As we move forward into the new year, it is as important as ever for us as a business to continue to reflect upon our investment performance and the ongoing strategic decision-making process of our team. In this article, Myles Renouf, Senior Investment Manager at Oakglen Wealth provides an overview of capital market performance in 2024 and reflects on the performance of our discretionary investment management service as we celebrate its five-year anniversary.

Equity markets delivered another strong year, with the last two years marking the best consecutive years for US equities since the late 1990s. In contrast, fixed income performance was poor, as fiscal worries globally pressured the long end of most bond markets. In the UK, rising yields were exacerbated by mounting concerns over the inflationary impact of the new government’s budget. Continental Europe lagged behind the US, as concerns around the French and German economies weighed on equity markets. Meanwhile, in Asia, both Japanese and Chinese equities produced impressive double-digit returns.

Source: Bloomberg

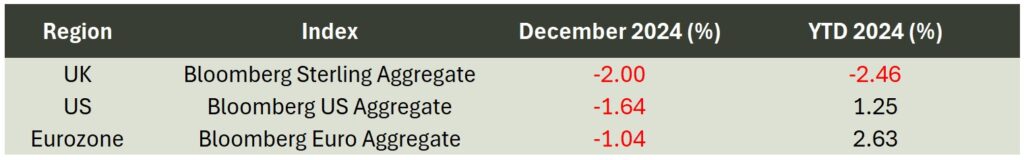

Bloomberg Aggregates Total Returns Indices

Source: Bloomberg

Turning to the performance of our discretionary strategies, our Diversify strategy, tailored for medium risk investors, delivered a +7.2% return in 2024. This compares favourably to the +6.8% return achieved by the ARC Sterling Balanced Asset PCI peer group. Additionally, the longer-term track record remains compelling, with a total return since inception (31.12.19) of +29.7%, comfortably ahead of the ARC Sterling Balanced Asset PCI, which returned +15.3% over the same period.

Similarly, our Grow strategy, designed for high-risk investors, returned +10.6%, outperforming the ARC Sterling Equity Risk PCI peer group, which posted a +9.8% return over the same period. Since inception the strategy continues to outperform meaningfully versus the ARC Sterling Equity Risk PCI, with a return of +48.4% versus +25.2% respectively.

We expect several key themes that we highlighted in 2024 will remain prominent in the coming year. Among these are increased defence spending, particularly in Europe, and sustained growth in cyber defence spending. The financial sector, which performed strongly in 2024, is also likely to continue to prosper as yield curves normalise. Similarly, technology sector spending is expected stay strong, driven by the mega cap tech stocks in the US fuelling an arms race in the development of Artificial Intelligence.

There will be differences as well. We expect less alignment of central bank policy, as the final phases of the fight against inflation will hinge more on domestic factors rather than the pandemic driven-global supply shocks that produced the inflationary spikes of the past few years. The US Federal Reserve (Fed) has adopted a more cautious stance on future rate cuts, while the European Central Bank (ECB) has expressed growing confidence in achieving its inflation target. This divergence will likely result in larger interest rate differentials and increased foreign exchange rate volatility.

The divergence of US economic policy and that of other developed nations may deepen further. President-elect Trump has pledged significant regulatory rollbacks and tax cuts, positioning the US on a markedly different trajectory. In contrast, the UK has recently raised taxes, while political paralysis in France and upcoming elections in Germany do not suggest economic dynamism there. Meanwhile, China has committed to providing significant new stimulus for their domestic economy, though the policy specifics need to be fleshed out.

President Trump’s leadership introduces a significant variable, as his decision-making style is volatile and the considerable execution risks tied to the implementation of his policies could create substantial uncertainty. The recent turmoil surrounding the passing of a continuing resolution to fund the US government for the next year is a good example of the near chaos he and his administration may bring.

Upon his inauguration he can immediately reduce the regulatory burden many sectors of the US economy face, more complex initiatives such as tax cuts and immigration changes will take much longer. Volatility from Trump’s policy making will be felt in the markets and we should expect greater volatility in asset prices during his tenure.

To find out more about our discretionary investment management services, please contact the below:

Jersey

| Jersey@oakglenwealth.com | |

| Tel | +44 (0) 1534 789 942 |

UK

| UK@oakglenwealth.com | |

| Tel | +44 (0) 20 4583 1118 |

Capital may be at risk.

The ARC Private Client Indices are determined by Oakglen Wealth to be the most suitable benchmark for comparison purposes only. It must be noted that the last 3-month performance figures may be based on ARC estimates and may be subject to revision.

Further information can be found here: www.suggestus.com