Spring has sprung, but are markets bouncing back?

As we move further into March and the final month of the first quarter, global markets continue to navigate a complex landscape of significant economic and geopolitical changes. The so-called “Magnificent Seven” tech giants have once again dominated headlines, driving significant market momentum while raising questions about valuation and sector concentration. Meanwhile, broader equity and fixed income markets have responded to shifting economic data, central bank signals, and evolving investor sentiment.

In this month’s investment summary for March, our Chief Investment Officer, Jeff Brummette, reflects on February and provides insights into the key market movements, emerging opportunities, and an outlook for the months ahead as we prepare to start a new quarter.

_______

February saw Trump tariff fatigue weigh on U.S. equity markets, as both the S&P 500 and the tech-heavy NASDAQ experienced declines. The so-called Magnificent Seven – Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla – were anything but, as six of the seven ended the month in red.

In contrast, China and Europe posted strong gains, despite President Donald Trump’s persistent tariff threats. We’ve added the Hang Seng China Enterprises Index to our table below, as this narrower index provides a clearer picture of the performance of large-cap Chinese stocks.

Source: Bloomberg

Fixed income markets were positive for the month with the U.S. beginning to price in an economic slowdown.

Source: Bloomberg

Commodities and crypto had a mixed month, with gold positive, while oil and Bitcoin declined. Bitcoin has experienced a sharp drop and has erased most of its Trump election victory inspired gains.

Source: Bloomberg

Source: Bloomberg Finance L.P.

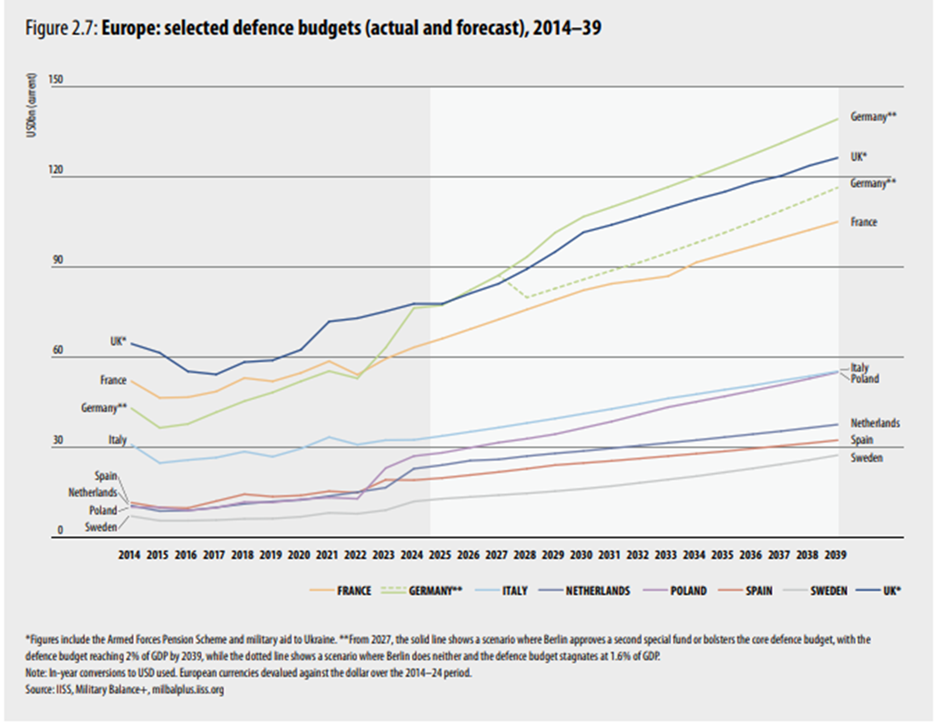

European equity markets were led higher by defence stocks, as most NATO countries continue to pledge ever higher defence spending. President Trump’s recent press conference with Ukraine President Volodymyr Zelensky will add to those spending pressures, as the U.S. seems to be on a path to reducing its financial and military support for Ukraine. In response, Europe will need to step-up to try and fill the void that will result from this reduction in aid.

Source: IISS, Military Balance+

It’s worth highlighting that since Trump’s election victory, European defence names have outperformed the Magnificent Seven.

Magnificent Seven vs Euro Stoxx Defence Index

Source: Bloomberg Finance L.P.

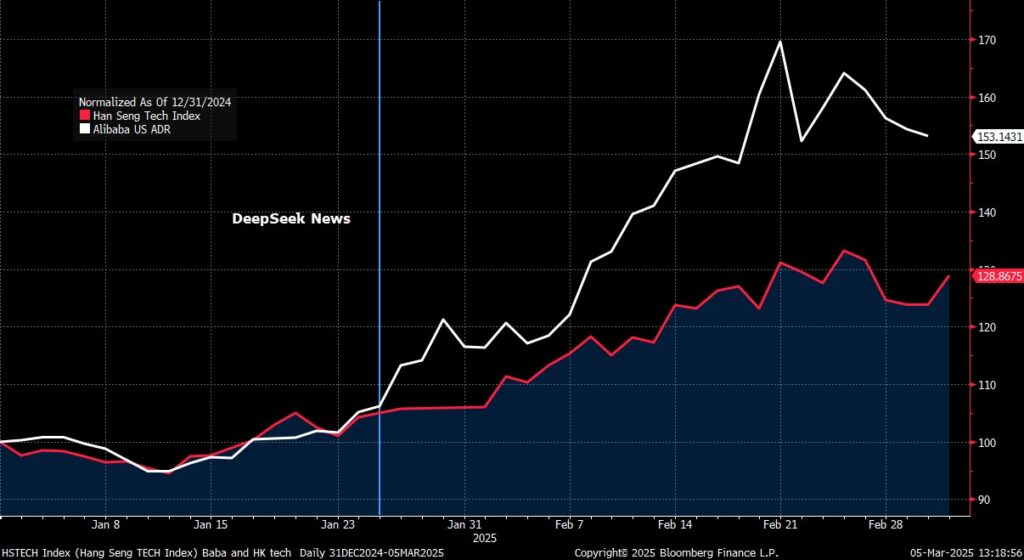

The Chinese equity market has been driven higher by their tech names with Alibaba, now seen as a new AI darling, up over 60% year to date.

Hang Seng Tech Index and Alibaba

Source: Bloomberg Finance L.P.

How do we reconcile outperformance by European and Chinese equity markets versus the U.S., especially when China and Europe are President Trump’s primary tariff targets?

Following Trump’s election victory, it was anticipated that he would usher in a new era of lower taxes, reduced regulation, secure the U.S. border, and implement tariffs to incentivise foreign manufacturers to build more factories in the U.S. Forty days into his administration, we have witnessed a flurry of executive orders, many of which are being fought in federal courts, and a confusing volume of tariff threats most of which would have negative impacts on U.S. consumers and industry.

On the tax front, the House and Senate are still trying to fund this current fiscal year and must raise the debt limit to prevent an imminent government shut down. The prospect of increasing an already exceptionally large budget deficit is bothering some Republicans in Congress. It appears the best President Trump may do is extend the tax cuts he implemented in his first term, which are due to expire at the end of this year. Securing the border has been his one notable achievement.

Financial markets have responded negatively to his chaotic policy announcements, and it is clear they do not like tariffs. With equity valuations remarkably high in the U.S., it is easy for them to fall simply due to a change in sentiment. In contrast, China and Europe currently trade at much lower valuations.

Chinese President Xi Jinping has recently shown public support for the tech industry and its leaders after shunning them for the past five years. Chinese monetary policy remains very loose, with the government continuing efforts to boost consumption.

In Europe, low valuations combined with the ECB’s ongoing interest rates cuts create an attractive combination. Europe has also seemingly awoken from a slumbering policy malaise and is now striving to enhance competitiveness.

As we have highlighted previously, we are not overly exposed to the Magnificent Seven and continue to favour exposure to European defence names and China. Our fixed income holdings have also been helpful, and we recently extended our duration in January during the sharp rise in yields.

_______

Hear more from the Oakglen experts

Our investment team continue to provide interesting and informative content to help keep you in the loop on recent global news and market trends. See below for some key highlights from around the world which some of the investment management team have recently covered:

Read more:

- The Global Automotive Sector: Losing Grip of the Wheel?

William Lamond, Investment Director

- Central Bank Update: February 2025

Jeff Brummette, Chief Investment Officer

- February 2025 Investment Summary

Jeff Brummette, Chief Investment Officer

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.