Despite the wet “summer” weather we have been experiencing lately, markets have continued their resilience and been far more positive. As we move further into Q3, we take a closer look at how things are going in our August Investment Summary.

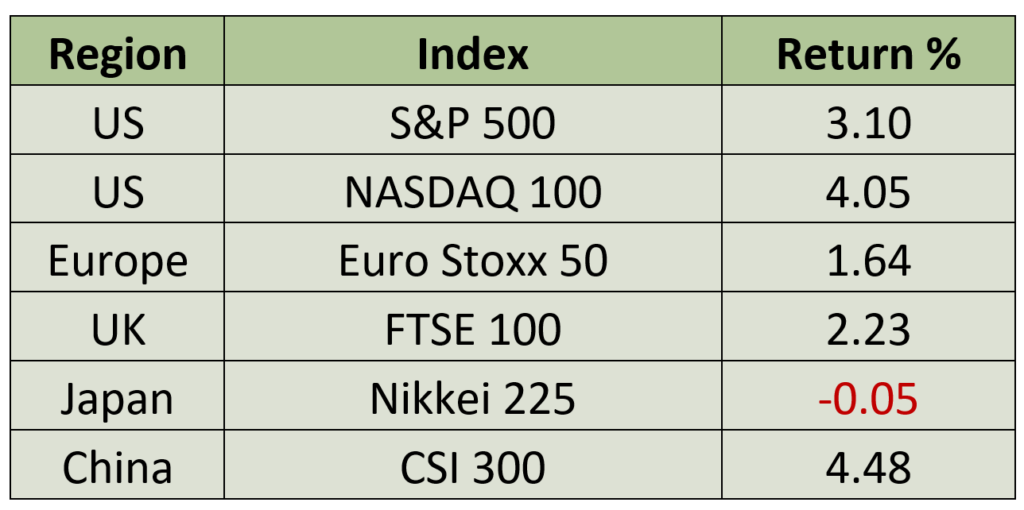

Equity investors experienced another robust month overall, as major markets recorded positive returns. The exception was Japan, which was essentially flat for the month of July. This came after a very strong rally in June and given the excellent performance of Japanese equities this year, a flat month was likely due.

Source: Bloomberg

Equities were propelled higher by the same forces that have been pushing them higher all year, namely that inflation is steadily declining while growth remains for the most part steady. Despite some exceptions in certain parts of Europe, such as Germany flirting with a recession, labour markets remain firm, wages are experiencing significant growth, and the service sectors of most developed economies continue to expand.

The technology sector remains the standout performer, buoyed by the excitement surrounding Artificial Intelligence (AI). There’s a widespread belief that AI will soon lead to remarkable productivity gains for the global economy, and major technology companies, which we are all familiar with, are expected to deliver these gains.

Inflation remains a key concern for central banks. We had three meetings in July and one ongoing as of the time of writing. Except for the Bank of Japan (BoJ), the actions and the outlooks of the US Federal Reserve (Fed), the European Central Bank (ECB), and the Bank of England (BoE) were very similar.

Starting with the Fed, their meeting followed an excellent inflation report showing a decline in US headline to 3.0%, while core inflation remained stubbornly high at 4.8%. After a pause in their last meeting in June, the Fed decided to raise rates by another 25 basis points. They expressed the belief that the policy rate had now entered restrictive territory, and moving forward, they would continue to assess economic data on a meeting-by-meeting basis to make policy adjustments. The Fed’s next meeting is scheduled for late September, and they will observe two labour market reports and two more inflation reports ahead of that meeting. Overall, the markets perceived the Fed’s rate-hiking cycle may have come to an end, provided inflation behaves as expected.

The ECB followed suit as they also raised rates by 25 basis points and, like the Fed, refrained from offering specific future guidance. They, too, declared their intention to operate on a meeting-by-meeting basis. However, the ECB has faced challenges in achieving the same level of success as the Fed in curbing inflation, as it currently stands at 5.3% in the Eurozone. Moreover, the Eurozone’s economic growth is comparatively softer than that of the US, further complicating the ECB’s task. While the ECB’s mandate primarily revolves around controlling inflation, they cannot entirely overlook the issue of weak economic growth.

Similarly, the BoE raised rates by 25 basis points to 5.25% and conveyed a more assertive stance, indicating that further policy tightening might be necessary. This stance is understandable, given that they face the most severe inflation problem among the central banks discussed.

Lastly, the BoJ stands as the sole major central bank that continues to pursue quantitative easing and negative interest rates, maintaining their policy rate at -10 basis points. The BoJ continues to make adjustments to their yield curve control policy. In December last year, they raised their cap on 10-year Japanese government bond yields from 25 basis points to 50 basis points. Now they have further modified this policy by stating that they will refrain from intervening and purchasing Japanese Government Bonds (JGBs) until the 10-year yield reaches 1% – the yield was 0.59% at the end of July Interestingly, they have intervened twice already when JGB yields jumped over 60 basis points, raising questions about their objectives.

While the BoJ denies any readiness to abandon negative rates, it’s essential to monitor their actions closely. Inflation in Japan has now surpassed that of the US, and the persistent weakness of the Yen is partially to blame for this. We suspect more tweaks to their monetary policy framework are on the horizon and such changes are likely to have significant impacts for other fixed income markets were Japanese funds to start flowing home.

We are currently in the midst of the second-quarter earnings releases for public companies, a period that always garners significant attention as analysts attempt to forecast earnings and companies aim to surpass those forecasts. As is often the case, the majority of companies manage to beat the forecasted earnings, and this quarter is no different with most companies “beating” expectations.

However, when we take a step back and look at the bigger picture, it becomes evident that overall earnings are declining year on year. Specifically, for the S&P 500, there has been a noticeable decline in earnings of 8.9% compared to the same period last year, with technology sector earnings down 11.5% year on year. It is hard to reconcile this with the S&P 500 rally of over 15% YTD, and the NASDAQ 100 surging over 30%. The apparent contrast between declining earnings and the strong performance of the stock markets presents a challenging puzzle for investors and analysts to reconcile.

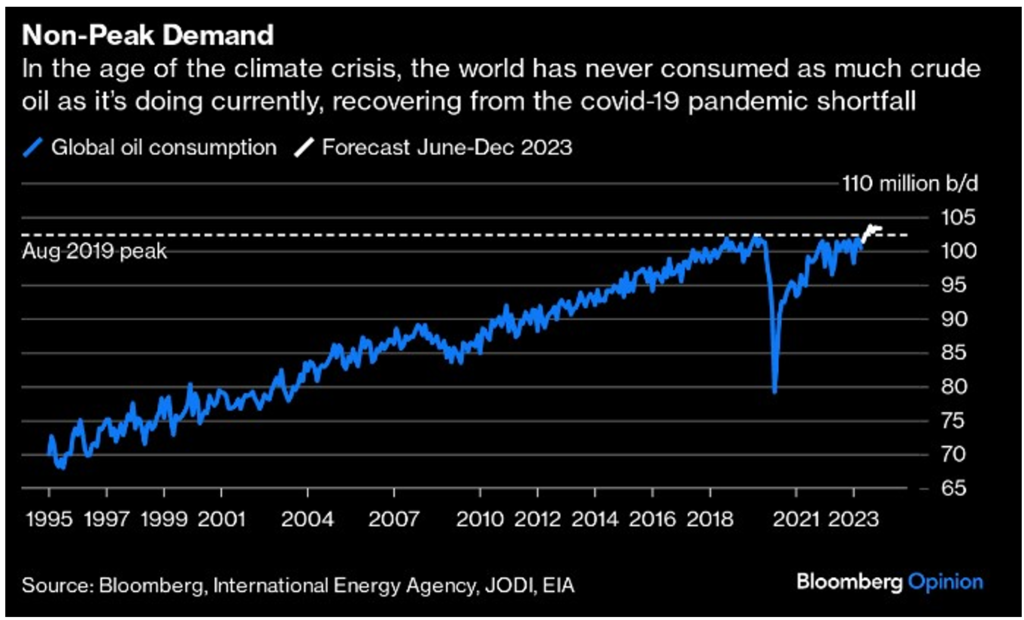

Over the past month, we’ve witnessed a notable surge in oil and other energy prices. Oil prices have comfortably crossed the $80-per-barrel mark, and signs suggest that US production is topping out while Saudi Arabia continues to maintain reduced production levels. Even with the Chinese economy still encountering difficulties, global oil demand has already exceeded pre-pandemic levels. The inflation impact of this has yet to be felt but it will not be helpful.

Source: Bloomberg, International Energy Agency, JODI, EIA

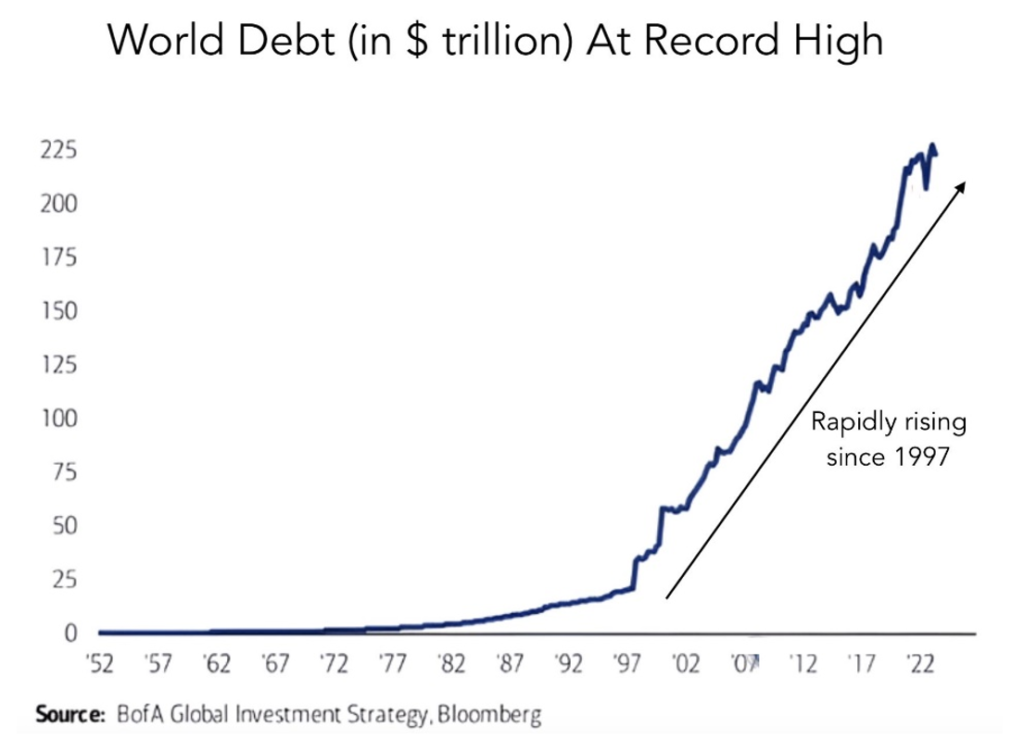

The issue of funding large scale fiscal deficits amid rising interest rates rise is becoming increasingly concerning. This trend is evident in the UK, where long-term yields on UK government bonds have risen over 60 basis points this year, impacting the cost of servicing a substantial amount of debt. The situation is not limited to the UK; most developed countries are grappling with a growing burden of debt, yet none are making serious efforts to reduce spending or address their debt levels.

Source: BofA Global Investment Strategy, Bloomberg

Fitch, a major credit rating agency, recently downgraded the United States’ credit rating from AAA to AA+ due to the country’s challenges in handling the debt ceiling and fiscal policy in general. The situation is further complicated by members of the Republican-led House of Representatives delaying the authorisation of spending bills and issuing threats of a government shutdown in September. These developments have raised concerns among bond investors, as they do not inspire confidence in the country’s financial stability.

We continue to maintain a cautious and conservative approach in our positioning. Instead of chasing the runaway price-to-earnings expansions in the tech sectors, we have focused on more stable investments. Holding stocks with excessively high valuations leaves little margin for error if those valuations change suddenly. We have taken profit in some of our NASDAQ exposure and allocated part of the proceeds to cash. Moreover, we are being prudent with our fixed income, keeping the duration moderate. We don’t anticipate rate cuts coming soon and believe concerns around fiscal deficits will continue to put upward pressure on yields. As we look ahead, we believe markets are likely to be more volatile and perhaps not as rewarding as the first half has been. We continue to have confidence in our strategic positioning, which we believe will help us successfully navigate these challenges.

Discover more informative content from our Chief Investment Officer Jeff Brummette in the recent 2023 Mid-Year Outlook and Investment Summary for July 2023. Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below or get in touch with one of the team.