Autumn is officially here. As we leave behind the third quarter and enter Q4 2024, our Chief Investment Officer, Jeff Brummette, reflects on the market developments from September, analysing key drivers of performance and the challenges faced during the month. With a focus on global economic trends, inflationary pressures, and central bank actions, he provides insight into how these factors are shaping our investment strategy moving forward in our October 2024 Investment Summary.

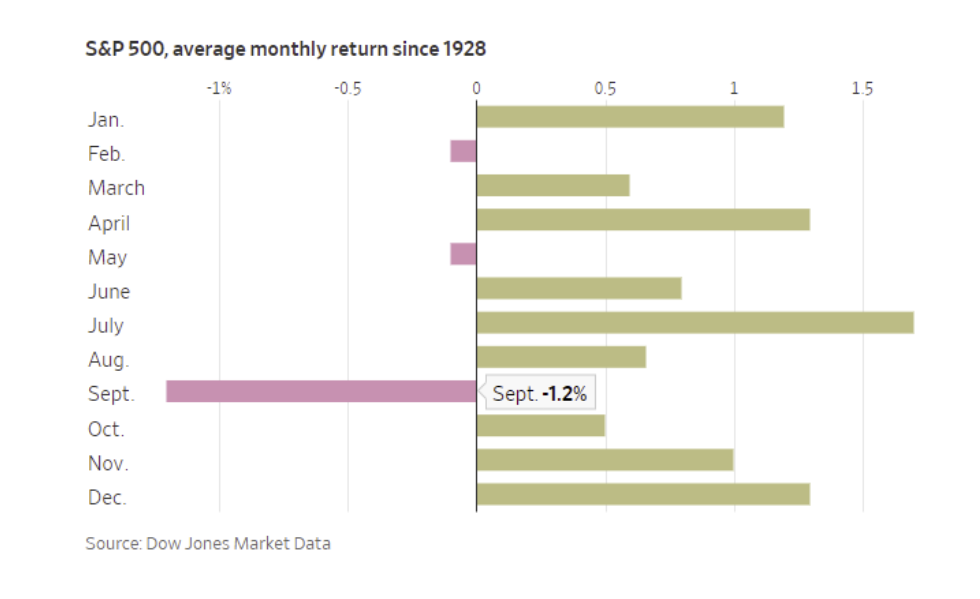

September has been a highly significant month, marked by several major events that are likely to influence the markets in the coming months (and possibly the year) ahead. At the start of the month, market analysts had warned that September is historically a rather challenging month for stocks, and the first few days seemed to support this view.

S&P 500, average monthly return since 1928

Source: Dow Jones Market Data

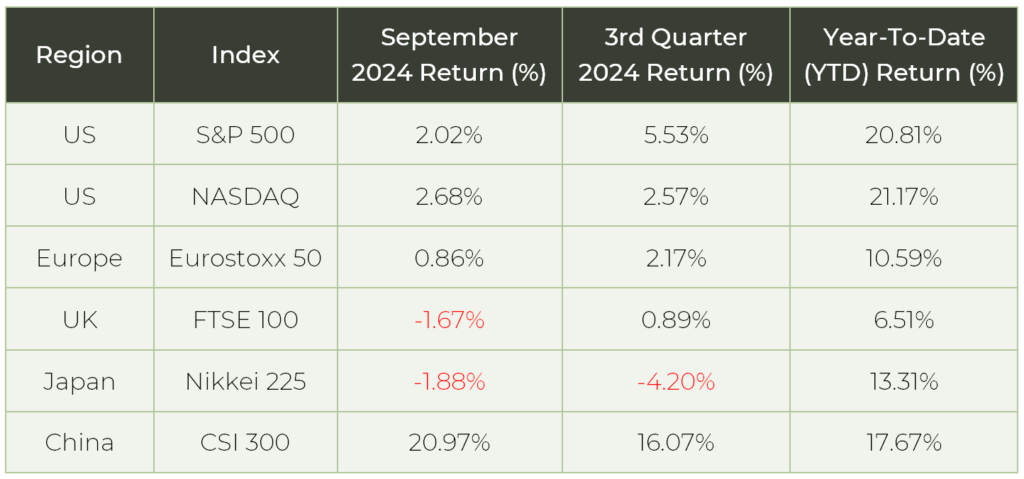

However, the calendar doesn’t dictate asset prices. Equity markets rebounded on the back of central bank actions and a recently announced major stimulus effort in China.

September 2024, Quarter 3 2024 and Year-To-Date Returns (%)

Data through to 30 September 2024

Source: Bloomberg

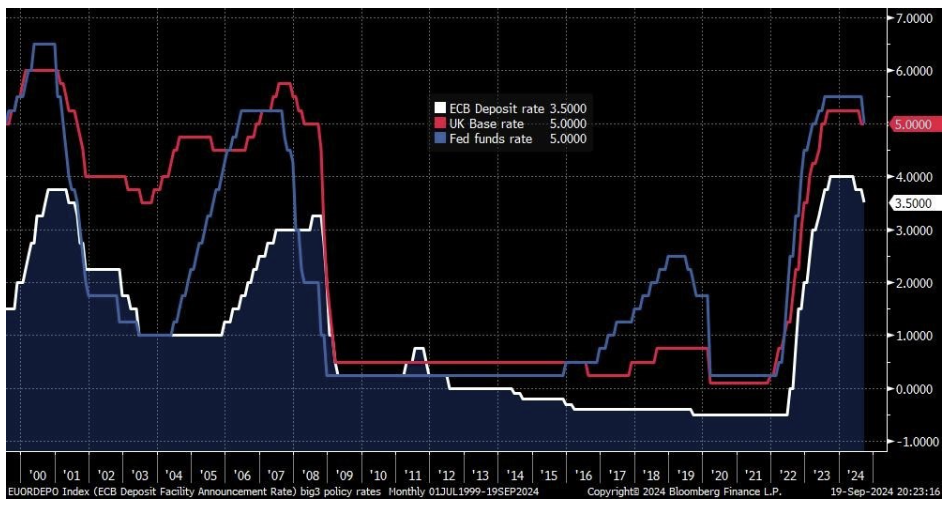

The European Central Bank (ECB), the US Federal Reserve Bank (Fed) and the Bank of England (BoE) all held monetary policy meetings this month. Each of these institutions concluded that they have successfully tackled inflation and now consider it appropriate to adopt easier (though not necessarily loose) monetary policy.

Inflation Rates – US, UK and Eurozone

Source: Bloomberg Finance L.P.

The Federal Reserve (Fed)

The Fed lowered rates by 50 basis points, with Fed Chair Jerome Powell confidently stating:

“Inflation is now much closer to our objective, and we have gained greater confidence that inflation is moving sustainably toward 2 percent.”

During the Q&A session at the press conference following the Federal Open Market Committee meeting, Powell further elaborated on the Fed’s perspective that rate cuts are a tool to help maintain a strong labour market:

“The labour market is actually in solid condition. And our intention with our policy move today is to keep it there. You can say that about the whole economy. The U.S. economy is in good shape. It’s growing at a solid pace, inflation is coming down, the labour market is in a strong pace, we want to keep it there. That’s what we’re doing,”

The Fed’s latest forecasts suggest an additional 50 basis points in cuts by the end of this year, with another 100 basis points projected for 2025. These forecasts are contingent on economic performance; if the economy shows signs of weakness, the Fed may implement larger cuts, whereas a stabilisation or acceleration in economic activity could lead to smaller cuts. The focus has shifted from “higher for longer” to a strategy of “25 or 50” (size of the cut) and whether it will be decided at this meeting or the next.

_______

The European Central Bank (ECB)

The ECB has taken two meetings to deliver a total of 50 basis points in rate cuts, and, with inflation as their sole target, they remain somewhat cautious about the pace of further rate cuts. Nevertheless, ECB President Christine Lagarde hinted at more cuts on the horizon, though she emphasised that future moves will remain data dependent.

_______

The Bank of England (BoE)

Meanwhile, the BoE is the laggard, having only cut rates once by 25 basis points and holding steady at their meeting this month, though they did suggest that cuts were likely. Governor Andrew Bailey stated the below:

“Inflationary pressures have continued to ease since we cut interest rates in August. The economy has been evolving broadly as we expected.”

“If that continues, we should be able to reduce rates gradually over time,” he said. “But it’s vital that inflation stays low, so we need to be careful not

to cut too fast or by too much.”

Policy Rates – US, UK and Eurozone

Source: Bloomberg Finance L.P.

With the three major central banks now in the process of lowering interest rates, it is no surprise that equity and bond markets rallied.

Source: Bloomberg

Notably, 10-year government bond yields are now higher in the US, UK and France compared to the day of the Fed interest rate cut.

These countries all face large budget deficits funded by ever increasing debt-to-GDP ratios, despite positive economic growth. The issue of budget deficits and high debt-to-GDP ratios extends beyond these three countries, affecting much of Western Europe, Japan, and even China. While there is no specific threshold at which a deficit or debt-to-GDP ratio becomes problematic, there’s an old saying that “you can’t borrow your way to prosperity”.

Interest payments on US government debt are set to surpass defence spending, becoming the largest line item in the budget. Neither political party nor Presidential candidate appears interested in addressing this issue, and regardless of who is elected, the budget deficit is likely to continue rising.

The new UK Labour government are hinting at tax hikes to try and rein in the deficit whilst also suggesting that infrastructure spending should not be considered part of the deficit or debt-to-GDP ratio, framing it as “investing in the future”. Don’t be surprised if government spending rises and the fiscal deficit widens further in the UK.

The fragile coalition government in France is also looking to raise more tax revenue, but there aren’t enough wealthy targets to draw from.

While it’s uncertain when another “Liz Truss moment” might occur in the government bond market, policymakers are certainly increasing the odds of another one happening.

_______

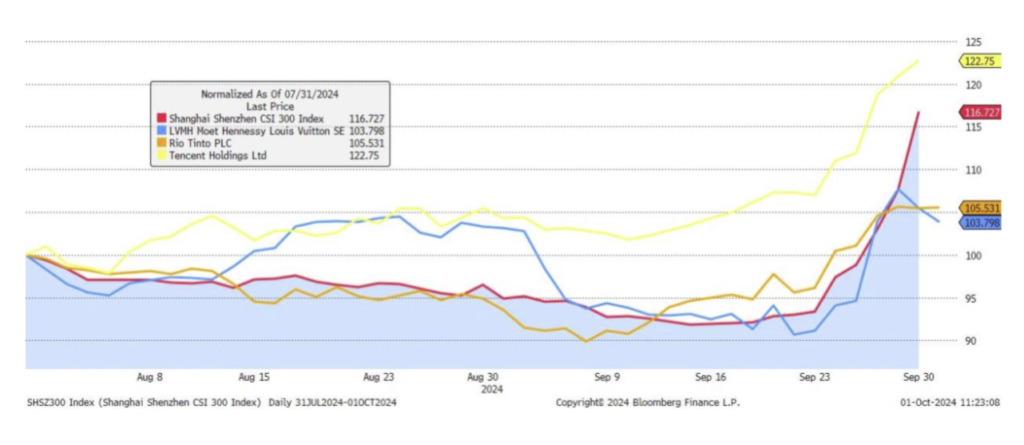

China has chosen to follow a similar path, recently announcing a series of rate cuts and fiscal initiatives aimed at supporting the housing market and revive consumer spending. The financial market’s reaction has been significant, with Chinese stocks rallying and many Western businesses dealing in China or supplying raw material experiencing sharp increases in their share prices.

CSI 300 Index, Tencent, LVMH and Rio Tinto

Source: Bloomberg Finance L.P.

Undoubtedly, there will be more policy moves by the government if the measures announced prove insufficient. Currently, the three largest economic blocks in the world are lowering interest rates and pursuing expansionary fiscal policies.

Additionally, inflation has fallen significantly, leading to a rise in real household income. Oil prices have dropped nearly $20 a barrel since spring, adding further stimulus and ensuring that inflation will remain low in the near term. As a result, more interest rate cuts from the Fed, ECB, BoE are likely on the horizon.

This is a very supportive environment for risk assets.

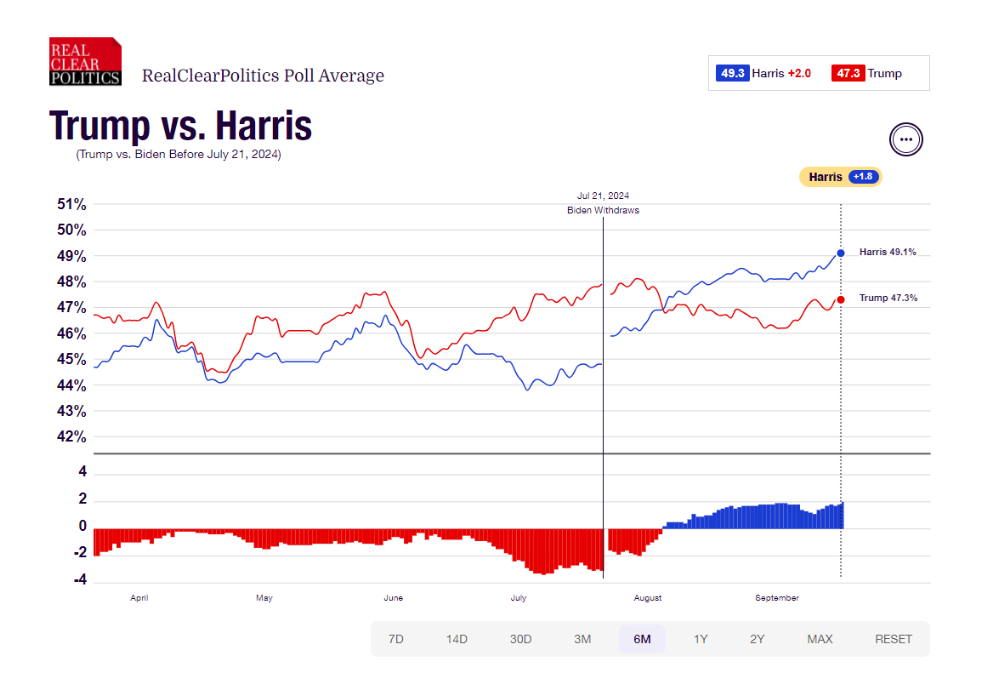

With less than 40 days until the US elections, the presidential race remains exceptionally close.

RealClearPolitics Poll Average: Trump vs. Harris

Source: RealClearPolitics

Harris has a slight lead in the national polls, but it is within the margin of error, making it still too close to call. There are reports of a surge in new voter registration among young voters, who are likely to favour Harris, though this may simply be a feel-good news story.

What is clear is that either Trump or Harris will be the next President.

Both candidates are promising a mix of tax cuts and new spending initiatives, with Trump proposing new tax cuts almost daily. However, many of these proposals are viewed as unrealistic and unlikely to become law, leaving it uncertain whether they are swaying voters. Most voters have already formed strong opinions about Trump over the past eight years, as he continues to deliver a familiar message of impending disaster if he is not elected. In contrast, Vice President Harris’s optimistic yet somewhat vague message about improving life in America may resonate more with voters, energising Democratic supporters and potentially attracting a larger share of the independent vote.

If Republicans were to sweep both the Senate and the House, alongside a Trump victory, the initial market reaction would likely be a rally in equity markets, fuelled by expectations of significant tax cuts. However, bond yields would likely rise in anticipation of increased government borrowing and inflation risks. As Trump’s agenda unfolds, the Federal Reserve would likely slow the pace of interest rate cuts, perceiving his policies as potentially inflationary and taking measures to prevent the economy from overheating.

A Harris victory, accompanied by a Democratic sweep of Congress, would likely lead to a more muted market reaction, as she is not proposing the same degree of fiscal stimulus and supports raising the corporate tax rate. The Federal Reserve would likely not be disturbed by this, continuing to ease policy as inflation stays contained.

If either Trump or Harris wins without their party having full control of Congress, the market outlook becomes more challenging to predict, with potential policy gridlock complicating expectations.

Currently, we lean towards a Harris win, though not a full Democratic sweep. However, in all possible outcomes, there is little chance of a reduction in government spending. This could eventually pose a problem for the US, but predicting the timing of such an issue remains difficult.

_______

Hear more from the Oakglen experts

Our investment team continue to provide engaging content to help keep you informed on recent market news. Our Chief Investment Officer, Jeff Brummette, has put together a variety of insightful investment commentary for you to digest (as per the below):

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.