As we move further into 2025 and the first quarter continues to unfold, all eyes remain on central banks as they navigate a complex global economic landscape shaped by evolving monetary policy. Against a backdrop of persistent inflation, geopolitical tensions, and slowing growth in key markets, these developments are not just headlines at this stage – they carry significant implications for investors. In this update, our Chief Investment Officer, Jeff Brummette, examines the latest central bank meetings, their key decisions, and what they mean for our clients and partners.

Over the past two weeks, the four major central banks – the Bank of England (BoE), the European Central Bank (ECB), the Bank of Japan (BoJ) and the U.S. Federal Reserve (Fed) – held their first policy meetings of 2025.

The Fed opted to keep its policy on hold, the ECB and the BoE each cut by 25 basis points, and the BoJ hiked rates 25 basis points. All these moves were widely anticipated by markets and did not produce any big responses in asset prices. Since 2022, the BoE, ECB and Fed have broadly been following the same trajectory; raising rates once they acknowledged the high and rising inflation following the pandemic reopening was not transitory, and now gradually lowering them as inflation approaches their target levels.

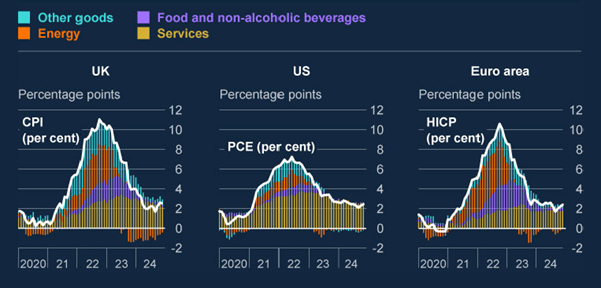

Headline inflation has moved slightly above central banks’ targets in the UK, US and euro area

Contributions to annual headline consumer price inflation in the UK, US and euro area

Sources: Eurostat, ONS, US Bureau of Economic Analysis and Bank calculations

We are beginning to see greater divergence in their policy approaches of these central banks. The ECB is confident that inflation will remain around their target and has signalled optimism about the potential for further rate cuts. In contrast, the Fed is less certain about reaching their target and is contending with significantly stronger economic growth than what is currently being experienced in the Eurozone. The differing outlooks are being reflected in forward rate curves.

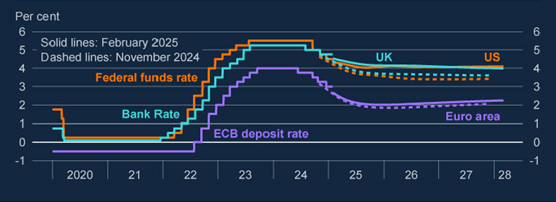

The market-implied advanced economy policy rates on which the February forecast was conditioned had risen since the November Report

Policy rates and instantaneous forward curves for the UK, US and euro area

Sources: Bloomberg Finance L.P. and Bank calculations

All data as of 28 January 2025. The November 2024 curves are estimated based on the 15 UK working days to 29 October 2024. The February 2025 curves are estimated using the 15 UK working days to 28 January 2025. The federal funds rate is the upper bound of the announced target range. The ECB deposit rate is based on the date from which changes in policy rates are effective. The final data points are forward rates for March 2028.

This policy divergence is also leading to larger moves in exchange rates with the euro underperforming versus the dollar and the pound.

EUR exchange rate vs USD and GBP

Source: Bloomberg Finance L.P.

This divergence may persist, but we are approaching a point where central bank policy moves will carry less weight in driving market dynamics. Whether they cut rates by another 50-75 basis points each, remain on hold, or adopt some combination of the two, these actions are unlikely to cause dramatic shifts in equity and bond markets. What is important is that there is extraordinarily little chance of the need for any rate hikes and there is ample room for significant rate cuts if global growth and labour markets were to show signs of weakening.

What is now starting to dominate market direction is the prospect of a global trade war. The U.S. has initiated a wave of tariffs on exports around the world, prompting retaliatory tariffs on U.S. goods and services from affected countries. Such a scenario would severely hamper world growth, ultimately prompting central banks to respond. However, the initial inflationary impacts from these tariffs could lead central banks to keep rates on hold at first. The challenge lies in the unpredictability of President Trump. The central banks have acknowledged this and are no better equipped than the markets to anticipate the President’s next moves.

The second focus of markets is the release of DeepSeek, the Chinese-developed AI app claimed to have been created at a fraction of the cost of OpenAI’s ChatGPT and other leading AI platforms, without relying on Nvidia’s most advanced chips. This announcement triggered the largest loss of market cap by a single stock in history, with Nvidia’s value falling by nearly $600 billion on January 27th.

Neither of these issues – tariffs or the evolving landscape of AI and AI-related spending – will be resolved quickly or with clear outcomes. However, these are the areas where market participants will need to direct their attention. While occasional central bank rate cuts may be welcomed, they are unlikely to serve as primary drivers of market movements in the current environment. Our investment team will continue to keep you updated on any further developments of note.

_______

Hear more from the Oakglen experts

Our investment team continue to provide interesting and informative content to help keep you in the loop on recent global news and market trends. See below for some key highlights from around the world which our Chief Investment Officer, Jeff Brummette, has recently covered:

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.