Our Q1 2024 Investment Summary revisits the strong market performance of the first quarter and what we expect to see in the month ahead as we enter Q2. Will markets manage to grind any higher or will they be doused by a smattering of April showers?

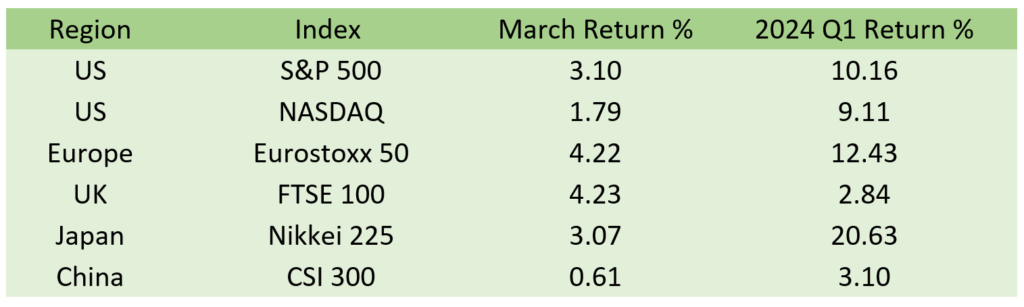

March was another strong month for equity markets, rounding off an impressive first quarter of the year. All markets were positive for both the month and the quarter. Notably, this marks the best first quarter for equity markets in the last five years. Even China, which had a terrible 2023, generated positive returns.

Source: Bloomberg

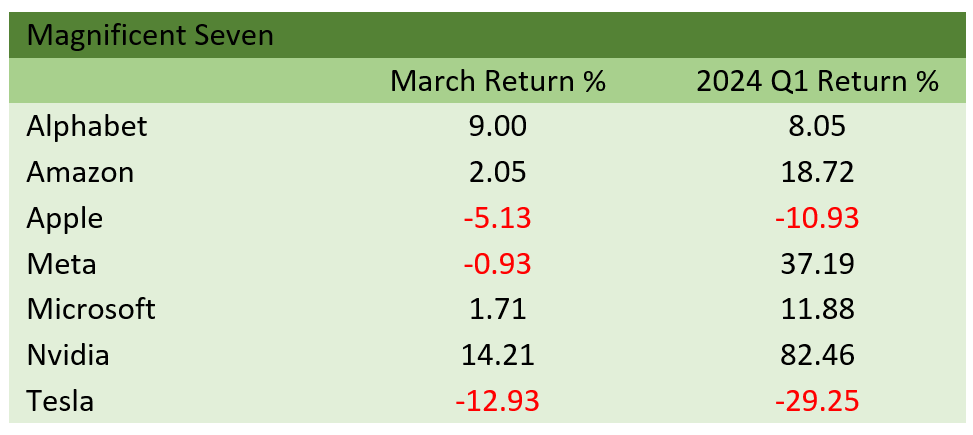

The drivers of the rise in equities were many and varied. Excitement around stocks with exposure to Artificial Intelligence (AI) led several of the so-called Magnificent Seven – Nvidia, Meta, Microsoft, Amazon, Tesla, Apple, and Alphabet – to new highs.

The average increase for these stocks was an impressive 17%, compared with the 10% rise in the S&P 500. That said, the performance varied from Nvidia’s 82% increase to Tesla’s near 30% decline. Given that only four of the stocks have outperformed the index so far this year, is the Magnificent Seven in danger of turning into the Fantastic Four?

The Magnificent Seven

Source: Bloomberg

US economic data proved more resilient than expected, while there were signs of improving activity in Europe and the UK. China too, showed better activity during the first quarter.

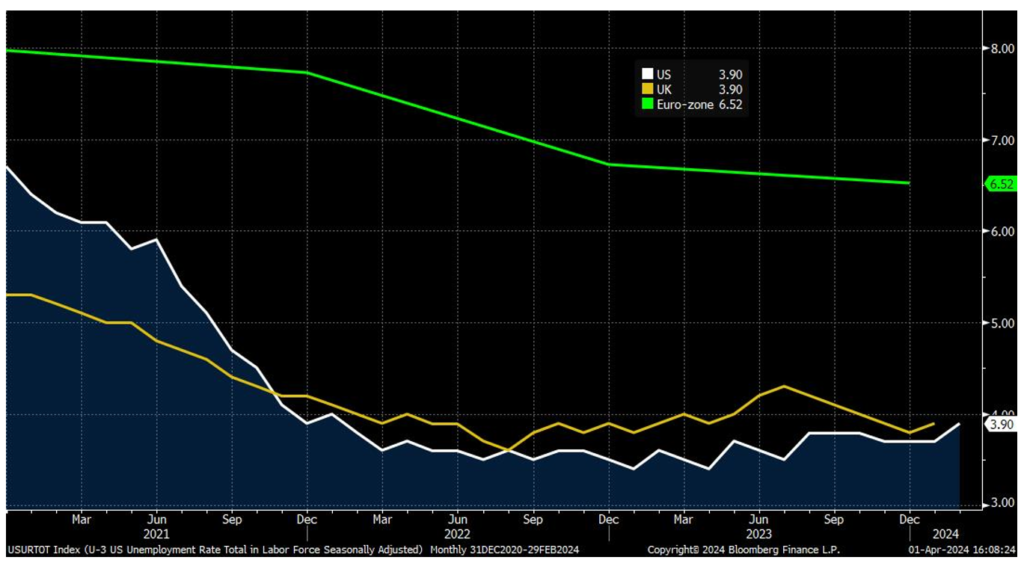

Despite the brighter macro-outlook, financial markets are still pricing central banks to begin lowering rates later this year. However, expectations have shifted to fewer cuts happening later in the year, as the pace of inflation improvement is slowing and a still tight labour market influences market sentiment.

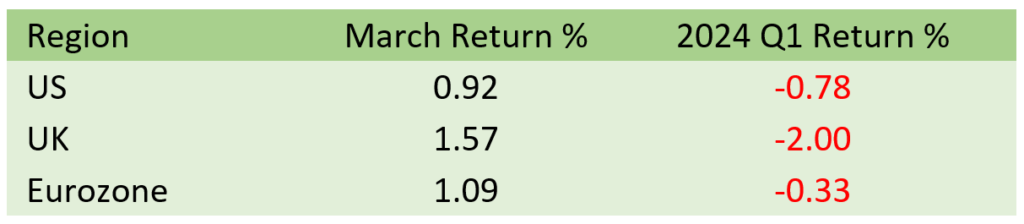

Inflation – Eurozone, UK and US

Source: Bloomberg Finance L.P.

Unemployment Rates

Source: Bloomberg Finance L.P.

Despite central banks signalling a delay in the number of expected rate cuts and their timing, equity investors remained undeterred. (Refer to our Central Bank Update note – click here).

However, fixed income investors were unsettled by both the data and central bank rhetoric over the quarter. While fixed income returns were positive for March, largely due to the three major central banks all hinting at rate cuts coming this summer, returns were negative for the quarter as markets adjusted to the prospect of fewer cuts this year. It’s worth noting that towards the end of last year markets were pricing in as many as 6 rate cuts by the US Federal Reserve (Fed) this year. At the time of writing, markets were now pricing in 3 rate cuts.

Bloomberg Aggregates Total Returns Indices

Source: Bloomberg

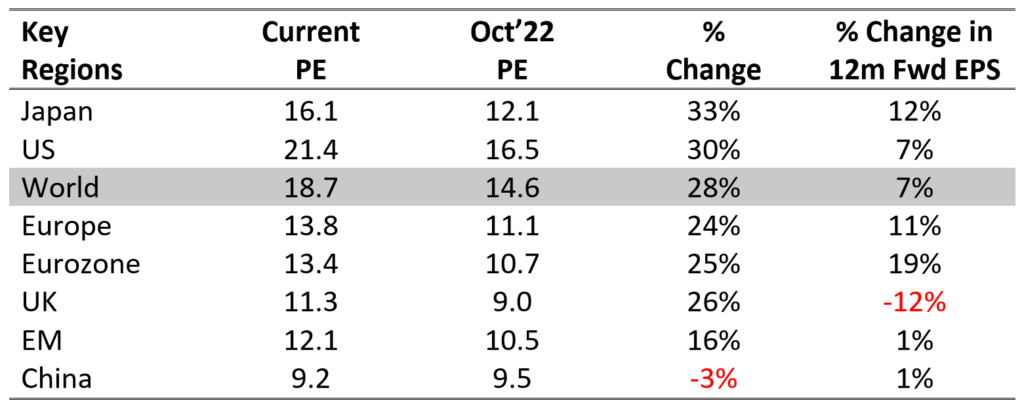

While there are no immediate catalysts to halt the current equity rally, there are several factors to consider. The rapid move higher for equities in such a short space of time suggests that a temporary pause would not be unexpected. While corporate earnings have been positive and earnings expectations have increased, the pace of the rise in equity market valuations has significantly outpaced them.

Will earnings catch up to the sharp rise in valuations?

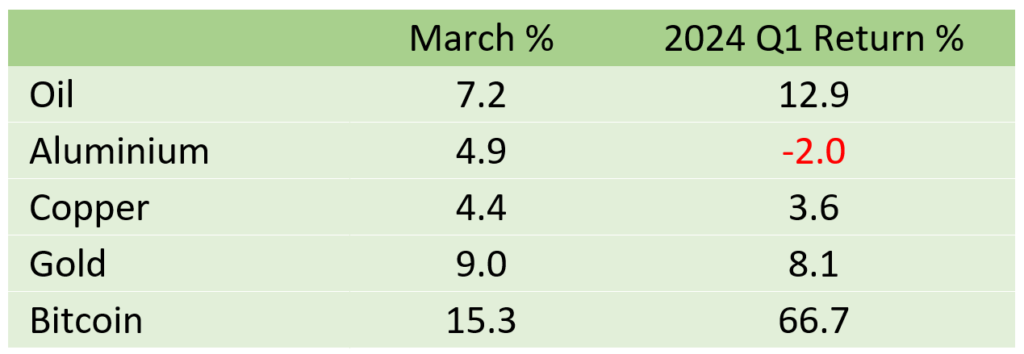

Another scenario to consider is that central banks don’t implement rates cut to the extent markets expect, or possibly not at all. Given how tight labour markets are globally, some would argue that rate cuts could prove to be stimulatory and might reignite inflation. The behaviour of some markets is suggesting this concern. Commodities (and Bitcoin) are often viewed as hedges for inflation.

Inflation Fears?

Source: Bloomberg

Over the coming months, economic data will be critical for the decision-making process of central banks. Their aim is to strike a balance: they do not want to keep policy too tight, running the risk of triggering a recession to bring inflation down by another 0.50% – 1.00% to meet their 2% targets. Conversely, they don’t want to find themselves cutting rates and finding inflation rising again. We think they will be patient and err on the side of caution, opting for modest and gradual rate cuts.

The economic environment remains supportive of risk assets. Inflation is generally low; labour markets are healthy, and corporate earnings remain positive. Our well-diversified portfolio is poised to adapt to any actions taken (or not) by central banks. At a sector-level, we continue to see upside potential for healthcare, energy, and materials.

Read more engaging insights from our experienced team of investment professionals; Chief Investment Officer Jeff Brummette covered the key market trends in the recent Investment Summary for March 2024, whilst Investment Director Edward Maidment encouraged a sense-check of allowances before tax-year end to ensure a timely utilisation of tax allowances before 5th April 2024. Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client? Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.