets have responded negatively, with an immediate sell-off in equities exposed to in international trade. Additionally, the dollar has strengthened, not only against the Chinese yuan, Mexican peso, and Canadian dollar, but also more broadly. This reflects fears that Trump may impose tariffs on Europe and the UK. The logic is the countries who are impacted by tariffs on their exports are likely to depreciate their currencies to partially offset the impact of the tariffs.

Concerns are mounting that the inflationary impact of tariffs might cause the U.S. Federal Reserve (Fed) to tighten policy – or at least pause easing – to address new inflationary pressures. However, we view this as an overly simplistic perspective, as the negative growth impacts of a global trade war would carry more weight as far as the Fed’s decision making is concerned.

We do not know exactly what Trump would like China, Canada, and Mexico to do to have the tariffs removed. Over the last 24 hrs, Trump held a conversation with Mexican President Claudia Sheinbaum and delayed the implementation of the tariffs for one-month. She apparently promised to send Mexican National Guard forces to the border to help secure it and curb drug shipments by Mexican cartels. This development has provided temporary reassurance to financial markets, but uncertainty looms.

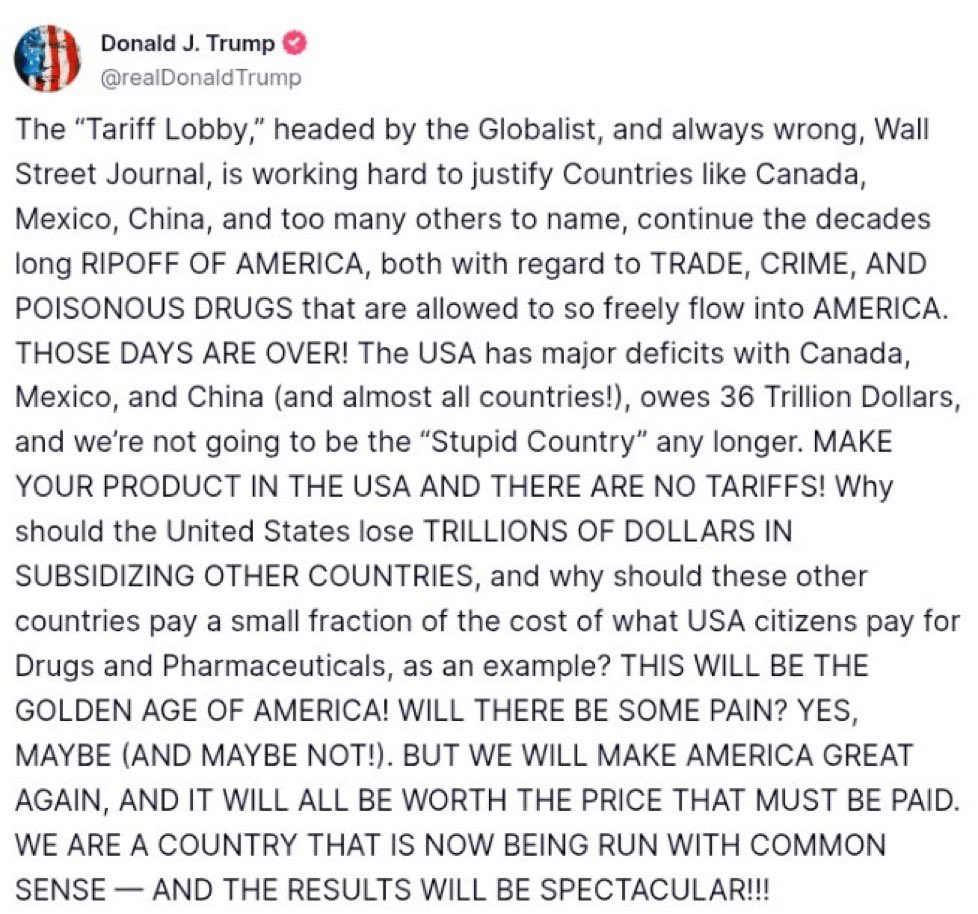

When Trump announced the tariffs over the weekend, he shared the news through this social media post:

“Will there be some pain?

Yes, maybe (and maybe not!).”

“It will all be worth the price that must be paid.”

Source: X Platform via Donald J. Trump @realDonaldTrump

This is Trump 2.0.

We will keep you fully informed as things progress, and both the economic and political impact unfolds.

_______

Hear more from the Oakglen experts

Our investment team continue to provide interesting and informative content to help keep you in the loop on recent global news and market trends. See below for some of our most recent articles, which you may find interesting and informative, brought to you by our investment experts:

Read more:

- Market Outlook 2025: Trump meets Goldilocks

Jeff Brummette, Chief Investment Officer

- H2 2024: Discretionary Investment Management Service Update

Myles Renouf, Senior Investment Manager

- Trump 2.0 Goes Live!

Jeff Brummette, Chief Investment Officer

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.