Our Central Bank Update for Q3 | September 2023 is a concise summary of recent movements from some of the key central banks globally. Let’s dive in…

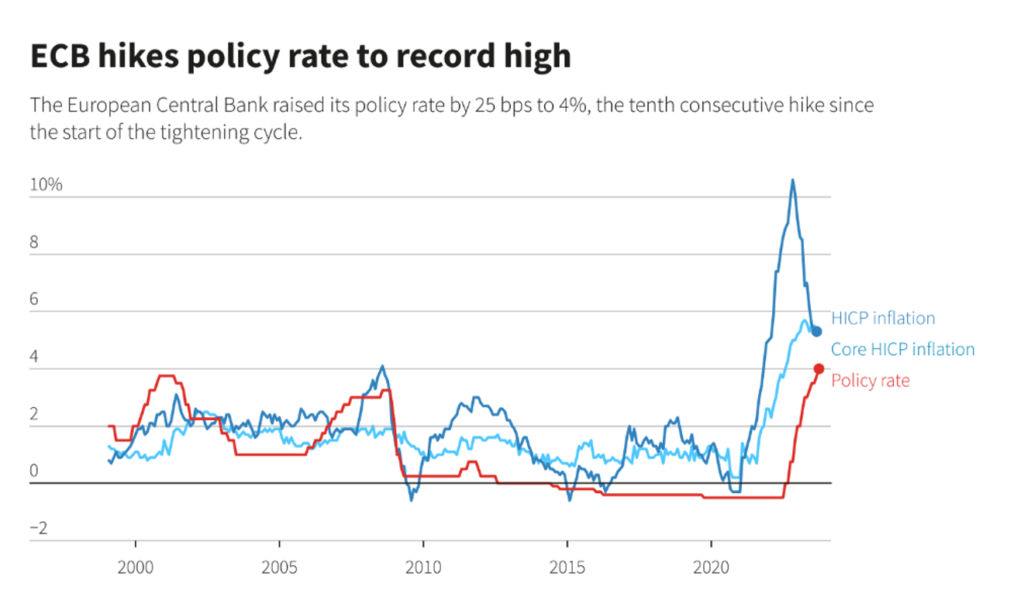

Once again, we find ourselves in the midst of a significant week with three important central bank monetary policy meetings. Yesterday, the European Central Bank (ECB) hiked their deposit rate another 25 basis points (bps), bringing it to 4%. Their rate hikes have now totalled 450 bps since they commenced their tightening measures back in July of 2022, a noteworthy shift from a low of negative 50 bps. Indeed, the ECB deposit rate now stands at its highest level since the Euro was established in 1999.

ECB President Christine Lagarde suggested that interest rates were now at levels “that maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our target.”

Source: Refinitiv Datastream | Reuters, September 14, 2023 | Vincent Flasseur

The ECB has revised its inflation projections for this year and 2024, and they are not dismissing the possibility of further hikes. This comes alongside a downward adjustment in their growth forecasts for the Eurozone over the same period. The ECB’s stance appears to be one of unwavering determination, signalling that any expectations of interest rate reductions in the near future should be set aside – tough love from the ECB.

Do the actions of the ECB provide any insights into the potential moves of the US Federal Reserve (Fed) and the Bank of England (BoE) in the upcoming week?

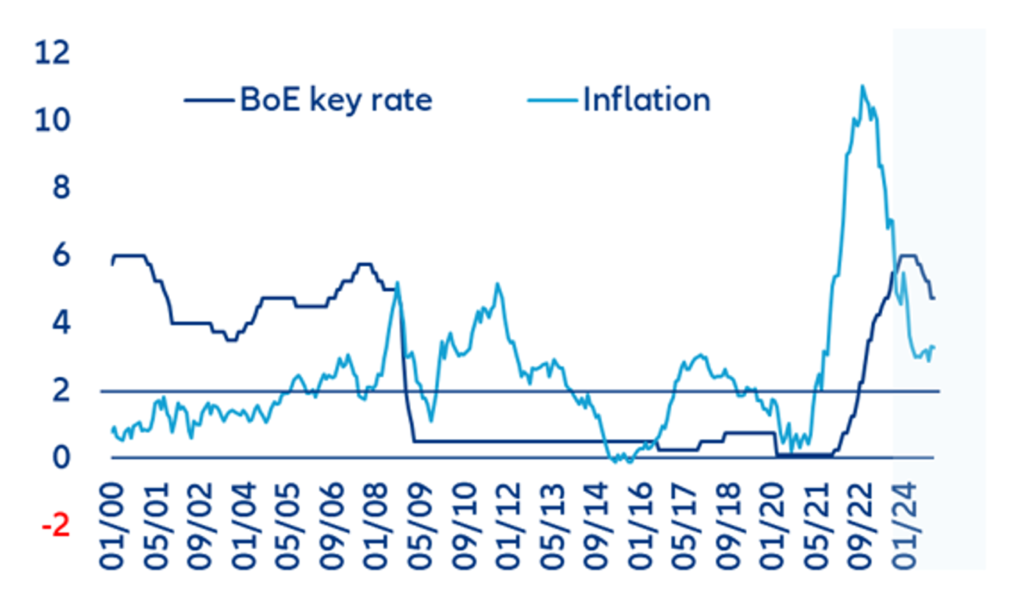

Both central banks find themselves in a similar position to the ECB. Although inflation has fallen considerably from the highs recorded in the summer of 2022, it still lingers well above their respective 2% targets.

The BoE began hiking in December 2021, while the Fed embarked on a similar path in March 2022. Both have raised rates over 500 bps, and their recent rhetoric has echoed the ECB’s, namely that rates will have to “remain sufficiently high for sufficiently long” (Huw Pill BoE, Chief Economist, 31 August) to get inflation down to their 2% target. Notably robust wage data suggest that the BoE might opt for another rate hike in the upcoming week.

Source: Allianz

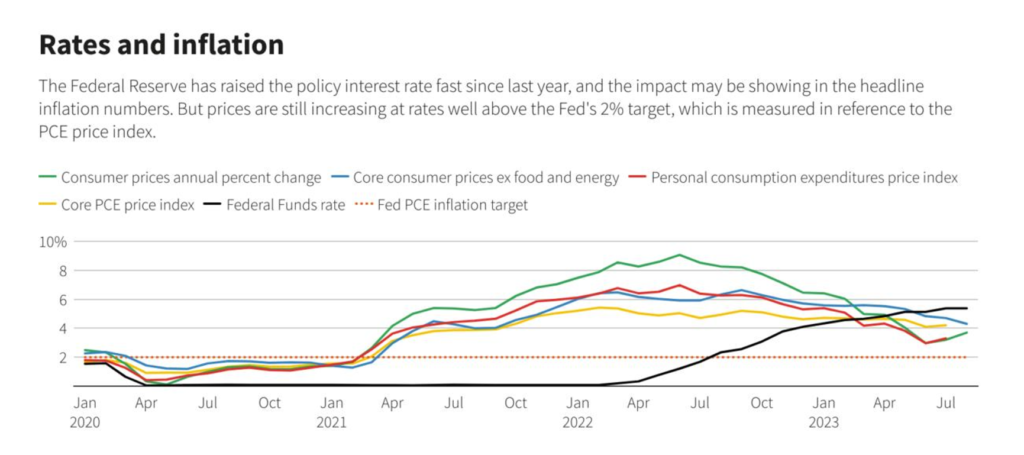

In the US, the August inflation data saw headline inflation rise to 3.7% from 3.2%, primarily driven by increases gasoline prices. Meanwhile, core inflation edged lower from 4.7% to 4.3%. The decision on whether the Fed will implement a rate hike is finely balanced.

Source: Federal Reserve, Bureau of Labour Statistics

Our expectation is that they will hold rates at their current levels, particularly in light of recent indications of a looser labour market. However, it is certain they will emphasise the importance of sustaining a restrictive monetary policy over an extended period of time to steer inflation back toward its target. In the current landscape, the central banks’ strategy entails committing to keeping rates elevated for a longer duration, even amid a deceleration in economic activity, essentially transforming the act of maintaining policy as a form of tightening. In this context, unchanged policy equivalent to a rate hike.

In conclusion, although we may be approaching the end of the current rate hiking cycle, we believe that the market’s pricing of rate cuts into 2024 is overly optimistic. Our perspective is that central banks will opt to maintain elevated interest rates (higher for longer) for an extended duration, which could create a demanding landscape for risk assets, particularly those currently trading at premium valuations.

What are your thoughts? Get in touch with us and share your opinions. You can also suggest a topic you would like to hear more about in the future from our investment team.

Read more from our Chief Investment Officer Jeff Brummette in the 2023 Mid-Year Outlook and September 2023 Investment Summary pieces. Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below.