Our Central Bank Update for Q2 | May 2024 is another concise roundup of news and analysis surrounding some of the key central banks globally.

The Bank of England (BoE) just concluded their Monetary Policy Committee (MPC) meeting today (Thursday, 9 May 2024), opting to maintain the base rate at 5.25% — a 16-year high. The decision, supported by 7-2 vote, was for unchanged policy. In their own words:

_____

“We are holding interest rates steady at 5.25%.

This will help to make sure that inflation gets back to the 2% target and stays there.

The progress we are seeing in the key economic data is encouraging, but we are not yet at the point of cutting interest rates. We need to see more evidence that inflation will stay low before we can do it.”

Bank of England: Monetary Policy Report – May 2024

_____

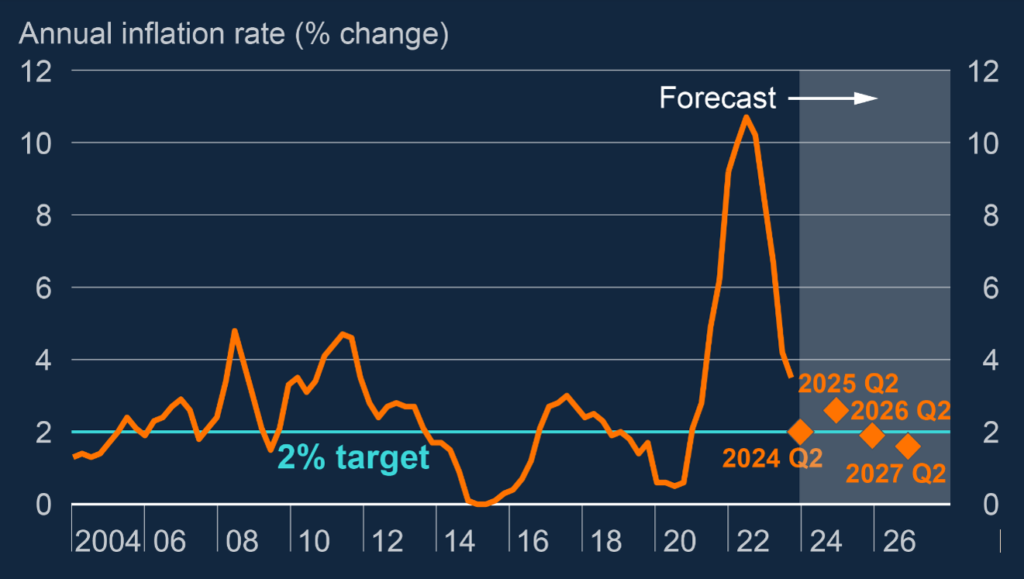

The BoE specifically highlighted concerns about services inflation, which remains elevated at 6%. Their latest forecast anticipates inflation falling to their 2% target later this year, followed by a subsequent rise again before an eventual return to target by 2026. They also referred to ongoing challenges with UK labour data that is making it more difficult to gauge labour market conditions accurately.

Additionally, they cited wage gains, also at 6%, as still being higher than they would like to see.

Source: Bank of England Monetary Policy Report – May 2024

The current economic outlook suggests there may be some room for rate cuts later this year, perhaps as soon as June, judging by moves in the swap market. Yesterday, swaps were pricing in the likelihood of a rate cut in June at around 46%, this has now increased to nearly 60%. If the BoE doesn’t cut in June, we would expect to see a rate cut at the following meeting on 1st August. However, any adjustments are likely to be modest, rather than signalling the beginning of a significant rate reduction cycle. The intention behind such adjustments would be to prevent monetary policy from becoming excessively restrictive.

At last week’s meeting of the Federal Reserve Bank, at the Federal Open Market Committee (FOMC), the Fed Chairman Jay Powell expressed views like those of the Bank of England. He emphasised that “in recent months, inflation has shown a lack of further progress toward our 2 percent objective, and we remain highly attentive to inflation risks.”

Although the FOMC opted to keep rates unchanged, they did notably reduce the pace of shrinkage of the Federal Reserve’s balance sheet by a significant $35 billion per month. In Chairman Powell’s opinion, there was no monetary policy significance to that reduction. Moreover, he did not hint at any imminent rate cuts in the near term.

Chairman Powell felt policy was restrictive enough at current levels to steer inflation back down to its 2% target. He outlined three possible policy directions:

1) If inflation resumes its decline towards the Federal Reserve’s 2% target, this could pave the way for easing measures, which would allow the Fed to ease.

2) Unexpected weakness in the labour market would make it appropriate to cut rates.

3) Inflation doesn’t fall significantly further, and the Federal Reserve would likely maintain rates at their current levels.

He avoided discussing the possibility (or need) for the Federal Reserve to hike rates further.

Both central banks are indicating that rate cuts are their likely next move. However, neither is displaying a sense of urgency, so the timing and number of cuts remains highly uncertain.

These central banks are unlikely to do anything to harm the equity markets, other than leave interest rates where they are. If economic conditions (growth) were to unexpectedly deteriorate, both the Bank of England and the US Federal Reserve have the capacity to swiftly lower interest rates and would not hesitate to do so. Currently, both institutions find themselves in a comfortable position. The next upcoming event to watch is the European Central Bank meeting on 6th of June.

Hear more from the Oakglen experts

Our investment team continue to provide topical and informative content for you to digest. You can discover more insights from Jeff Brummette in our recent May 2024 Investment Summary and reflect on Q1 earnings in the Fed, 1st Quarter Earnings, and the Equity Market piece.

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.