With Valentine’s Day on the horizon, investors may be feeling either a deep affection or growing frustration with the markets. January set the tone for the year, revealing key trends that will shape investment decisions in the months ahead. Inflation data, central bank policies, and geopolitical events all played their part, influencing risk sentiment and sector performance. Just as in any strong relationship, successful investing requires patience, strategy, and a clear vision for the future. Our Chief Investment Officer, Jeff Brummette, reflects on the month of January and how we are positioned for the coming months as we move further ahead in Q1.

_______

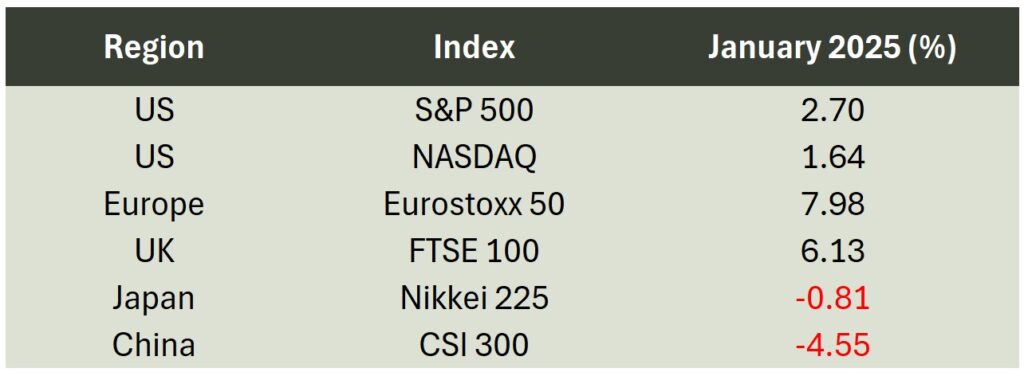

Enthusiasm over Donald Trump’s U.S. Presidential Election victory, coupled with optimism for the continuation of strong U.S. economic growth carried into January. The month provided a fruitful one for most major equity markets.

Source: Bloomberg

U.S. equity markets had been even higher earlier in the month but faded as the release of a Chinese created AI app DeepSeek, sent shockwaves through the tech sector. In contrast, it is harder to explain the impressive performance of European and UK markets. It may be as simple as they had become so cheap relative to the U.S. that some catch up was due. Excitement over prospects for world growth helped energy and commodity prices, boosting the shares of miners and oil companies listed in the UK. Meanwhile, the Japanese equity market has been moving sideways for months, with ongoing political struggles offering little incentive for the market to rally. China was the only major market where concerns over tariffs and a potential trade war with the U.S. seemed to matter, as the market fell over 4.5% for the month. A lack of new stimulus initiatives also disappointed investors.

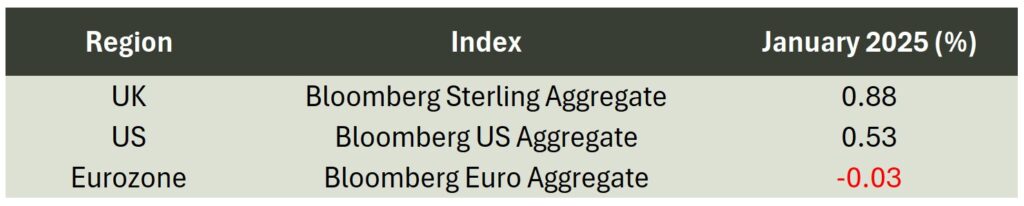

Fixed income markets also stabilised in the latter half of the month as the fears about fiscal deficits and inflation abated.

Source: Bloomberg

UK and US Ten-Year Government Bond Yields

Source: Bloomberg Finance L.P.

This decline in yields may have been the biggest contributor to the enthusiasm for stocks.

Towards the end of the month, two developments took centre stage and are poised to influence the market for some time. The first was the emergence of the Chinese AI app DeepSeek, whose creators claimed spent a fraction of what Open AI spends on creating and training a large language AI model, and they did it without access to Nvidia’s latest and greatest GPUs. This revelation challenges the AI investment theme and questions the wisdom of the huge capital spending by the mega cap tech names in the U.S. The market response was sharp and quick – Nvidia fell by 17% on the day the news broke, resulting in the largest daily loss ($589 bn) for a single stock in history.

Wealth Destruction: Market Cap ($ Billions)

In one day, Nvidia’s value dropped by more than Oracle’s entire market cap

Source: Bloomberg

The second major development was the inauguration of Donald Trump for a second term as U.S. President and his immediate plans to place tariffs on the exports of China, Canada, and Mexico (Click here for our recent article on these developments).

Negotiations with Canada and Mexico this week have resulted in a delay of one month for the implementation of the proposed 25% tariffs on their exports to the U.S. In response, China has countered with retaliatory tariffs on U.S. exports and investigations into some U.S. firms operating in China. None of this is helpful to markets and is producing greater volatility in foreign exchange and equity markets.

It is far too early to come to firm conclusions on what this means for inflation and growth, or how central banks will react. The U.S. Federal Reserve kept rates on hold last week, suggesting no urgency to adjust policy anytime soon, while the European Central Bank lowered rates by another 25 basis points and hinted at future cuts. It is anticipated that the Bank of England will soon follow suit. We are comfortable in the belief that if economic growth were to stumble due to a global trade war, central banks are likely to respond with aggressive interest rate cuts.

We maintain the best strategy is to hold a high quality, diversified portfolio and to refrain from overreacting to “news” in our now much noisier investment environment.

_______

Hear more from the Oakglen experts

Our investment team continue to provide interesting and informative content to help keep you in the loop on recent global news and market trends. See below for some key highlights from around the world which our Chief Investment Officer, Jeff Brummette, has recently covered:

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.