As we move ever closer towards the end of the year, the UK Chancellor Jeremy Hunt will present his Autumn Statement to the House of Commons this week on 22nd November. We reflect upon the past month in our November Investment Summary and what market trends have been occurring.

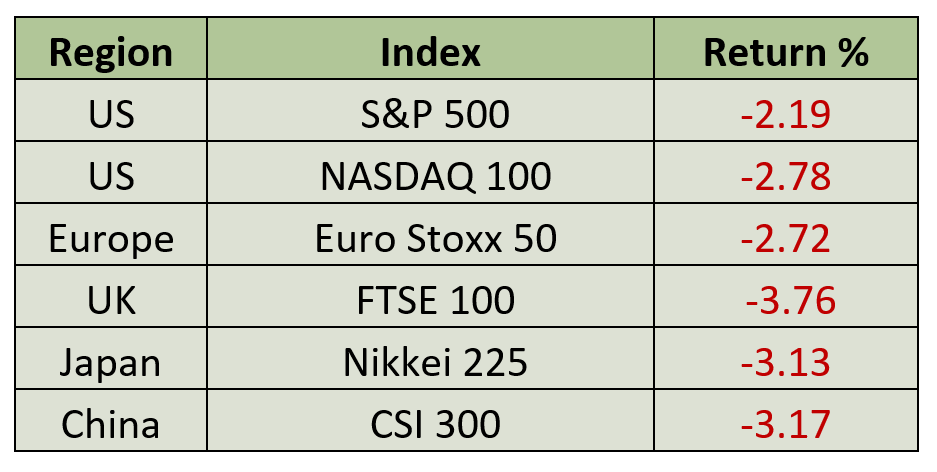

There was no relief from higher long term bond yields in October. US ten-year treasury yields briefly touched 5%, a level not seen since just before the 2008 Great Financial Crisis. Equites responded as you would have expected, with declines across all major markets. It could have been worse if not for a small rally in fixed income late in the month, which alleviated some of the stock market losses. Despite robust earnings from three – Amazon, Meta, and Microsoft – of the so-called “magnificent seven” stock prices continued their descent.

Source: Bloomberg

It can be difficult at times to identify reasons for short-term market fluctuations. Throughout the course of October, we had a series of US economic data releases that pointed to continued strong economic activity. Early in the month, payroll numbers showed considerable strength, while inflation remained stable at 3.7%, with a slight uptick in core inflation.

Additionally, retail sales were strong, and third-quarter real GDP rose 4.9%. This type of positive news doesn’t provide room to allow the Federal Reserve to ease and, if this trend persists, might prompt them to tighten measures further. The movements in US treasuries pulled interest rates higher, overshadowing the lacklustre economic conditions indicated by data releases in other developed markets.

When will this dynamic stop?

Fortunately, over the past fortnight, major central banks – the European Central Bank (ECB), the Bank of Japan (BoJ), the Federal Reserve Bank (Fed), and the Bank of England (BoE) – have conducted monetary policy meetings. BoJ aside, they are all sending a unified message: the necessity of maintaining sufficiently high interest rates for a prolonged period. They argue that with interest rates now at restrictive levels, inflation will move back to the target rate if held at these levels for long enough.

All the central banks are comfortable monitoring the data and state their readiness to tighten further, if necessary, contingent upon incoming data. Moreover, they remain comfortable with the ongoing reduction of their balance sheets as an additional means of policy tightening.

Notably, none of these central banks are even contemplating the circumstances that might prompt them to lower interest rates. Chairman Powell, of the Federal Reserve, explicitly conveyed this sentiment during his press conference on November 1st, although markets interpreted his stance as dovish.

How long do rates need to stay restrictive?

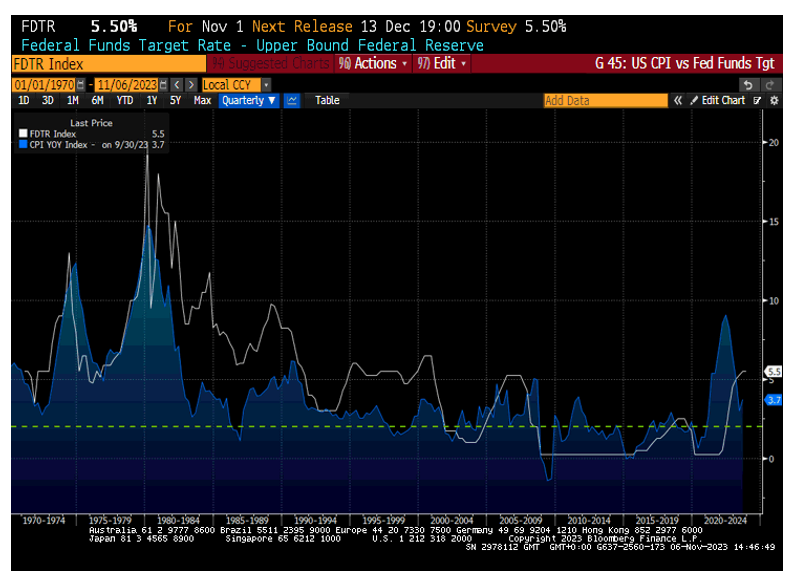

If you look at the chart below you can see that the more common state of affairs is for the Fed funds rate to be above inflation for long periods of time. We have only recently experienced this rate rising above inflation.

Source: Bloomberg

Markets tend to interpret information in ways that align with their desires, and they’ve concluded that central banks are finished with rate hikes. Their perception was reinforced by a softer-than-expected US labour market report released on November 3rd, which further emboldened markets to aggressively price in rate cuts for next year. As a result, equity markets responded positively to these developments, admittedly from a position where technical indicators had shown they were in deeply oversold territory.

Is this virtuous circle set to continue?

It certainly could until we observe stronger economic data or witness inflation ticking up. We suspect we are going to be bounced around by the random volatility of economic data. While recent data might hint at the start of a slowdown or even a recession, we lack sufficient data to draw that conclusion.

Do corporate earnings provide any insights into the future economic outlook?

Most of the major third quarter earnings have been released, showing a 2% year-over-year increase in the US and a 13% year-over-year decline in Europe. However, when excluding the energy sector, earnings per share increased 9% and 8% year-over-year in the US and Europe respectively. These numbers don’t align with the narrative of an impending recession.

Ongoing developments in the war in Gaza continue to unsettle markets and could exacerbate volatility. Furthermore, the looming risk of a US government shutdown remains uncomfortably high, despite (or because of) the election of a new Speaker of the House of Representatives.

We also suspect there will be continued fallout from the world adjusting to a higher level of interest rates. What once benefited from near-zero interest rates may face challenges with rates at 5%.

Throughout the year, we’ve consistently maintained a cautious and conservative approach. While technology stocks sold-off last month, we still hold the view that it’s premature to venture into the sector with a high-level of conviction largely due to stretched valuations. Nevertheless, we do maintain some exposure to the sector, particularly in mega-cap names such as Microsoft and Alphabet, both of which continue to demonstrate strong cashflows.

In fixed income, we maintain a moderate level of duration. We don’t foresee immediate rate cuts, despite the market pricing such, and expect unease around fiscal deficits to cause some concern for both market participants and policymakers.

At the time of writing, risk assets have benefitted from a slight relief rally. Nonetheless, we anticipate intermittent bouts of volatility, especially surrounding major economic data releases.

Discover more informative content from our Chief Investment Officer Jeff Brummette in the recent Investment Summary for October 2023 and our insightful half-way point 2023 Mid-Year Outlook. Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below or get in touch with one of the team.