For our June 2023 Investment Summary, we take a closer look at the latest investment news and occurring market trends as we move towards the end of Q2 2023.

It seems it would have been more appropriate to have Artificial Intelligence (AI) write this month’s investment summary since AI has proven to be the flavour of the month.

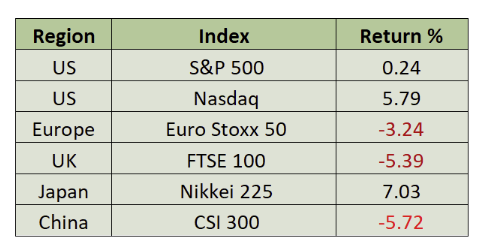

An AI-inspired rally in US tech stocks sent the NASDAQ higher by nearly 6%. One stock, Nvidia, was the focus as its chips are key to providing the infrastructure for AI. It rose just over 100% for the month (yes for the month), and is now up 160% year to date (recall it fell 50% last year).

These moves always make the headlines and can leave investors feeling foolish if they are not involved. Do not feel like you must chase it though. There will be plenty of opportunities to participate in the benefits of AI, much of which we have yet to discover.

The Nikkei 225 was the other big gainer in May as it rose just over 7%, again with much of the gains coming from Japanese tech related names. The rest of the world was disappointing with the UK, Europe and China experiencing losses for the month.

Source: Bloomberg

The UK market was hurt by the inflation data for April. Although the headline rate of inflation declined from 10.1% to 8.7%, it was by less than the markets and the Bank of England had expected.

Energy and mining shares were also soft as the post Covid-19 economic recovery in China has not been as robust as everyone had hoped, by the markets leading to softer commodity prices. The Chinese equity market faltered in sympathy with this view.

European stocks also suffered as German growth was weak, (no doubt linked to weakness in Chinese demand for German exports) and fear that interest rates still would have to rise further to combat inflation in the Eurozone.

In the US, apart from the AI tech rally, equity markets focus was on the debt ceiling and a growing realisation that the US Federal Reserve (Fed) might be about to pause hiking rates at their next FOMC meeting. Yields on US Treasuries rose around 40 – 60 basis points (depending on maturity) as markets began reducing their rate cut expectations.

The US debt ceiling crisis was averted late in the month by a bi-partisan agreement in Congress to suspend the debt limit until January 2025. By then, a new President and Congress will have to argue about paying for past spending once again. This is a foolish waste of political effort that has produced nothing meaningful in the way of deficit reduction.

This latest fix still approves increases in defence spending and limits the increase in most non-defence discretionary spending to 1% until fiscal year 2025, when the fight will start again. The US fiscal situation is a mess and will at some point begin to hurt the economy and bother financial markets. It may be soon as the US Treasury issues a record $1 trillion in T-bills to rebuild their cash balance for the second half of the year.

Bad fiscal behaviour is not unique to the US – the UK, Europe, China, and Japan all have enormous amounts of debt outstanding that are growing every year. No one is running a budget surplus. Now that interest rates are dramatically higher than they have been, increasing debt service costs are going to become an issue for governments and financial markets.

China has seen the strength of its post Covid-19 recovery fade, and the recent investigations and arrests of employees at a few foreign consulting firms based in China are not helping the moods of investors. Continued US/China friction over trade in the latest semiconductor technology is also damaging to the equity market. China has allowed their exchange rate to weaken, and we expect other stimulus measures to be taken to stabilise the economy and boost activity.

Inflation remains the biggest concern for central banks and the financial markets. While it is lower than its peak of last summer, inflation is nowhere close to the 2% targets most central banks have chosen to meet. The most anticipated recession ever, has yet to start. Unemployment rates in the developed world sit near record lows and service sectors are still expanding despite recessionary like levels of activity in the manufacturing side of most economies.

This is not where the central banks expected to be. They have made a surprisingly significant amount of rate hikes in little over a year. They are also shrinking their balance sheets. So, it is not surprising that the rhetoric coming out of them suggest they may soon pause hiking rates to watch and see how inflation and other activity develop for a few months before deciding if they need to tighten financial conditions further.

The US will lead the pause as they have been the most aggressive in raising interest rates. They also need to see how the problems in regional banks tighten credit conditions further. Don’t be surprised if the Fed pauses, while the ECB and the Bank of England hike a few more times. But do not expect any rate cuts, in the short-term. Financial markets are slowly coming around to this view and it is pushing market rates higher. Interest rates higher for longer will be our new normal. This will slowly weigh on the less visible parts of financial markets as well.

While we are seeing some problems in commercial real estate, there will also be challenges in private credit and private equity as debt is refinanced at significantly higher rates. It is very possible that the AI tech rally squeezes up a bit more, but we suspect the best of the year’s equity returns may have already occurred.

We continue to re-iterate the importance of diversification, both geographical as well as sectorial, with a focus towards high quality defensive and cash generative businesses. Such businesses should prove somewhat resilient during economic slowdowns, helped in part by their strong balance sheets, but also through their competitive economic moats and pricing power. Oakglen will obviously continue to bring you our latest insights and other investment commentary, so you are well versed on the most recent market news.

Read more from our Chief Investment Officer Jeff Brummette in our piece from last month on the US Debt Ceiling. Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below.