The UK gilt market has recently faced significant turbulence, with yields climbing to their highest levels in years. Rising yields, driven by persistent inflationary pressures and expectations of prolonged tight monetary policy, have sparked concerns among investors and policymakers alike. As the gilt market faces increasing scrutiny, our Chief Investment Officer, Jeff Brummette, provides us with a deep dive on the implications of the recent news regarding UK government bonds.

_______

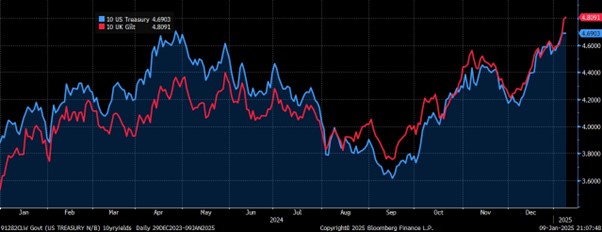

Since the start of December 2024, the UK has witnessed a significant rise in gilt yields, reaching levels unseen since the 2008 crisis.

Source: Bloomberg Finance L.P.

This escalation in borrowing costs has profound implications for the pound, monetary policy, the broader economy and the government’s fiscal strategies.

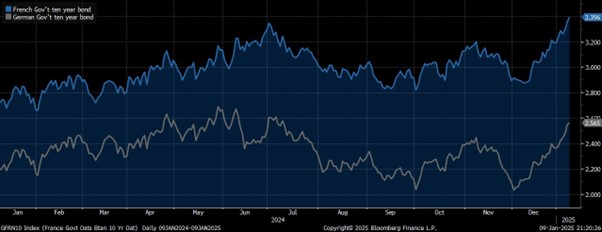

Yields are not only rising in the UK, we have also seen government bond yields increase in other developed markets such as the US, Germany and France. Since September 2024, 10-year government bond yields have risen nearly 100 basis point in the UK and the US.

UK and US Ten-Year Government Bond Yields

Source: Bloomberg Finance L.P.

France and Germany Ten-Year Government Bond Yields

Source: Bloomberg Finance L.P.

These rises have been driven by several factors including economic uncertainty and inflationary concerns but also a simple return to normal upward sloping yield curves. It is the return of the term premium. Why should investors lend government funds at the same yield for 30 years as for 2 years?

In the absence of zero rates and no more QE (in fact Central Banks are shrinking their balance sheets), investors can obtain attractive returns on short maturities without taking the risk of holding longer term securities. Add in general fiscal recklessness and concerns over the long-term trajectory of inflation, and investors are likely to demand higher yields for longer maturities. Over the past 20 years, the yield spread between UK 10-year and 2-year government bonds has averaged 69 basis points. Currently, it stands at just 29 basis points.

Source: Bloomberg Finance L.P.

Turning to the UK, the recent Autumn Budget, delivered by Chancellor Rachel Reeves, aimed to address economic challenges but appears to have had limited success in calming market apprehensions. Scepticism around the government’s ability to manage the fiscal balance has further intensified these pressures. Inflation is now at its highest level for eight months (2.6% in November) and sits above the BoE’s 2% target.

Source: Bloomberg Finance L.P.

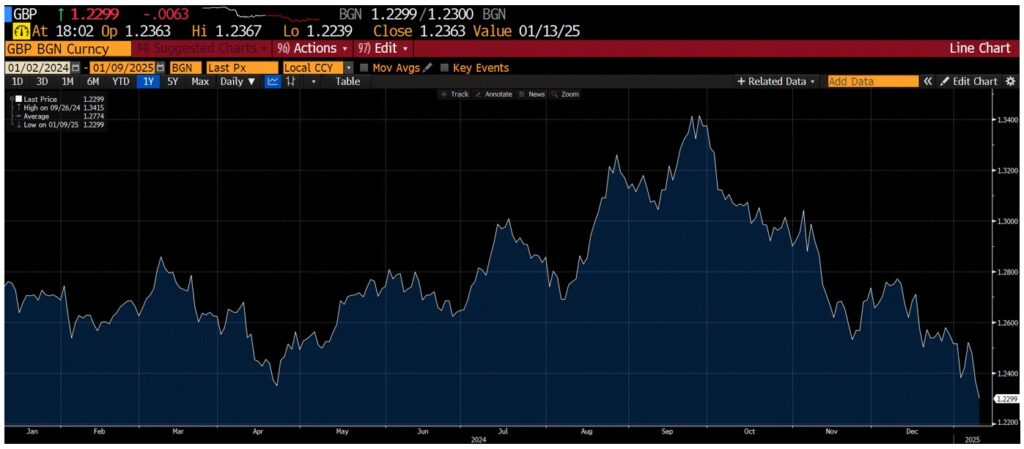

Growth appears to have stalled, with the economy shrinking for two months in a row. In turn, these concerns have driven down the pound which now trades below $1.23 against the US dollar (in September this was $1.34). It is not all UK policymakers’ fault as the US dollar has been strengthening versus nearly all currencies as the Federal Reserve has become more cautious about predicting further rate cuts.

Source: Bloomberg Finance L.P.

The Bank of England (BoE) faces a complex environment with persistent inflation and rising gilt yields tightening financial conditions. This scenario reduces the likelihood of interest rate cuts in the near term – at the time of writing the market was pricing in 50 bps of cuts from the BoE in 2025.

In response to these moves, the Treasury Public Finances: Borrowing Costs – Hansard – UK Parliament have moved to calm markets saying there is no need for intervention in financial markets and that it will not make any spending or tax announcements ahead of the official borrowing forecast from the Office for Budget Responsibility, scheduled for 26 March.

As we have highlighted before, it was only a matter of time before markets started to take notice of widening deficits in developed economies. Investors and governments need to realise that we are no longer in the zero-rate world. In the absence of massive central bank intervention in bond markets the yield curve will be upward sloping and borrowing money has a cost.

_______

Hear more from the Oakglen experts

Our investment team continue to provide interesting and informative content to help keep you in the loop on recent global news and market trends. See below for some key highlights from around the world which our Chief Investment Officer, Jeff Brummette, has recently covered:

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.