In late April, BHP Group (BHP) announced that it had approached the management of Anglo American PLC with an all-share deal valuing the company at £31.1bn. The non-binding offer came with the caveat that Anglo American would divest its majority shareholdings (circa 70%) in its South African assets (Kumba Iron Ore and Anglo American Platinum). These divestments would ensure the combined group would reduce its exposure to iron ore and eliminate exposure to platinum, while also limiting BHP’s exposure to South Africa, where historically it has had a chequered past.

Not surprisingly, BHP’s offer was unanimously rejected by the board of Anglo American, citing a significant undervaluation of the company’s earnings potential over the medium term. Numerous market commentators expect BHP to make an improved offer, but they have until 22nd of May to do so. Failure to do would exclude BHP from approaching Anglo for at least 6 months, unless the UK regulator or Anglo approve an extension.

At time of writing, Anglo American’s share price trades at a noticeable premium to BHP’s all share offer, which highlights there is a strong likelihood that BHP makes an improved offer. It is also not unreasonable to expect other interested parties to throw their hats into the ring.

With Anglo American’s disappointing share price performance over the last few years, attributed to operational issues and a downturn in commodity prices affecting earnings in the short term, the company appears to be a prime takeover target. It boasts exposure to a number of high-quality assets that produce hard commodities, with copper being particularly coveted. Expectations are that Anglo will ramp up copper production over the medium term.

Among the top ten diversified miners by market capitalisation (which Anglo currently is not), the majority are looking to increase exposure to copper. However, we would exclude the two Chinese miners (Zijin Mining and China Shenhua Energy), who would probably not receive regulatory approval for a bid due to concerns of China’s intentions over Taiwan and its aggressive expansion within the geopolitical arena and global trade. This would leave the likes of Rio Tinto, Freeport-McMoRan, Vale, Saudi Arabia Mining, and Glencore, who could potentially engage in a bidding war.

Glencore is currently perceived by the market to be the most likely candidate to make a competing bid. The company has been rather active in M&A over the last few years, acquiring Xstrata (2013), Chevron South Africa (2018), and currently pursuing the acquisition of Teck Resources’ coal mining business. Notably, Glencore previously attempted to buy Teck in its entirety, which also owns copper assets, but the bid was rejected by Teck’s board. An acquisition of Anglo by Glencore would also make sense operationally, as it would increase Glencore’s exposure to copper, allow it to gain exposure to iron ore production, and improve profitability through potential cost synergies.

Glencore and Anglo both operate in Australia, Peru, South Africa and Chile, so there are potential demonstrable cost synergies to be realised as a combined company. A merged entity would also be able to reduce headcount, as well as general & administrative and drilling costs through the merger of operations. It is also worth noting that Glencore and Anglo own 44% each of the Chilean copper mine, Collahuasi, which is the second largest copper mine in the world by production.

There is also a high likelihood that management at Anglo American will look to gain support from its shareholders by reorganising the business to make it more profitable. The business is made up of 6 distinctive businesses, copper, iron ore, platinum, metallurgical coal, de Beers and others. They could potentially jettison metallurgical coal, de Beers and platinum and look to reinvest the proceeds in the core business of copper and iron ore. This would certainly improve profitability within the repositioned business.

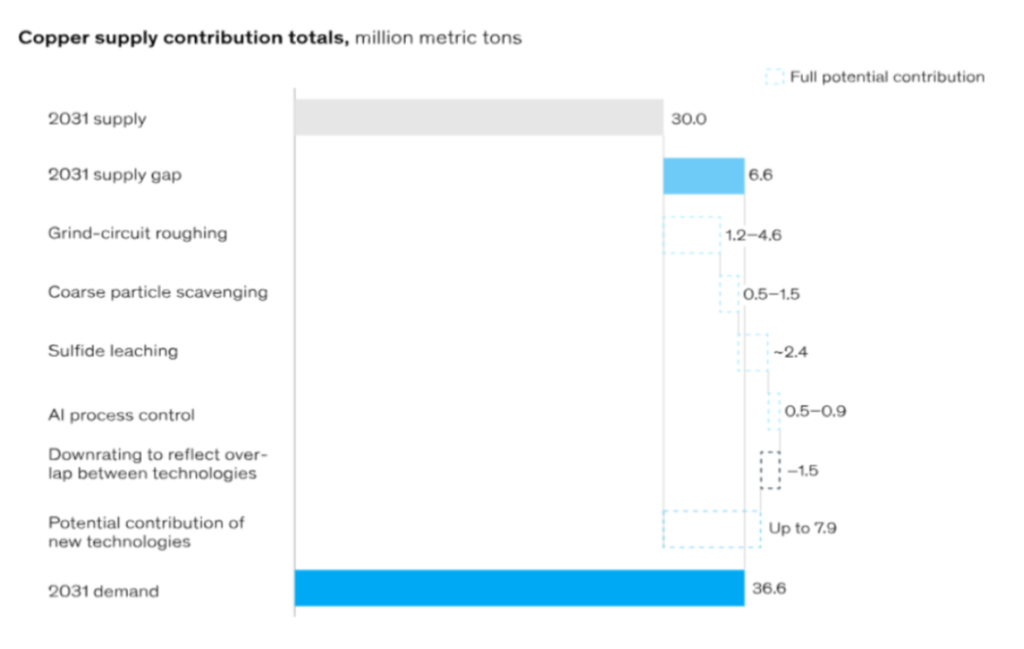

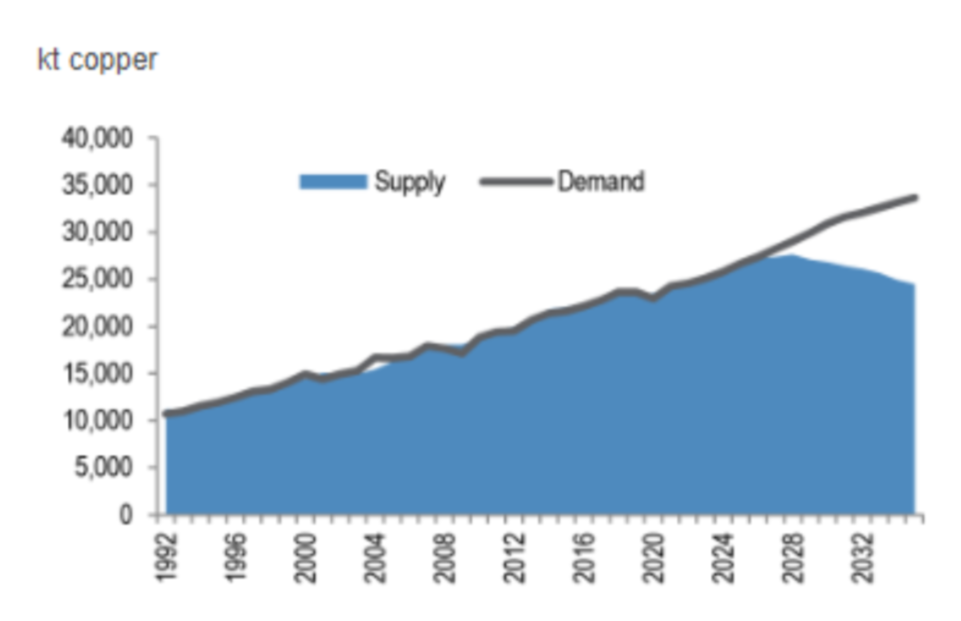

The demand for copper continues to grow due to its vital role in the global energy transition and technological advancements, such as Artificial Intelligence and Data Centres. McKinsey & Company estimates that copper demand will reach 36.6mn metric tonnes per annum by 2031, compared to Statista’s current estimate of 22mn in 2023. However, production in 2031 is projected to only accommodate 30mn metric tonnes, highlighting a potential supply-demand gap in the near future.

Note: Figures do not sum to 100%, because of rounding.

Source: McKinsey Analysis, McKinsey & Company

The picture looks even more bleak when considering the noticeable under investment in copper exploration over the last decade. Teck Resources highlighted at its Investor Day in April, that a further $120bn in capital expenditure over the next five years is needed for demand to keep up with supply. Presently, copper supply growth is expected to reach a plateau in 2028, followed by a decline as realised reserves are depleted. This underscores the urgent need for increased investment in copper exploration and production to meet future demand.

Source(s): JPM Commodities Research, CRU, Wood Mackenzie, BGRIMM, World Bank, OECD, Bloomberg New Energy Finance, Auto Manufacturer Guidance, Industry and Governmental Agencies, IEA

Even in the absence of further bids for Anglo American, the current interest highlights that Anglo American’s share price is undervalued, particularly when taking account of its exposure to copper, as well as world class assets in iron ore, which should enable the company to grow profitability over the medium term. The company’s balance sheet is not overly levered with a net debt-to-equity ratio of 26%. Although the shares trade on 15.7x 2024 estimates, which represents a premium to its peer group, they are now trading on 5.2x 2021 peak earnings.

Hear more from the Oakglen experts

Our investment team continue to provide topical and informative content for you to digest. Chief Investment Officer Jeff Brummette covers the recent Bank of England Monetary Policy Committee meeting, which decided interest rates would remain unchanged in the Central Bank Update and the Investment Summary for May 2024, which reflects upon market trends in April and the upcoming month.

Read more:

You can read other articles from the team on our News & Insights page.

Sign up below to receive similar content directly into your inbox.

Want to become an Oakglen client?

Get in touch with one of our wealth team via the Contact Us page to hear more about our products and services, and how suitable they are for you and your personal circumstances.