As we motor ahead in 2025, markets are navigating a delicate balance between optimism and uncertainty, reminiscent of Goldilocks’ pursuit of “just right.” But what happens when this fairy tale meets real life disruption? In this year’s market outlook, our Chief Investment Officer, Jeff Brummette, explores the ever-evolving economic landscape shaped by inflation, interest rates, geopolitical influences, and policy shifts – including a new chapter in U.S. leadership.

_______

Introduction

As we commence the year, the global economy finds itself at a juncture where fiscal ambition intersects with market scepticism. In Europe, Germany, France, and the UK continue to grapple with economic challenges, constrained by limited fiscal flexibility. The new U.S. administration, under President Trump, has indicated that growth and stability take precedence over fiscal restraint. Meanwhile, in Asia, both China and Japan contend with the dual pressures of tariffs and evolving demographic challenges. While threats to the investment landscape are likely, we firmly believe that 2025 will also present ample opportunities for investors.

A Quick 2024 Recap

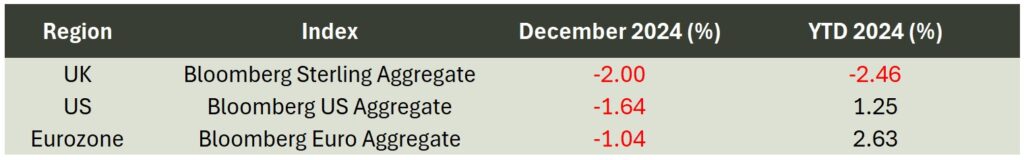

Equity markets delivered another strong year, with the last two years marking the best consecutive years for U.S. equities since the late 1990s. In contrast, fixed income performance was poor, as fiscal worries globally pressured the long end of most bond markets. In the UK, rising yields were exacerbated by mounting concerns over the inflationary impact of the new government’s budget. Continental Europe lagged the U.S. and Asia, as concerns around the French and German economies weighed on equity markets. Meanwhile, in Asia, both Japanese and Chinese equities produced impressive double-digit returns.

Source: Bloomberg

Bloomberg Aggregates Total Returns Indices

Source: Bloomberg

Despite a steady decline in inflation throughout the year, the two main alternatives to fiat currencies – gold and bitcoin – performed exceptionally well. These gains suggest that markets remain sceptical about central banks confidence in defeating inflation. Bitcoin surged following Donald Trump’s election win. Optimism in the sector was driven by his support for cryptocurrencies and the appointment of a new, more crypto-friendly head of the U.S. Securities Exchange Commission, widely regarded as more progressive on crypto regulations compared to their predecessor.

Source: Bloomberg

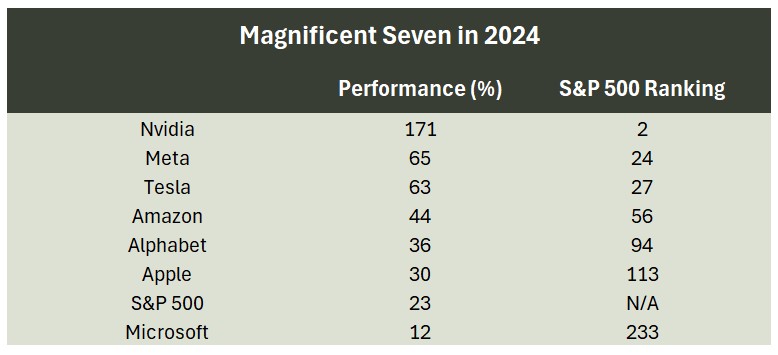

The Magnificent Seven led the way again this year, with strong earnings growth supporting multiple expansion and large stock price gains.

The question you must ask is can these stocks continue to outperform in 2025?

Magnificent Seven in 2024

Source: Bloomberg

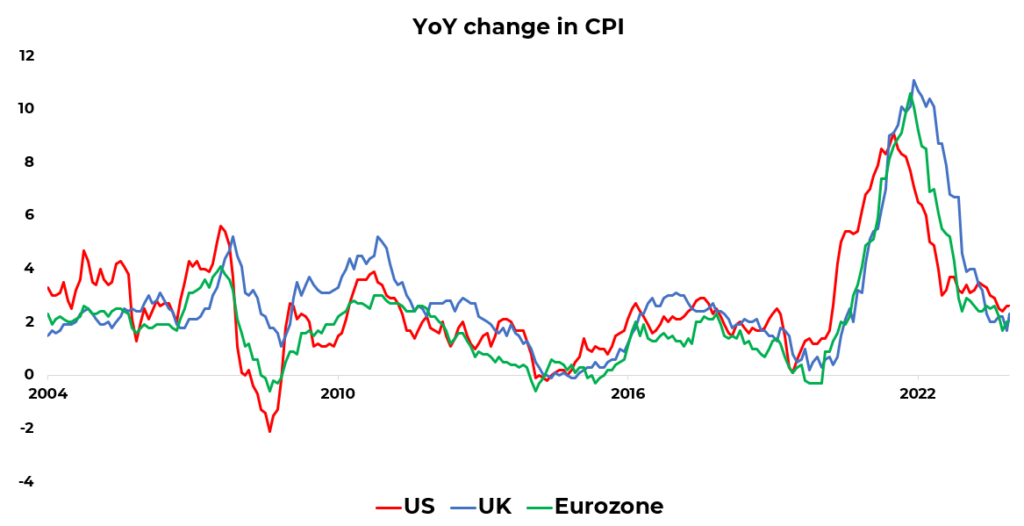

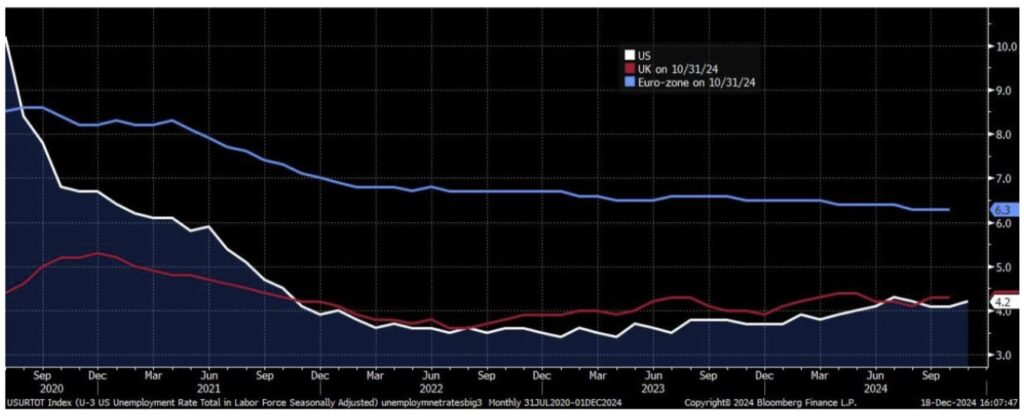

Labour markets remained healthy and oil prices have also declined significantly since the spring, boosting real incomes, and keeping the rate of inflation on a downward path.

Inflation Under Control

Source: Bloomberg and Oakglen Wealth

Low Unemployment Rates

Source: Bloomberg Finance L.P.

We expect this environment to continue into 2025, but with greater divergence in growth amongst countries. This will also lead to greater variance in central bank policy. Sticky services inflation is likely to limit the amount of rate cuts by central banks. While loose fiscal policies throughout the world will assist economic growth to remain positive.

The United States of America: Trump 2.0

The election of Donald Trump as President and the Republican takeover of the U.S. Senate and retention of the House of Representatives brings a complicated mix of policy goals with no clear set of implementation plans. The market’s initial reaction is to view Trump’s plans as positive for growth, suggesting continued outperformance of U.S. assets in the year ahead.

President Trump has targeted four principal areas he wants to focus on: immigration, regulation, tariffs, and taxes.

1. Lower corporate taxes and renew the expiring Tax Cuts and Jobs Act that he passed in his first term as President. This won’t happen until late 2025. It is possible the Republican congress looks for spending offsets to prevent worsening the budget deficit.

2. Reduce regulations to stimulate energy production and improve the overall business environment. Encourage more M&A activity and reduce regulatory interference from the likes of the DOJ, FTC, SEC and FCC to name a few.

3. Impose significant tariffs on imports to encourage U.S. trading partners to deal more “fairly” with the U.S. and, in the case of Mexico, to help restrict illegal immigration at the southern US border and limit the flow of illegal drugs into the U.S.

4. Dramatically reduce illegal immigration and prioritise the deportation of undocumented individuals. Initially, he plans to deport criminals which has broad public support. Going beyond that will prove much more challenging as many “illegals” are working and would be impossible to replace if they were removed from the U.S.

President Trump is already speaking with the leaders of Canada, Mexico and China. He has threatened all three nations with tariffs unless they take steps to stop the importation of illegal drugs into the U.S. He has also threatened tariffs on the nine nations that make up the BRICS group should they try to avoid using the dollar in international trade.

Tariff targets – countries with trade surpluses with the U.S.A

Source: J.P. Morgan Equity Macros Research, USITC

How nations respond to the tariff threats is hard to predict and there are a wide range of outcomes from good to bad that will no doubt impact financial markets.

Taxes and spending are the responsibility of Congress, and they must approve spending for the current fiscal year (which started in October 2024) before they can look at extending the Trump tax cuts and making other changes to tax rates. Scott Bessent, Trump’s nominee for Secretary of the Treasury, is not an advocate for making the deficit larger. In fact, he has a plan called 3-3-3. He would like to see real GDP growth at 3%, the budget deficit at 3% of GDP (currently 7%) and U.S. oil and gas production to grow by another 3 million barrels per day. He and many Republicans in Congress would look to find some spending reduction to partially offset the renewal of the expiring Trump tax cuts from 2017.

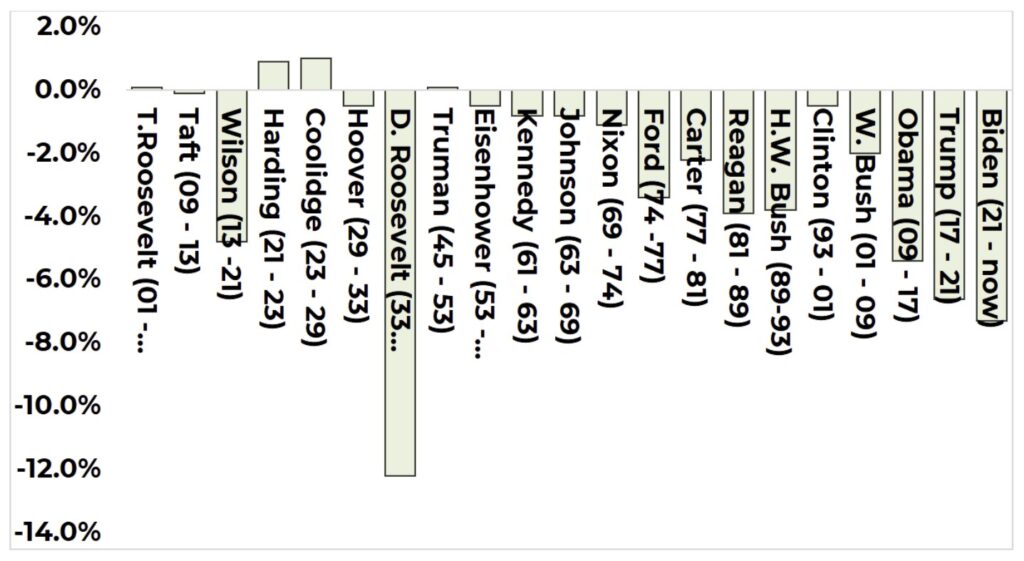

Average U.S. federal government deficit as % of GDP under each President since 1900

Source: Oakglen Wealth

Reducing regulation by replacing the heads of many Federal agencies and issuing a flurry of executive orders has happened quite quickly and the impact may be significant. Paul Atkins, Trump’s nominee for the Chair of the Securities and Exchange Commission, is much more positive on cryptocurrency and the markets have responded dramatically with the price of Bitcoin up significantly since the election.

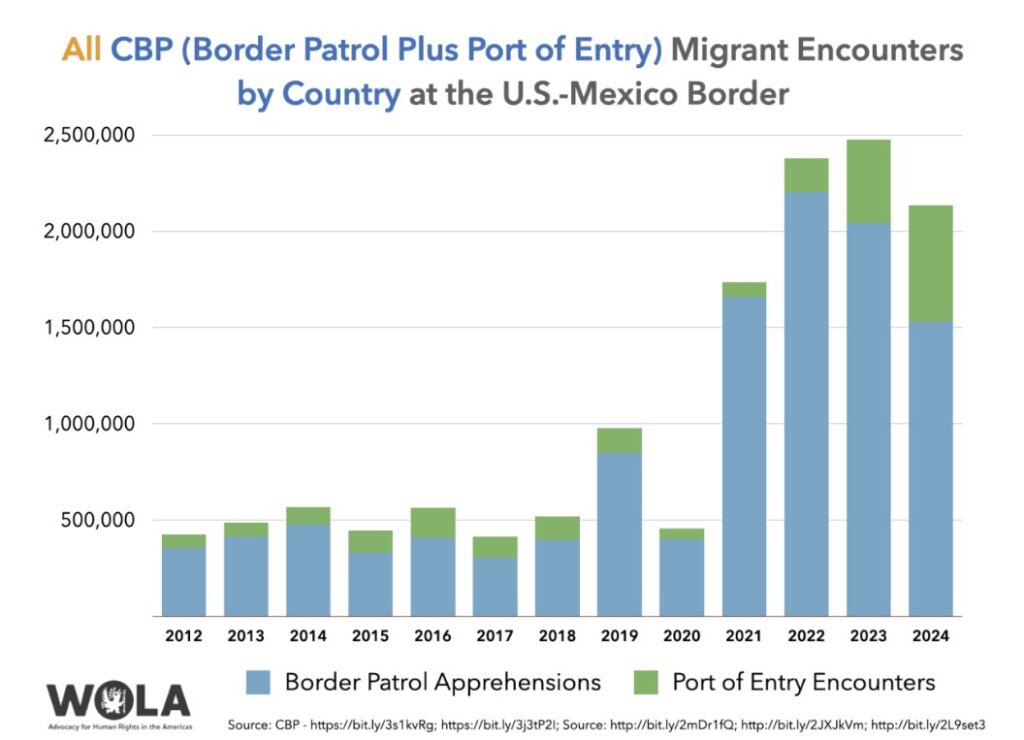

Stopping illegal border crossings and the deportation of millions of illegal aliens in the U.S. is much more problematic. Trump’s initial goal is to deport illegals who have committed crimes (other than coming into the U.S. illegally). He is also pressuring Mexico under the threat of tariffs to tighten controls on their side of the border with the U.S.

Source: US CBP

There is no infrastructure set up to handle mass deportations and businesses are urgently lobbying Trump not to do this. If this is not managed well it could turn into a disaster and impact on the economy in a very negative way.

Europe: Stuck between a rock & a hard place

Weak Chinese consumption is having a significant impact on Europe. German automakers are struggling to compete with their Chinese counterparts in the Chinese market, while inexpensive Chinese electric vehicles are increasingly entering Europe, intensifying competition. Despite recent declines in oil and natural gas prices, European manufacturers continue to face considerably higher energy costs than their Chinese or US counterparts, further eroding competitiveness.

European luxury goods makers are also experiencing a steep decline in sales in China, driven not only by reduced consumer spending but also by a growing sentiment that purchasing foreign luxury goods is “unpatriotic.”

Global Personal Luxury Goods Market, Estimated Quarterly Growth (at current exchange rates)

Source: Bain & Company

The European Central Bank has responded to the slowing economic outlook by cutting rates by 100 basis points last year and is expected to continue this trajectory this year. It is likely to adopt a more aggressive rate-cutting stance than the U.S. Federal Reserve and the Bank of England, which could lead to further depreciation of the euro against the dollar and the pound.

Notably, the divergence between Europe and the U.S. in both macroeconomic performance and equity markets has now persisted for over a decade. As Mario Draghi recently highlighted, Europe faces substantial challenges in restoring its global competitiveness. Following Trump’s re-election, the probability of Europe’s economic and market underperformance continuing remains high.

UK: Low valuations, but for a reason

The dominant narrative surrounding the UK economy often highlights significant fragility, marked by high inflation, sluggish growth, and fiscal pressures. While this perspective is rooted in genuine risks, the reality is more nuanced, particularly when considering recent movements in bond yields.

British Borrowing Costs Surge As Investors Sell Gilts

Source: LSEG | Reuters, January 8 2025

The perception persists that the UK is struggling with inflation, fiscal challenges, and weak growth, all of which have contributed to notable increases in bond yields. However, inflation is beginning to moderate, and growth has shown relative resilience. Negative sentiment, partly influenced by Chancellor Reeves’ comments regarding spending cuts, has exacerbated these concerns.

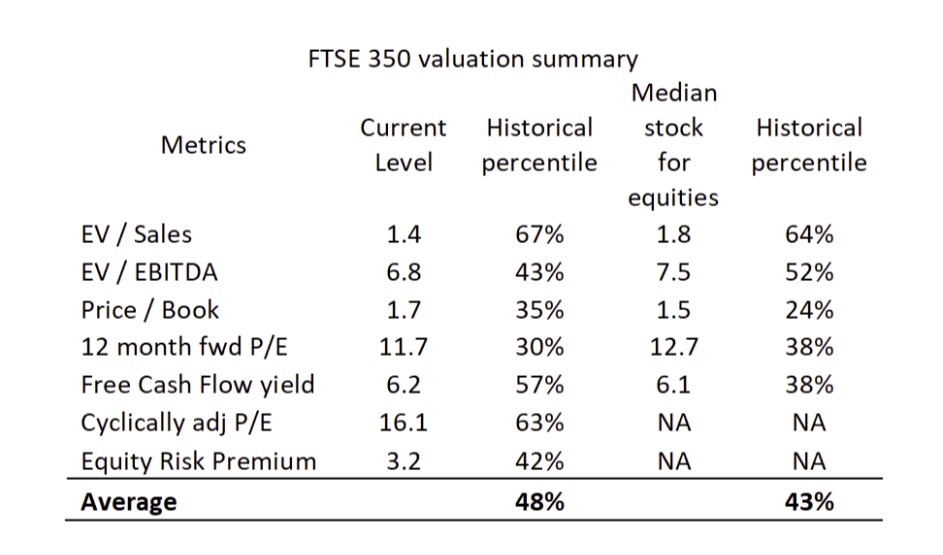

In the equities market, the UK stands out for its low valuations, one of the few regions where prices remain below historical averages. That said, much of the UK’s discount to the US and other markets is justified by its sector composition and low growth prospects. Over the past six months, the UK has underperformed the S&P 500 by more than two standard deviations, mirroring broader trends in Europe.

FTSE 350 Valuation Summary

Source: Bloomberg

Could this underperformance reverse?

It largely depends on resolving policy and economic uncertainties in Europe and the UK relative to the U.S. For the valuation gap to narrow, we would likely need significant developments, such as a resolution to the war in Ukraine or clarity on trade and tariff policies. However, in the near term, these conditions appear unlikely.

Instead, the valuation gap may close through lower performance of U.S. mega-cap tech stocks, rather than a significant re-rating of UK equities. In the meantime, the UK’s low valuations offer a degree of relative appeal, though broader structural and geopolitical factors remain key to shifting investor sentiment.

Japan: Rates are rising

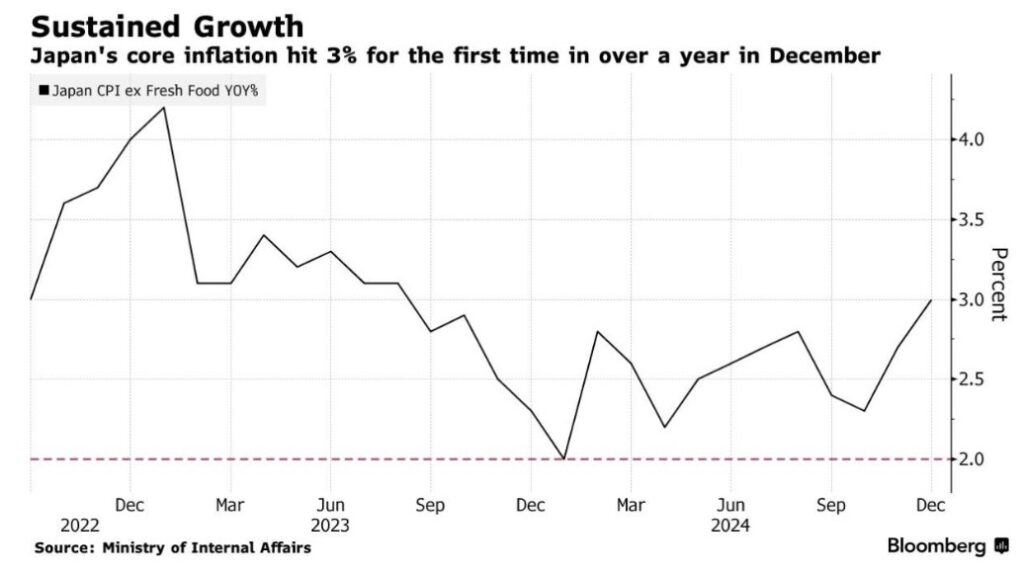

Japan was the only major economy to raise interest rates in 2024. Inflation appears to have comfortably surpassed the 2% target, and robust wage growth is anticipated in 2025, likely prompting further normalisation of interest rates. This tightening may finally halt the yen’s decline.

Sustained Growth: Japan CPI

Source: Ministry of Internal Affairs via Bloomberg

The primary risk for Japan in 2025 lies in the potential stalling of its moderate economic recovery, which could dampen business and investor sentiment. Earnings growth is projected to reach high single digits, led by the financial sector. However, a slowdown in manufacturing may weigh on profits, as fixed costs are unlikely to adjust quickly to declining revenues.

While Japan has reduced its reliance on exports, nearly half of the revenues of Tokyo Stock Exchange-listed companies still come from overseas, leaving them closely tied to global economic conditions.

Japanese equities, buoyed by low valuations and governance reforms driving improvements in return on equity, remain resilient. We consider them an appealing risk-reward asset class, particularly for companies with significant exposure to global growth opportunities.

Japanese Equities Trading Below 5-Year Average

Source: Ministry of Internal Affairs via Bloomberg

China: Investors await stimulus

Chinese equities rose approximately 35% from their September lows to their October peak as investors anticipated more aggressive fiscal stimulus from China. However, we expect the rally to lose momentum in 2025 without necessarily collapsing, as markets have already priced in much of the anticipated benefits from fiscal and monetary measures.

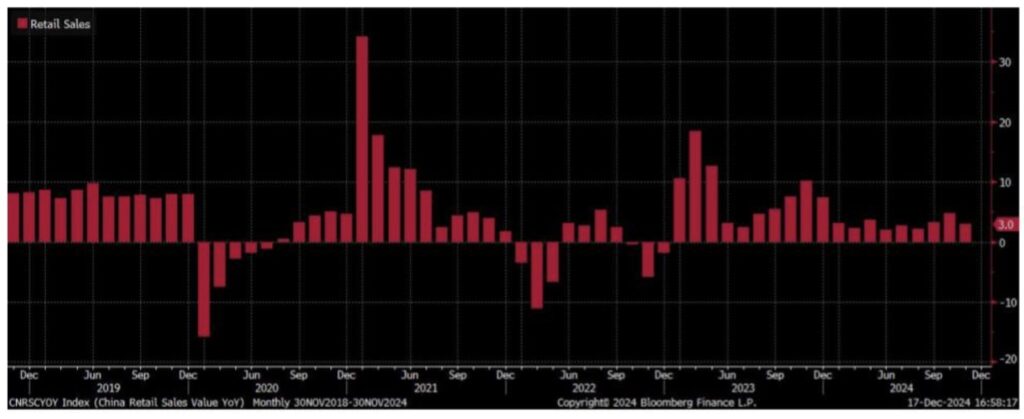

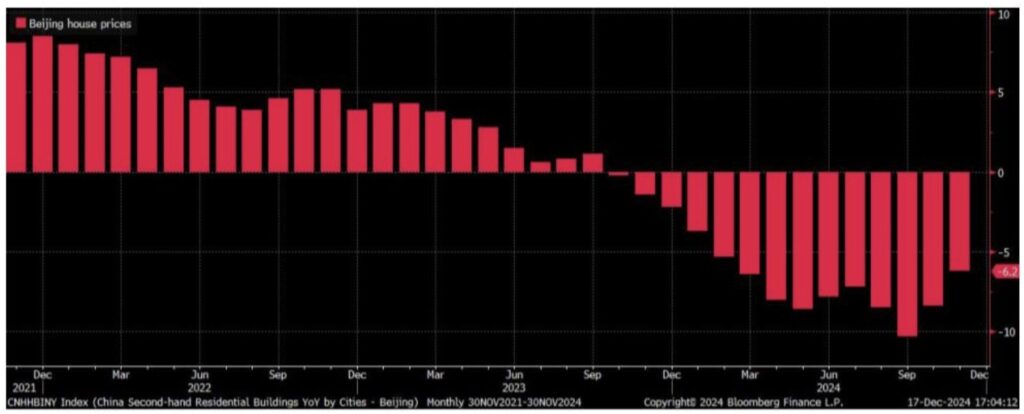

With valuations now back to fair value, further re-rating of the market will depend on improvements in China’s economic data and corporate fundamentals, which are likely to take time without additional policy support. While some economic indicators are beginning to show signs of recovery, key areas such as housing market performance and retail sales remain weak and will need time to stabilise.

Chinese Retail Sales (Monthly)

Source: Bloomberg Finance L.P.

Beijing Existing Home Prices YOY (%) Change

Source: Bloomberg Finance L.P.

Downside risks appear limited, as monetary easing and measures to address local government debt risks should help to mitigate further economic stress. However, with current stimulus already reflected in valuations, further market re-rating may require a fresh round of policy action. This could be triggered by weaker-than-expected economic growth or additional U.S. policy measures, such as increased tariffs.

Fixed Income: Watch duration

Inflation has moderated, and labour market imbalances have largely been resolved suggesting that further reductions in inflation is possible. Economic growth across developed markets is anticipated to remain close to trend with the U.S. slightly above and the Eurozone below, leaving some room for additional easing of monetary policy by central banks, particularly the ECB. Consequently, cash yields are expected to fall below bond yields, diminishing the appeal of cash holdings.

As a result, fixed income may outperform cash this year. However, fiscal issues remain a concern, and should President Trump manage to implement all the tax cuts he desires longer term U.S. treasury bond yields should continue to rise. This will weigh on foreign markets, notably the UK, as we have seen this year.

Investment grade bonds historically deliver stronger returns, both in absolute terms and relative to cash, during periods of slowing or steady inflation and moderate growth, monetary policy easing, and an upward-sloping yield curve. Many of these conditions are falling into place but spreads over government bonds are very tight so it may be prudent to favour more government bonds in fixed income portfolios.

Summary

In our multi-asset class portfolios, we remain focused on high-quality, large-cap equities, while our fixed income exposure is concentrated in short-to-intermediate-duration government and investment-grade corporate bonds.

We continue to see growth in technology spending, particularly in artificial intelligence and the cyber defence sector. European defence companies remain attractive, with defence spending on a secular uptrend driven by the ongoing war in Ukraine and the anticipation of increased pressure from President Trump for NATO members to boost their military budgets. Financials, particularly in the United States, also hold appeal, with lighter regulation and a more normal upward-sloping yield curve likely to bolster earnings and encourage mergers and acquisitions. China warrants close attention, as robust stimulus measures could have a significant impact on global markets.

Overall, we maintain a positive outlook for equities in 2025. Inflation is expected to remain contained, and central banks are likely to continue lowering interest rates. At worst central banks hold rates steady. It is difficult to envisage a scenario where central banks would need to resume tightening of policy. While U.S. equity valuations are undeniably high, if President Trump succeeds in reducing regulation and lowering taxes without creating significant disruptions through tariffs or immigration policies, U.S. equities are likely to remain market leaders.

Fixed income is expected to offer limited excitement, with the front end of the yield curve likely to perform best in response to further rate cuts. Fixed income does provide protection in the event of an economic slowdown as there is ample room for yields to decline.

_______

Hear more from the Oakglen experts

Our investment team continue to provide interesting and informative content to help keep you in the loop on recent global news and market trends. See below for a few recent highlights from some of the team:

Read more:

- Trump 2.0 Goes Live!

Jeff Brummette, Chief Investment Officer

- H2 2024: Discretionary Investment Management Service Update

Myles Renouf, Senior Investment Manager – Jersey

- Rising UK Gilts: Cause for Concern

Jeff Brummette, Chief Investment Officer

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.