France has recently passed a critical piece of legislation aimed at stabilising its national budget and averting a repeat of the parliamentary deadlock that threatened its governance. This special law, while seen as a necessary measure to prevent financial turmoil, serves as a temporary stopgap rather than a long-term solution. Our Chief Investment Officer, Jeff Brummette, analyses the implications of such a fiscal manoeuvre for global markets since our last update. (To recap on this news, please click here to read our last article).

France continues to face significant fiscal and political challenges, as their government seeks to address a budget deficit projected at around 6.2% of GDP, twice as much as the limit set out by the European Union. Government plans to reduce these levels to 5% in 2025 through a proposed budget adjustment of €60 billion are on the agenda. This outlook has been further complicated by political turbulence, marked by the collapse of the government under Michel Barnier, and the recent appointment of centrist François Bayrou as his successor.

Barnier’s appointment as Prime Minister in early September followed a disastrous General Election for President Emmanuel Macron, which forced Macron to rely on alliances with smaller parties. In the absence of a stable parliamentary majority, coupled with fierce opposition to his appointment from both the far-left and far-right of the political spectrum, Barnier faced a precarious situation from the outset. His use of Article 49.3 of the French Constitution to force through the 2025 budget, without a parliamentary vote, culminated in a vote of no-confidence and the subsequent collapse of the government.

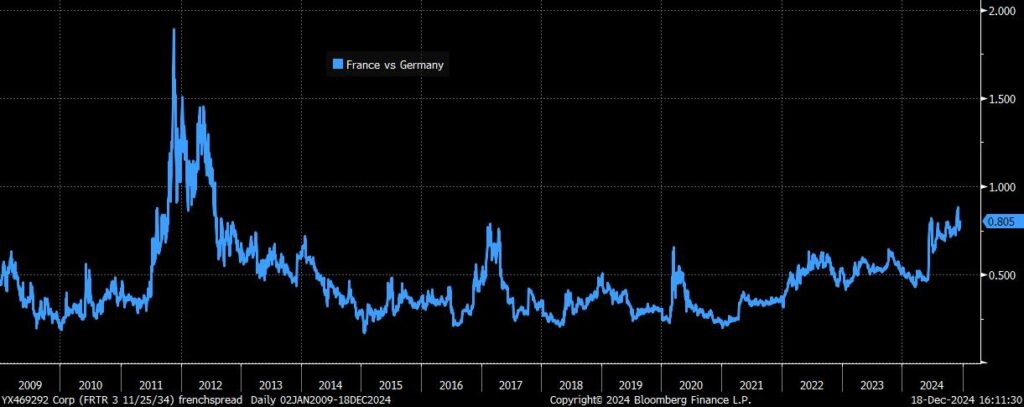

Since Bayrou has taken over, parliament has already approved the special law and provisional budget, to maintain essential state functions. However, with a divided assembly, passing the full budget remains unlikely before 2025. Any new election cannot be called until July 2025 either. Markets are responding to this instability – yields on 10-year French bonds have risen to 3.04%, while the spread between French and German bonds has widened to its highest level in over a decade, since the Eurozone crisis. Moody’s just recently downgraded their credit rating for France to Aa3 and predicts France’s debt to GDP ratio will rise to 120% in 2027. The euro dollar exchange rate has also slipped below $1.05 as the political woes in France and now Germany weighs on the currency.

At the time of writing, the CAC 40 up +1% year-to-date (inc. dividends) significantly underperforming its developed market peers. Without political stability and a clear roadmap to fiscal sustainability, this underperformance is likely to persist into 2025. That said, if Prime Minister Bayrou can provide the market with clarity and stability, we would expect a rebound in French equities.

Yield spread 10-Year France vs Germany

Source: Bloomberg Finance L.P.

_______

Hear more from the Oakglen experts

Our investment team continue to provide interesting and informative content to help keep you in the loop on recent global news and market trends. See below for some key highlights from around the world which our Chief Investment Officer, Jeff Brummette, has recently covered, as well as our investment summary for December 2024:

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.