Recently, central banks worldwide have been adjusting their policies in response to persistent inflation and economic uncertainty. These moves aim to strike a balance between controlling inflation and sustaining economic stability, though the risk of slowing growth remains a key concern in many regions. Our Chief Investment Officer, Jeff Brummette, provides some concentrated analysis on some of the more recent decisions.

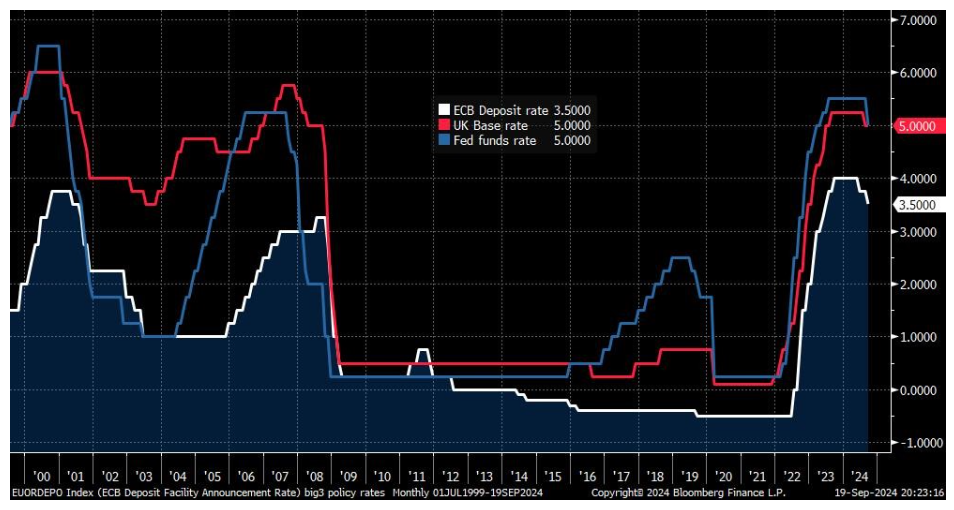

Interest rate cuts are becoming the norm for the three major central banks: The European Central Bank (ECB), the US Federal Reserve Bank (Fed) and the Bank of England (BoE). Each of these institutions has concluded that they have won the war against inflation and believe that adopting easier (though not necessarily loose) monetary conditions is the appropriate policy.

Inflation

Source: Bloomberg Finance L.P.

The US Federal Reserve

Earlier this week, the Fed lowered rates by 50 basis points, with Fed Chair Jerome Powell confidently stating:

“Inflation is now much closer to our objective, and we have gained greater confidence that inflation is moving sustainably toward 2 percent.”

During the Q&A session at the press conference following the Federal Open Market Committee meeting, he further elaborated on the Fed’s perspective that rate cuts are a tool to help maintain a strong labour market:

“The labour market is actually in solid condition. And our intention with our policy move today is to keep it there. You can say that about the whole economy. The U.S. economy is in good shape. It’s growing at a solid pace, inflation is coming down, the labour market is in a strong pace, we want to keep it there. That’s what we’re doing.”

The Fed’s latest forecasts indicate an additional 50 basis points in cuts by the end of this year, with another 100 basis points projected for 2025. These forecasts depend on economic performance; if the economy shows signs of weakness, the Fed may implement larger cuts, while a stabilisation or acceleration in economic activity could lead to small cuts. The focus has shifted from ‘higher for longer’ to a strategy of ’25 or 50′ (size of the cut) and whether it will be decided at this meeting or the next.

The European Central Bank

The ECB has taken two meetings to deliver a total of 50 basis points in rate cuts, and with inflation as their sole target, they are a little more cautious about the pace of further rate cuts. Nevertheless, ECB president Lagarde hinted that more cuts are on the horizon, though she emphasised that future moves would remain data dependent.

Bank of England

Meanwhile, the BoE is the laggard, having only cut rates once by 25 basis points and holding steady at their most recent meeting this week. They are still maintaining a more cautious view on their progress in reducing inflation.

Governor Andrew Bailey stated that,

“Inflationary pressures have continued to ease since we cut interest rates in August. The economy has been evolving broadly as we expected.”

“If that continues, we should be able to reduce rates gradually over time,” he said. “But it’s vital that inflation stays low, so we need to be careful not to cut too fast or by too much.”

Policy Rates

Source: Bloomberg Finance L.P.

We anticipate that if inflation remains within the 2% and 3% range, each of these central banks could implement an additional 100 to 150 basis points in cuts over the next year. The Fed has been the most aggressive so far, and this has put downward pressure on the US dollar. Should the Fed continue to lead in both the speed and scale of their rate reduction, the dollar is likely to weaken further.

Interest rate cuts, driven by falling inflation and the reduced need for restrictive monetary policy, are unequivocally positive for risk markets. Central banks are now providing a tailwind for both equity and bond markets.

The other major central bank we actively follow, the Bank of Japan, remains on course for further rate hikes.

Hear more from the Oakglen experts

Our investment team continue to provide topical and informative content for you to gain insights from. Our Chief Investment Officer, Jeff Brummette, provided a concise investment summary last month for September 2024, along with some deep analysis on the recent Economic Symposium at Jackson Hole.

Read more:

- Oakglen Wealth: September 2024 Investment Summary

- Jackson Hole Update: Rate cuts are coming!

- Eyes on Powell: The Jackson Hole Economic Symposium

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.