It is safe to say that there is never a dull moment in the financial markets these days, and last month was no exception. For our July 2023 Investment Summary, we cover how the month ahead is shaping up and reflect on market news from June.

If I had informed you at the end of May that six developed world central banks (namely, the Reserve Bank of Australia, Bank of Canada, Bank of England, European Central Bank, Norges Bank, and the Swiss National Bank) would raise interest rates in June, while the US Federal Reserve (Fed) would temporarily halt its rate hikes but articulate its actions using strongly assertive language and imply the possibility of future hikes, and additionally, the Bank of England (BoE) would increase rates by 50 basis points, you would not have expected equity markets to post one of their best months for the year. Nevertheless, that is precisely what transpired!

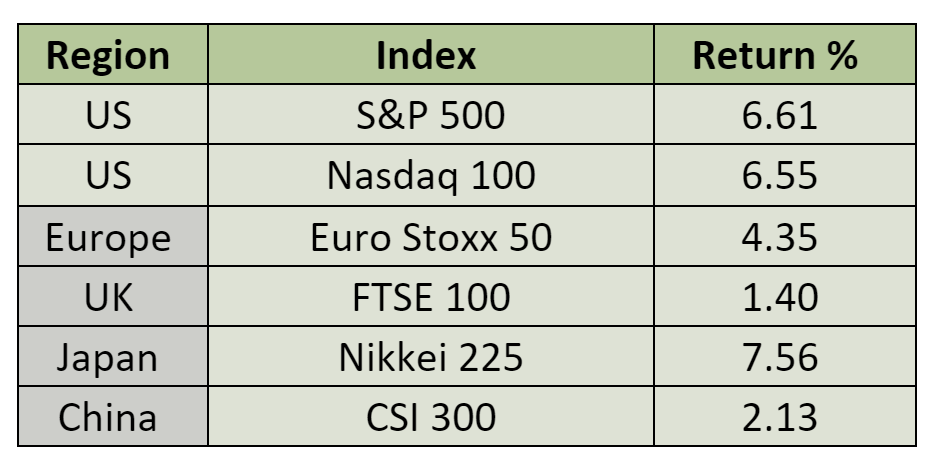

Source: Bloomberg

The fear of missing a powerful (bear market) rally is chasing stock prices higher. The excitement over Artificial Intelligence (AI) continues to drive the major technology names in the US towards valuations approaching last year’s highs, despite declining revenues in numerous instances. Japanese equities have now had two great months in a row as the ever-weakening Yen (144 to the US dollar at present) suggests good earnings for Japanese exporters lie ahead. On the other hand, Chinese equities continue to face challenges as the economic data from China stays soft. Recent policy moves by the People’s Bank of China to lower interest rates have been viewed as anaemic, correctly so in our opinion, as a mere 10 basis point rate cut provides minimal stimulus.

Central bankers continue to raise interest rates and express unwavering determination to restore inflation to its target level, typically set at around 2%, regardless of the associated cost. The European Central Bank (ECB) recently increased rates by 25 basis points and announced plan for another 25-point increase in July. The BoE surprised many market participants with a 50-basis point hike and conveyed their readiness to take further action if necessary. Although the Fed refrained from rates hiking (as widely anticipated) they revised their projections, indicating that rates could reach over 5.6% by the end of the year.

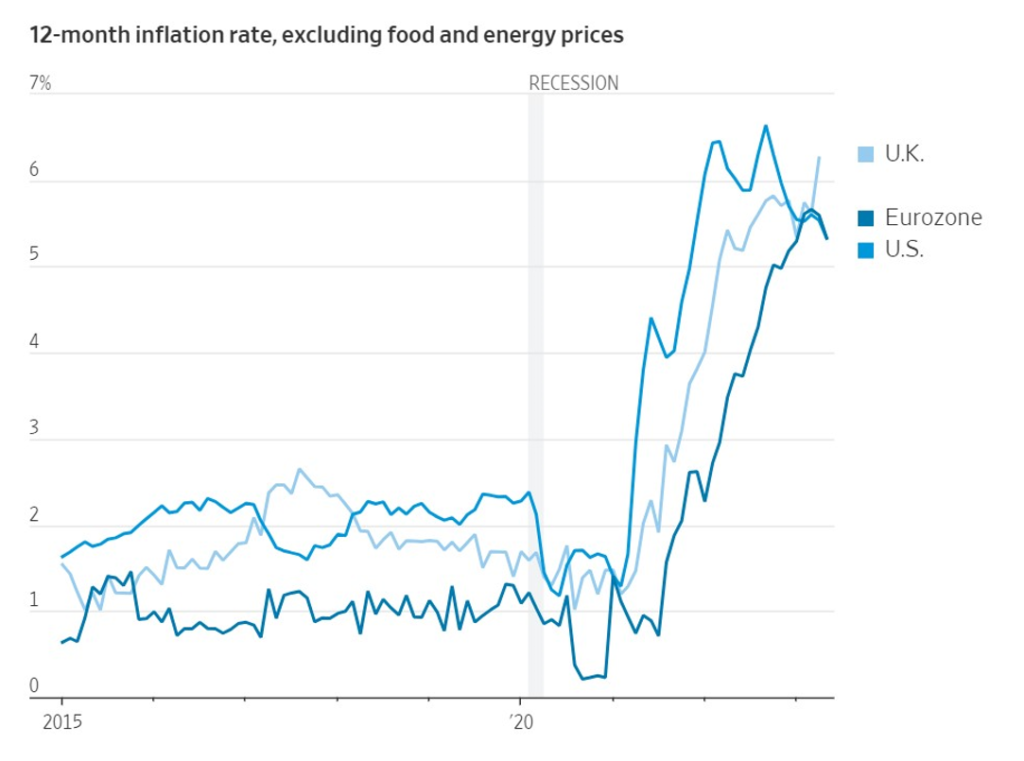

For now, we must take them at their word. Inflation has declined significantly from the peaks witnessed last summer, yet both headline inflation and, perhaps of greater significance, core inflation indicators remain well above target. Core inflation excludes the highly volatile food and energy components, serving as a more reliable gauge of the fundamental forces driving inflation.

Source: Eurostat, Labour Department, OECD via St Louis Fed

During the recent ECB Forum on Central Banking that was just held in Sintra, Portugal, the world’s leading central bankers reiterated their commitment to combatting inflation and collectively indicated that we should expect to face an extended period of interest rates remaining at current levels or potentially increasing. Among these central banks, only the Bank of Japan (BoJ) is persisting in keeping negative interest rates, which are still in effect. Despite inflation rising to 4% in Japan, the BoJ remains hesitant to assume that it will remain at that level. Given their nearly three-decade-long experience with deflation and sluggish growth, they appear cautious and influenced by those past challenges, thus being very cautious in tightening monetary policy. As a result, the Yen continues to weaken, and if this weakness persists, it may eventually prompt the BoJ to act.

Historical evidence highlights the importance of policy rates remaining above the inflation rate for a considerable period to effectively reduce and sustain desired levels of inflation. Despite market expectations suggesting an imminent decrease in interest rates for the following year, there is a possibility of significant disappointment in this regard. In such an environment, we anticipate that richly valued equities may encounter difficulties. However, fixed income investments may not be immune to challenges either. Consider the recent experience of UK fixed income, which has encountered yet another demanding month. The emergence of higher than anticipated inflation has sparked concerns regarding the BoE’s future actions and the market’s ability to absorb the increasing debt issuance from the UK Treasury. Consequently, yields had to rise to attract buyers.

This problem will not be limited to the UK. Virtually every developed nation lacks fiscal discipline. Governments and finance ministers grew accustomed to accumulating substantial fiscal deficits during a period characterised by zero (or negative) interest rates. However, the current reality is beginning to take hold, and markets are starting to pay attention to the implications of debt service costs and the magnitude of deficits.

We maintain a cautious approach across our strategies and have recently reduced our exposure to the very highly valued NASDAQ index, taking profits in the process. Anticipating increased volatility as the battle against inflation persists, we believe that adopting a somewhat conservative stance will prove beneficial for us.

Read more from our Chief Investment Officer Jeff Brummette in our Investment Summary for June 2023. Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below.