In today’s evolving financial landscape, the luxury goods market has emerged as a compelling investment opportunity for discerning investors. From iconic fashion houses to rare collectibles, high-end assets are not only symbols of status but also resilient in uncertain times, often outperforming more traditional investments. In this article, our Jersey Investment Director, William Lamond, explores why affluent investors are increasingly turning to this sector to diversify and safeguard their wealth for the long-term.

In the luxury sector, where opulence and exclusivity reign supreme, a select group of companies have established themselves as market leaders. Over the last few decades, the industry has witnessed significant growth, expanding its range of participants and products to include fashion, jewellery, watches, cosmetics, automotives and hospitality.

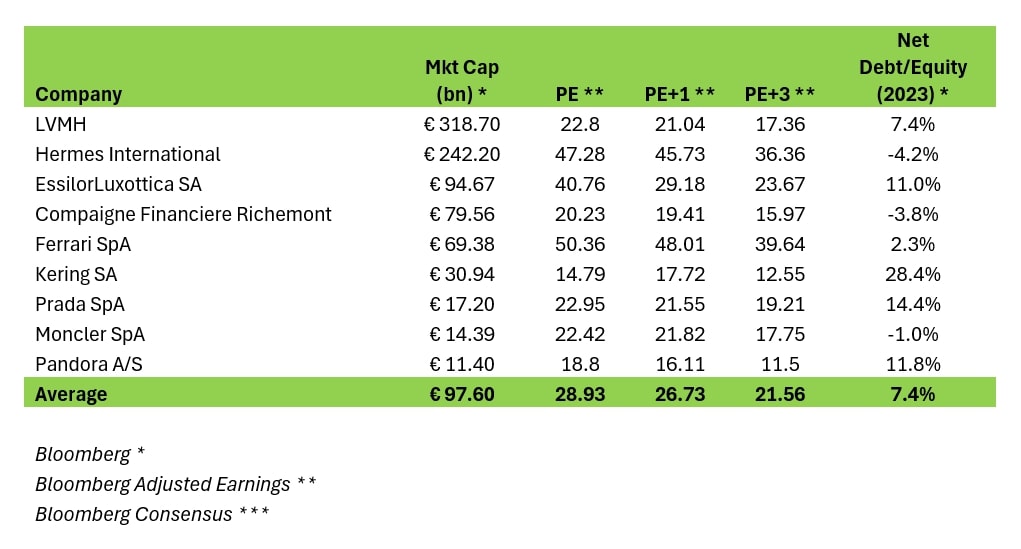

When one looks at the luxury sector by market capitalisation, 9 of the top 10 are listed on European exchanges (4 France, 3 Italy, 1 Switzerland and 1 Denmark), with the Titan Company (India) being the only external listing. Christian Dior Se has been excluded from the below list as it is nearly 100% owned by LVMH and so consolidated within its accounts and at some point in the future will not exist as a separate listing.

Source: Bloomberg

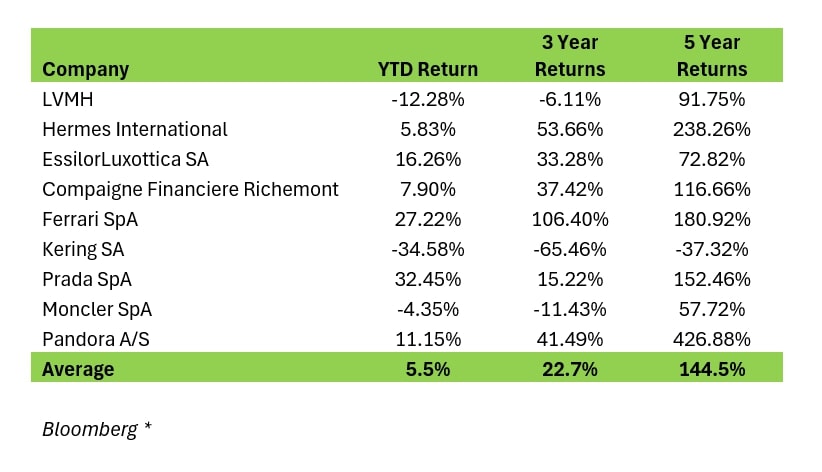

In recent months, the sector has come under the microscope as sales and profitability in some of the industry heavyweights have been constrained by an aggressive inflationary environment in the Western world, a lack of economic recovery in China and heightened geopolitical issues.

Source: Bloomberg

Kering SA has been the most exposed to this deterioration in earnings as the business was exposed to the Chinese market and brands that are more cyclical than the higher luxury brands of LVMH and Hermès. The newly hired lead designer Sabato de Sarno at its flagship Gucci brand has also failed to turn the company’s fortunes around. Management is focussed on ensuring the company returns to growth with further investment into the core brands in terms of product and brand awareness.

LVMH which historically has been perceived as a bellwether for the industry because of its size, footprint of more than 75 countries, offering high luxury products from watches, wine/spirits, bags and travel, has also not been immune to the slowdown in China.

However, other companies in the sector have so far been immune to the downturn in profitability. Hermès in its most recent quarter experienced above consensus earnings growth as wealthy consumers, even in China, continued to buy its high-end luxury leather goods which includes handbags of $10,000 or more.

Ferrari has also continued to maintain its growth trajectory, thanks to management’s strict control of the supply of new vehicles and investment in brand awareness. The company continues to increase production of cars globally, focussed on only a handful of models, but with demand expected to significantly outstrip supply, meaning earnings should continue to be economically agnostic. Ferrari is without doubt one of the best run automotive companies in the world and its price to earnings multiple reinforces it as a global leading luxury brand.

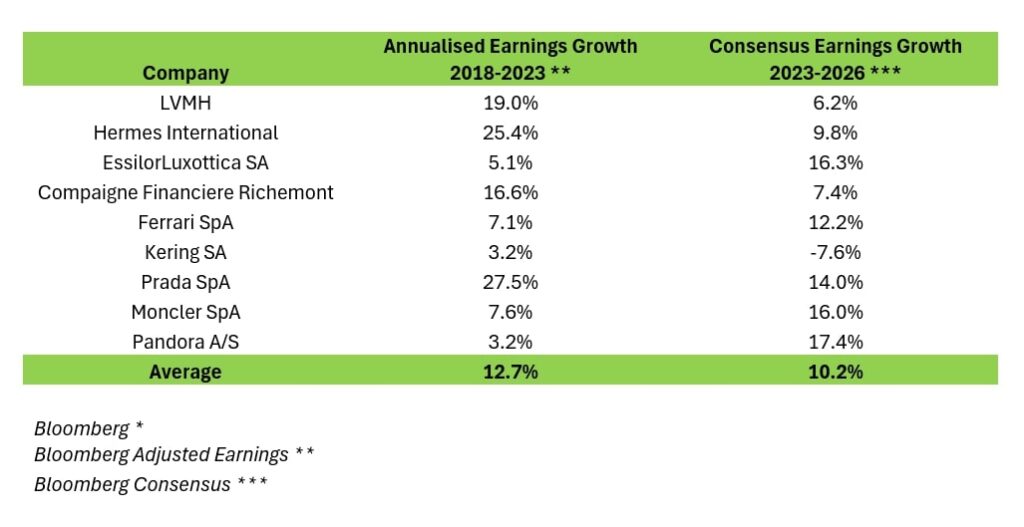

According to Bloomberg consensus forward earnings, the European Luxury sector earnings growth is expected to be strong, with only Kering’s earnings forecast to be negative. By and large, the sector has managed to keep pricing discipline, even in a more benign economic environment and ensured their products are distributed to areas of growth to ensure there is limited inventory build. This should leave the sector in an advantageous position to benefit when demand returns, particularly from China, which was one of the major engines of growth over the last couple of decades.

Source: Bloomberg

At Oakglen Wealth, we believe the elevated multiples that the likes of Ferrari and Hermès are trading on reasonably reflect the anticipated earnings growth over the medium term. Although the recent weakness in LVMH and Kering has caught our attention, we remain cautious, recognising the potential for further earnings disappointment in the short term. Such disappointment could lead to a further compression in the earnings multiples these shares trade at. Nonetheless, Forbes forecasts that the luxury goods market will expand from $283bn in 2022 to $392bn by 2030. While the short-future outlook for the sector may be uncertain, the long-term prospects appear promising.

_______

Hear more from the Oakglen experts

Our investment team continue to provide engaging content to help keep you informed on recent market news. Our Chief Investment Officer, Jeff Brummette, has put together a variety of insightful investment commentary for you to digest this month, from our monthly investment summary, to the impending US election and recent news from central bank policymakers (as per the below):

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.