A new year has begun, and the investment landscape remains dynamic, shaped by shifting market trends, evolving economic conditions, and the enduring impact of global events. January presents a critical opportunity to reassess portfolios, balancing resilience with growth potential in a time of cautious optimism. We kick things off this year with some comprehensive analysis from our Chief Investment Officer, Jeff Brummette, as he reflects on the month of December.

_______

Trump trade enthusiasm clashed with a hawkish stance from the Federal Open Market Committee meeting in mid-December, reversing the rally in US stocks witnessed during the first half of the month. By month-end, the S&P 500 had declined 2.5%, while the NASDAQ posted a modest gain of just under 0.5% for the month. In contrast, UK equities registered losses, European markets advanced, and Asia outperformed, with Japan and China experiencing strong local currency returns.

Source: Bloomberg

Despite December’s challenges, it was another strong year for equity markets, in fact the past two years being the best consecutive years for US equities since the late 1990s.

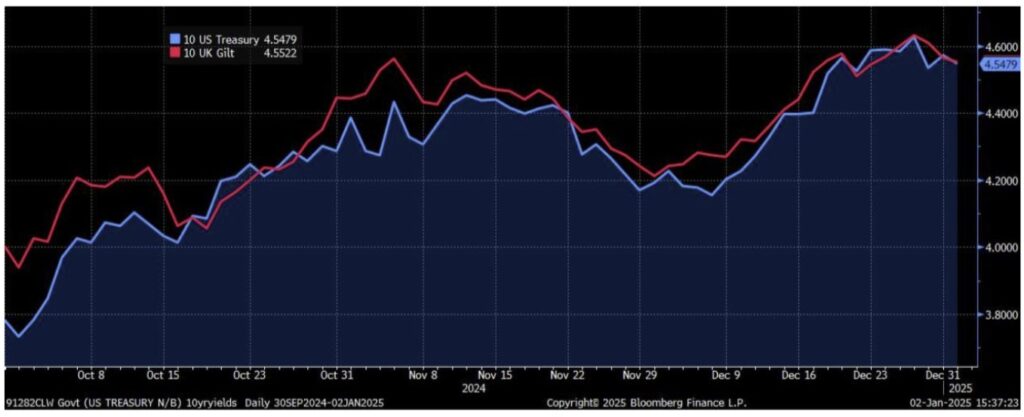

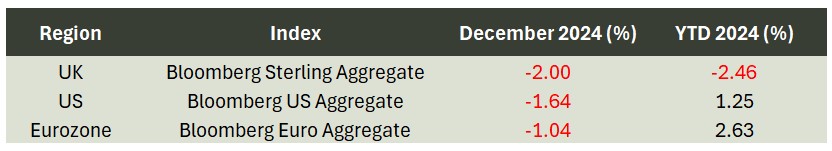

Fixed income performance was poor during the month, as fiscal worries globally pressured the long end of most bond markets. In the UK, rising yields were further amplified by mounting concerns over the inflationary impact of the new government’s budget.

UK and US Ten-Year Government Bond Yields

Source: Bloomberg Finance L.P.

For the full year, fixed income delivered lacklustre performance, even with central banks implementing rate cuts in the second half of the year.

Source: Bloomberg

Despite a steady decline in inflation throughout the year, the two main alternatives to fiat currencies – gold and bitcoin – performed exceptionally well. These gains suggest that markets remain sceptical about the central banks’ confidence in defeating inflation. Bitcoin, in particular, surged following Donald Trump’s election win. Optimism in the asset was driven by his support for cryptocurrencies and the appointment of a new, more crypto-friendly head of the Securities Exchange Commission, widely regarded as more progressive on crypto regulations compared to their predecessor.

Source: Bloomberg

We anticipate that several key themes that we highlighted in 2024 will remain prominent in the coming year. Namely, growth in defence spending, particularly in Europe, along with sustained increases in cyber defence spending. The financial sector, which had a strong 2024, is also likely to continue to prosper as yield curves normalise. Additionally, technology sector spending will stay strong, driven by the mega cap tech stocks in the US fuelling an arms race in the development of Artificial Intelligence.

There will be differences as well. We expect less alignment of central bank policy, as the final phases of the fight against inflation will hinge more on domestic factors rather than the pandemic driven-global supply shocks that produced the inflationary spikes of the past few years. Currently, the US Federal Reserve has adopted a more cautious stance on future rate cuts, while the European Central Bank has suggested they are more confident about meeting their inflation target. This divergence will result in larger interest rate differentials and increased foreign exchange rate volatility.

The divergence of US economic policy and that of other developed nations may deepen further. President-elect Trump has pledged significant regulatory rollbacks and tax cuts, positioning the US on a markedly different economic trajectory. In contrast, the UK has recently raised taxes, while political paralysis in France and upcoming elections in Germany do not suggest new economic dynamic there. Meanwhile, China has committed to providing significant new stimulus for their domestic economy, though the policy specifics need to be fleshed out.

President Trump’s leadership introduces a significant variable, as his decision-making style is volatile and the considerable execution risks tied to the implementation of his policies could create substantial uncertainty. The recent turmoil surrounding the passing of a continuing resolution to fund the US government for the next year is a good example of the near chaos he and his administration may bring.

Upon his inauguration he can immediately reduce the regulatory burden many sectors of the US economy face, more complex initiatives such as tax cuts and immigration changes will take much longer. Volatility from Trump’s policy making will be felt in the markets and we should expect greater volatility in asset prices during his tenure.

Look out for our 2025 Outlook which will be published shortly.

_______

Hear more from the Oakglen experts

Our investment team continue to provide interesting and informative content to help keep you in the loop on recent global news and market trends. See below for some key highlights from around the world which our Chief Investment Officer, Jeff Brummette, has recently covered:

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.