Introduction

Donald Trump’s recent election as President, along with the Republican Party gaining control of the Senate and the retention of the House of Representatives, gives Trump a unique opportunity to implement his policy plans. His “Make America Great Again” pledge focuses on four main areas: taxes, immigration and border control, regulation, and trade (tariffs).

Tax Policy

During his campaign, Trump made numerous promises related to tax policy, such as exempting tax on income earned as tips and removing tax on overtime pay. It remains uncertain how many of these promises will be pursued, but the main focus is expected to be on renewing the 2017 tax cuts he introduced, which are set to expire at the end of 2025. Extending these cuts, or potentially lowering tax rates further, could worsen the long-term debt issues faced by the US. However, given that Republicans control both the House and Senate, they may look to cut spending in other areas to offset the impact on the deficit. Biden’s Inflation Reduction Act is likely to be targeted, with reductions in tax credits being used to “pay for” lower tax rates in budget calculations.

Regulation

On reducing regulation, Trump plans to replace the heads of the FTC, SEC, and FCC, along with other regulatory agencies, to facilitate more mergers and acquisitions. He also intends to boost domestic energy output by reintroducing the export of LNG and streamlining related processes, which will likely involve relaxing environmental regulations and targets.

Trade Policy

Trade and immigration, however, are more complex and controversial, making it harder to predict specific actions or outcomes.

On trade, Trump has vowed to impose sweeping tariffs on imported goods, with rates as high as 60% on Chinese imports. His advisers have tried to moderate the extreme sound of these promises, claiming that such rates are likely a negotiating tactic rather than a definitive policy goal. What Trump aims to achieve in exchange for not implementing these tariffs remains unclear. During his campaign, he stated he was open to Chinese car manufacturers building plants in the US. He may also push European countries to increase defence spending in return for forgoing tariffs.

There is a risk that the rest of the world will resist Trump’s trade policies and retaliate with tariffs on US exports, potentially sparking a trade war. The European Union previously responded to Trump’s tariffs on EU steel and aluminium by enforcing its own tariffs on American products, such as bourbon, motorcycles, and jeans, affecting iconic US brands like Jim Beam, Harley-Davidson, and Levi’s. Such retaliatory measures could impact a wide range of industries and further complicate international relations.

Immigration and Border Control

Turning to immigration, Trump has pledged to heavily restrict entry at the US-Mexico border and deport millions of undocumented immigrants. The logistics of this plan are challenging, and its legality will likely be contested by attorneys general in most Democrat-led states and cities. From a practical perspective, the US economy is operating at full employment, and additional workers are needed, particularly if Trump’s regulatory, tax, and trade policies lead to an uptick manufacturing and business activity. The business community is likely to lobby against large-scale deportations and strict restrictions on new migrants.

Trump’s immigration policies, like his trade agenda, are messy and likely to be difficult to implement, adding greater volatility to markets. To demonstrate his commitment, Trump has already appointed two hardline advisers to oversee the process, bypassing congressional approval, which suggests he aims to make rapid changes upon taking office. Additionally, two foreign policy hawks have been nominated for senior positions: Marco Rubio, Senator of Florida, as Secretary of State, and Michael Waltz, a Republican congressman and former special forces soldier, as National Security Adviser. Both are known to view China as the greatest threat to the US, suggesting a harder line on China and Iran, alongside a withdrawal of US involvement in Europe.

Market Reactions

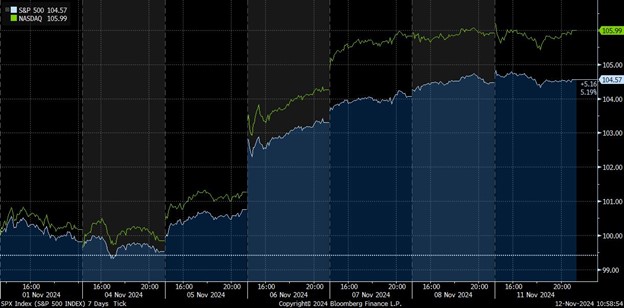

Following last week’s election, financial markets have responded positively to potential changes in regulation and taxes, with US equity prices rising by 5-6% so far this month. The dollar has also strengthened, especially against the Yuan and the Euro, in anticipation of tariffs.

S&P 500 and NASDAQ (election day was November 5)

Better Preparation?

Trump appears significantly more organised than in 2016. He has already appointed a well-regarded chief of staff, Susan Wiles, who managed his campaign, and he has assembled a transition team actively vetting candidates for key positions across the administration. This preparation positions his team to hit the ground running on 20 January. While markets are likely to remain enthusiastic about tax and regulatory changes, the complexities of trade and border control will challenge this narrative early next year. Investors should prepare for increased market volatility as these policies unfold.

Final Thoughts

Trump’s second term promises significant changes in tax policy, regulation, trade, and immigration. While markets are responding positively to his pro-business agenda, the complexity and controversy surrounding trade and immigration policies are likely to add volatility. Investors should stay informed and be prepared for market shifts as Trump’s policies begin to take shape.