As we enter the second half of 2024, it is important for us as a business to continue to reflect upon our investment performance and the ongoing strategic decision-making process of our team. In this article, Oakglen Wealth Investment Manager, Myles Renouf, reflects on H1 2024 performance of our discretionary investment management service.

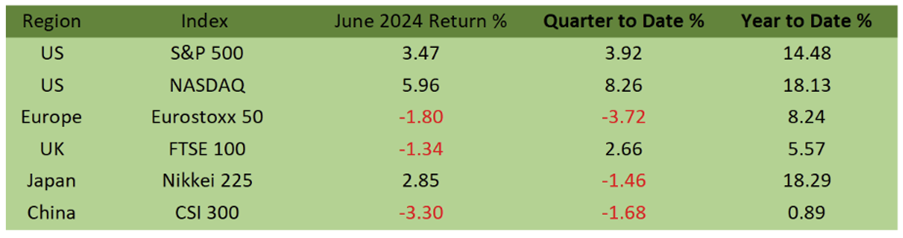

Equity markets ended the first half of the year with a mixed set of results in June. US equities rose on continued strength in AI (Artificial Intelligence) related big tech, while European markets weakened as the strong performance of right-leaning parties in the European Parliamentary elections unnerved investors. Japan performed well despite continued weakness in the yen, while China stumbled as property market woes continued to weigh on economic growth and sentiment.

Overall, all major indices are positive for the year so far, with the technology-focused NASDAQ leading the way. While technology stocks have continued to outperform, a very benign economic environment has contributed to strong investment returns across most major equity markets. Notably, whilst the Nikkei 225 Index posted a strong gain of over 18% for the first half of the year, the yen is down well over 10% YTD against the US dollar, hovering near 38-year lows.

Source: Bloomberg

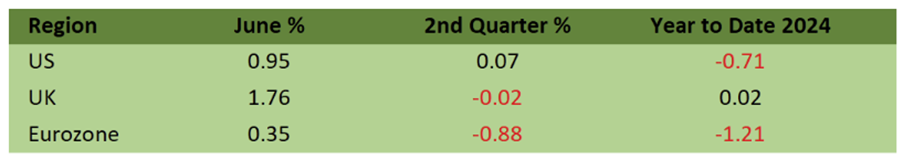

Inflation rates continued to move closer to the 2% target set by the major central banks. Meanwhile, economic growth continued to improve in Europe and the UK and remained steady in the US. However, this acceleration in growth has posed challenges for fixed income markets, which had priced for significant central bank interest rate cuts throughout the year. Consequently, fixed income has delivered mediocre performance so far this year.

Bloomberg Aggregates Total Returns Indices

Source: Bloomberg

Regarding the performance of our discretionary strategies, our Diversify strategy, tailored for medium risk investors, delivered a +4.6% return for the first half of 2024. This compares favourably to the +4.0% return achieved by the ARC Sterling Balanced Asset PCI peer group. Additionally, the longer-term track record remains compelling, with a total return since inception (31.12.19) of +26.6%, comfortably ahead of the ARC Sterling Balanced Asset PCI, which returned +12.2% over the same period.

Similarly, our Grow strategy, designed for high-risk investors, returned +7.6%, outperforming the ARC Sterling Equity Risk PCI peer group, which posted a +6.6% return over the same period. Since inception the strategy continues to outperform meaningfully versus the ARC Sterling Equity Risk PCI, with a return of +44.3% versus +21.59% respectively.

As we move into the second half of 2024, we maintain a positive outlook for risk assets. We are operating in an environment where economic growth is still positive, inflation has significantly moderated, and central banks are either easing monetary policy or preparing to do so, with no plans for any tightening of policy in sight. Fiscal policies across various governments are expansionary, with no significant efforts to curtail spending.

Equity markets have experienced a strong rally so far this year, delivering returns that many would consider satisfactory for an entire year. Given this performance, it’s conceivable that we may see some sideways movement or even a modest correction as we digest elections results in Europe and anticipate the upcoming election in the US.

In terms of current portfolio positioning, we maintain a high-quality bias within our equity and fixed income exposures. More specifically, our equity exposure has a focus towards companies that have strong balance sheets and pricing power with attractive growth potential. Within our fixed income selection, we continue to hold a mixture of government bonds as well as corporates with a preference of investment grade exposure, particularly given the level at which credit spreads are.

To find out more about our discretionary investment management services, please contact the below:

Jersey

| Jersey@oakglenwealth.com | |

| Tel | +44 (0) 1534 789 942 |

UK

| UK@oakglenwealth.com | |

| Tel | +44 (0) 20 4583 1118 |

Capital may be at risk.