Our May 2024 Investment Summary reflects upon a somewhat taxing period of market performance for April and what to expect for the upcoming month of May, as we continue further into Q2. Our Chief Investment Officer Jeff Brummette breaks down what has been going on…

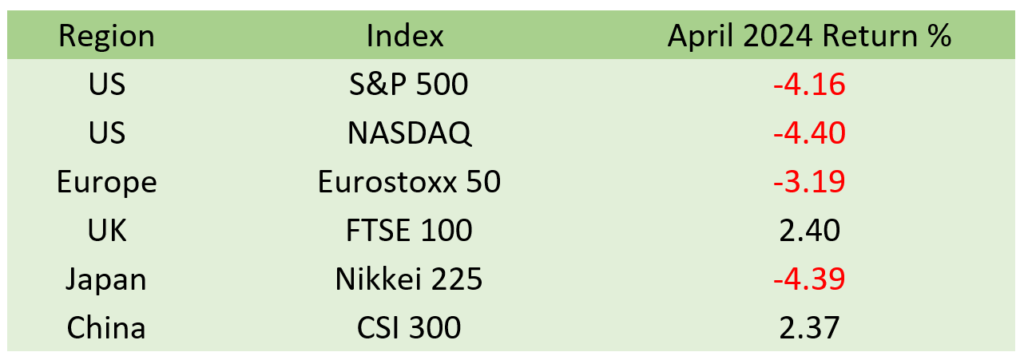

April proved challenging for most of the major equity markets, particularly following the strong performance in the first quarter. This probably shouldn’t have been a surprise, considering the scale of the equity rally over the past six months. Markets rarely ascend in a steady, linear fashion. You can probably tell by our tone we view this as a correction rather than a fundamental shift in trend.

Source: Bloomberg

The declines were driven mainly by the increasing recognition that the US Federal Reserve (Fed) is not going to cuts rates as quickly and by as much as had been anticipated by the markets at the beginning of the year. The resilience of US economic growth, particularly in the labour market, and the potential stalling of inflation improvement around 3%, contributed to this realisation. While this situation doesn’t necessarily spell trouble for markets, robust growth and strong labour markets typically translate to increased spending and healthy revenues for businesses. However, if markets were counting on interest rate cuts, it may necessitate an adjustment of some equity market valuations.

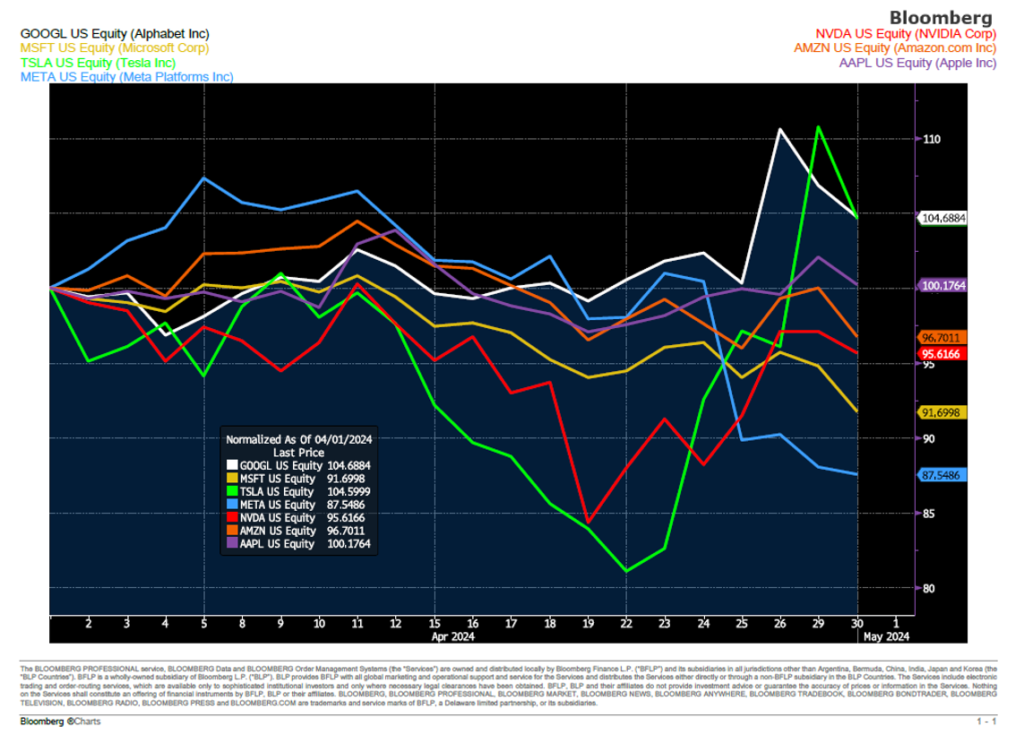

Maybe such an adjustment is taking place in the Magnificent Seven; Nvidia, Meta, Microsoft, Amazon, Tesla, Apple, and Alphabet.

Source: Bloomberg

Out of the seven, only two posted positive returns for the month: Alphabet and Tesla. Tesla’s performance was primarily a rebound from a 40% decline in the year, whereas Alphabet had genuinely strong earnings and provided positive guidance in terms of the outlook ahead.

Both China and the UK experienced positive equity market performance in April, each for their own specific reasons. China witnessed better economic data for the first quarter, and there were hints of potential “official buying” taking place. Chinese authorities are renowned for encouraging large state-owned financial institutions to purchase securities, with the aim of stabilising or bolstering the market.

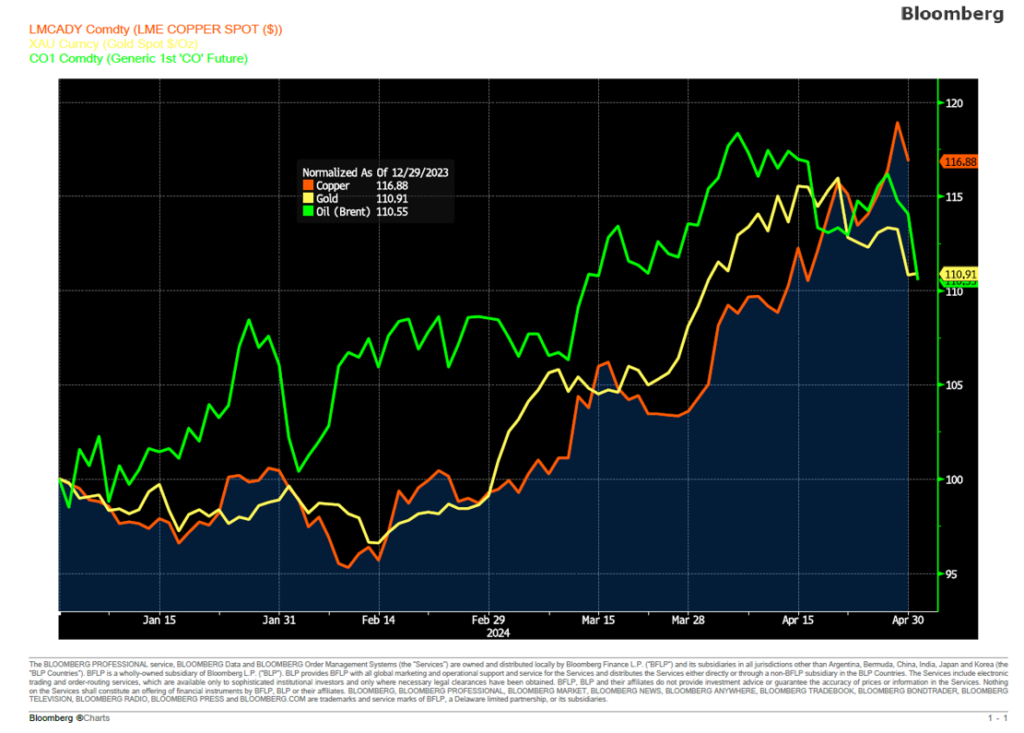

UK equity gains were the result of the continued rise in commodity and energy prices (see the chart below). The FTSE 100, which has a significant weighting to energy and mining, was a big beneficiary of this move.

Source: Bloomberg

The mining sector also received a notable boost from BHP’s bid for Anglo American. It will be intriguing to observe how this potential M&A play unfolds and whether additional potential buyers emerge.

There’s a growing realisation that the current copper mining capacity is insufficient to meet the demands of expanding global electric grids. The increasing prevalence of electric vehicles on the roads, coupled with the surge in data centres for Artificial Intelligence training, and governments initiatives encouraging the use of electricity for heating, cooling, and cooking, is significantly boosting electricity demand. Consequently, copper prices have surged this year, with copper producers following suit. The concurrent rise in gold and oil signals strong demand, although there may also be a hint of the markets starting to think that the central banks are done hiking rates despite inflation persisting above their 2% target.

It appears probable that the European Central Bank will cuts rates in June, and we wouldn’t be taken aback if the Bank of England followed suit by lowering rates by September. However, it’s crucial not to interpret these rate cuts as the start of a new easing cycle. Instead, these are just modest adjustments to prevent monetary policy from becoming overly restrictive.

With Eurozone growth finally showing signs of picking up, it is hard to see interest rates going much lower than 3%.

Source: National Statistics Institutes via Bloomberg

European businesses and households are benefitting from the lowest energy prices in two years, providing a significant boost to real income. If confidence continues to improve and they opt to spend, there’s ample capacity to do so.

As we have been suggesting all year, while interest rate cuts would be positive, they are not essential for the equity markets to maintain their upward trajectory. Solid economic growth, along with robust business and consumer spending, can continue to support stocks, but it is important to own the right companies. A diversified portfolio of comprising quality stocks, combined with moderate fixed income exposure, will enable investors to navigate the new world of higher inflation and interest rates. This new environment is not an aberration, rather it signifies a return to long-term averages.

Hear more from the Oakglen experts

Our investment team continue to provide topical and informative content for you to digest. Hear from Jeff Brummette on Q1 earnings in The Fed, 1st Quarter Earnings, and the Equity Market, whilst our Investment Manager Myles Renouf recently covered upon our investment performance in Q1 2024: Discretionary Investment Management Service Update. You can read more on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.