As we motor towards the end of Quarter 2 and the UK General Election, our June 2024 Investment Summary reflects upon the month of May and the upcoming weeks in June. With geopolitics and central banks in focus, our Chief Investment Officer Jeff Brummette takes a closer look at what has been occurring in financial markets.

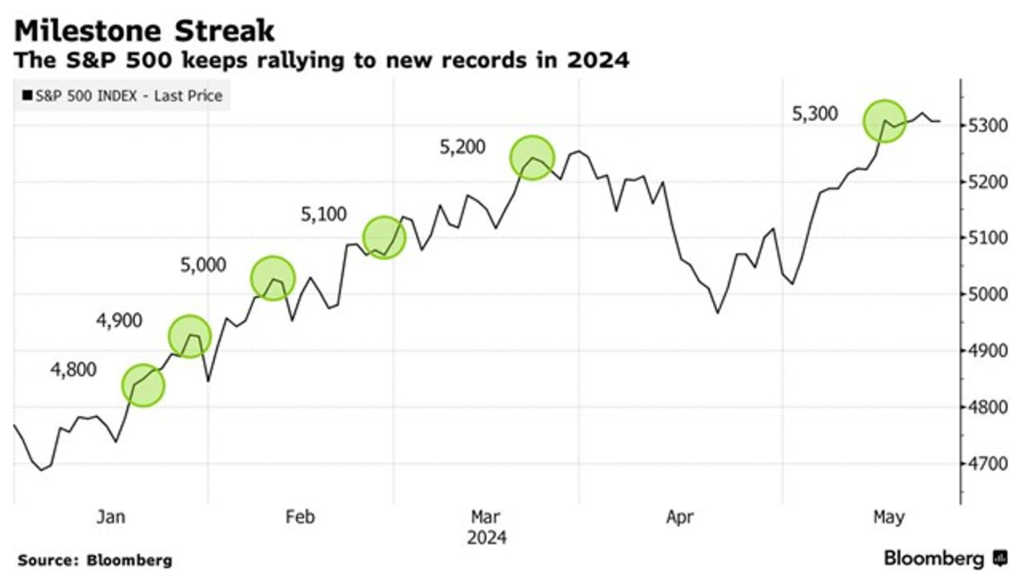

The losses global equity markets experienced in April were quickly reversed in May, once again led by the US markets and big tech. The S&P 500 advanced nearly 5%, closing over 5,300, whilst the Nasdaq Composite crossed 17,000 for the first time.

Source: Bloomberg

Slightly weaker economic data in the US, particularly in the labour market, along with continued declines in inflation, re-kindled hopes for interest rate cuts by the Bank of England (BoE), European Central Bank (europa.eu) (ECB), and the Federal Reserve Bank (Fed). This anticipation led to an intra-month decline in interest rates, which, coupled with generally upbeat earnings reports, spurred a sharp equity rally.

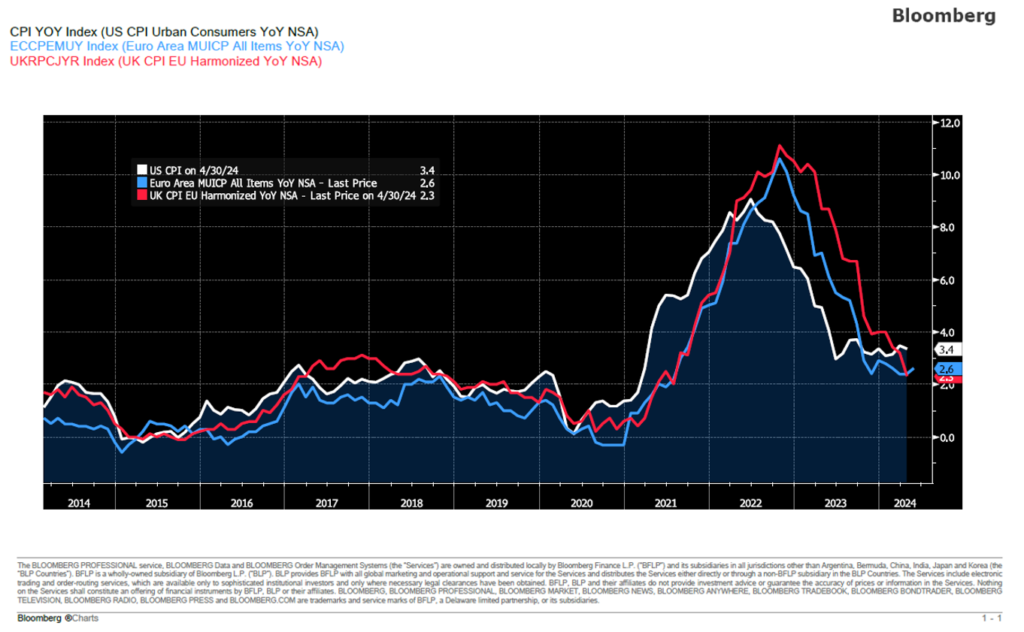

Inflation is now close to the 2% targets of the BoE and the ECB. On June 6th, the ECB lowered rates 25 basis points stating “it is now appropriate to moderate the degree of monetary policy restriction after nine months of holding rates steady.”

However, they also raised their forecasts for inflation over the next two years, suggesting there is no predetermined plan for additional cuts. This move by the ECB could potentially serve as a template for the Fed and BoE to follow.

Source: Bloomberg

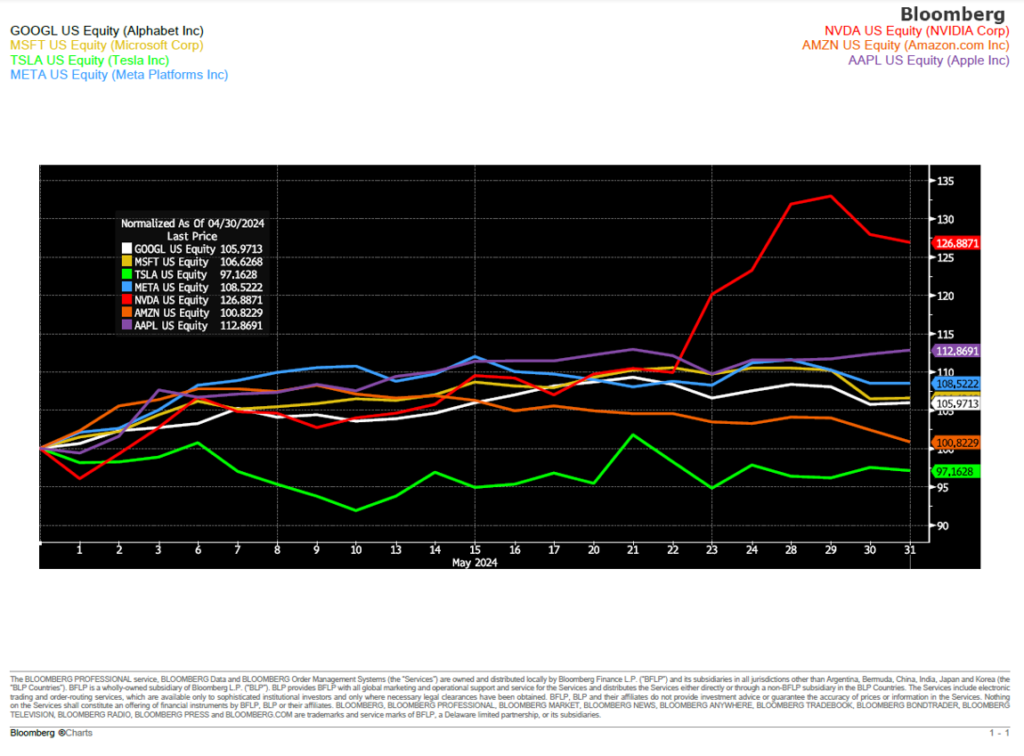

Six of the Magnificent Seven were positive for May, with Nvidia crossing the $1,000 mark for the first time as it posted a 26% gain, following another quarter of record earnings. This impressive performance helped propel the Nasdaq to rise nearly 7% for the month.

Source: Bloomberg

There are no immediate risks on the horizon that could halt the global equity rally. Inflation has cooled, labour markets remain robust and economic growth is positive. Central banks are inclined to ease monetary policy if inflation continues to decline. Additionally, they are also likely to ease if growth falters, effectively reinstating the “Fed put”.

In the post-Great Financial Crisis period, whenever US equity markets experienced significant declines, the Fed would intervene with new rounds of quantitative easing (QE), encouraging markets to reverse stock market declines. This behaviour came to be known as the “Fed put”. Currently, market participants believe this safety net is back, as Chairman Powell has indicated that the Fed would ease policy in response to a sharp deterioration of the labour market. We believe this accurately reflects current Fed policy and is supportive of the markets.

That doesn’t mean equities can’t fall in price in response to a slowing of economic activity. They certainly can, and rate cuts wouldn’t necessarily halt a sell off and immediately revive the economy. However, the Fed’s policy bias is asymmetric: they will cut if needed, with the worst case being that they keep rates on hold. The threshold for them to resume tightening policy is high; inflation would have to start climbing again in a manner that the Fed feared could become permanent.

The next Federal Open Market Committee is scheduled for 11th and 12th June, and they receive new inflation data on the morning of their meeting. While this data might generate significant market reactions, it is very unlikely that the Fed would make policy decisions based on a single data point. Instead, the market’s attention will shift to second-quarter earnings, which begin in early July and will become the next focal point.

The US elections may also begin to take a more prominent role in influencing markets. There will be a debate on June 27th between the two presidential candidates. Neither candidate is particularly popular; in fact, political pundits are referring to the undecided voters (approximately 20% of the electorate) as the “double haters” because they intensely dislike both candidates. It is these voters who will decide the election. The early polling suggests the recent conviction of Donald Trump has not significantly altered voters’ opinion of him. While the “double haters” might dislike him even more, this sentiment is not yet definitively clear.

Regardless of who wins, it is likely to be a divided government, with the Democrats retaking the House of Representatives and the Republicans securing the Senate. This would prevent any radical agenda being implemented by either party. However, it also raises concerns about legislative gridlock, which is worrisome given the conflicts in Ukraine and the Middle East, as well as the deteriorating fiscal situation in the US. Both the Medicaid and Social Security benefits programs are projected to run out of funds by the end of the next decade, while interest service costs on the national debt are becoming a key expenditure item in the US government’s budget. At some point this will become an issue, there is just no telling when.

Closer to home, the UK holds its General Election on July 4th. The outcome almost certain, with the main question being the size of the Labour majority. Labour isn’t campaigning on a clear economic agenda, so it’s unclear how markets will respond to their anticipated victory. However, there is some hope that they may achieve better relations with the EU, which be beneficial to the UK economy. We will have to wait and see.

At a portfolio level, we continue to hold a modest level of duration in fixed income, although stand prepared to adjust this in the event of more aggressive rates than markets are currently pricing. In equities, we have selective exposure to some of the mega-cap technology stocks as well as the commodities sector.

As we have been suggesting all year, while interest rate cuts would be a positive, they are not essential for the upward trajectory of equity markets to persist. Solid economic growth, coupled with healthy business and consumer spending, can continue to underpin equities. A well-diversified portfolio comprising of quality stocks, along with a moderate allocation to fixed income, will enable investors to navigate our new world of higher inflation and interest rates. This evolving landscape is not an anomaly; rather, it signifies a return to a more typical market environment.

Hear more from the Oakglen experts

Our investment team continue to provide topical and informative content for you to digest. Our Managing Director Dominic Tayler covered the UK General Election and the economic implications, and our Chief Investment Officer Jeff Brummette covered China’s plans to sell off special central government bonds in an attempt to stimulate the economy.

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.