As children return to school (that’s assuming it hasn’t already been closed due to crumbling foundations!) and the summer holiday season officially comes to an end, investors are preparing themselves for a volatile month ahead. We reflect on the past few weeks and what we expect going forward into September.

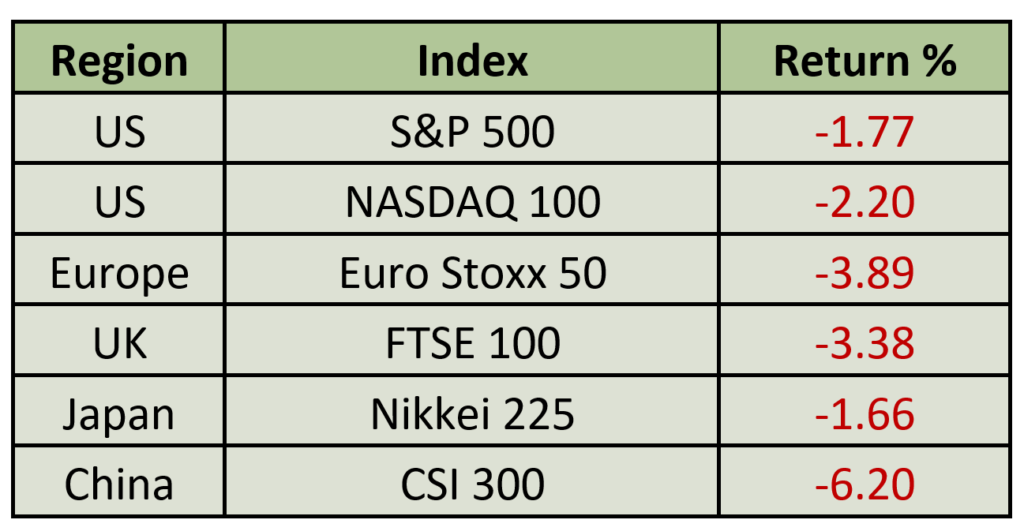

Major equity markets were negative across the board for the month of August and if it wasn’t for a rally in the final week of the month, it would have been far worse. This price action, following an excellent previous five months of strong equity performance particularly in the US, may simply be the normal ebb and flow of markets, or as financial pundits often phrase it, there was some “profit taking” by investors.

Source: Bloomberg

Reflecting on the start of the year, both investors and professional forecasters, including ourselves, were filled with apprehension regarding the markets. There was widespread talk and even anticipation of an impending recession in the second half of the year.

Our concerns centred around inflation, the necessity of higher interest rates required to fight inflation, the risks this posed to corporate earnings, and as the year progressed, the sluggish recovery of China as it emerged from its pandemic-induced lockdown.

Throughout this year, the markets have comfortably, and for many, profitably navigated through the aforementioned concerns. Central banks have continued to raise interest rates, albeit at a reduced magnitude and pace, while inflation has moderated from its highs of last summer.

Corporate earnings have remained resilient, meeting or even surpassing expectations, and companies have discovered they have more pricing power than they expected. The labour markets have remained tight, workers are obtaining significant wage increases and with the recent fall in inflation many are even experiencing real wage growth.

Consequently, consumer spending has remained robust, with a focus on services rather than goods, averting any signs of a recession. In fact, the new popular view is perhaps the central banks may achieve the proverbial “soft landing” where higher interest rates curtail inflation without increasing unemployment and triggering a recession.

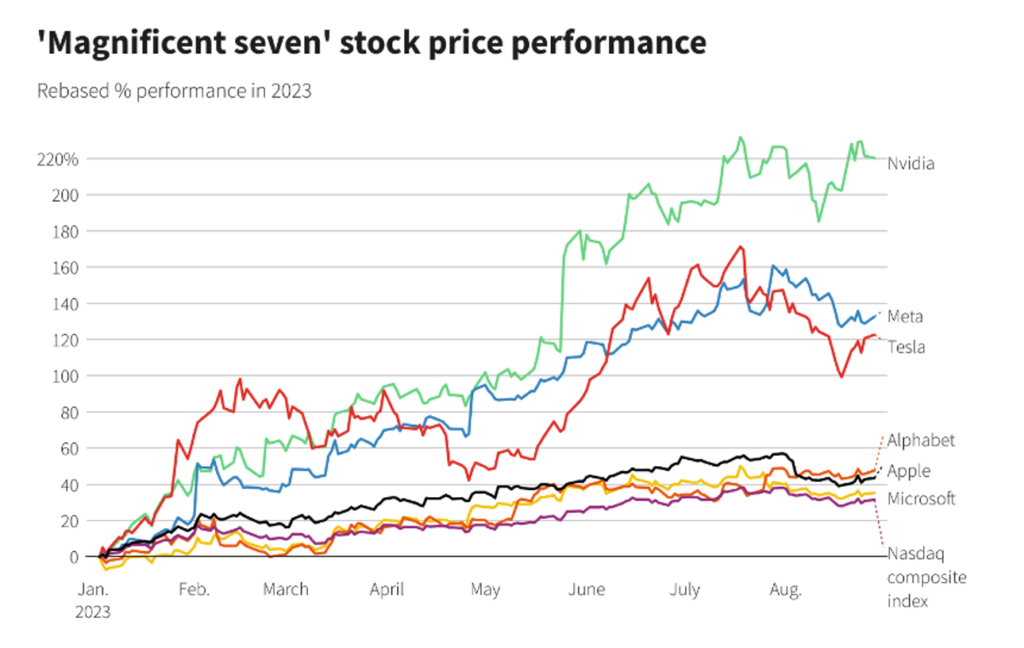

Adding to the positive momentum, the excitement surrounding advancements in Artificial Intelligence (AI) and the dramatic surge in earnings at Nvidia, a designer of the microchips needed by AI developers and users, sparked a dramatic rally in all things AI (or frankly tech) related. Investors were determined not to miss out on this trend, leading to tech valuations rebounding to levels seen in early 2022.

There is an old investment saying that “nothing is more painful than seeing your neighbour get rich” and this sentiment was palpable over the summer as stocks continued to rise, even in the face of higher interest rates (with the yield on the US ten-year Treasury note surpassing 4.25%) and worsening news about European and Chinese economic growth. Investors were chasing the price movement; one doesn’t want to be left behind!

Source: Refinitiv

We have maintained a highly conservative approach within our portfolios and resisted the temptation to chase after the tech-driven rally. While this stance may have initially had a slight impact on our performance, the behaviour of the equity market in August suggests that our discipline is poised to pay off. The concerns we initially harboured have not dissipated.

Inflation remains uncomfortably high, and there’s a likelihood that central banks may have to raise rates further or, at the very least, keep them at current levels for an extended period, even if means accepting slower economic growth.

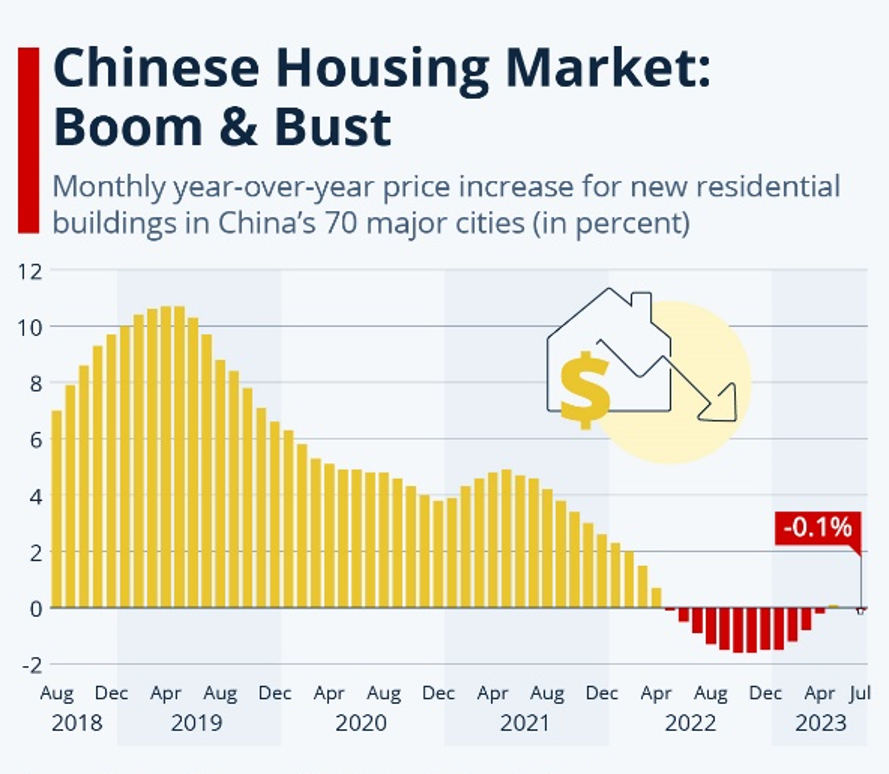

China continues to grapple with growth challenges, and the magnitude of the debt crisis in its real estate sector cannot be underestimated. The ripple effects of China’s weakness are seriously impacting Europe, with the German economy sliding into a recession.

Source: National Bureau of Statistics of China via Tradingeconomics.com

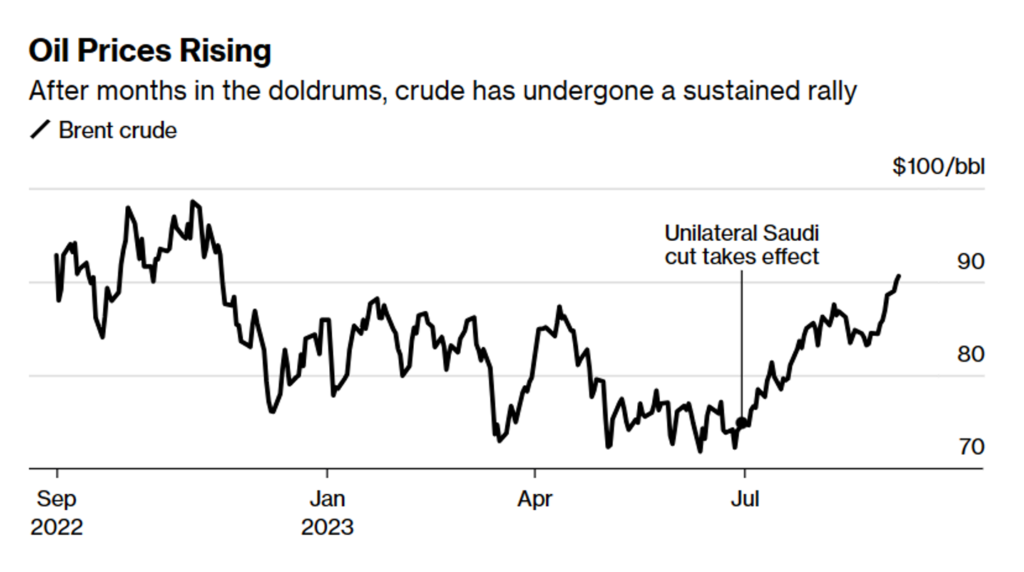

Furthermore, the resurgence in oil prices, attributed to production cuts by Saudi Arabia, is set to have repercussions for both economic growth and inflation.

Source: Bloomberg

Meanwhile, Japan has seen a considerable weakening of the yen, and the combination of this currency depreciation and higher energy costs is leading to uncomfortably elevated levels of inflation. We are approaching a juncture where Japan may need to abandon its ultra-loose monetary policy stance, a move that global financial markets are likely to react unfavourably to.

In light of these ongoing challenges, we hold firm in our belief that our conservative positioning will enable us to navigate through what we anticipate will be a demanding path leading into the year’s end.

Discover more informative content from our Chief Investment Officer Jeff Brummette in the recent Investment Summary for August 2023 and our insightful half-way point 2023 Mid-Year Outlook. Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below or get in touch with one of the team.