March’s 2024 Investment Summary revisits February’s market performance and highlights key trends and opportunities for the month ahead. Growth stocks kept driving the market higher in February, although regional and sectoral returns also widened. With fresh new highs for stocks, has Spring finally sprung or will we see a pull back?

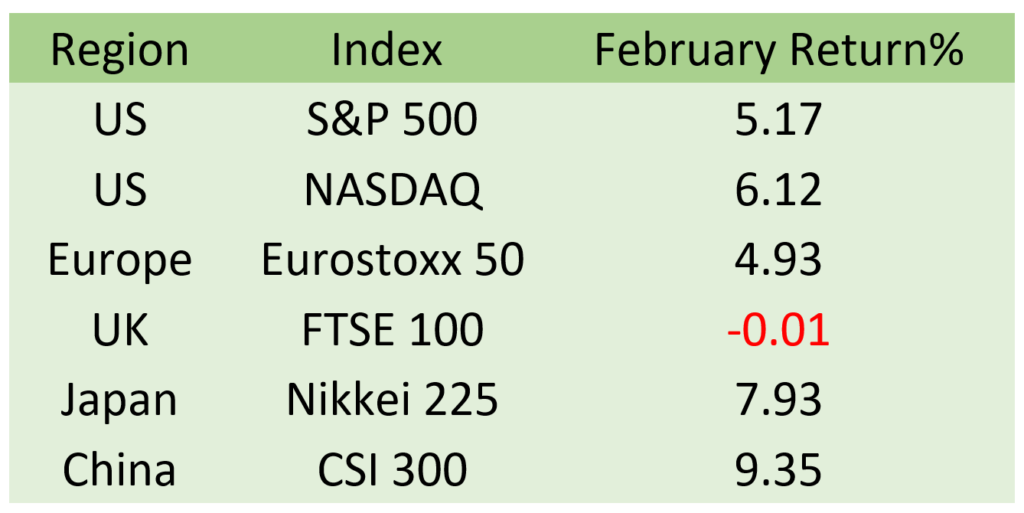

February was one of the best months for equities in some time, with many of the major indices making new 52-week highs. Notably, the S&P 500 closed above 5,000 for the first time. The combination of robust 4th quarter earnings releases, coupled with expectations of forthcoming interest rate reductions by central banks, spurred upward momentum across global markets, excluding the UK.

Particularly noteworthy was the performance of Chinese equities, not so much by fundamental economic and corporate improvements, but rather by official interventions such as measures to impede short selling and support from the government via the purchase of equities.

Source: Bloomberg

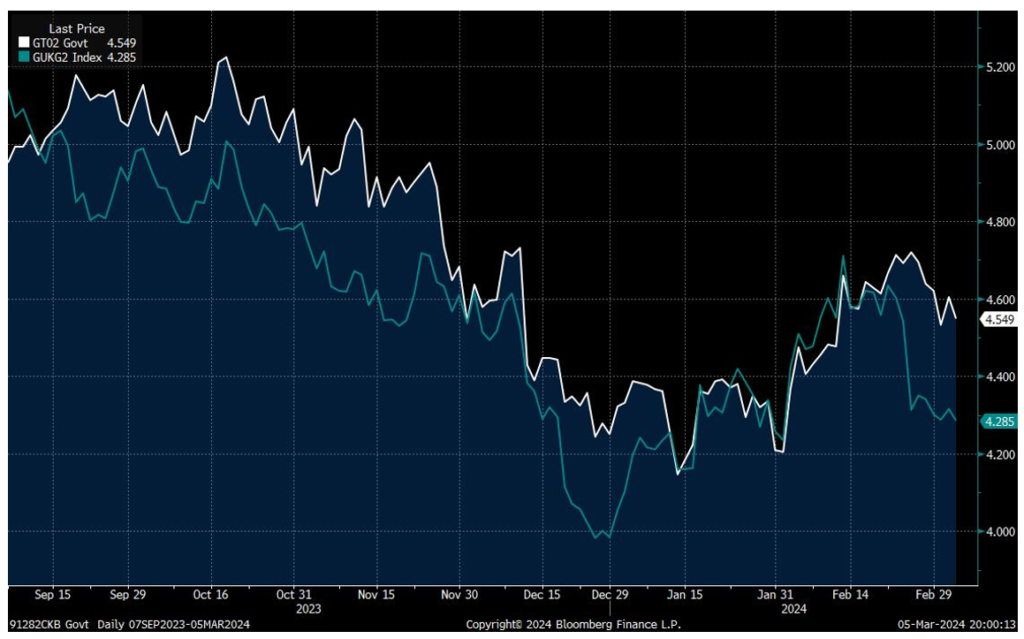

In fixed income, yields continued to grind higher as bond markets reassessed the size of expected central bank interest rate cuts.

Two-Year UK Gilts and Two-Year US Treasury Bonds Yields

Source: Bloomberg Finance L.P.

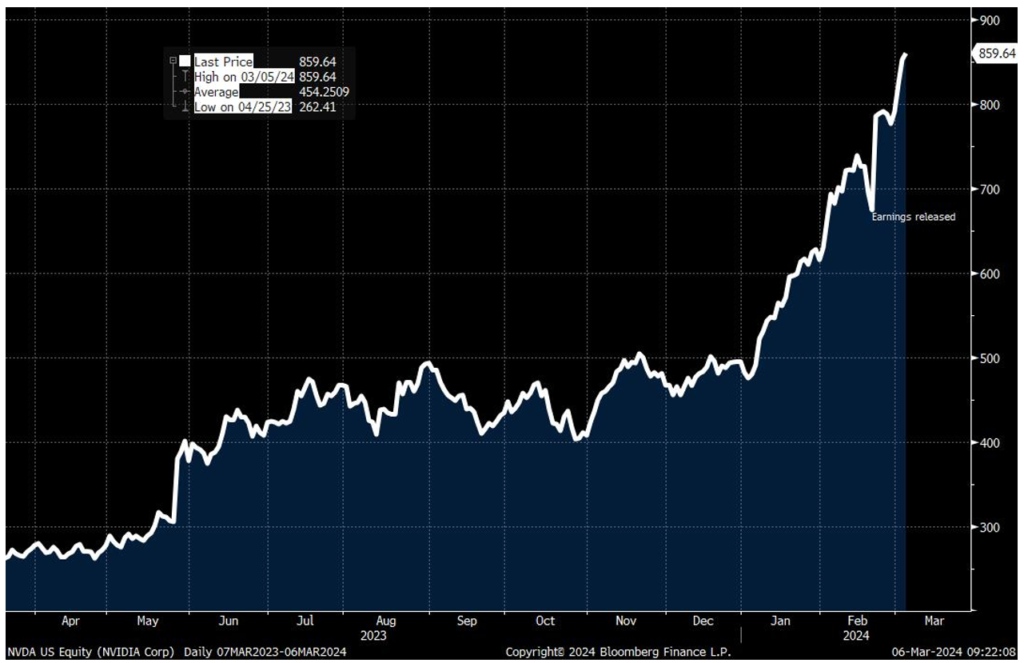

This rise in yields and the associated volatility didn’t faze equities as the NASDAQ, S&P 500, and the Nikkei 225 achieved record highs (see our note on the Nikkei 225 Index). Strong earnings reports, notably from Nvidia, helped boost stocks, while there is a hint of speculative momentum beginning to gather steam.

NVIDIA

Source: Bloomberg Finance L.P.

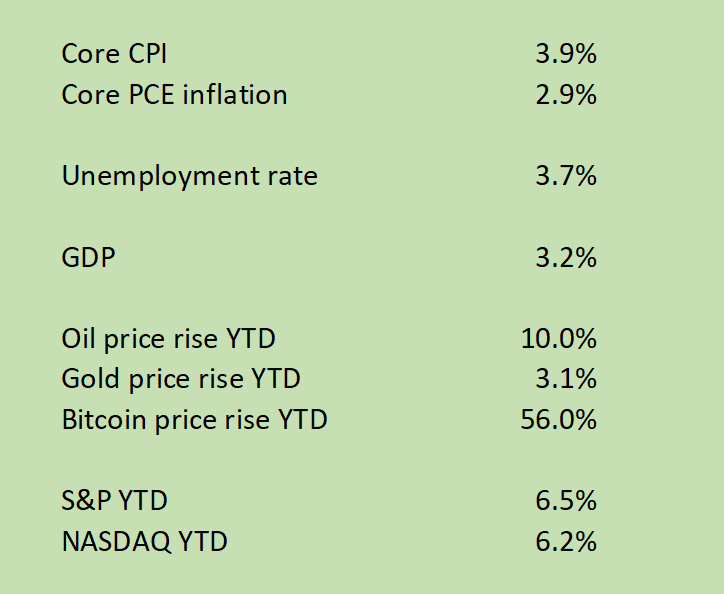

The rhetoric from central banks and stronger economic indicators are casting doubts about the size and timing of interest rate cuts. In fact, some analysts are now predicting no cuts at all by the US Federal Reserve this year – a contrast to Europe, where analysts are still anticipating interest rate cuts from both the Bank of England (BoE) and the European Central Bank (ECB). If you look at the current state of the US economy, it is difficult to see a need for interest rate cuts.

Source: Bloomberg

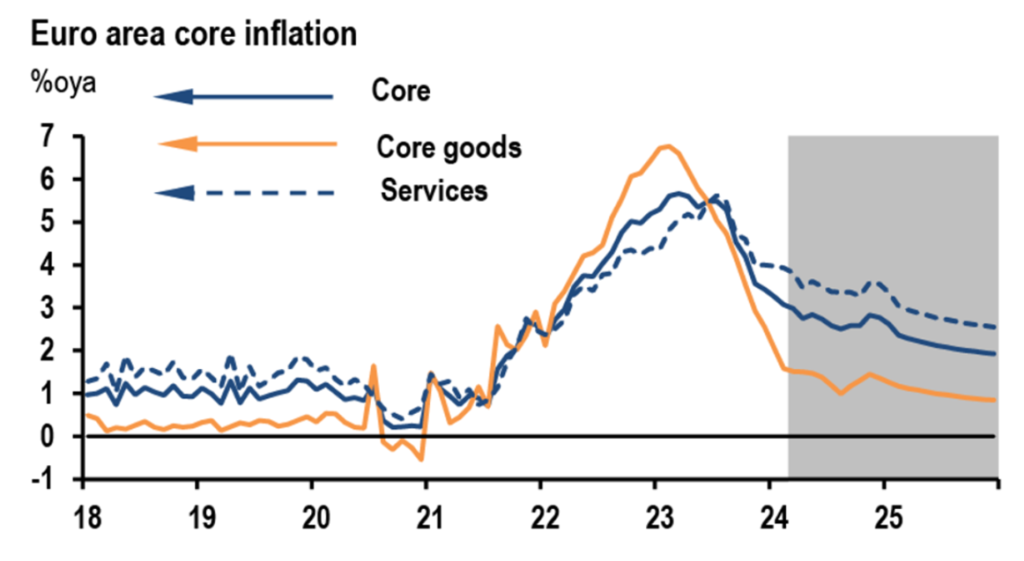

Whilst economic growth isn’t as strong in Europe, you could still argue it might be premature for the ECB and BoE to cut rates, considering inflation remains stubbornly above the 2% target. Central bankers have been trying to make this case, yet financial markets have been hesitant to embrace it.

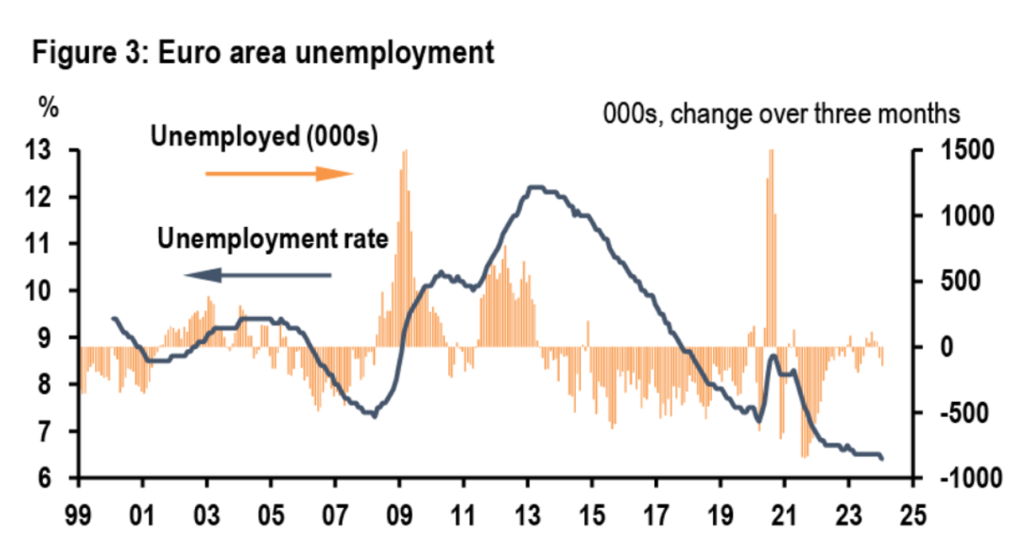

The primary driver keeping inflation above target is inflation stemming from services. With unemployment rates near all-time lows, it is difficult to anticipate inflation falling much further. Europe serves as a prime example; despite headline inflation falling to 2.6%, services inflation remains stubbornly around 4%. Unemployment in the Eurozone is the lowest it has ever been since the inception of the Euro. Consequently, workers wield considerable bargaining power in wage negotiations, thereby keeping upward pressure on inflation.

Source: Eurostat, J.P. Morgan

Source: Eurostat, J.P. Morgan

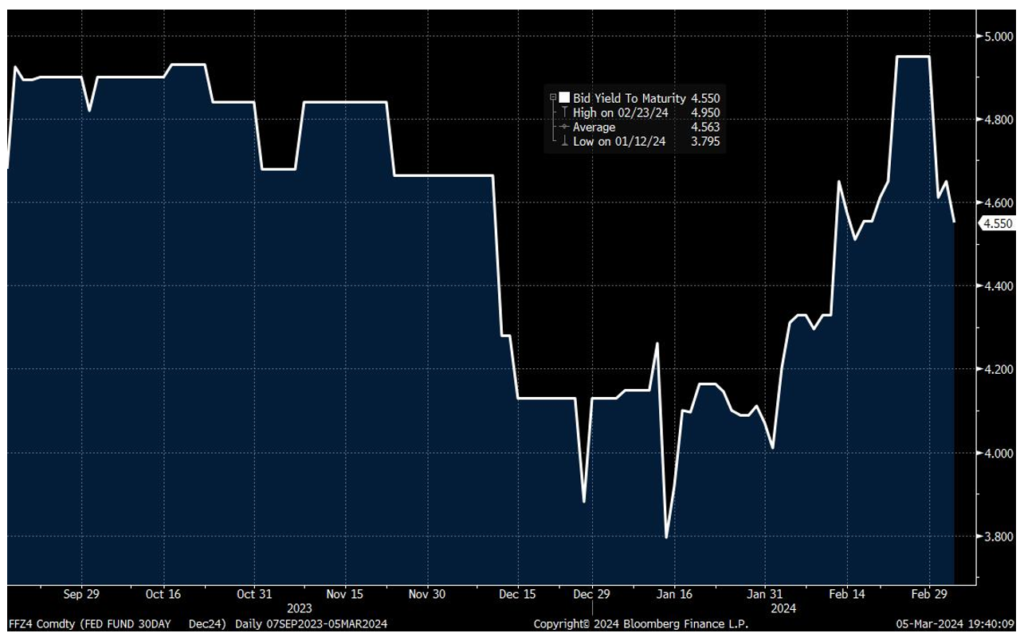

Certainly, central banks could still cut rates. With the possibility of further falls in inflation over the next few months, they may decide they are comfortable with the progress and direction of inflation, potentially leading to a less stringent policy stance. This could translate into a more modest reduction in interest rates compared to market expectations. The chart below illustrates how expectations for the US Federal Funds rate by year-end have been rapidly changing. At the start of 2024, financial markets were pricing a Federal Funds rate below 4% by year-end, within a matter of weeks this has been reassessed with markets now projecting a rate of just under 5%.

Source: Bloomberg Finance L.P.

We anticipate ongoing volatility like this, which may eventually spill over to equities – that trend may already be underway as we write this note.

Despite the prospect for fewer interest rate cuts than hoped, we remain positive on bond and equity markets. Solid growth in the US, coupled with improving growth prospects in the Eurozone and the UK, augurs well for earnings. While central bank rate cuts could be helpful, they are not essential to the performance of our strategies. Additionally, we maintain sufficient government and high-grade corporate fixed income to protect us in the event of any sudden and unexpected economic downturn.

Browse through some of the other insights from our investment team, from thoughts on the recent UK Spring Budget 2024, to more detail around our Discretionary Investment Management Service offering. Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client? Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.