Our Central Bank Update for Q1 | March 2024 is another concise roundup of news and analysis surrounding some of the key central banks globally. Let’s take a closer look at what has been happening since our last update in February.

In the past fortnight, we have witnessed four major central bank policy meetings (apologies to the Bank of Canada, the Reserve Bank of Australia, and the Swiss National Bank). The question remains:

Has inflation receded enough to allow the central banks to begin lowering interest rates?

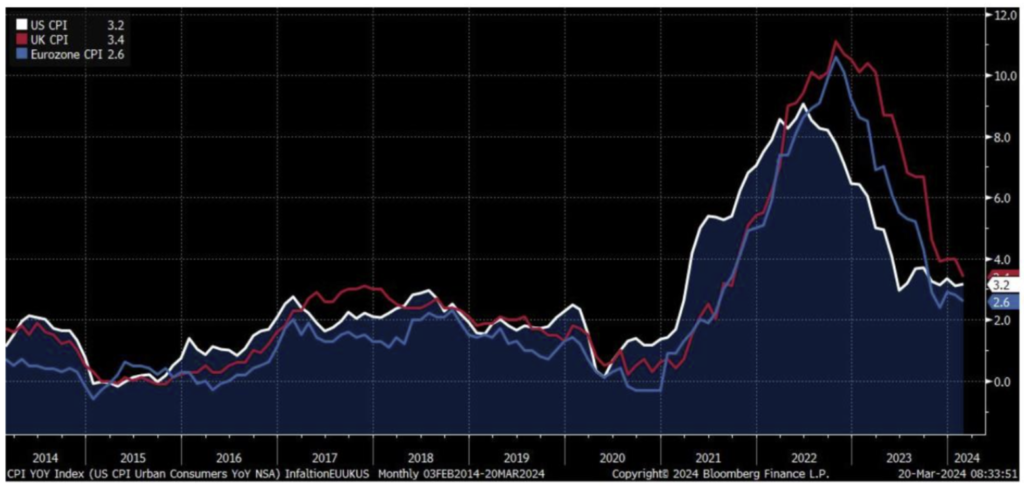

Inflation Approaching the 2% Target

Source: Bloomberg Finance L.P.

First up was the European Central Bank (ECB), who held their Governing Council monetary policy meeting on March 7. Opting to keep interest rates unchanged, the ECB stressed their determination to bring inflation back down to their 2% target. Additionally, they expressed confidence that their current policy was tight enough to return inflation to target, projecting inflation rates of 2.3% for this year, 2.0% for 2025, and 1.9% in 2026.

In a recent speech, ECB President Lagarde highlighted three domestic factors that would determine if inflation was going to stay on the right path, thereby allowing the ECB to begin contemplating interest rates reductions. These factors are wage growth, profit margins, and productivity growth. President Lagarde hinted that by June, the ECB would have sufficient information on all three of these variables, potentially allowing them to begin easing policy. However, President Lagarde emphasised that there was no guarantee of a steady path for rate cuts ahead and that policy changes would be largely data dependant.

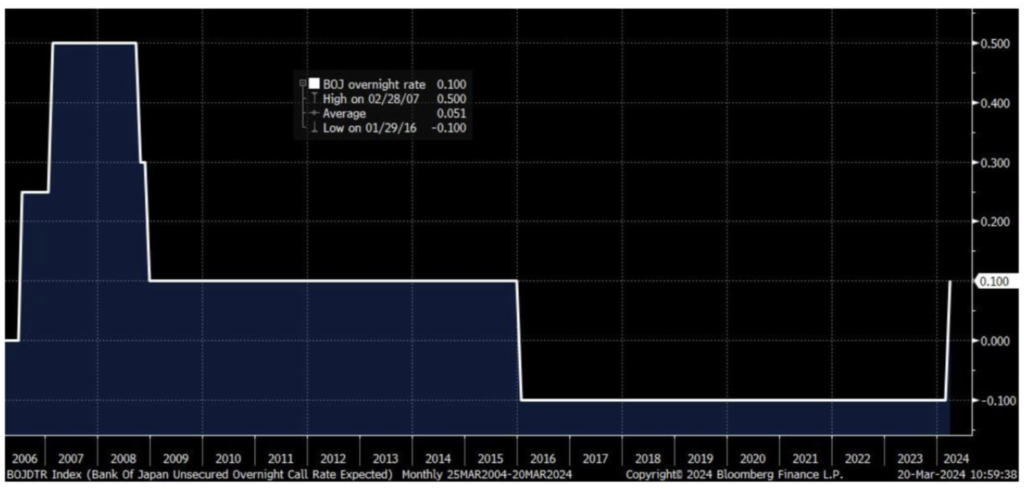

On March 19, the Bank of Japan (BoJ) made their long awaited (and well telegraphed) end to negative interest rates and yield curve control. This marked their first interest rate increase in 17 years. While they refrained from any predictions of further rate moves, they confirmed the halt of purchases of Japanese equity ETFs and real estate investment trusts (J-REITS). The market response was underwhelming, as the Yen weakened against most other developed market currencies. As we have previously highlighted, we believe that this policy change will ultimately prove significant for global financial markets.

First BOJ Rate Hike in Seventeen Years!

Source: Bloomberg Finance L.P.

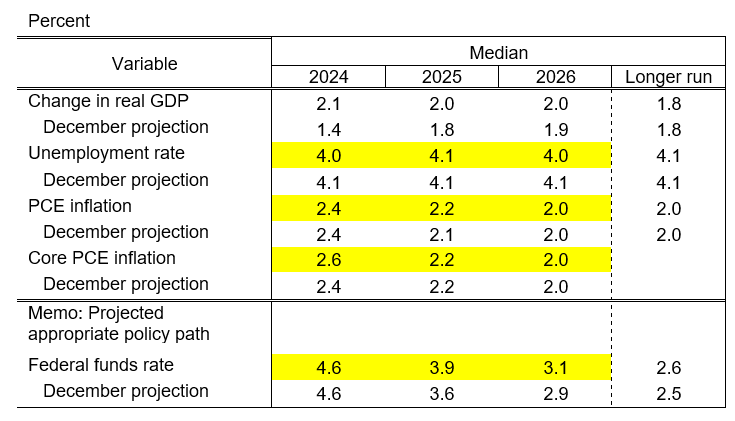

The US Federal Open Market Committee (FOMC) released their new rate forecasts yesterday.

Summary of Economic Projections, March 20, 2024

Source: Federal Reserve Board (click here)

Table 1. Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, under their individual assumptions of projected appropriate monetary policy, March 2024

They still expect nearly three 25 basis point rate cuts this year and two more next year. They foresee modest growth over the next few years than they forecast in December, accompanied by a slightly elevated Fed funds rate. At his press conference, Federal Reserve (Fed) Chair Jerome Powell reiterated his confidence that inflation would return to target. This stance remains compatible with a few interest rate cuts.

The Fed badly misjudged inflation in 2021, prompting an aggressive response in 2022/23 as they raised interest rates in an attempt to combat inflation. For reasons economists are still debating, inflation has declined significantly without a rise in unemployment or a recession, surprising everyone, including the Fed. Now with inflation around 3%, why risk a recession or prompt a significant increase in unemployment by keeping monetary policy too tight to squeeze the final 1% out of inflation?

The final quarter of 2023 witnessed a strong equity rally, driven by a steady decline in projections for the Fed funds rate in 2024. Strong economic data in the US led financial markets to reduce their interest rate cut expectations considerably, as equity markets continued to rise. Will this trend continue? We believe so.

Equities are rising not only due to anticipated rate cuts by central banks, but also due to improving economic data and the outlook for corporate earnings. Regardless of whether the central banks cut two times or four times, the impact may be negligible.

S&P 500 and December 2024 Fed Funds Futures

Source: Bloomberg Finance L.P.

Following yesterday’s Monetary Policy Committee (MPC) meeting, the Bank of England (BoE) opted to keep the current level of interest rates and reiterated the necessity of maintaining a restrictive policy to bring down inflation, currently at 3.4%, to target levels. Whilst none of the MPC members voted to raise rates, one member advocated for a rate cut in an 8-1 vote. Financial markets interpretated this as dovish, suggesting the next move by the BOE will be an interest rate cut. We would agree, and much like the Fed, the BoE does not want to create a recession to squeeze inflation down from 3% to 2%. In their minds, they have room to cut rates by 0.75% to 1.00% while still maintaining a restrictive stance of monetary policy.

In conclusion, we anticipate the BoE, ECB, and the Fed will declare victory over inflation and begin lowering their policy rates around the middle of the year. The extent of these adjustments will be driven by the scale of further declines in the inflation rate. Whilst this shift should be beneficial for risk assets, it does not guarantee continual upward price movements. Equity prices influenced by a multitude of factors, with central bank policy being one of these. Whether the base rate stands at 4% or 5% this will not be the key determinant of how the stock market performs.

Explore other interesting insights from the Oakglen investment team on our News & Insights page, such as our recent March 2024 Investment Summary or our recap summary of a recent private client event in Jeff’s Spring Update 2024. Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client? Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.