For our April 2023 Investment Summary, we take a closer look at the latest news and market trends we are seeing take place this month.

After the market drama of last month, it was refreshing to have a month without a major bank failure in the US (JP Morgan effectively took over First Republic Bank on 1st May – read message from First Republic here). Inflation continued to ease, and the equity markets with the lowest valuations performed the best during the month.

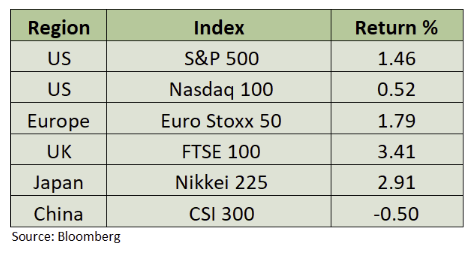

Most major exchanges had a strong month, with the FTSE 100 leading the way with an impressive return of 3.41% (recovering from last month’s 3% decline). This was despite strong gains for pound sterling, which was up 1.9% against the USD. It is difficult to pinpoint why the pound is strengthening, much of it is simply due to US dollar weakness and the possibility that the US Federal Reserve (Fed) may pause their rate hiking process soon.

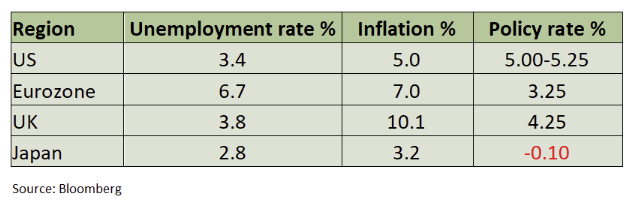

Indeed, there seems to be a growing acceptance by the markets that Prime Minister Sunak can turn the UK economy around. That said, despite this positive sentiment, inflation remains high in the UK, standing at over 10%. As a result, we expect the Bank of England to implement further rate hikes soon in an attempt to bring this under control.

It has been slightly over a year since central banks began taking the fight against inflation seriously by raising interest rates. Financial markets are still grappling with the various effects of this policy shift. The latest 25 basis point hike by the Fed brings their policy tightening to 500 basis points in a year. Despite the Fed’s aggressive rates hikes, the unemployment rate in the US has dropped to 3.4%, a level that neither the Fed (nor market participants) had anticipated. While headline inflation has fallen back to 5%, core inflation remains stubbornly high at 5.6%.

Meanwhile, the European Central Bank (ECB) also recently raised rates by 25 basis points, bringing their increase to almost 400 basis points in a year (remember they started from -50 basis points). Whilst inflation in the Eurozone has fallen, the latest print remained stubbornly high at 7.0%. Like the US, the region continues to have a tight job market and recently achieved its lowest level of unemployment since the creation of the Euro. Both the Fed and ECB are continuing to shrink their balance sheets to remove some of the monetary stimulus they injected during their decade-long period of asset purchases, known as quantitative easing.

Achieving the 2% inflation target that both these central banks must meet is proving to be challenging without some weakness in their respective labour markets. Although energy prices, which were a significant contributor in the sharp rise in inflation last summer, have fallen back to levels below where they were prior to the start of the war in Ukraine, the bulk of their contribution to lowering inflation is probably behind us. It appears that a more substantial economic slowdown will be needed to push inflation lower from here, which may mean more rate hikes, interest rates remaining at these levels for much longer than markets are pricing, or a combination of even higher rates and prolonged rate hikes.

At their last press conference, the Fed suggested that their 500 basis points of rate hikes, ongoing balance sheet shrinkage, and expected tightening of credit conditions due to bank failures may be sufficient to achieve their desired reduction in inflation. However, neither they nor the markets know if this is true. What we do know is that the central banks do not have a great record in forecasting.

In response to the current climate of tighter monetary policy and the reduction in central bank balance sheets, financial markets initially reacted by marking down publicly traded asset prices, such as stocks and bonds. That was last year’s story.

This year has brought some recovery in stock and bond prices, but there have also been second-order effects of higher interest rates, such as bank failures and growing concerns about commercial property, including mortgage defaults on major office buildings by well-known real estate firms. Many assets had received valuation boosts from the zero interest rate regime of the last decade or so, but rates at 5% will be less helpful and may be damaging in some cases.

Revaluations of assets are currently happening in real-time in publicly traded markets, but it will be much more challenging to uncover problems in private markets and markets with fewer transactions, like real estate, where issues may arise unexpectedly. According to analysts at Morgan Stanley, nearly $1.5trn of commercial real estate in the US is due for repayment by the end of 2027. It is estimated that regional banks, like Signature Bank of New York and Silicon Valley Bank, hold 4.4-times more exposure to commercial real estate loans than their larger peers. In summary, expect more regional banks to fail in the US.

Corporate earnings for the first quarter of this year are nearly all in and generally more companies beat expectations (not surprising given analysts had already reduced forecasts) than disappointed. Despite the fact that many companies have beaten first quarter earnings expectations, there is a general trend of declining earnings that are likely to negatively impact equity prices.

Additionally, central banks policies are only going to make this worse as they work to slow economic activity in an attempt to cool inflation. Unless they have a dramatic change of heart about meeting their inflation targets, we should expect the current or even higher level of interest rates to persist for some time, along with a period of slower growth. Keep in mind that the Fed has increased rates twice, even as three large bank failures have occurred. Despite the potential consequences, they remain committed to reducing inflation – a policy error is now looking more likely.

Our current portfolio positioning remains conservative, with our equity exposure tilted towards high-quality companies. In fixed income, we continue to prefer government bonds and investment-grade corporate credit.

Read more from our Chief Investment Officer Jeff Brummette in our Investment Summary for March 2023. Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below.