Dominic Tayler, Managing Director – UK at Oakglen Wealth, offers insights on the 2024 Spring Budget delivered yesterday by the Chancellor, Jeremy Hunt.

In the last scheduled Budget before the General Election, the Chancellor shared with the House of Commons his Budget speech and the Government’s updated five-year fiscal plan (most of which probably won’t even be implemented).

As was signposted over the last week, he announced a 2p cut to National Insurance for both employed and self-employed, alongside a removal of the non-domiciled tax regime. Whilst the move could be seen as an attempt to gain votes, it could come at some cost. It’s worth noting that recent research by the Institute of Fiscal Studies stated that as at April 2023, there were c.68,000 non-doms living in the UK, with an estimated 37,000 using the remittance-based charge.

Collectively it is estimated that these remittance-basis users pay £6bn a year in UK tax. Compare that with a recent paper from the London School of Economics, which claimed that scrapping the non-dom exception would save £3.2bn a year – lots to ponder.

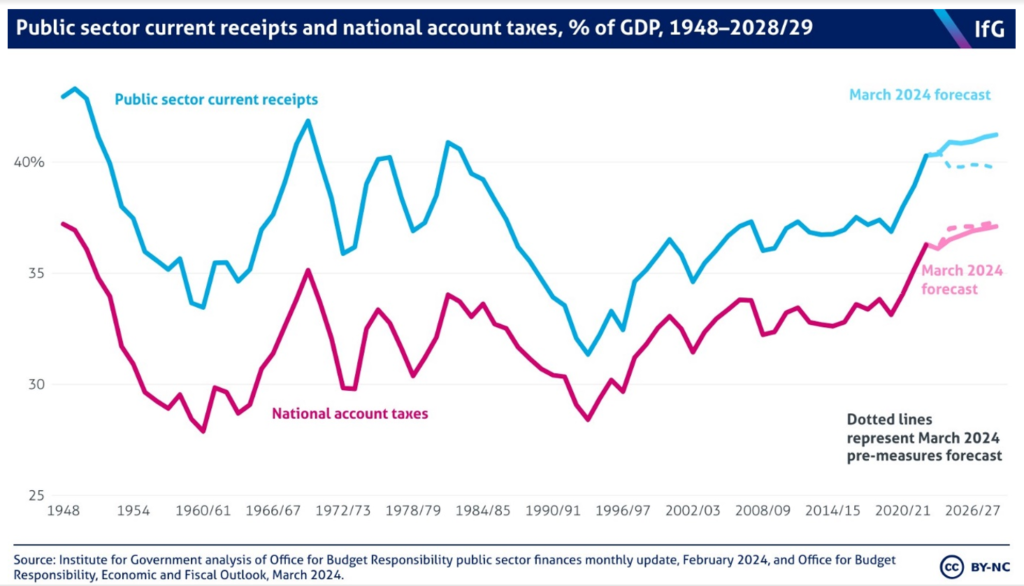

It’s clear that Chancellor Hunt had very little room for manoeuvre from a fiscal standpoint. It’s expected the 2p cut to National Insurance will cost around £10.5bn a year. Most likely using up any benefit from an improving economic picture, albeit growth is on the margins. Despite these cuts, taxes remain high when compared to recent history.

Source: Institute for Government Analysis of Office for Budget Responsibility Public Sector Finances Monthly Update, February 2024, and Office for Budget Responsibility, Economic and Fiscal Outlook, March 2024

Another highlight of the Budget was the introduction of the £5,000 “British ISA” tax allowance – subject to consultation – for savers investing in “UK-focused” shares, which was a welcome addition given how unloved UK equities have been over the last few years.

Certainly, UK mid-cap stocks seemed to like this announcement as the FTSE 250 closed the day +1.3% vs. +0.6% return for the large-cap (and international) focused FTSE 100. We also saw a rally in real estate exposed stocks following the lowering of capital gains tax paid on property sales of non-permanent residences (buy-to-let, second homes etc.) from 28% to 24%.

For savers more focused on cash returns, the Chancellor announced the introduction of a “British Savings Bond” to offer savers a guaranteed rate fixed, for three years. No other detail was provided, and this move has already been met with some scepticism.

A final point on investment, and one that was underreported in mainstream media, was the rollback in the High Net Worth Individual (HNWI) and Self-Certified Sophisticated Investor regime limit. In the Budget statement, the Chancellor indicated that he would see to reinstate the previous eligibility criteria (with lower minimums) and undertake further work to review the scope of the exemptions.

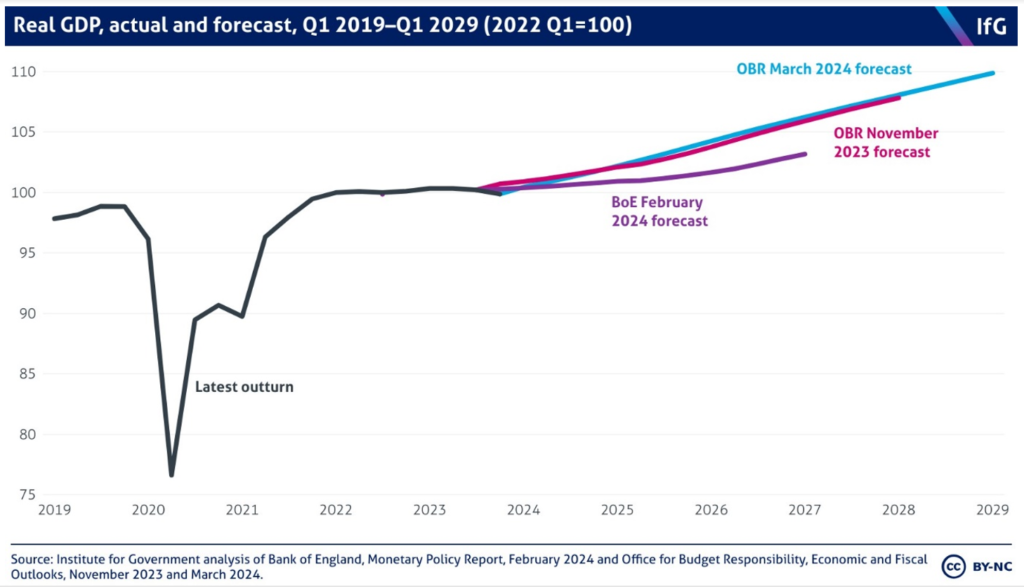

Moving on to the economy, the Office for Budget Responsibility (OBR) predicts UK economic growth of 0.8% this year, and 1.9% in 2025. On the face of it, this is a small pick-up in growth and should be welcomed.

Source: Institute for Government Analysis of Bank of England, Monetary Policy Report, February 2024 and Office for Budget Responsibility, Economic and Fiscal Outlooks, November 2023 and March 2024

Furthermore, the OBR has forecast that the UK inflation rate is likely to fall below the 2% target by the end of June and to 1.5% for 2025. Perhaps rate cuts from the Bank of England are not too far away.

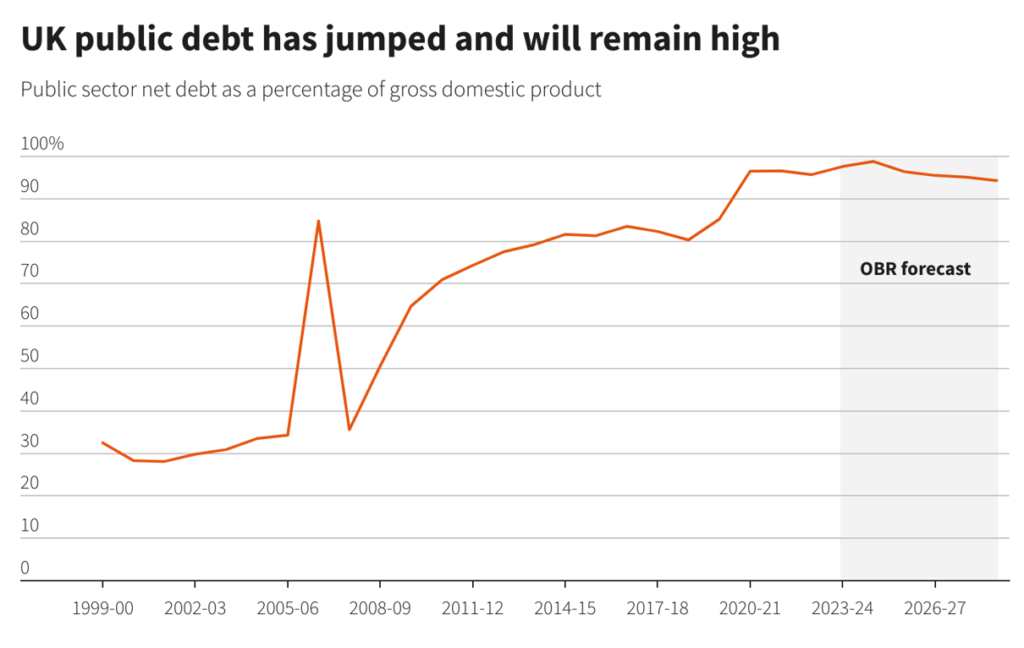

Looking ahead, we now have the General Election to look forward to. What is clear is that whoever wins this will have very little to play with in terms of implementing tax cuts or increasing spending, in an attempt to boost UK growth.

Source: Office for Budget Responsibility | March 6, 2024, Reuters | By Harry Robertson

By 28th January 2025, we will know who the next Government of the United Kingdom will be. It’s poised to be a pivotal and fascinating year for UK PLC.

What did you make of the Spring Budget today?

Get in touch to let us know your thoughts.

Compare and contrast how the UK Government has developed their fiscal strategies from the Autumn Statement in 2023 by revisiting our insightful November article here.

Click here to connect with Dominic on LinkedIn | Contact Dominic >