In this piece, we take a closer look at the US Debt Ceiling and why this matters to financial markets around the globe. Let’s dive in…

Over the past few weeks, financial markets have found themselves forced to worry about the US potentially defaulting on its debt obligations. In light of this, you will no doubt have heard a lot of talk about the US debt ceiling.

What is the debt ceiling?

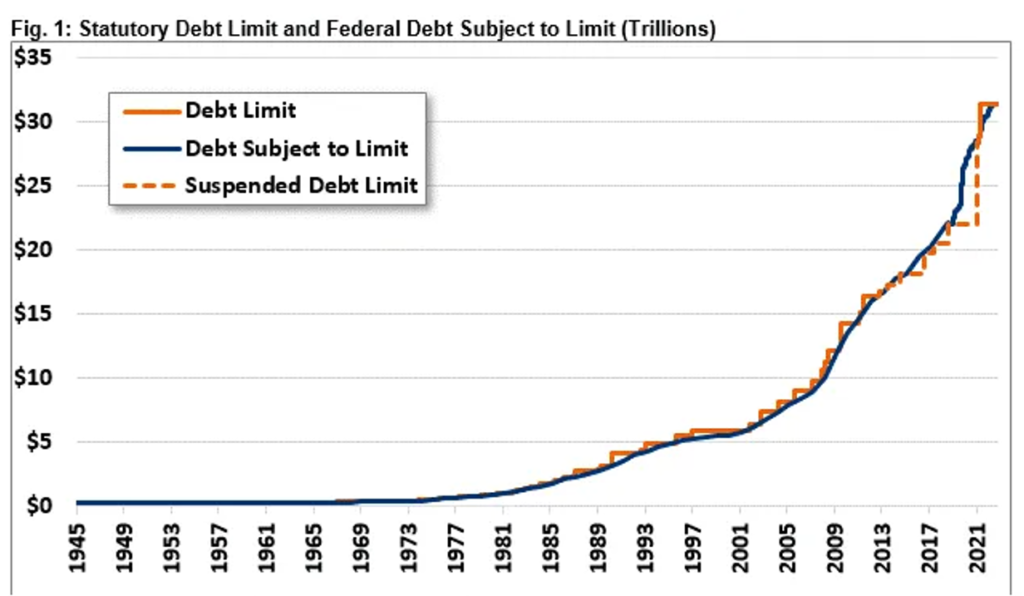

The debt ceiling is the limit on the amount of money the US government can borrow. The limit, which is set by the US Congress, currently stands at USD $31.4 trillion – a figure last set by Congress in December 2021.

Sources: Congressional Research Service, Office of Management and Budget, and Treasury Department

Why does the debt ceiling matter?

Because the US runs a significant budget deficit, incoming tax payments do not provide enough income for the government to pay its bills. Without the ability to issue more debt, the US Treasury will run out of money and be unable to pay government salaries and government suppliers, as well as not being able to make interest payments and principal payments on outstanding debt. This is a disastrous scenario.

How did we get to this point and why does the US government even have a debt limit?

Prior to the First World War (WWI), the US government did not borrow very much and as Congress controls spending and taxation, they required the US Treasury to come to them for approval every time they wished to issue government debt. WWI made this challenging, as the country needed to raise a great deal of debt to pay for the war. In response to this, Congress provided blanket authority to issue a proscribed amount of debt (about USD $25 billion).

Fast forward to the 1930s when the Treasury asked Congress for more flexibility, so they could refinance the WWI debt and start preparing for the Second World War (WWII). In 1939, Congress set a debt limit of USD $45 billion and by the end of WWII it had risen to USD $300 billion. The debt limit stayed at a reduced level of USD $275 billion until 1962. It has been raised over 80 times since then, usually without drama.

Are we currently in a crisis?

We could be if Congress and the President do not reach an agreement by early June. The Republican party controls the House of Representatives and passed a bill to raise the debt limit by USD $1.4 trillion through to March 2024, but it requires a sharp reduction in the growth of future spending (not a cut in spending as the President and the Democratic party are claiming).

The Democratic run Senate will not agree to this. Both sides have only begun negotiating despite Treasury Secretary Yellen warning of running out of money by early June. The danger is that both political parties are more interested in point scoring, rather than dealing honestly with the situation, and whether an accident happens.

If the debt limit is not raised or suspended, and the US fails to pay on a maturing treasury security, it would spell disaster for the world’s biggest economy. While the President and the leaders of both parties in Congress understand the risks, a great many members of Congress do not.

We even saw former President Trump calling for risking default to make the Democrats concede on spending. This is an insanely dangerous strategy.

What happens if the US defaults?

Even if the US manged to pay off a maturing security a few days late, after first defaulting, the likely panic in the markets would be significant. US treasuries are considered the benchmark risk free security and almost all other fixed income securities are influenced by treasury prices. There would be serious doubts about the creditworthiness of the US. If you have defaulted once, well you could certainly do it again.

This would raise the cost of borrowing for the US, perhaps dramatically, and given that the US is running a large fiscal deficit it would be very damaging for the economy. The decline in the equity market would likely be significant.

Nothing good would come from the US defaulting on a treasury security. It must not happen.

Will we get a debt limit deal in time?

We probably will…after a bit more political grandstanding and some market drama. But this will only be a temporary reprieve unless they abolish the debt limit completely. That does not appear to be on the agenda. We will no doubt face this issue again.

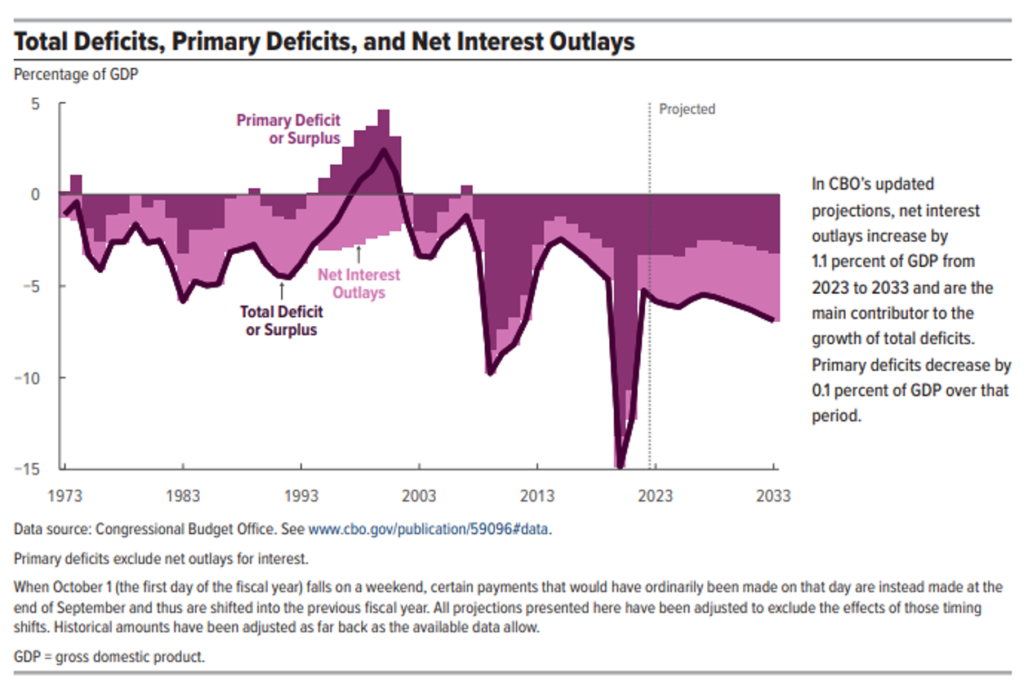

Meanwhile, US fiscal policy is on a dangerous trajectory with the US running large deficits even with the economy growing. This is going to become an issue for financial markets in the next few years and will damage the US dollar and influence the level of US interest rates.

Below is a graph on Deficits taken from the Budget and Economic Outlook (2023 to 2033) by the Congressional Budget Office, which shows the Total and Primary Deficits, as well as Net Interest Outlays. Read the whole report here.

Source: Congressional Budget Office. See www.cbo.gov/publication/59096#data

Read more from our Chief Investment Officer Jeff Brummette in our Investment Summary for April 2023. Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below.