Since we have surpassed the midpoint of 2024, now is a good time to examine the key market trends, economic indicators and portfolio performance so far this year, highlighting the impact of global events and monetary policies. Our Chief Investment Officer Jeff Brummette provides a comprehensive summary and deeper analysis of how things have been going in our H1 2024 Investment Summary.

Equity markets closed the half-year with a mixed set of results in June. US equities rose on continued strength in AI (Artificial Intelligence) related big tech, while European markets weakened as the strong performance of right-leaning parties in the European Parliamentary elections unnerved investors. Japan performed well despite continued weakness in the yen, while China stumbled as property market woes continued to weigh on economic growth and sentiment.

Overall, all major indices are in the green year-to-date, with the technology-heavy NASDAQ leading the way. While technology stocks have continued to outperform, a very benign economic environment has contributed to strong investment returns across most major equity markets. Notably, whilst the Nikkei 225 Index posted a strong gain of over 18% for the first half of the year, the yen is down well over 10% YTD against the US dollar, hovering near 38-year lows.

Source: Bloomberg

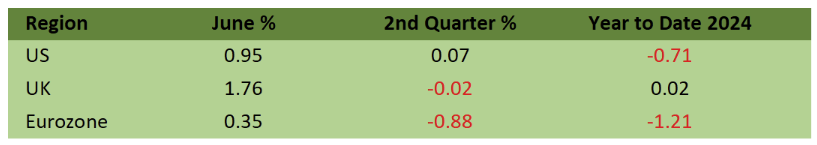

Inflation rates continued to decline toward the 2% target set by the major central banks. Meanwhile, economic growth continued to improve in Europe and the UK, and remained steady in the US. However, this pick-up in growth has been a headwind for fixed income markets, which had priced for significant central bank interest rate cuts throughout the year. As a result, fixed income has delivered mediocre performance so far this year.

Bloomberg Aggregates Total Returns Indices

Source: Bloomberg

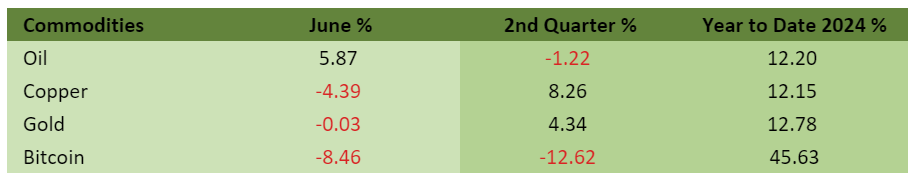

Commodity price movements have also garnered interest and concern for investors this year. Copper, gold, and oil have all risen due to fears of supply shortages and lingering inflation concerns. Owning commodities is often viewed as a hedge against inflation. Bitcoin, often viewed as digital gold, has had a particularly strong year despite struggling in the 2nd quarter.

Source: Bloomberg

There have been two main macro drivers of markets this year. The first is the ongoing fight against inflation by the Bank of England (BoE), the European Central Bank (ECB) and the US Federal Reserve Bank (Fed). Inflation has now fallen close to their 2% target. In the BoE’s case, while inflation has reached the central bank’s target it is expected to drift higher over the remainder of this year.

Inflation rates US, UK, and Eurozone

Source: Bloomberg Finance L.P.

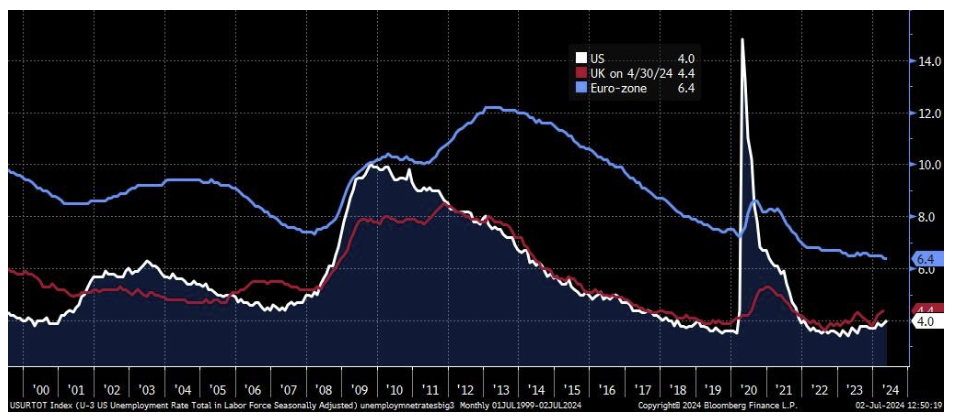

The decline in the rate of inflation has already prompted the ECB to lower rates by 25 basis points. Both the Fed and the BoE are likely to follow suit, though the timing remains uncertain. The improvement in inflation rates has given central banks the latitude to modestly reduce the tightness of monetary policy without, in their judgment, jeopardising the gains made. We believe they do not feel the need to keep policy too tight to squeeze out the last 50 or 100 basis points of inflation. Remarkably, they have managed to achieve a significant decline in inflation without harming labour markets. No central banker wants to cause unemployment to rise if it can be avoided.

Unemployment rate US, UK, and Eurozone

Source: Bloomberg Finance L.P.

These still extraordinarily tight labour markets may, in fact, be the reason inflation may never reach and stay at 2%. Healthy wage gains are keeping service price inflation running at rates that are inconsistent with achieving 2% target. Inflation in the range of 2-3%, coupled with central banks easing or planning to ease, is still a very favourable environment for risk assets. We do not believe central bank actions will stop this bull market.

____________

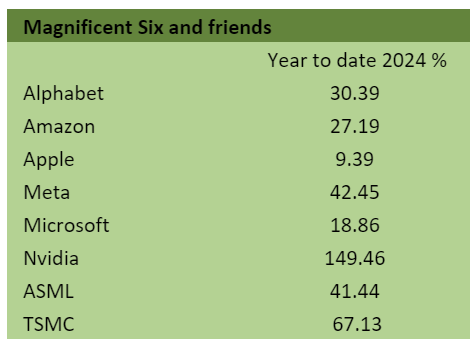

The second major macro driver this year has been the continued surge in stocks related to AI. Excitement over AI’s potential to dramatically change how we live and work, has driven the share prices of several tech companies significantly higher, adding billions (and in some cases, trillions) to their market capitalisation.

Source: Bloomberg

The Magnificent 6 (we now exclude Tesla, as they are down on the year) account for two–thirds of the gains in the S&P 500 so far this year.

Capital spending by the top five names in this table, aimed at expanding their AI capabilities, has notably propelled the earnings and share prices of Nvidia, ASML and TSMC.

The major tech firms need Nvidia’s GPUs (graphical processing units). ASML produces the equipment that TSMC (Taiwan Semiconductor) uses to manufacture the GPUs that Nvidia designs.

How many more GPUs do Apple, Alphabet, Meta and Microsoft need?

That is the trillion-dollar question. Market sentiment may be showing signs of concern, as Nvidia saw a sharp correction late in June.

Nvidia

Source: Bloomberg Finance L.P.

While we are not necessarily suggesting a sharp reversal in this performance, we do believe it will be hard to repeat over the next twelve months without even more spending by the usual suspects to boost AI capacity.

____________

The elections in the UK, France and the US may become a third macro factor as they have the potential to influence markets. What all three elections will highlight are significant fiscal problems that no politicians want to deal with.

In the UK, it will be interesting to observe how the new Labour government led by Sir Keir Starmer will fulfil their manifesto promises. They have assured that no tax hikes are planned, with commitments not to raise income tax rates, national insurance, or VAT. However, like any new administration, they will look to give something to their voters and you do that by spending money. The UK already faces a substantial budget deficit and a debt–to–GDP ratio nearing 100%. Finding additional revenue sources beyond borrowing could prove challenging (remember Liz Truss). It’s conceivable that at some point in their term the government will look to raise funds, potentially through measures such as raising capital gains tax on gains exceeding a certain threshold or taxing gains from the sale of your principal residence again over a threshold that only affects the “rich”. The potential abolition of the non-domicile rule appears consistent with this approach.

In France, the recent parliamentary election results have left the country facing political deadlock. The first round of voting had suggested that Marine Le Pen’s far-right National Rally were likely to win the most seats, albeit perhaps not enough for a majority. However, when the second round of results were announced on Sunday 7th July, it was the left-wing New Popular Front that emerged with the most seats, followed by President Emmanuel Macron’s centrist Ensemble alliance. Clearly, some tactical voting took place to push National Rally into third position.

France National Assembly Elections 2024

(Breakdown of Seats)

Source: French Interior Ministry / Le Monde

Both the far left and the far right advocate for increased spending and the abolition of many measures President Macron introduced to try and address France’s challenging fiscal position. Recently, the European Commission announced its intention to place France under an Excessive Deficit Procedure due to its failure to keep is budget deficit within 3% of GDP. Now, with a hung parliament, it is unlikely there will be sufficient support to pass the necessary budget cuts required for France to comply with EU rules.

In the US, the two most unpopular presidential candidates in history, who have presided over the largest peacetime deficits in US history, are both campaigning on promises to increase spending even further!

US Government Budget Deficits under Biden & Trump highest since FDR

(Average US government deficit as % of GDP under each President since 1900)

Source: BofA Global Investment Strategy, GFD Finaeon, Haver

BofA Global Research

The very weak performance of President Joe Biden at the recent first (and possibly only) Presidential debate, has led to calls from Democratic–leaning media for him to step down. Despite this, Biden has reiterated his determination to run and has received verbal support from various senior Democratic Party figures to stay in the race. At a New York fundraiser the following night, he stated,

“Folks, I would not be running again if I did not believe with all of my heart and soul that I can do this job.”

The Democratic National Convention is scheduled for August, and it seems unlikely Biden would step down before then. He has already secured enough delegates to clinch the Democrat’s nomination for President, and while it’s unprecedented for delegates to change their minds at the convention in Chicago, it is not impossible. However, any potential candidate would face challenges in garnering support and momentum at this stage.

Who might an alternative Democratic Party nomination be? And could they defeat Trump?

Governors Gavin Newsom of California and Gretchen Whitmer of Michigan have been suggested, as well as Vice President Kamala Harris. Whether one of them could win would depend on their ability to gain the votes of the undecided voters.

About a quarter of the voting public are unaffiliated with either major party and are now referred to by the media as “double haters”. These voters dislike both candidates, and post-debate polling indicates they were not impressed by Biden’s performance. However, they were also not swayed by Trump’s more vigorous manner, where he forcefully presented his standard pack of inaccuracies and fabrications.

At this juncture, the race leans slightly towards former President Donald Trump, though it remains too close to call. In response to Trump’s potential re-election, the US bond market has shown some signs of unease, with longer–term yields higher edging higher since the debate. Traders fear a larger fiscal deficit under Trump, especially given his pledge to extend the 2017 tax cuts, which are due to expire in 2025.

____________

Looking at all this from a high level, we have a world where economic growth is still positive, inflation has significantly moderated, and central banks are either easing monetary policy or preparing to do so, with no plans for any tightening of policy in sight. Fiscal policies across various governments are expansionary, with no significant efforts to curtail spending. This backdrop continues to support a favourable environment for risk assets.

Equity markets have had a nice rally year-to-date, posting performance that many of us would accept as a nice return for a full year. Indeed, it is conceivable that we may see some sideways movement or even a modest correction as we digest elections results in Europe and anticipate the upcoming election in the US.

We continue to hold a very diversified and balanced portfolio that we feel will withstand whatever election outcomes and central bank movements we experience.

____________

Hear more from the Oakglen experts

Our investment team continue to provide topical and informative content for you to digest. Our Chief Investment Officer, Jeff Brummette, provided an update on central banks and market responses to any changes, whilst our Managing Director – UK, Dominic Tayler, gave a round up of the stages leading up to the UK General Election.

Read more:

- Summer is here – time for suncream, BBQs, and central bank rate cuts?

- UK General Election: Part 1 – The Dissolution of Parliament

- UK General Election: Part 2 – Polling Day Approaches

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

____________

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.