We are now deep into the reporting season for 1st Quarter earnings, and we are one third into a year that was supposed to bring us as many as six rate cuts by the US Federal Reserve (Fed). We have had a good start to the year for equity markets as steady growth combined with rate cut expectations made investors optimistic about future earnings.

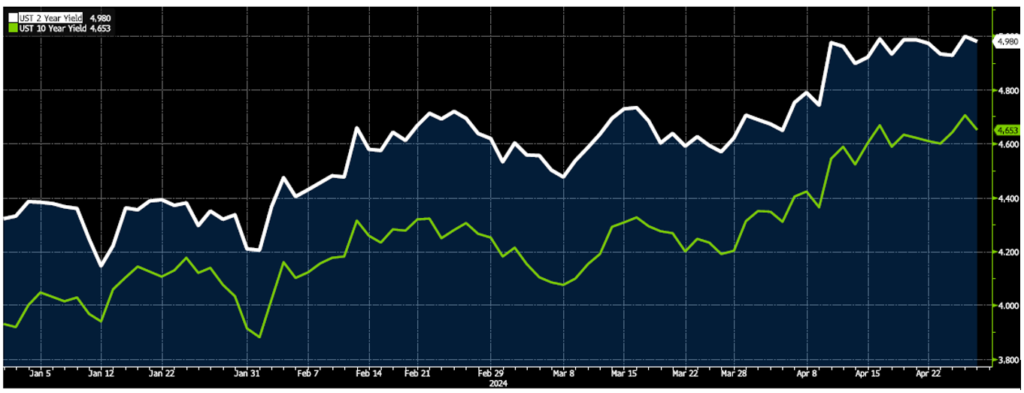

Rate cuts were anticipated due to the ongoing improvement in the inflation outlook and an expectation of moderating growth. Fed officials were encouraging this sentiment by stating they anticipated cutting rates later this year if the inflation improvement they expected occurred. However, the cooling in the rate of inflation in the US has stalled, plateauing around 3%. Despite this, economic growth remains resilient, and the labour market is still firm. Consequently, there has been a gradual shift in rate cut expectations, with the market now only pricing one rate cut from the Fed towards the end of the year. Bond markets have responded with a steady but notable rise in yields. This movement has been substantial, with two-year note yields touching 5% and the ten-year yields approaching 4.75%.

Source: Bloomberg Finance L.P.

This isn’t necessarily bad for the equity market, provided this rise in yields is coming from stronger, sustained economic growth.

The key question remains: Can strong earnings overcome the rise in yields and sustain the equity rally?

So far, April has been challenging with equity markets mostly on the backfoot, except for the FTSE 100, which is particularly sensitive to commodity prices.

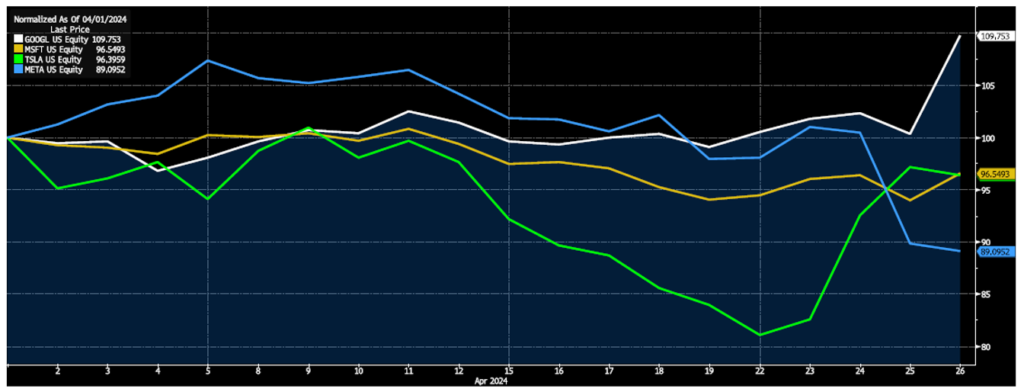

Let’s look at four of the Magnificent Seven who released earnings this week: Tesla, Meta, Alphabet, and Microsoft. We could characterize Alphabet and Microsoft having good earnings, beating expectations, and offering positive outlooks while Tesla and Meta were more nuanced. Tesla continues to grapple with well-known challenges, particularly amidst a slump in electric vehicle sales across the industry. In response, Tesla has slashed prices and initiated workforce reductions, while Elon Musk hints at a future dominated by Robo-taxis. However, the market response has been lukewarm.

Meanwhile, Meta reported robust revenue, but CEO Mark Zuckerberg’s projection of significant future spending on AI raised concerns about the potential earnings impact, leading to a brutal sell-off for the stock. Clearly, the company’s foray into the metaverse and the financial impact of that is still fresh on investors minds.

Source: Bloomberg Finance L.P.

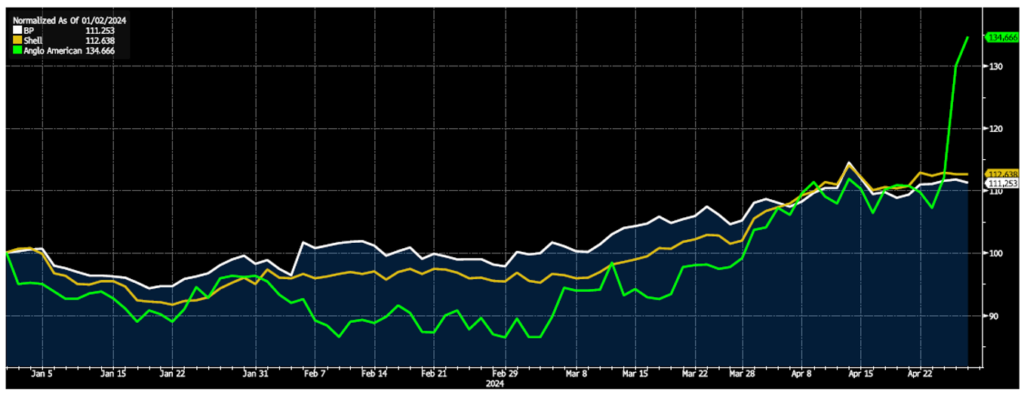

Meanwhile in the world of energy and commodities, the resilience of global growth coupled with persistent tensions in the Middle East has been supportive for the share prices of commodity exposed firms. BHP’s £31billion bid for its smaller competitor, Anglo American, has further fuelled interest in the sector.

Revisit our recent coverage of the conflict between Iran-Israel and the implications of this geopolitical struggle – read more here.

Source: Bloomberg Finance L.P.

We expect the rest of this earnings season and indeed for the rest of the year, company-specific developments will carry far greater significance than the actions of decisions of the Fed and other central banks.

Hear more from us

Read more engaging insights from our experienced team of investment professionals; Chief Investment Officer Jeff Brummette covered the key market trends in the recent Q1 2024 Investment Summary, whilst Investment Manager Myles Renouf provided an interesting and concise update on the Oakglen Wealth Discretionary Investment Management Service for Q1 2024 and how well our investment strategies have continued to perform. Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.