As we step into September, our latest investment summary reflects on the key market movements and investment opportunities that emerged in August. From shifting economic indicators to evolving market dynamics, August was a pivotal month that offered both challenges and potential growth areas. Dive into some comprehensive analysis from our Chief Investment Officer, Jeff Brummette, as he shares his view on some of these developments.

A strong rally on the last day of the month resulted in a positive month overall for four of the six major equity indices, excluding the DJIA (The Dow Jones Industrial Average).

Source: Bloomberg

It was no surprise to see Japanese equities struggle as they adjust to a more aggressive Bank of Japan, which is now set to gradually but steadily raise interest rates. Meanwhile, Chinese stocks are under pressure from the ongoing housing crisis in China and its negative impact on domestic consumption. Chinese growth continues to disappoint, with the government’s response focused on boosting exports rather than supporting domestic consumption. The surge in Chinese EV (electronic vehicle) exports has alarmed Western countries, leading to the imposition of tariffs, and China threatening to retaliate. This is an unwelcome development that threatens growth and adds to market volatility.

The end of month recovery in share prices obscures the extreme volatility these markets experienced earlier in the month (see our recent article on the Summer Swoon – click here).

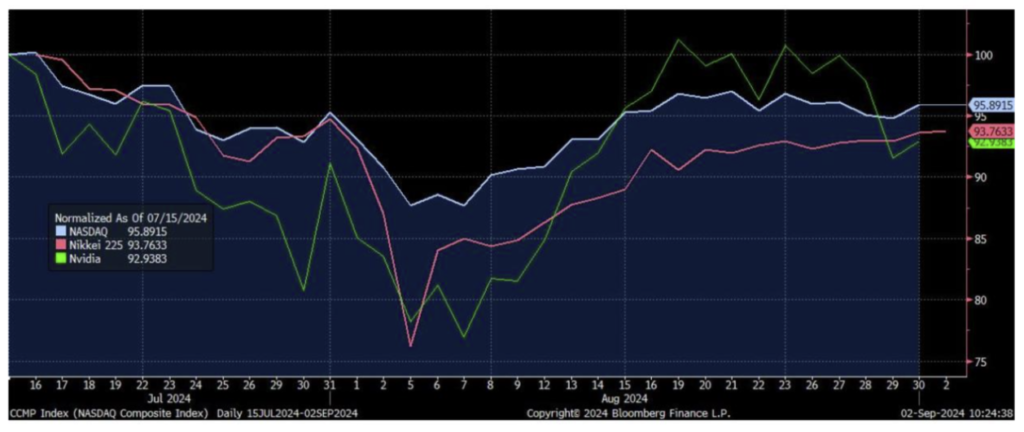

Nasdaq, Nikkei 225 and Nvidia

Source: Bloomberg Finance L.P.

The Nasdaq Index, the Nikkei 225 Index, and Nvidia have been among the top performing assets for investors this year. However, since mid-July these two indices and Nvidia – a $3 trillion dollar market cap company – have experienced high volatility and sharp declines. Despite a partial recovery in the second half of August, they have not regained their recent highs. Even Nvidia’s strong earnings report last week failed to generate investor enthusiasm.

Was this simply a one-off bout of turbulence, as can happen in financial markets, or does it signal something more fundamental at play?

Since the spring of 2022, financial markets have been influenced by the fight to contain inflation led by central banks, resulting in a very significant rise in interest rates over roughly 18 months. This battle has been successful, as inflation has now retreated to levels at, or near, the central banks’ targets of 2%.

Eurozone, UK and US Inflation

Source: Bloomberg Finance L.P.

Central banks have declared victory over inflation and have begun to lower interest rates. The European Central Bank (ECB) and the Bank of England (BoE) have already initiated rate cuts, while the US Federal Reserve (Fed) has signalled a cut coming in September. More notably, the Federal Reserve Bank Chair Jerome Powell, has stated that the Fed’s focus is now on the labour market;

“We do not seek or welcome further cooling in labour market conditions.” (from Chair Powell’s speech at the recent Jackson Hole Economic Symposium).

The Fed, having been aggressive in raising interest rates, may adopt a similarly aggressive approach in lowering them. This could be beneficial for stocks and might also lead to further weakness in the US dollar, especially if the Fed is more aggressive than the ECB or the BoE. As US labour market data steadily weakened into the summer, financial markets grew concerned that the Fed might have waited too long to decide on lowering interest rates.

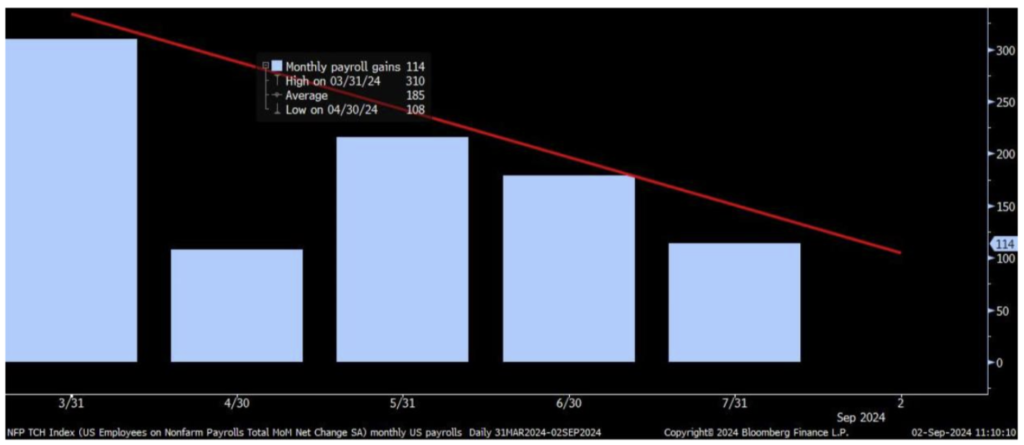

Monthly US Payroll Changes

Source: Bloomberg Finance L.P.

This concern led to a downturn in stocks. Whether the markets’ apprehension is justified remains to be seen, but one thing is certain: market volatility will likely remain higher as investors assess the Fed’s strategy. Worries about overall economic growth can overwhelm earnings as the primary driver of share prices. While central bank rate cuts in response to weakening growth may not immediately prevent share price declines, they will be essential to ensuring recovery if economic growth is indeed slowing.

Fixed income holdings have been helpful for portfolio returns. Not only are coupons attractive but yields have room to fall. The front end of the yield curves has outperformed, particularly in the US. For example, the two-year note has rallied 50 basis-points relative to the ten-year note since June. UK fixed income markets have seen a similar move, with two-year gilts rallying nearly 80 basis-points versus the ten-year gilt over the past year. We anticipate central bank rate cuts will continue to support the outperformance of shorter dated bonds. However, longer-term bond yields are influenced by more than just central bank actions. Fiscal deficits and inflation expectations may keep yields on longer maturity bonds steady despite interest rate cuts.

We do not anticipate a recession in the United States, and global growth remains positive. We believe that a combination of lower inflation and interest rates will sustain the economic expansion, though it is likely to be a bumpy path. With the US elections less than 75 days away, what once looked like a certain victory for Donald Trump now looks to be too close to call. Some polls now show Vice President Kamala Harris slightly ahead, indicating she has gained momentum and revitalized the Democratic Party. Her rising popularity is also influencing other races in the Senate and the House of Representatives. It is not impossible for the Democrats to retain the Senate and regain control of the House.

Vice President Harris has generally kept her policy proposals broad (reminds one of Keir Starmer) focusing on promises to improve quality of life. Her plans include more spending on social programs, assistance for first-time home buyers, and tax increases targeted at the wealthy and large corporations. On the other hand, Trump has painted a bleak picture of America’s future without his leadership, insisting that only he can restore the country. He promises to extend the tax cuts he passed in 2017 and proposes additional tax cuts for both corporations and individuals. Whatever the election’s outcome, neither party has outlined plans to address the budget deficit or tackle longer-term fiscal issues. The size of the deficit and the costs to service it will continue to grow.

This is not an issue specific to the US. The newly elected Labour government here is looking for new sources of revenue to fund their spending plans. They claim to have discovered a financial “black hole” in the government’s books and warn of “painful times ahead “when they present their budget in late October. Despite their commitment not to raise income tax or national insurance for “working families” they plan to grant substantial pay rises to employees in the Public Sector. We remain sceptical that we will see a meaningful decline in government spending or reduction in the fiscal deficit under their leadership.

These observations apply to many nations in the Eurozone, as well as Japan and China. The post-2008 Global Financial Crisis era of zero interest rates, coupled with the massive spending spree in response to the COVID-19 pandemic, has left governments dangerously addicted to large budget deficits. This keeps us cautious about owning too much in the way of long-term government bonds.

In the coming months, we expect capital markets will face a tug-of-war between the benefits of central bank interest rate cuts and worries that these cuts may not be sufficient or timely enough to prevent a slowdown in economic growth. Additionally, there is a potential risk of further weakening of the US dollar should the Fed prove to be more aggressive in its approach to rate cutting than the other central banks. This well could adversely impact returns for investors holding non-dollar-based assets, as witnessed over the last month.

Hear more from the Oakglen experts

Our investment team continue to provide topical and informative content for you to gain insights from. Our Chief Investment Officer, Jeff Brummette, has put together some concise coverage on the recent Jackson Hole Economic Symposium and our Investment Manager, Myles Renouf, has reflected upon the first half of the year with an update on the performance and strategy for our Discretionary Investment Management Service.

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.