As we settle into November and the final stretch of the year, it’s hard not to look back on October without a hint of awe. Like a well-timed firework display, markets delivered a colourful display of highs and lows, lighting up with bursts of opportunity and risk. Whilst markets may not always ignite exactly as expected, they certainly have the power to surprise us. In this month’s November 2024 Investment Summary, our Chief Investment Officer, Jeff Brummette, explores the sparks, the undercurrents, and what they will mean for markets as we gear up for year-end.

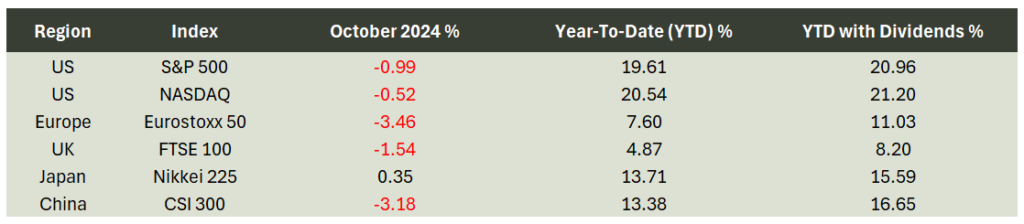

After a promising start, October ended on a disappointing note, with both bonds and equities delivering negative returns. A sharp sell-off across nearly all asset classes on the last day of month ensured the decline.

Source: Bloomberg

Considering the strength of returns in September and the third quarter overall, it is perhaps no surprise that markets had a modest decline. However, it’s always unsettling when a positive month flips negative.

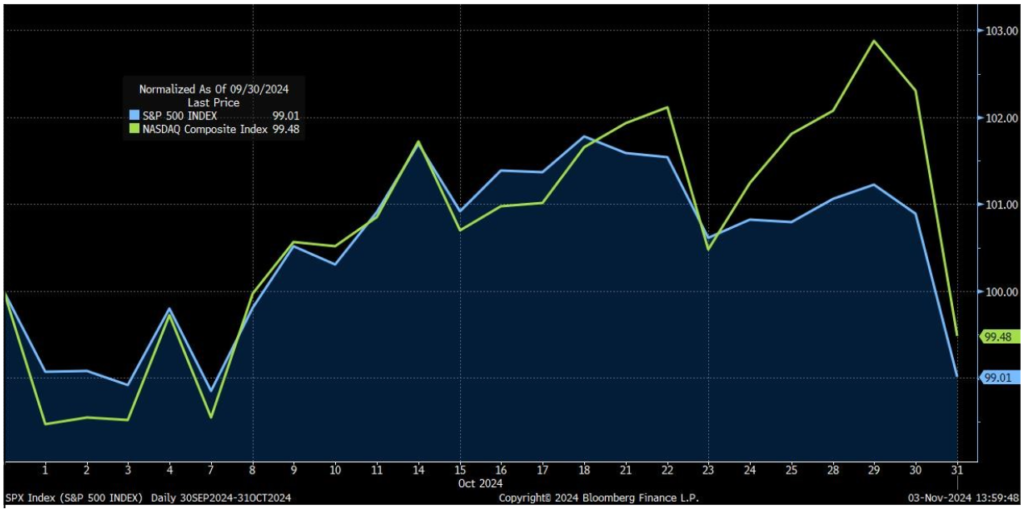

S&P 500 and NASDAQ – October 2024 (%)

Source: Bloomberg Finance L.P.

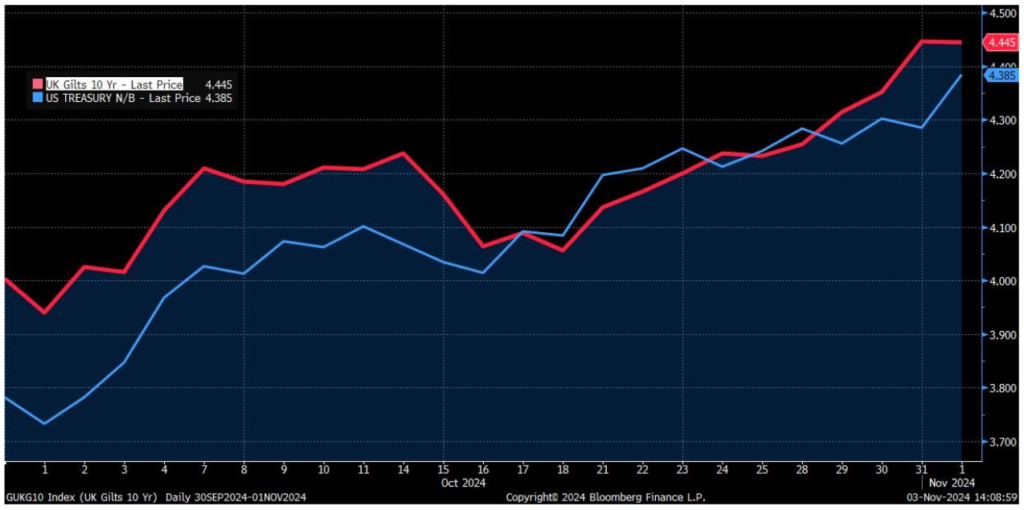

UK and US Ten-Year Government Bond Yields – October 2024

Source: Bloomberg Finance L.P.

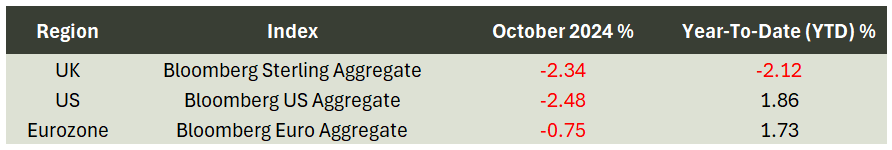

Source: Bloomberg

As shown in the table above, fixed income offered little protection from the equity market sell-off. In fact, it likely contributed to the decline in equity prices, as financial markets grow increasingly concerned with the scale of the ongoing fiscal deficits in the developed world economies. Yield curves in major developed bond markets are essentially flat, meaning investors earn the same yield whether they lend money to a government for two years or for ten years. This is atypical; ordinarily, investors demand higher yields for longer-term debt due to the increased uncertainty over the likelihood of repayment, with the higher yield serving as compensation for this risk.

In the post-Global Financial Crisis era of zero interest rates, quantitative easing (QE) and the massive pandemic-driven purchases of government debt by central banks, resulted in the normal supply and demand dynamics of bond markets becoming dramatically distorted.

Now, with QE over and interest rates no longer at zero, financial markets are slowly trying to return to more traditional supply and demand dynamics. This transition, however, is colliding with governments that are still behaving as if we are in a zero-interest rate world. They are addicted to large deficits and ever-increasing spending.

US Ten-Year Treasury Yields Less US Two-Year Treasury Yields

Source: Bloomberg Finance L.P.

As shown in the chart above, ten-year bonds have typically yielded around 100 basis points more than two-year bonds over the past 25 years. Currently, however, that spread is 17 basis points. There is a great likelihood this spread reverts closer to the long-term average. In a perfectly benign world, it would come from central bank easing, which would lower the yields on short term securities. This has begun to happen, but long-term yields are rising at the same time.

Why is this happening?

We believe this rise in long-term yields reflects concerns over fiscal deficits.

At the end of October, UK Chancellor of the Exchequer Rachel Reeves announced her budget, with the headlines focused on substantial tax hikes totalling over 1% of GDP. However, what unsettled fixed income markets was her commitment to increase overall spending by 2% of GDP annually for the next five years. This represents the largest net stimulus by the UK government in the past two decades, aside from the enormous pandemic related stimulus.

Meanwhile in the US, voters are facing a choice between two candidates, each proposing to increase the US fiscal deficit by between $3.5 trillion and $7.5 trillion over the decade.

In the Eurozone, the European Commission has now extended the timeline for EU member states to reduce their fiscal deficits back to the target of 3% of GDP. Rather than the previous three-year timeframe, countries now have seven years to meet this goal.

We are not predicating any kind of immediate fiscal crisis or a sudden “Liz Truss moment.” Instead, we anticipate a gradual normalisation of yield curves, with rates on longer term bonds likely drifting higher despite central bank rate cuts, as we still expect.

EU, UK and US Headline Inflation Rates

Source: Bloomberg Finance L.P.

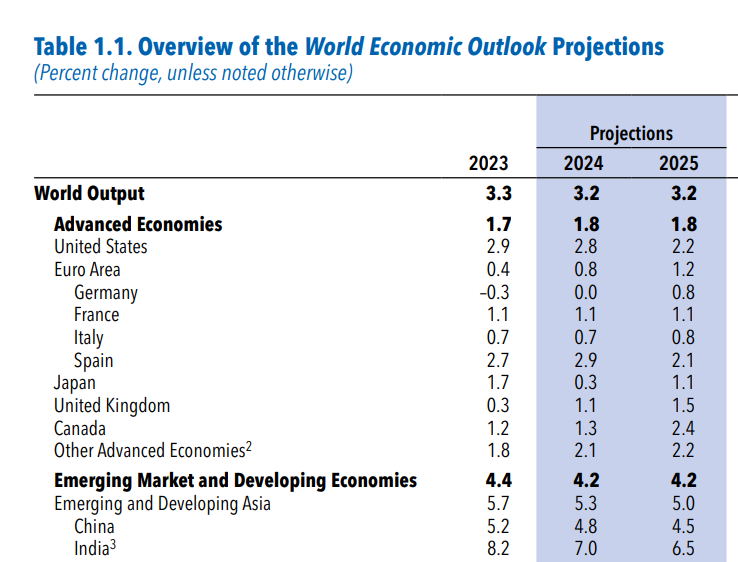

With inflation remaining steady and effectively back to target, there remains ample room for central banks to continue with rate cuts. Growth remains positive in much of the world and lower interest rates should provide additional support. Labour markets remain tight, allowing workers to experience real wage gains. The latest IMF outlook for global growth is also encouraging.

Overview of the World Economic Outlook Projections

(Percent change, unless noted otherwise)

Source: International Monetary Fund (IMF) – www.imf.org

Click here to view the full report

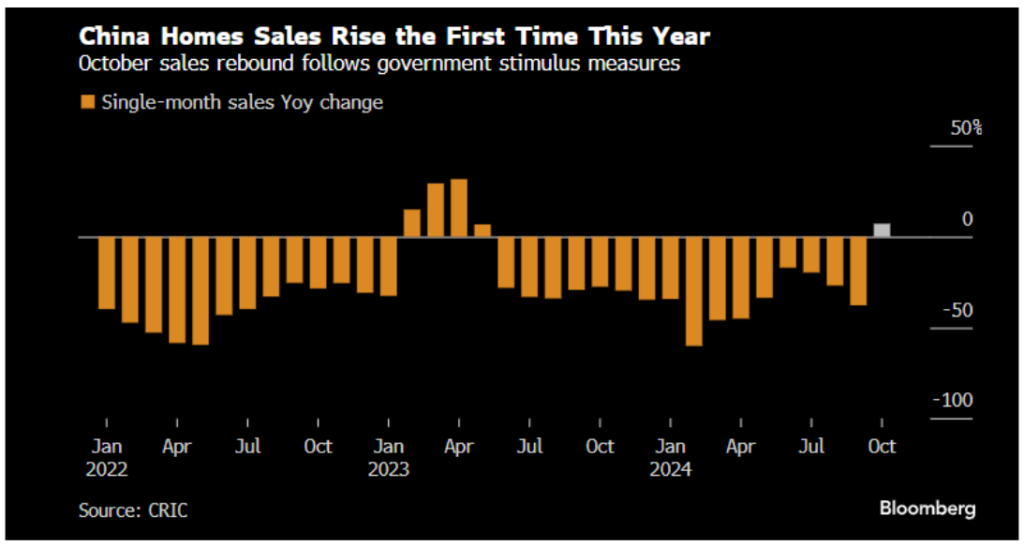

In late September, China announced a series of interest rate cuts and new lending facilities to stabilise economic activity and boost the housing market. Early indications suggest that these measures are having a positive impact, with Chinese home sales showing their first increase of the year in October. More economic stimulus measures will be announced next week.

China Home Sales in 2024

Source: CRIC via Bloomberg

Overall, we see a world with low inflation, central banks with additional room to cut rates, generally healthy labour markets and governments continuing to implement expansionary fiscal policies.

Chinese leadership has recognised the scale of their problems and are beginning to take steps to address them, which should all be generally supportive of risk assets.

However, there are of course risks to consider. It is possible inflation may have bottomed, and rate cuts may be less aggressive than the markets expect.

Geopolitical risks remain elevated, particularly as tensions between Israel and Iran may intensify. It is rumoured that North Korea has deployed troops to Russia to support their fight with Ukraine, adding another layer of risk to that war. Additionally, the US Presidential election is just days away and a Trump victory could introduce vast new amounts of uncertainty and volatility into US policy and their engagement with the rest of the world.

Our strategy remains to keep our interest rate exposure in high quality government and investment grade bonds with short to intermediate maturities and to hold a high-quality diversified portfolio of equities with some exposure to commodities and gold.

_______

Hear more from the Oakglen experts

Our investment team continue to provide interesting and informative content to help keep you informed on recent market news. Our Jersey Investment Director, William Lamond, provided some insightful analysis on the luxury goods market and our Chief Investment Officer Jeff Brummette gave his thoughts on the third quarter in last month’s Investment Summary (as per the below):

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.