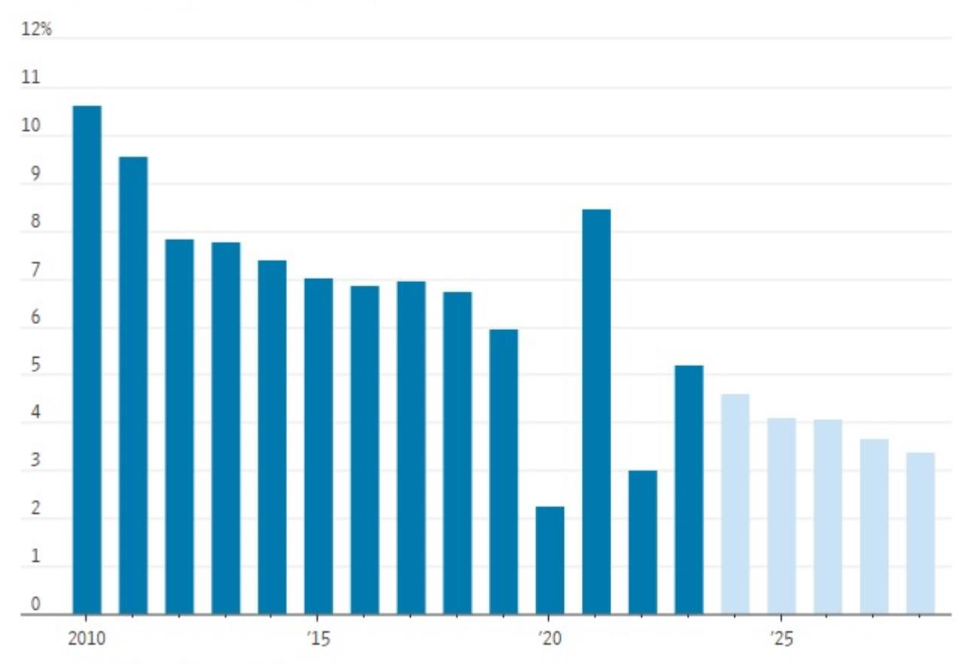

China has recently unveiled plans to conduct auctions for the first tranches of special central government bonds, with the sale process expected to begin this Friday. The proceeds will be used to fund projects in an attempt to stimulate the economy. This initiative stems from the government’s proposal, initially introduced during the National People’s Congress in March, to issue RMB 1 trillion ($138 billion) worth of bonds. It is anticipated that these bonds will have maturities ranging from 30 to 50 years, taking advantage of the current low level interest rate environment present in China. With growth and inflation experiencing a gradual slowdown, yields in China have been on a consistent decline.

Gross domestic product, change from a year earlier

Note: 2024 through 2028 are forecasts.

Source: International Monetary Fund

It is not clear how the funds will be used. Liu Sushe, deputy head of the National Development and Reform Commission (NDRC), emphasised the significance of the bond sale in supporting crucial projects:

“The bond sale is a critical part of the concerted efforts to support significant, urgent and challenging projects that are essential for the modernisation of the economy,”

“These are all projects that have long been intended but not materialised and requiring a central level drive.”

While $138 billion in new government spending is helpful, even in an economy boasting an annual GDP (Gross Domestic Product) of $18 trillion, it’s unlikely to fully counteract the ongoing deceleration of Chinese growth. The People’s Bank of China (PBOC), the central bank, has hinted that they might buy the bonds in the secondary market to ensure market stability. This looks like quantitative easing.

The primary concern lies within the real estate sector, particularly residential housing. The Chinese housing market is unusual in that buyers pay the full purchase price upfront, aided by a mortgage, and then endure a wait of 1 to 2 years for the delivery of their property. Developers had been operating a version of a Ponzi scheme, using the payments from new homebuyers to finance the construction of properties for previous buyers. This system functioned well until home prices began to fall, leading to developers failing to fulfil their obligations of delivering homes. It is estimated that around 20 million homes, fully paid for by the public, haven’t been completed. Several large developers are insolvent and in bankruptcy proceedings. The public is furious and demanding answers from the government. Naturally, consumers are unwilling to buy any proposed new or unfinished properties. Consequently, construction activities are significantly curtailed, contributing to a slowdown in overall economic growth.

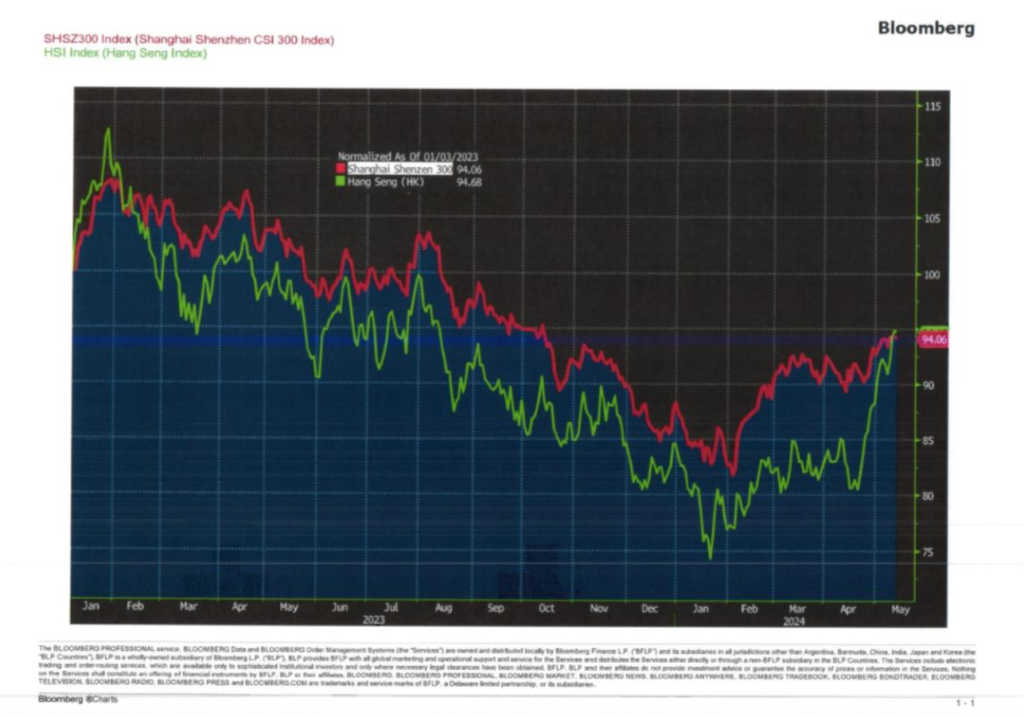

At the recent Politburo Meeting of the Chinese Communist Party in April, the severity of this problem may finally have been acknowledged. Discussions revolved around a potential plan to finance the completion of all pre-sold and unfinished homes, with funds potentially sourced directly from the Peoples Bank of China. The proposed scale of this would need to be as much as RMB 3 trillion, marking a momentous move. For the moment, this is only speculation but if it were to happen it is likely this would be announced at the upcoming third Plenum of the 20th Central Committee of the Chinese communist Party in July. Chinese equity markets may already be anticipating this, as they have seen a sharp recovery from last year’s significant decline.

Source: Bloomberg Charts via Bloomberg

Hear more from the Oakglen experts

Our investment team continue to provide topical and informative content for you to digest. Chief Investment Officer Jeff Brummette covers the recent Bank of England Monetary Policy Committee meeting, which decided interest rates would remain unchanged in the Central Bank Update and our Investment Director William Lamond covered the bid news for mining company Anglo American.

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.