As we begin another summer month, the global economic landscape presents a complex array of opportunities and challenges for investors. From the persistent inflation concerns in major economies to the shifting dynamics in emerging markets, our Chief Investment Officer, Jeff Brummette, cuts through the noise and offers a comprehensive summary of the factors influencing investment strategies and recent market trends.

July was an extraordinary month, and not just because of the correction in the Magnificent Seven stocks. There was an assassination attempt on former President Trump, exposing significant incompetence on the part of the US Secret Service. Additionally, President Biden withdrew from the Presidential race, endorsing Vice President Kamala Harris as the presumptive Democratic nominee.

Three major central banks have held meetings since our last monthly update. The US Federal Reserve (Fed) left interest rates unchanged but hinted they were close to a cut. They will review two labour market reports and two measures of inflation data before their next meeting in September. If inflation falls modestly and the labour market appears a little softer, they are likely to cut rates at that meeting. The Bank of Japan hiked rates by 15 basis points, bringing them to 0.25%, and announced plans to reduce their purchases of Japanese Government bonds. On the 1st of August, the Bank of England (BoE) lowered rates by 25 basis points as inflation had fallen close to their 2% target. Looking ahead, they are concerned that inflation may drift back higher and made no promises on the pace or scale of further rate cuts.

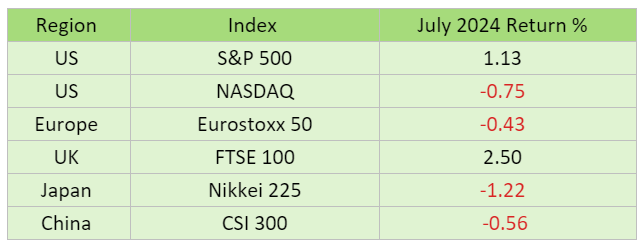

Equity markets were mixed, with Nasdaq negative and the S&P 500 modestly positive, after a rally on the final day of the month. Tech names were the major source of weakness. European markets were down slightly, while the FTSE 100 managed a small gain. Japan and China also declined. The Japanese yen strengthened by over 5% at one point versus the dollar and the pound during the month, which would have offset most of the losses if you held Japanese stocks unhedged. Fixed income markets were positive, benefiting from the European Central Bank (ECB) rate cut in June and the growing expectation of cuts by the Fed and the BoE, and additional cuts by the ECB.

Source: Bloomberg

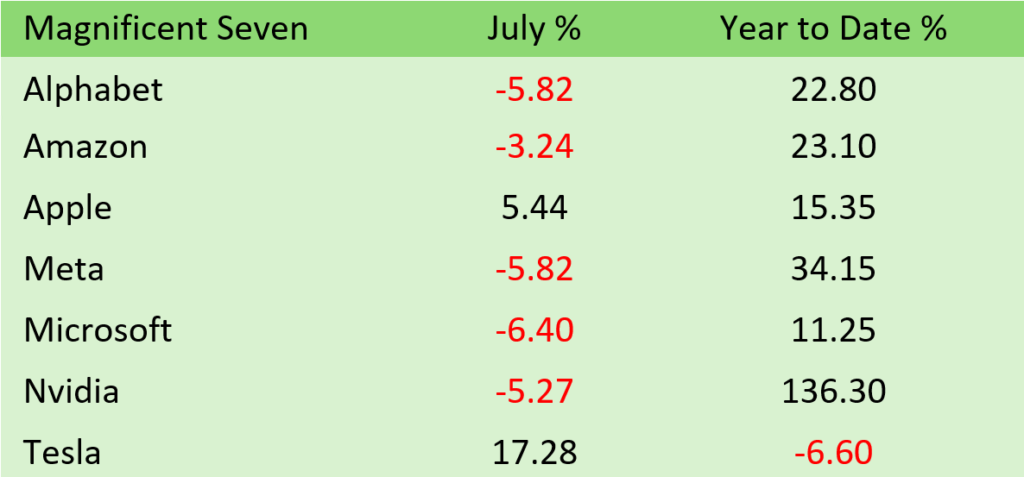

The Magnificent Seven had a volatile month.

Source: Bloomberg

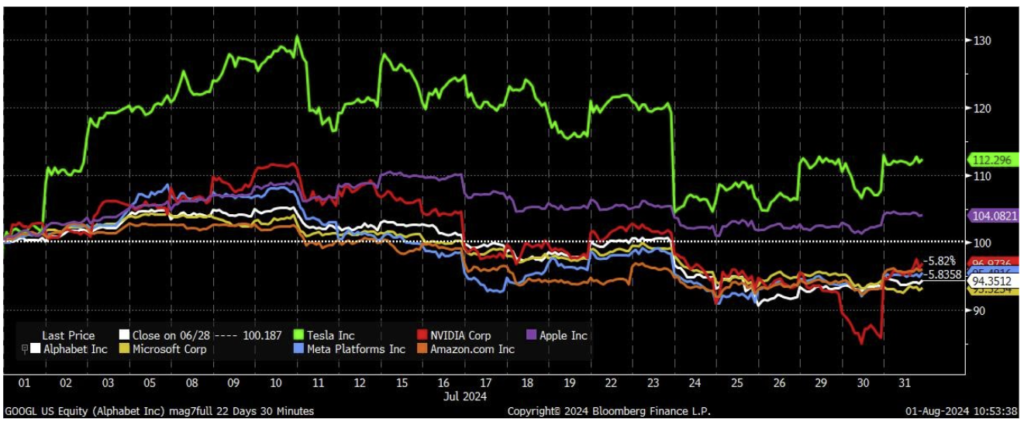

It is often hard to find a specific reason for a sharp market reversal. Selling can trigger more selling. Questions are mounting about when companies will see a return on all the billions of dollars they are spending to build out AI infrastructure. Former President Trump recently suggested that the US might not defend Tawain, and both Trump and President Biden hinted at the need for more restrictions on tech exports to China. This coincided with ASML’s earnings release, which revealed that a significant portion of their sales were in fact to China. ASML makes the specialised equipment that TSMC uses to make GPUs for Nvidia, leading to sharp declines in these stocks in July. However, this comes after substantial gains this year. This may simply be a correction; trees don’t grow to the sky is the old saying. What’s next? The earnings of the major tech firms will be closely scrutinised for evidence that they may be spending too much on AI, as seen with Alphabet’s recent earnings release.

Volatile Month for the Magnificent Seven

Source: Bloomberg Finance L.P.

Global economic growth remains robust. The US grew at a 2.8% annual rate in the second quarter of this year, while Europe saw a 1.0% increase. The UK’s first–quarter growth was revised higher, with further improvements in May. Inflation remains under control, allowing central banks flexibility to gradually reduce the restrictiveness of monetary policy, creating a favourable environment for risk assets. Should growth slow, central banks are prepared to implement more significant rate cuts faster if necessary. Conversely, if growth remains healthy and inflation stays contained, they will ease policy as well. This scenario should be supportive for both equity and bond markets, although we would not be surprised to see a short-term correction in equity markets given some of the YTD performance, especially from the large-cap technology stocks.

Non-economic factors could also introduce market volatility. The ongoing conflict in Gaza continues despite recent ceasefire negotiations. Additionally, Israel is suspected of having assassinated a high-ranking Hamas official who was visiting Iran and a Hezbollah leader in Beirut, Lebanon, prompting Iran to vow retaliation.

The general election in the UK produced a large victory for the Labour party, who campaigned on a promise of not to raise taxes on “working people”. However, they have since uncovered a “big hole” in the UK’s finances and admit that tax increases will be necessary, presumably to fund the 5.5% pay increases they plan to give public servants. The specific taxes to be increased will be revealed in the Chancellor’s Autumn budget taking place on Wednesday 30 October, but it seems probable that capital gains tax will be targeted.

The US Presidential election has undergone a major shift with President Biden stepping down from the race. Vice President Harris has been seemingly anointed as his successor and is set to be confirmed as the official candidate on August 7th through a virtual meeting of Democratic delegates. She will also announce her Vice President pick before then.

The race that former President Trump was clearly leading has now tightened into a dead heat, if the recent polls are to be believed. There may be an element of excitement over Kamala Harris’s newfound candidacy, but she clearly brings energy and enthusiasm back to the democratic side, although her economic plans are unclear. Trump’s economic proposals are inconsistent; he advocates for lower inflation, tariffs on imports, lower taxes and reduced interest rates. The crucial battleground will be the swing voters and which candidate can win them over. Trump’s choice of JD Vance as his Vice President does not seem to be aiding his cause. Harris’s selection will likely focus on appealing to independents and undecided voters. President Biden’s withdrawal from the race may also help Democratic candidates for the House and Senate, as they were suffering from the negative impact of his unpopularity.

The upcoming 100 days leading up to the election will be noisy.

Hear more from the Oakglen experts

Our investment team continue to provide topical and informative content for you to gain insights from. Our Investment Director, William Lamond, provided an interesting article focussed on Artificial Intelligence (AI) Stocks and our Chief Investment Officer, Jeff Brummette, has put together a timely update on the US election following news that President Joe Biden has bowed out of the race.

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.