Artificial Intelligence (AI) stocks represent companies engaged in the development and application of AI technologies across various sectors, including healthcare, finance, automotive, and technology. Our Investment Director, William Lamond, provides an insightful summary on this rapidly evolving field.

The equity rally witnessed in the first half of 2024 has been predominantly facilitated by a few technology companies, which have been developing their capabilities to produce products that enable or are supported by AI (Artificial Intelligence). Goldman Sachs recently estimated that ‘tech giants, other companies and utilities, will spend an estimated $1tn on capex in the coming years,’ to develop AI. This astonishing amount of investment could facilitate a revolution that could be compared to industrialisation of the developed world between 1760-1840 or automation of the 20th century.

Currently, it is unknown how much of an impact AI will have on the global economy or its workforce. If it does prove to be as revolutionary as certain industry commentators think, it is very much questionable how easily it will be accessed by users, especially with the knowledge that the current global infrastructure (power grids, data storage and communications) is woefully ill prepared to facilitate such a powerful medium?

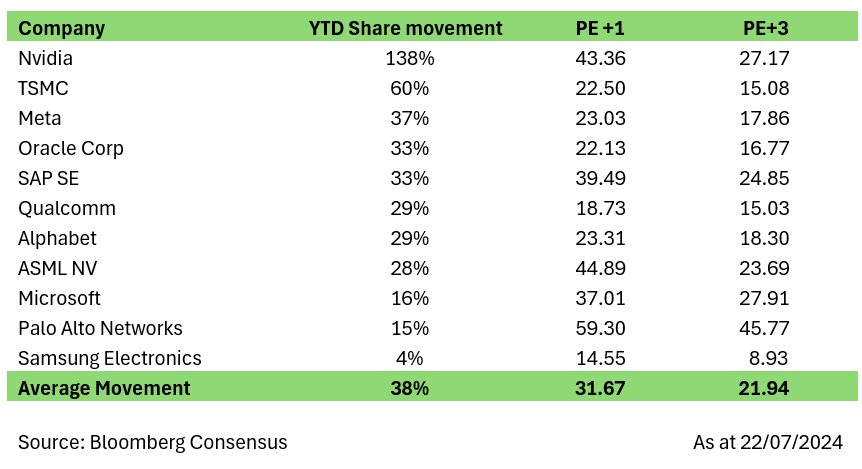

Looking at a few companies that are perceived to benefit from the development of AI, it is noticeable that one company, Nvidia, has benefited the most.

Source: Bloomberg Consensus (as at 22/07/2024)

Nvidia is responsible for designing the AI enabling chips which are put into computers. The current share price looks to be pricing in significant earnings growth over the next few years and leaves little room for disappointment. With the knowledge that its competitors, such as Intel and AMD, are developing similar chips, it looks unlikely that Nvidia will be able to protect its monopoly and consensus earnings projections could be far too aggressive.

At Oakglen, we currently hold TSMC (Taiwan Semiconductor Manufacturing Company), Meta, Qualcomm, Alphabet, Microsoft, Palo Alto Networks and Samsung Electronics in both or one of our discretionary equity models. Although all have been perceived to benefit from the excitement around AI, we believe they have standalone investment cases outside of AI.

TSMC is the world leader in the manufacture of semiconductor chips. At its foundries, the company produces chips for most of the chip designers, such as Qualcomm, Apple, Broadcom, et al. Demand for semiconductor chips, AI enabling or not, are expected to grow strongly over the medium term. Due to industry capacity constraints, TSMC is well positioned to benefit from strong earnings growth.

Both Meta and Alphabet are well positioned to grow earnings through the release of AI enabled products as they have significant data libraries of consumer habits, taken from their users / clients that they can utilise. Over the medium term, both should benefit from continued earnings growth as customers continue to use their platforms to advertise products & services at significantly lower cost to the more traditional mediums of advertising.

Qualcomm designs chips that are used in mobile phones to connect to the network and WIFI. Its unrivalled R&D budget enables Qualcomm to design industry leading products. Even with AI being in its infancy, Qualcomm has seen a noticeable increase in demand for its high-end chips from manufacturers such as Samsung and Apple, who want to release new phones which have the ability to facilitate AI usage.

Palo Alto is the largest cyber security software firm in the world. According to Precedence Research, the global market is expected to grow by 12.6% CAGR out to 2034. Palo Alto are expected to grow faster than the market as it offers numerous products in bundles that can be sold to clients. Although trading on elevated PE multiples, the growth in earnings should continue to drive the share price higher.

AI is still in its infancy. It remains uncertain how it will change the world, and more importantly, how it will be monetised by technology hardware and software producers. In the meantime, there are a number of technology names which offer strong earnings growth and remain underappreciated by the market.

Hear more from the Oakglen experts

Our investment team continue to provide topical and informative content for you to gain insights from. Leading the way is our Chief Investment Officer, Jeff Brummette, who has put together a concise investment summary for H1 2024 and a timely update on the US election following news that President Joe Biden has bowed out of the race.

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.