As geopolitical tensions continue to shape global security landscapes, investors are increasingly turning their attention to European defence stocks. With Europe’s strategic importance on the rise and nations prioritising defence spending, the market for European defensive companies presents unique opportunities for growth and stability.

In this article, we explore the dynamics driving the European defence industry, key players in the sector, and factors influencing investment decisions in this critical market segment.

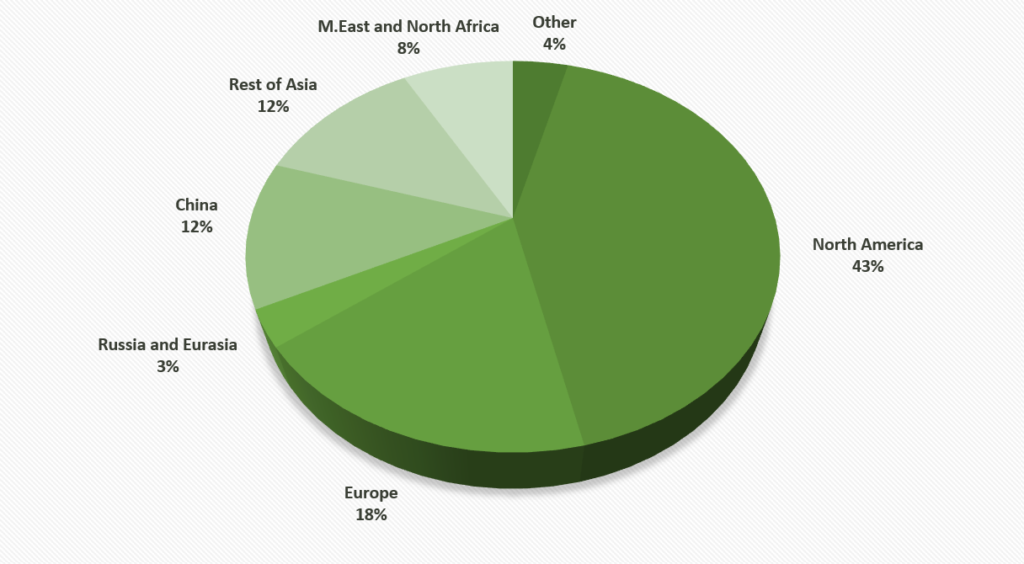

Over the last few decades, Western governmental expenditure on defence has been in noticeable decline. The USA has been the standout contributor to defence spending and continues to dominate the market, but this dominance will certainly be eroded over the next few years as European, Asian, and Middle Eastern countries increase their expenditure to meet the heightened threat of geopolitical unrest.

Share of Global Defence Spending by Region, 2022

Source: J.P.Morgan

With the war in Ukraine entering its third year, and a noticeable deterioration in relations between NATO and its usual protagonists (China, North Korea, Iran and Venezuela), defence budgets have become a major focal point, especially for the European members of NATO.

The UK Defence Minister, Ben Wallace MP highlighted this in his speech to a UK think tank, “The era of the peace dividend is over. In five years’ time we could be looking at multiple theatres involving Russia, China, Iran and North Korea. Ask yourselves – looking at today’s conflicts across the world – is it more likely that the number grows, or reduces? I suspect we all know the answer – it’s likely to grow. So, 2024 must mark an inflexion point.”

This sentiment was echoed by German Chancellor Olaf Scholz, who confirmed in February that “We have to move away from manufacturing towards large-scale production of defence equipment.” He also highlighted the need for European NATO members to increase their support for the Ukraine and move defence spending to the NATO agreed level of 2% of GDP.

Consequently, several defence companies have forecasted increased order books for 2024 and beyond. For instance, German-listed Rheinmetall AG’s management anticipates a substantial increase in its book-to-bill ratio, ranging between 3x to 4x (€28bn-€36bn) in 2024. This surge marks a significant departure from the European defence company average of 1.1x observed between 2006 and 2022.

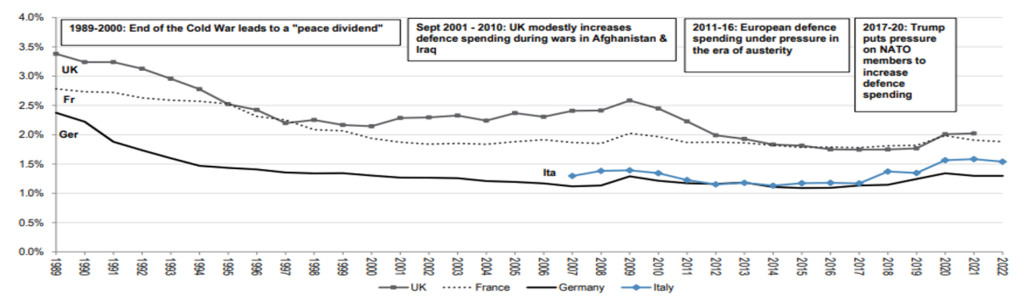

The key issue is that all NATO members, with the exception of the USA, have been spending below the NATO agreed level of 2% of GDP for a protracted period of time.

Major European Nations –

Defence Budgets as a % of GDP since 1989

Source(s): The Military Balance; Government Documents; IMF; J.P.Morgan Research estimates

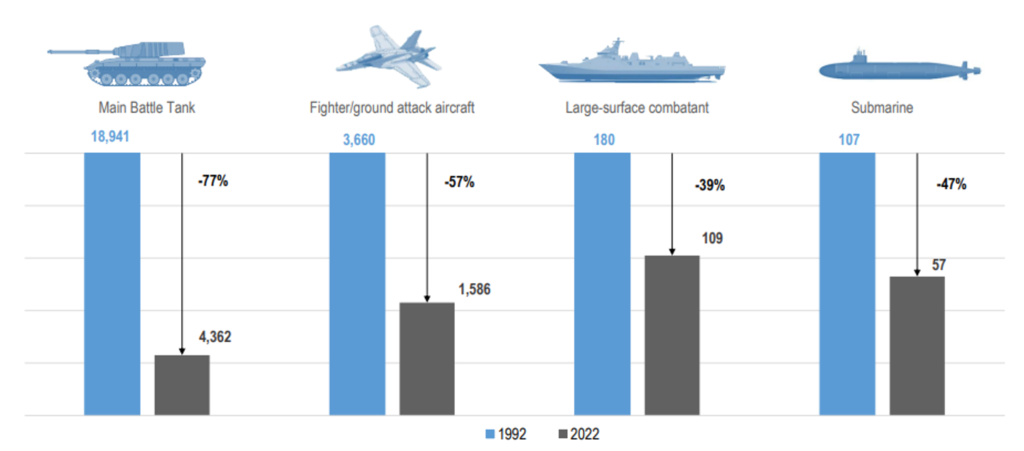

As a result, there has been a notable reduction in the size of the armed forces in terms of both manpower and equipment. While advancements in technology and automation have partially compensated for this shortfall as weapon systems have become more advanced and varied in terms of their functionality and able to operate with less human intervention, the reality remains: all European NATO members are ill-prepared for the current geopolitical environment and the heightened threat of military conflict.

Inventory of European Defence Equipment

Source: McKinsey (December 2022), 1992/2022 Military Balance

Note: Countries include France, Germany, Italy, Netherlands, Norway, Poland, Spain and Turkey. Fighter / ground attack aircraft include fighter jets and bombers. Large-surface combatant includes cruisers, destroyers and frigates.

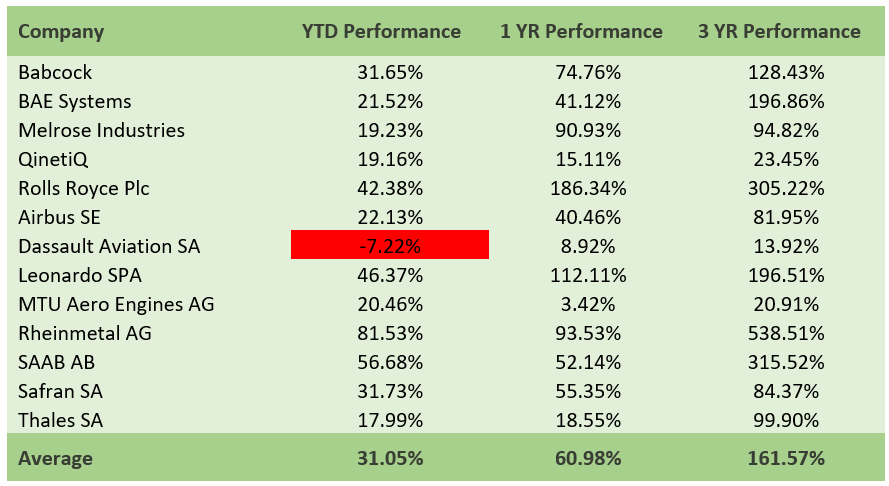

Listed European aerospace and defence names have reacted strongly to the expectation that defence spending in Europe will increase significantly over the medium term. The ongoing conflict in Ukraine and the prospect of tensions increasing in the South China Sea have been the major catalysts for the share price revaluation.

Source: Bloomberg

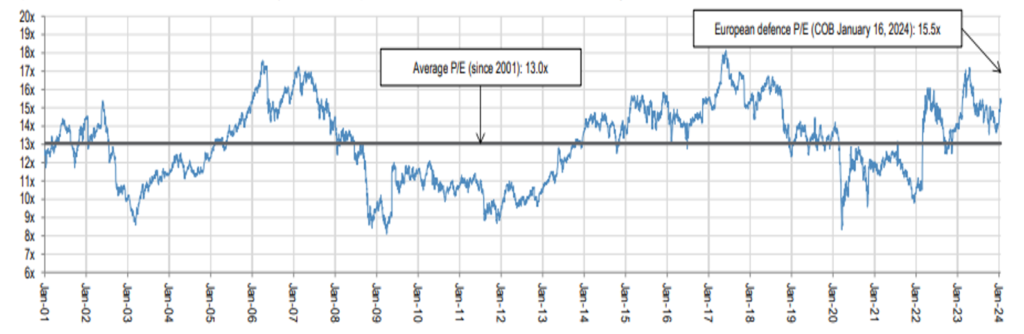

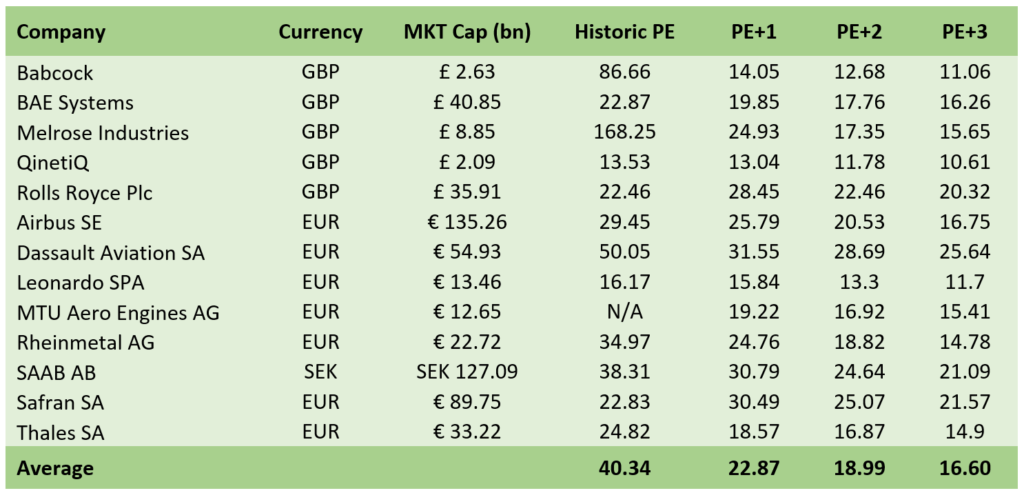

According to J.P.Morgan, the average 12 month forward Price / Earnings multiple of the European defence sector was 13x between 2001 and 2024. Currently, the collective basket of European defence stocks is trading at 22x 2024e, 19x 2025e and 16x 2026e Bloomberg consensus. These figures appear to be at the upper end of the trading range and only starting to look reasonably valued by 2026. Of course, any further announcements of increased defence spending in Europe and Asia would bolster current valuations and potentially drive these higher.

European Defence 12-Month Forward P/E since 2001 (IBES Consensus)

European Defence de-rated in 2020-2021 as ESG investment styles became more prevalent. Events in Russia-Ukraine in 2022 led to a re-rating of the sector.

Source: J.P.Morgan (COB January 16, 2024)

Note: The chart includes BAE, Thales, BAB, DA, SAAB, RHM, Cobham (until July 25, 2019 when the Advent bid was first announced), Ultra (until July 23, 2021 when the Advent was first announced); Leonard (since Jan 2003), QinetiQ (since Apr 2006), HAG (since Nov 2020)

Source: Bloomberg

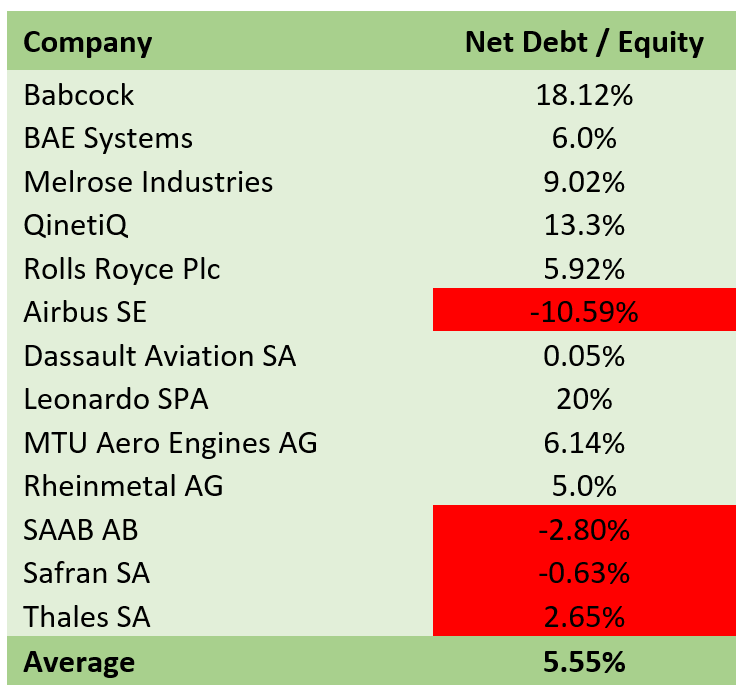

The European defence sector boasts robust balance sheets, with several companies holding significant net cash positions. The anticipated rise in defence spending should allow these companies to continue to strengthen their balance sheets or look to allocate excess capital to shareholders, through share buybacks and dividend increases. Additionally, there is the potential for strategic M&A, such as the recent purchase of Ball Aerospace by BAE Systems.

Source: Bloomberg

In summary, the European defence sector is enjoying a period of strong growth which arguably it has not seen since the collapse of the USSR and the end of the Cold War. The strength of their balance sheets should enable most of these companies to grow organically as well as through M&A. Moreover, they will be able to return excess capital to shareholders through increased dividends and share buybacks. At the current multiples the vast majority look to be pricing in the bullish sentiment, any temporary short-term weakness in the share price it could present attractive opportunities for investors seeking entry points.

Discover more engaging insights from our experienced team of investment professionals via our News & Insights page. Leading the way is our Chief Investment Officer Jeff Brummette, who has recently provided some commentary on the strong market performance of the first quarter of 2024 and a concise update on central banks.

Q1 2024 Investment Summary — Read here

Central Bank Update: March 2024 – Summertime rate cuts — Read here

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client? Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.